Ximalaya and the Economy of Ears

Five takeaways from the largest online audio platform in China's IPO filing

Hi friends!

Between the rise of Clubhouse (and the subsequent copying all across the board) and the recent developments in podcasting by Spotify and Apple, audio seems to be all the rage.

Ximalaya, which is the largest online audio platform in China, just filed to go public.

Ximalaya is a platform that connects users to billions of minutes of (non-music) audio content across a wide range of genres produced by professional to amateur creators. It is considered a pioneer in the online audio space, sometimes called the “economy of ears”.

Here are some interesting takeaways from their filing which shed light on the company and might suggest where things are headed in the audio world in the West.

I. Intentional focus on third-party devices and platforms to expand reach

Ximalaya ended the quarter with 250M monthly active users, growing ~24% y/y.

It reaches these users in three ways:

Mobile app: 42% of users

IoT and in-car devices: 20% of users

Third-party apps which embed Ximalaya: 38% of users

Over half of the users come from third-party platforms and devices, thanks to Ximalaya’s strategic focus on them

Ximalaya has done three things to expand its reach beyond just mobile:

They work with over 60 automobile makers in China, including Tesla China, Mercedes-Benz, BMW, and Audi to provide in-car audio content through pre-installed devices

They work with third-party mobile app developers and mobile device manufacturers to embed their features and access to their content library into their mobile applications

They also have their own IoT product portfolio of 6 products including smart speakers

It’s interesting to compare this with some of Spotify’s recent moves, including a mini-player on Facebook and the “Car Thing” smart player as well of course as Spotify’s integration with smart devices across the board.

II. A focus on “audio content” broadly

Ximalaya has over 280 million tracks of audio content across 100 genres, totaling approximately 2.1 billion minutes on their platform. Music aside, they have focused on audio content pretty broadly and have content including:

Podcasts: Ximalaya has a large variety of podcasts including personal development, business, leisure, sports, parenting, and technology on the platform

Audio entertainment including comedies: Ximalaya is the go-to destination for audio entertainment, in particular, traditional Chinese comedies such as Chinese Xiangsheng (or “crosstalk”) and Pingshu (a form of storytelling) and has ~1M albums1

Audiobooks: Ximalaya has ~4.5M titles sourced primarily from third-party IP partners.

Audio courses / educational content: Ximalaya has 9.5M albums of premium knowledge sharing which include courses for children and adults. Some are professionally produced, while others are user-generated.

Audio live streaming: Content creators on the platform tend to use audio live streaming to connect with fans and also create new kinds of content which integrate recorded content, such as audiobooks or radio dramas through dubbing and creative role plays

In the west, Spotify has music and podcasts (and some of these other use cases might sometimes be uploaded as podcasts), but it seems like Ximalaya has really leaned into audio as a format.

I wonder if over time Spotify will expand into more non-music and podcast content including specially produced comedies, meditation, fitness (guided audio workouts), and even audiobooks.

III. A vibrant content and creator ecosystem

Ximalaya has over 5M creators on the platform and talks about its “PGC+PUGC+UGC” strategy. What is that?

Ximalaya thinks of its content (and creators) across three segments:

Professionally generated content (PGC): This includes partnerships and licensing deals with top-tier publishers, online literature platforms, content creators, and key opinion leaders, including getting the rights to audiobooks and other content, as well as popular instructors who create courses. Ximalaya has exclusive licenses to ~70% of its top 100 albums. Ximalaya also is a leading player in acquiring rights to adapt popular content into audio series.

Professional user-generated content (PUGC): Ximalaya has a marketplace that matches content creators with high-quality copyrighted content that they can produce. It also helps train these content creators and helps them produce the content. This allows these creators to have a higher reach and better monetization than they might have otherwise. Ximalaya typically grants these PUGC creators rights to use the content they have licensed and shares a percentage of revenue generated from the applicable PUGC with them.

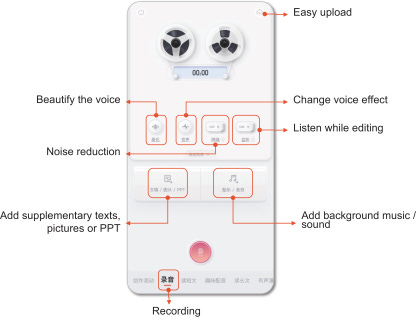

User-generated content (UGC): Ximalaya makes it easy for anybody to create and upload and get distribution for a wide variety of audio content. The user-generated content creators help maintain a breadth of content on the platform and also serve as a funnel into PUGC creators (many of the PUGC creators started as UGC)

In terms of volume of creators, about 2.1K produce PGC, 4.6K product PUGC and the other 5.15M produce UGC.

In terms of listening time, 15% comes from PGC content, 33% from PUGC content, and 52% from UGC content, illustrating the importance of the 6K PGC and PUGC creators and the power law in effect in that ~50% of the listening time comes from these ~0.1% of content creators.

Spotify’s leaning into exclusive content with Joe Rogan and Barack Obama is interesting and parallels the PGC focus of Ximalaya. In addition, however, I was fascinated by the PUGC approach, of essentially elevating talented people and giving them content to produce that Ximalaya separately acquired the rights to. I wonder if Spotify ever starts doing something similar.

Similarly, arguably none of the big platforms in the US (Apple, Spotify) has made it extremely simple to create a podcast/audio show. That’s one thing Clubhouse got right, and even Zoom and Descript on the pure “podcast” side. Spotify’s acquisition of Anchor was also a move in this direction.

IV. A multi-modal monetization model

Like many other Chinese internet companies, Ximalaya has a diversified monetization model comprising of many streams, best illustrated by the graphic below.

Advertising: Ximalaya makes advertising revenue from display ads and audio ads and has introduced programmatic advertising which now accounts for ~50% of advertising revenue.

Subscriptions: Ximalaya’s subscription revenue, which is the single largest source of revenue includes two things i) a monthly unlimited subscription which provides access to unlimited streaming of a large inventory of albums, and ii) one-time payment options for specific albums or pieces of content which can be as low as 50 cents. Currently, 13.3M users are active mobile paying users.

Live-streaming: Ximalaya has ~3.5M live-streaming MAUs. These users generate revenue for Ximalaya by purchasing virtual gifts and items for creators, which Ximalaya takes a cut from.

Educational Services: A newer segment, Ximalaya has essentially packaged its courses into subject-specific boot camps or vocational training programs or education for children. The foundational learning programs for children <12 years old in particular have been popular.

Others: A smaller segment comprising of revenue from the sale of IoT devices or fees they receive for the rights to convert their audio content to text.

The chart below shows the split of revenue over time, with education a recent and growing stream. The others are relatively constant in their splits (i.e., growing at similar rates).

A similar diversification is pretty constant across most Chinese companies, though no Western companies have cracked it. Spotify is arguably one of the most diverse with both subscriptions and advertising and is improving on it by adding one-off subscriptions to certain podcasts and building a dynamic advertising network. As the live-streaming platforms like Clubhouse think about monetization, the numerous examples of virtual gifting success in China might be a good source of inspiration.

V. Financials suggest “podcasting” has better economics than music for platforms

Ximalaya did $620M in revenue in 2020, growing 51.3%. In Q1 of ‘21, it grew revenue 65% compared to the same quarter the previous year.

A part of that revenue growth is driven by user growth, which is growing ~24% y/y, and the rest by higher revenue per user through higher engagement (active users spend 141 minutes per day on average in the app and this has been growing 5% y/y) and better monetization.

Given the nature of the business, content costs are a big expense but perhaps smaller than one might think. In aggregate, the cost of revenue for Ximalaya was ~51% (and has been declining as a percentage year over year). This is primarily driven by revenue sharing agreements (32%) which is the money paid out to the content creators and hosts and content costs (6-7%) which is the cost of licensed copyrights which are amortized over time.

Spotify has a lot lower gross margins (~25%), driven by the royalties it pays on the music side, which many believe is part of the reason for its push in podcasting. Ximalaya’s numbers could be a sign that even with exclusive content and first-party production, one can sustain higher gross margins in this type of content.

The other big cost driver for Ximalaya is sales and marketing, which is ~50% of revenue. It has also been reducing over time but is still high, as Ximalaya spends on user acquisition. It will be interesting to see if they can sustain some level of user growth as they reduce this.

Additional Reading

A few additional reads for those interested in learning more.

P.S. If you see this then that means I didn’t have a chance to edit this piece before it was sent out probably because of my second vaccine dose reaction. Apologies for that!

Thanks for reading! If you liked this post, give it a heart up above to help others find it or share it with your friends.

If you have any comments or thoughts, feel free to tweet at me.

If you’re not a subscriber, you can subscribe below. I write about things related to technology and business once a week on Mondays.

An album here refers to a series of episodic content from the same creator(s)

Hi Tanay, great article. You have very concisely summarized how Ximalaya works. I have few queries about their creator model. Would you be able to help?