Hi friends,

I hope everyone is hanging in there during this crazy period. You’ve probably read or seen enough about what’s going on in Ukraine on the news and I don’t have anything insightful to share, so I’ll spare you from that and resume regular coverage this week for those who could use a distraction.

Over the last few months, there’s been a bit of a debate in the community around who owns the web – both the current web2 as we know it, and web3, the new version being worked towards. It started with this Jack tweet on ownership in web3 which prompted Chris Dixon to ask about the ownership structure of web2.

I’ll be touching on this question today, for both web2 and web3.

Who owns web2?

So who owns web2 companies? Let’s consider both private and public companies.

Private Companies

Typically, private companies are owned by founders, employees (and other advisors) and venture capital firms.

Usually, founders choose who they let into the financing rounds of their startup, and typically only accredited investors who have access get an opportunity to invest.

While the breakdowns can vary quite widely based on a company’s trajectory and capital efficiency, a median tech company about to go public looks1 something like this:

Founders: ~20%

VCs: ~50-55%

Employees / Advisors / Individual angels: ~25-30%

Two things worth going further into here:

I. Who really owns the VC stake?

One imprecise but simple way to think about it is that ~20% of the ownership of the VC stake goes to VC firm itself, while 80% belongs to the LPs.

So for the numbers above, ~10% is owned by the Venture Capitalists themselves, while the remaining ~40% is owned by their LPs.

And who are these LPs? While most funds typically don’t disclose their full list, LPs could be:

high-net-worth individuals

family offices

nonprofit foundations

school endowments

pension funds

sovereign wealth funds

hospitals

Sequoia for example discloses some of their LPs which include the Ford Foundation, MIT, Smithsonian and Boston Children’s Hospital.

The point being that while it isn’t always the case, a lot of the 40% of this stake may be owned by the community at large in the sense that it benefits future students or the normal person living in a state in that it helps fund their pension).

II. Can anyone put money into these companies?

Typically, prior to going public, only people who are founders, employees or accredited investors with some degree of access and know-how are really able to put money in these companies.

Public Companies

That changes once companies go public, however. Now, anybody can put money into these companies.

At the IPO, companies usually sell 10-15%, typically bought by institutional investors. Following the IPO, as the company is tradeable on the stock exchange, anybody can buy and sell.

Practically, we can look at a typical web2 company that has been public for a little while to get a sense of ownership.

Going back to Chris Dixon’s tweet above, we can see at top shareholders for many of these web2 companies are institutional investors such as Vanguard, Blackrock, etc.

Based on CNN for example, a rough breakdown of Twitter and the top shareholders are:

These tell us a few things:

Most web2 firms, when public, are owned largely by mutual funds (followed by some hedge funds and VCs who have retained their stake)

Even after going public, individual shareholders, especially non-founders, usually only own 5-10% of the company (and some of that is probably employees)

And guess where the assets for mutual funds come from? From a similar group as for the VCs and from the people. Anybody with a 401K or a brokerage can put money into and likely has put money into these funds.

So, who owns the stake owned by funds such as Vanguard and Blackrock? Anybody and everybody with investable assets. Either because they put money into those ETFs directly through their 401K and brokerage accounts, or because they are in some sense the beneficiary of it because pensions, endowments, etc. put money into them.

In that sense, most public web2 companies can be owned by any individual, and are close to majority “owned” by the community, but through intermediaries that preside over that ownership.

Who Owns web3?

Now that we’ve touched on web2, let’s talk about web3.

The utopian version of web3 is that web3 companies can be wholly owned by its users. Is that true?

First, one thing worth calling out is that some companies operate in the crypto ecosystem broadly but are by and large run as web2 companies. These include Coinbase and Opensea, which have the same ownership structures as the web2 companies called out above.

For the others that are true web3 companies that do have tokens, reality doesn’t typically look like the utopian example. Many such as Solana raised a seed round from private investors at $0.04 per SOL and a public sale from the community at $0.22 per SOL, and reserved over 37% of the initial allocation for investors.

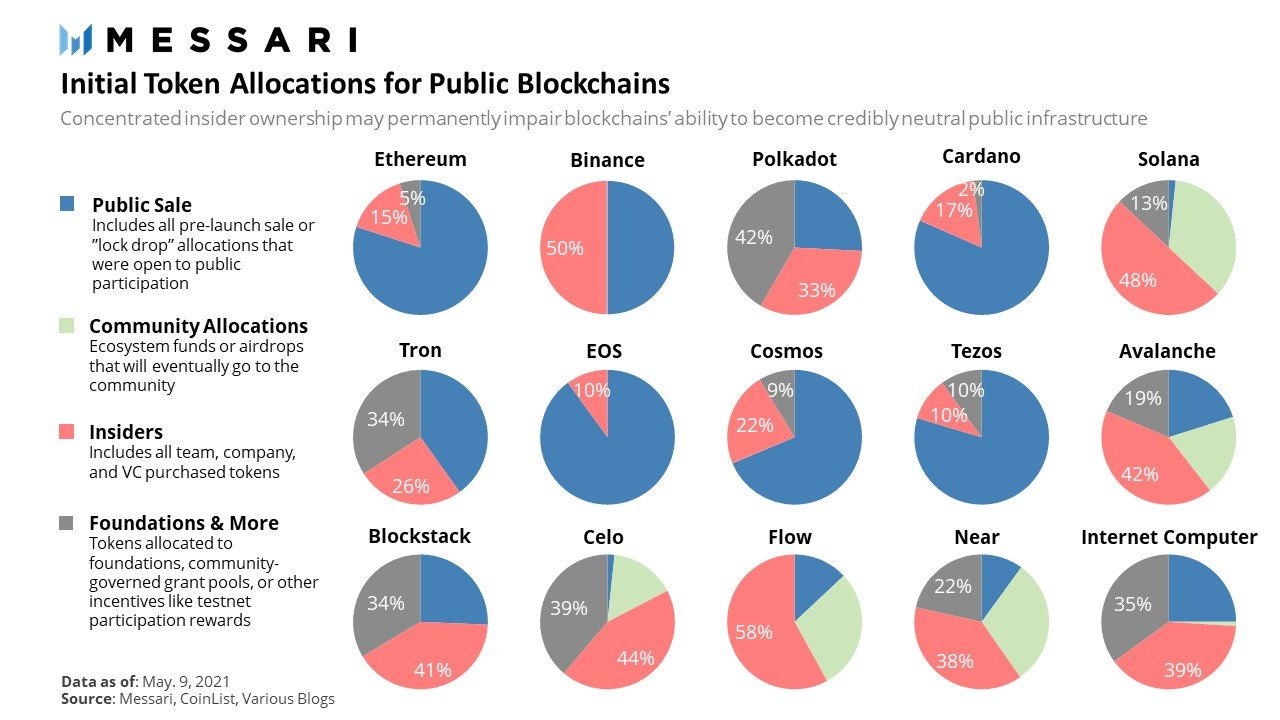

Looking at the graphic below which outlines the typical initial token allocation for some public blockchains, we see that while many do have public sales, meaning that the community can get an allocation quite early in the journey, many allow for VCs and others to purchase tokens as well (often at more favorable terms).

The main participants in token allocations are:

The team, equivalent to founders and employees in web2 companies having equity ownership

VCs and other private investors, who in many cases just like in web2 companies are able to purchase a stake (via tokens) in the projects early on.

The community, which is able to get in during a public sale, and also able to get tokens via airdrops from the community allocation.

However, a few interesting things are worth calling out:

The public token sale happens a lot earlier in the journey of these projects than say a web2 company going public, meaning that the typical average investor can purchase ownership much earlier in the journey and without the need to be accredited.

The community allocations typically allow a way for users and the community to earn tokens just by using the service which has no parallel in the web2 company world.

Also, as these projects mature, more institutional investors and larger entities typically get involved, as we can see with Bitcoin.

For example, over 3.5% of the Bitcoin supply is held by the Grayscale Bitcoin Trust and CoinShares ETF.

Similarly, a portion of it is also held by public and private companies and by countries.

Putting it together

web3 is owned by the community and the people. But web2 is more or less also owned by the community and the people.

Does that mean that web3 is nothing new? Not quite. There are a few key differences:

I. Earned Ownership in web3

In web3, given the community allocations present in many projects, often sometimes 20-30% of all tokens, individuals and users of their services can essentially earn a stake in their project just by using it.

In web2 world, typically only the people who directly work for the company can earn equity. But in web3 world, users can become owners more directly and easily.

II. Direct Ownership in web3

Most web2 companies are owned by the “community” as discussed above. But that ownership is very much indirect, through the private investors (VCs) and the public investor (mutual funds and ETFs) or post-public direct purchases.

Institutional investors are typically the stewards of the communities’ voice via governance decisions. And people don’t really have a choice to choose who gets to make the decisions related to their dollars, because that decision is tied to the fund being invested in (and often it is unknown what principles the fund is using to make governance decisions).

In web3, individuals can own tokens directly, whether the project is at the early or late stage. And while they may not want to participate in all decisions, they can choose who they delegate their decisions to if they want to.

III. Earlier and more liquid ownership in web3

For web2 companies, people can only voluntarily typically buy ownership when the company goes public. While they may get ownership indirectly via the benefit from VC’s LPs (endowments, pensions), that benefit is usually capped (as discussed below).

However, in web3, public sales happen very early in a project’s journey, and the tokens typically are liquid from then (minus any lockups), and so the typical person can acquire a stake in a web3 project much earlier than web2.

And since the stake is liquid, it allows people to invest even if they couldn’t afford to lock up their money for 7-8 years, which is why it’s not just about investing in private companies requiring one to be accredited.

IV. More “uncapped” ownership benefit in web3

Tied to the above, while in web2, people may have stakes via VCs LPs (pensions, etc) or endowments that earn high multiples of return, typically the individuals don’t benefit from that outperformance. Their benefit is usually capped in them either getting a scholarship (or their pension being fully funded vs not) rather than say them getting 100x what was expected because a company had much better returns than expected.

After a company is public, they do have uncapped ownership in that they can buy equity in the company directly. However, if they own their stake through say a pension or similar, then again, the direct benefit is restricted.

And more importantly, as this chart shows, as companies have stayed private longer, more of the returns have been coming in private markets, and so the return multiple post going public is more capped in general than it used to be as in this (dated) chart below.

The ownership in web3 projects can be uncapped from the day of the public sale, which happens at much lower valuations (and earlier in the journey) than web2 companies going public today, meaning a much higher potential (albeit with a lot higher risk) for those that participate.

There’s no real better example of this than Bitcoin and Ethereum themselves.

Bitcoin started trading at a market cap of <$0.02M and is now worth over $800B and has been accessible to everybody throughout that entire period.

Ethereum did a public token sale at a <25M market cap and is now worth over $400B.

Both of these projects were essentially two of the most successful startups created in their decade, liquid and available to the entire world at lower prices than the typical seed round of a new startup today.

Based on this analysis by Blossom Street Ventures