Understanding BNPL

Hi friends!

I’ve been spending some time researching the Buy Now, Pay Later (BNPL) trend, and below is a collection of some thoughts on the space.

I’ll cover:

An overview of the sector

User Behavior

Merchant Behavior

The Major Players

The Business Model

BNPL overview

Buy Now, Pay Later or BNPL is a type of payment mechanism where people can buy goods (or services) now and make payments over time or in installments.

It is a form of a credit line that isn’t attached to a credit card (and generally isn’t regulated) and avoids things like credit checks and (potentially) interest.

Users typically discover and use BNPL services in two main ways:

During checkout on the merchant’s website/app: More and more merchants are embedding one or more BNPL providers in their checkout flows.

Directly through the BNPL technology provider: Most BNPL providers today have an app or marketplace where users can browse products and buy them with BNPL as the payment method.

BNPL Product Types

Typically, the BNPL financing product takes two forms:

Pay in 4: This is typically used for order values that are typically less than $500 and involves splitting the payment into four equal parts, 25% at the time of purchase, with each subsequent payment 2 weeks later. Typically, there is no interest associated with the payments.

Longer-Term Installments: This is typically used for bigger ticket items and the payment period can be anywhere from 12-48 months. Interest can range from 0% to 35% APR. Pelotons and furniture are the quintessential examples of the types of purchases that use this BNPL method.

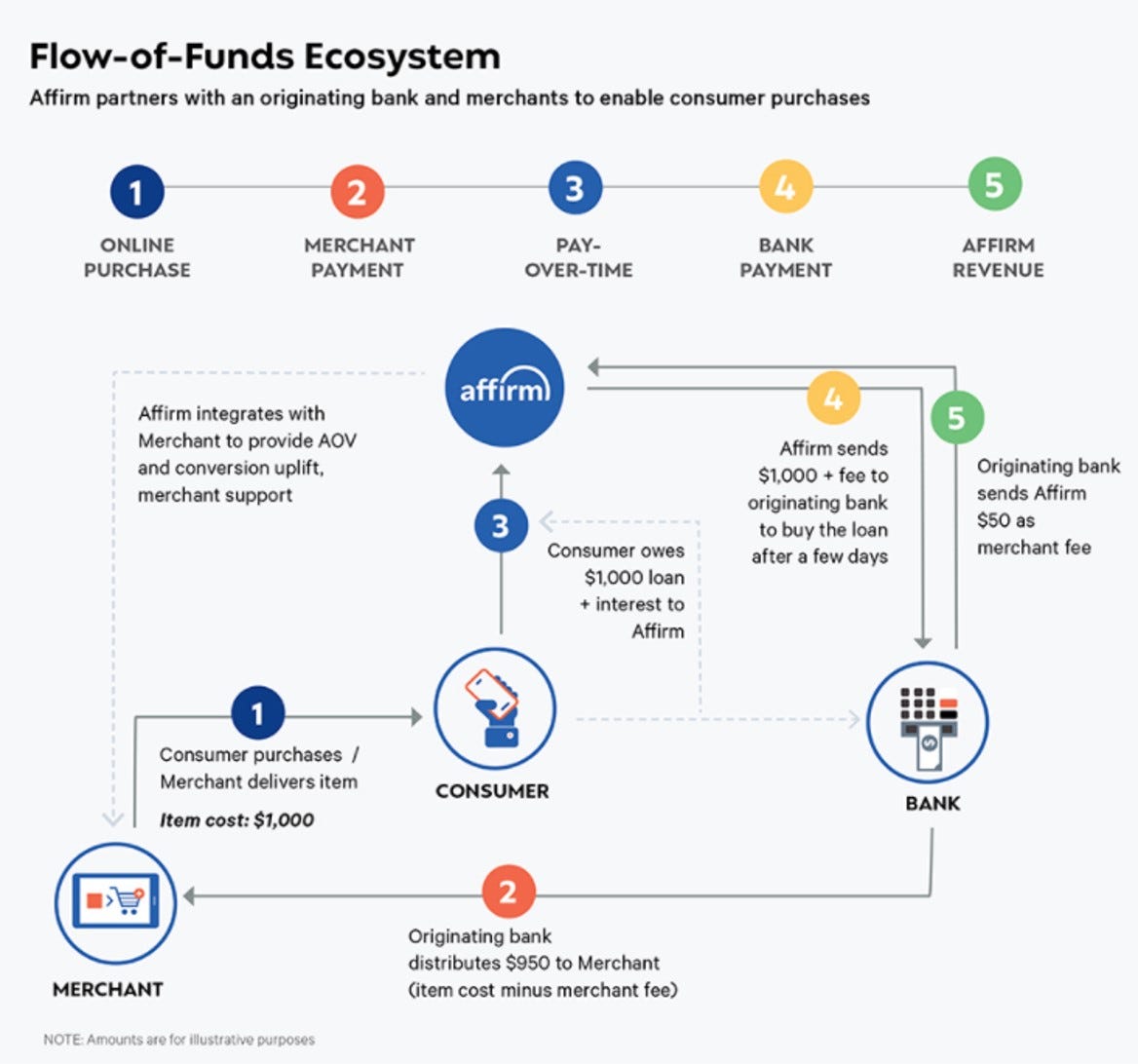

The way BNPL typically works from a movement of money perspective is described in this graphic below via Affirm.

Industry size

Globally, 2% of eCommerce transactions were through BNPL in 2020. That number is expected to double to 4% by 2024 as BNPL grows share.

The majority of BNPL transactions today are done online (>80%), but that might change going forward as more traditional payment/POS players get into BNPL as touched on later.

BNPL User Behavior

Demographics

There is a belief that BNPL tends to mostly be used by GenZ and millennials, which is only somewhat true.

First, BNPL has a wide user base. ~56% of Americans have used a BNPL service before, a jump from ~38% who had used it before July 2020.

Looking at it by user age, while it is more prevalent in terms of prior usage among younger users, over half of the users between 35-55 have used them in the past.

It is true however that Millennials and Gen Z tend to use BNPL as a payment method much more frequently.

In a survey1 that asked whether people used BNPL for their most recent online purchase, the percentage of those responding yes was:

Gen Z: 26%

Millennials: 11%

Older Generations: 7.5%

Why People Use it

Users like and use BNPL for several reasons. At a high level, some common reasons are:

Alternative/Replacement to credit: Many users distrust credit cards or cannot use a credit card, or do not want to pay the high interest on their credit cards and so use this as an alternative. Note that BNPL as an industry tends to be less regulated, and does not require credit checks.

Interest-free loans and smoothing expenses: Since in many cases, BNPLs are interest-free, even on big-ticket items over longer durations, even people who can afford to just buy on credit or debit use BNPL because they see it as a way of getting “interest-free” money and smoothing out some expenses over long durations.

Make purchases they wouldn’t have been able to otherwise: BNPL allows people to buy better quality items or items they might not have been otherwise and cover the payment over a longer duration.

Below are the reasons as highlighted by US consumers in a survey.

One thing to note is that depending on the size of the transaction, the rationale might be different.

For example, for the pay by 4 type installment purchases, the primary reasons would be to avoid paying interest on credit cards / as a card replacement. However, for the longer-term installment purchases, people might be wanting to purchase something they might not be able to otherwise or better manage finances or smooth out their spending or just take advantage of the merchant covering an interest-free loan.

Categories

From a category perspective, electronics is the most common, although people are using them for a wide range of categories including furniture and even groceries.

BNPL Merchants Behavior

Merchants have been adopting BNPL partly because of the appeal it has with consumers (especially younger ones) as a payment method and because they’ve found it can help drive conversions overall. Specifically:

Increases conversion rates: Merchants have found that providing BNPL options at checkout drives higher conversion rates since customers that might not have purchased otherwise end up purchasing.

Drives Higher Average Order Values: Similarly, BNPL allows customers to spend more than they would have otherwise since they’ll be paying over time and so leads to higher average order values.

Shopify’s test with Shop Pay Installments found that one out of four merchants observed a 50% higher average order volume with Shop Pay Installments.

Paypal found that their offering boosts merchant’s conversion rates and increasing cart sizes by 39%.

Afterpay notes an average 20% increase in conversions and a 40% increase in average order values

Interestingly, some merchants are starting to offer multiple BNPL options at checkout, giving consumers a choice of using their preferred provider.

For example, Adidas accepts Affirm, Klarna, and Afterpay.

The Major Players

The major players offering BNPL, which I’ve also referenced above are Klarna, Afterpay, Affirm, and Paypal as in the chart below.

Three metrics tend to be important for these providers (from a growth and scale perspective):

the number of merchants they have

the number of active consumers they have

the TPV or GMV transacted through them.

Klarna is the largest in terms of GMV and scale. They have 250K merchants and 90M+ customers.

Afterpay, which was just acquired by Square for $29B was already at 16M customers and 1000K merchants worldwide before acquisition.

Paypal, whose offering is relatively new, and can tap into their large customer base of over 300M+ customers and merchant bases. So far, they have 40,000 merchants and 7 million consumers who have used their BNPL.

Affirm has 5.4M customers and 12,000 merchants. Additionally, they will be powering Shop Pay Installments which is turned on by default for merchants, which could allow them to really ramp up growth since Shopify serves over 1M merchants.

While a lot of these started as BNPL solutions at checkout, most of them have layered on a consumer marketplace so users can browse and buy items through their BNPL provider.

In addition, as more and more merchants adopt BNPL, companies which serve merchants are making moves to integrate BNPL offerings in their solutions.

Shopify just announced that it will roll out Shop Pay Installment (powered by Affirm) to all Shop Pay merchants by default.

Square purchased Afterpay for ~$29B and will look to integrate its offering into their consumer and merchant products

Visa now offers a pay with installments product pre, during, and post-purchase.

Apple is working with Goldman on offering a BNPL for purchases made through Apple pay

Chase and Citibank also allow for paying off purchases on cards in installments.

Business Model

Lastly, onto the business model. BNPL providers typically make the bulk of their revenue through fees from merchants, with the rest coming from late fees or interest charged to consumers.

The revenue then typically takes three forms:

Fees From Merchants: Given that they can increase average order sizes and conversion rates, Merchants are actually willing to pay for / subsidize the cost of BNPL providers. Typically, merchants’ fees are higher on interest-free transactions. For some context, Affirm received an average of ~6.3% of their GMV as revenue from merchants, over 50% of their total revenue. For Afterpay, revenue from merchants made up over 85% of the revenue.

Late fees From Consumers: Most providers charge late fees to consumers who fail to make an installment payment on time. For context, late fees correspond to under 10% of revenues for Afterpay.

Interest fees from consumers: In some cases, consumers are charged interest which is(typically simple interest). This is especially true in the case of Affirm, where interest income accounts for over 30% of total revenues.

Thanks for reading! If you liked this post, give it a heart up above to help others find it or share it with your friends.

If you have any comments or thoughts, feel free to tweet at me.

If you’re not a subscriber, you can subscribe below. I write about things related to technology and business once a week on Mondays.

Source: PYMNTS survey

Great write up as usual, I think there is one typo though with the word "serve?"

In addition, as more and more merchants adopt BNPL, companies with serve merchants are making moves to integrate BNPL offerings in their solutions.

thx for sharing, bro