Two AI Lab IPOs: S-1 Breakdowns

Notes from Zhipu and MiniMax's IPO Filings

I’m Tanay Jaipuria, a partner at Wing and this is a weekly newsletter about the business of the technology industry. To receive Tanay’s Newsletter in your inbox, subscribe here for free:

Hi friends,

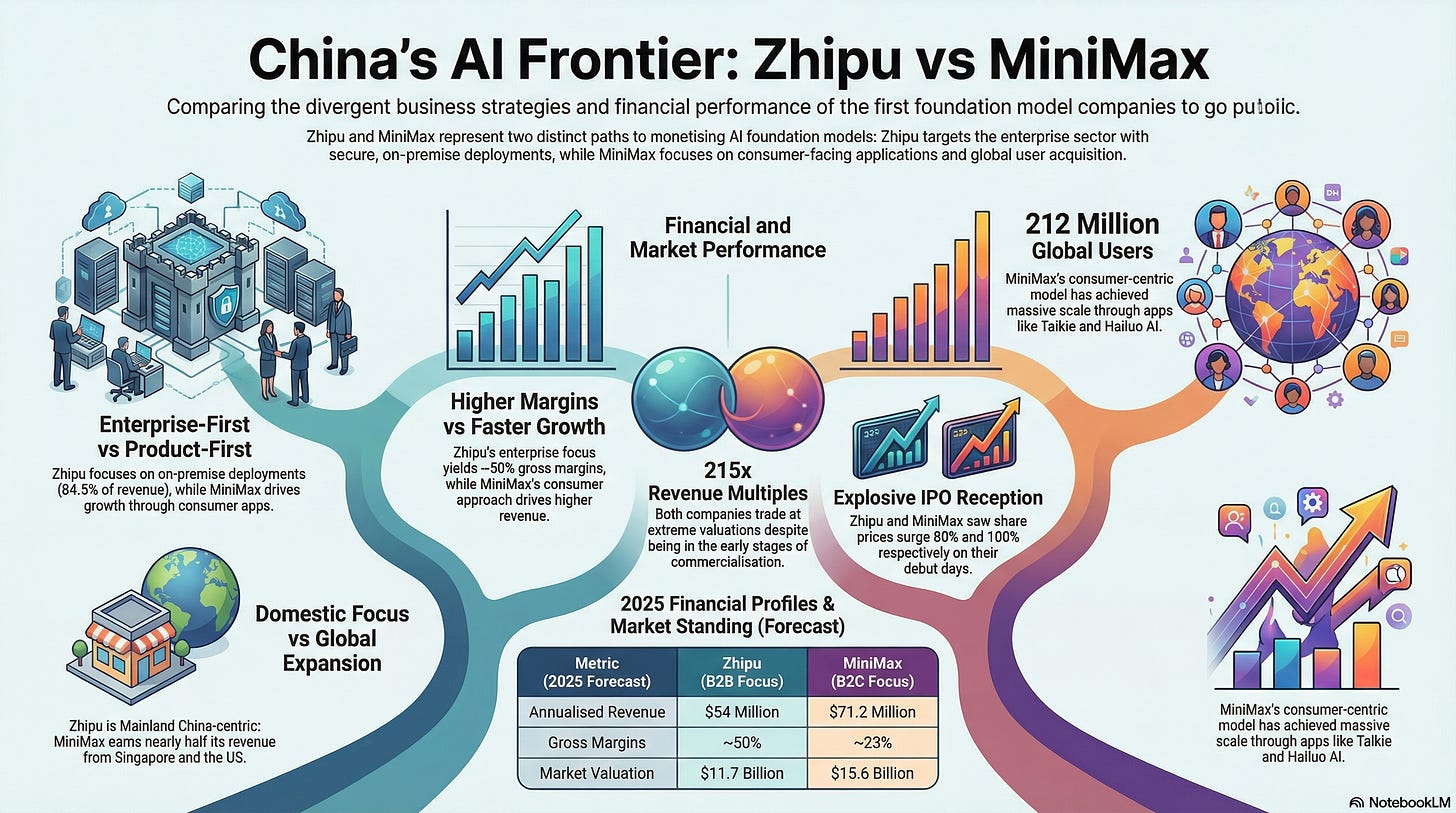

Two Chinese foundation model labs, Zhipu and MiniMax, went public over the past few weeks, with Zhipu becoming the first foundation model company to IPO globally. What stood out to me reading both filings is the different approaches they took to turn their models and capabilities into a real business.

Zhipu focuses on enterprise more, with a bulk of their revenue coming from on-prem enterprise deployments, while MiniMax is more product and consumer focused with multiple apps that leverage the models they build driving the majority of their revenue.

I’m going to break down both companies across product, business model, financials, and IPO reception1. Let’s dive in.

1) Product

Zhipu

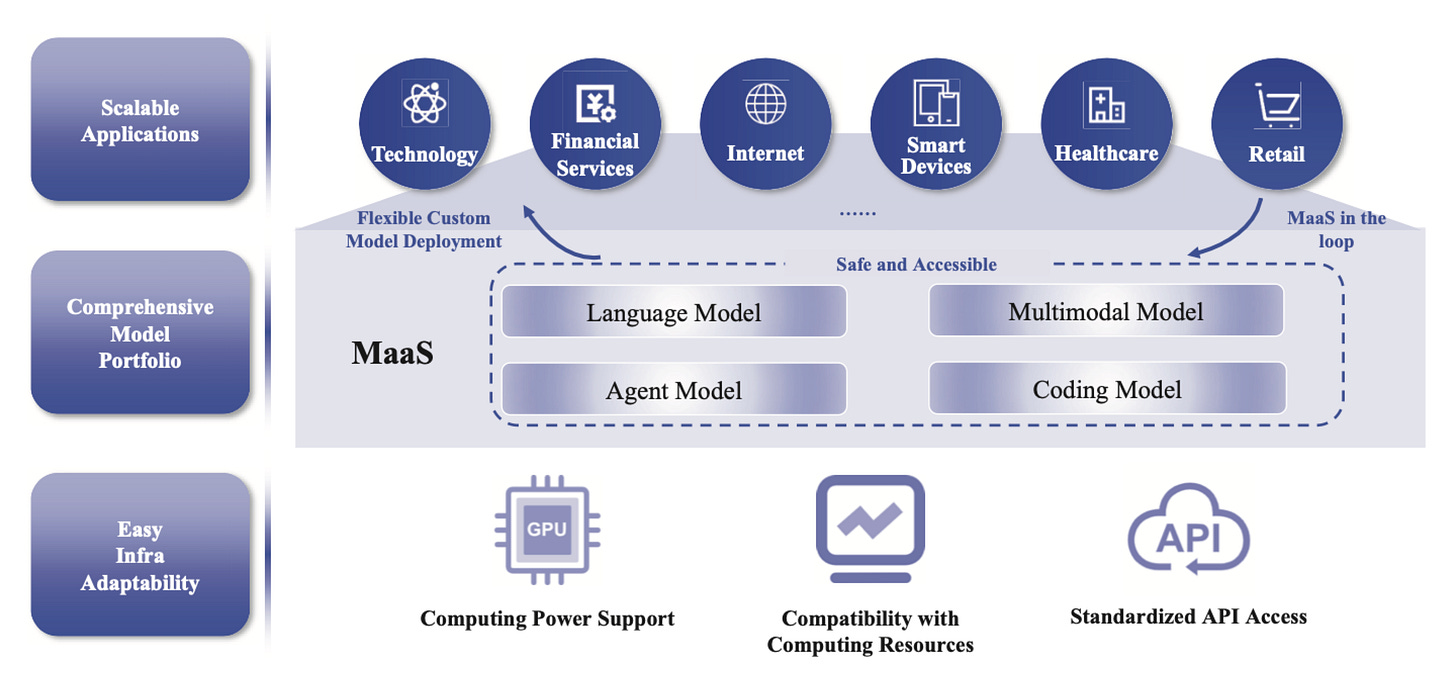

Zhipu is a deployment-first model company. The core asset is the GLM model family, and the filing emphasizes a set of newer releases like GLM-4 and its variants, including lighter versions and vision-capable versions, plus newer iterations in the GLM-4.x line which are most popular for their coding abilities. Zhipu is very explicit that it delivers capability through public cloud, private cloud, and on-prem deployments, and it pairs that with professional services. In other words, the “product” is often the model deployment plus a set of services that make it usable inside a real enterprise environment. They talk about their “Model as a Service” platform, which is highlighted below.

MiniMax

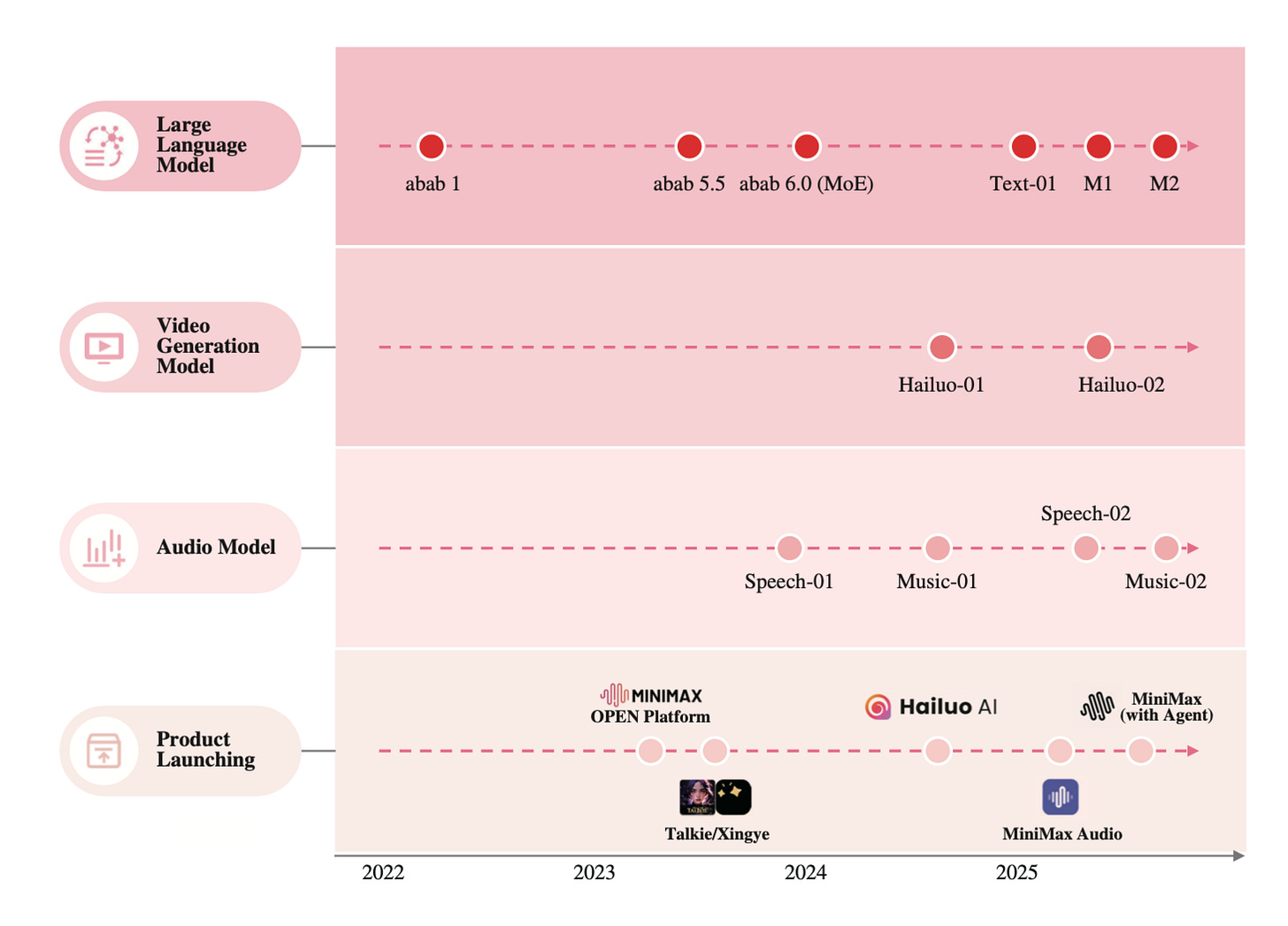

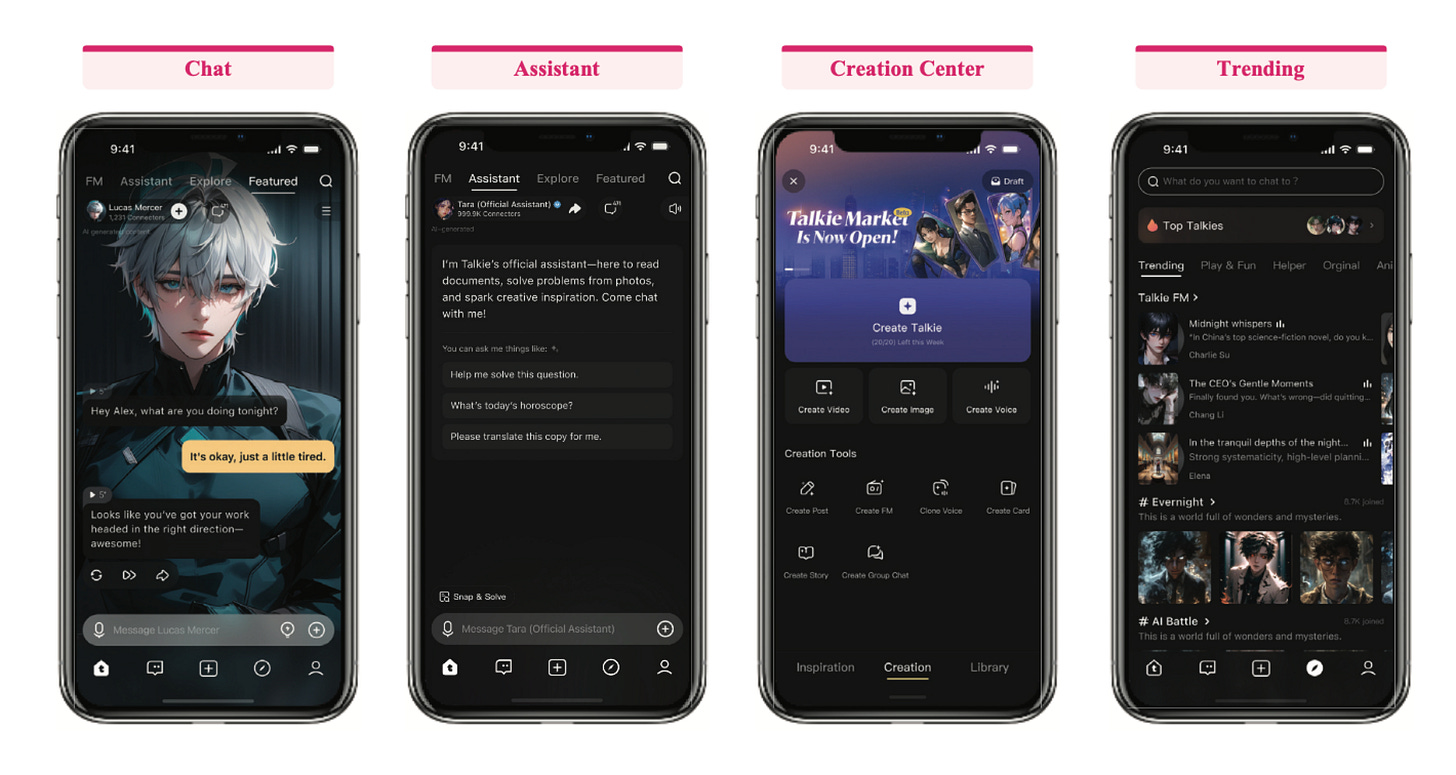

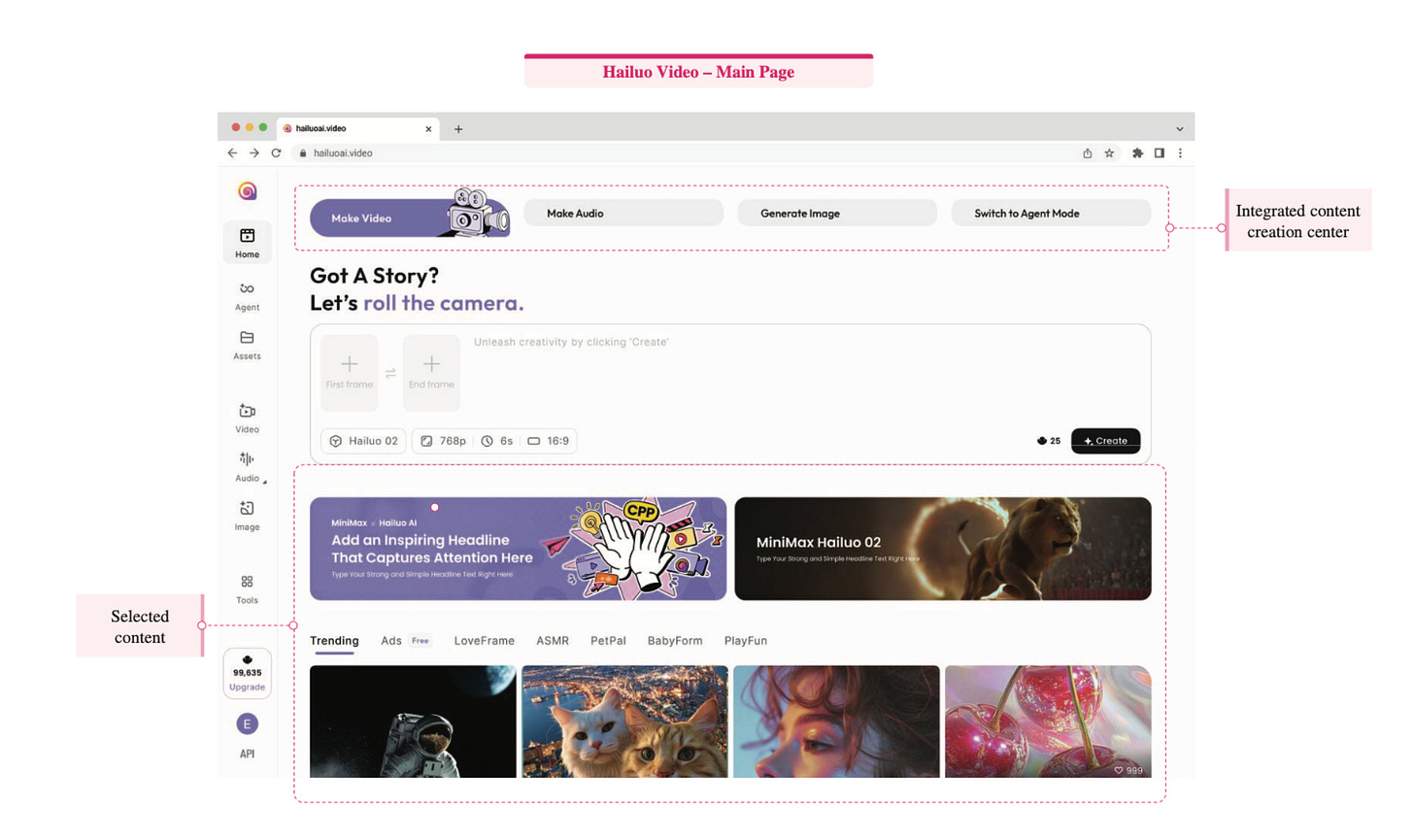

MiniMax is a product-first model company that was founded in December 2021. They still talk about their core model suite as below, but what jumps off the page is the multi-modality and the consumer-facing surfaces they have built. The filing discusses their lineup of models that spans text models and models for video, speech, and music generation. But the way these are primarily delivered is via consumer apps - Hailuo AI, Talkie (and Xingye), MiniMax, and MiniMax Audio. MiniMax is trying to express model capability through native products that can acquire users and monetize directly, while also running an Open Platform that can serve developers and enterprises.

2) Business Model and Monetization

Zhipu

Zhipu monetizes primarily through enterprise solutions delivered via deployments and support.

They generated $8m in 2022, $17m in 2023, $44m in 2024, and $26m in H1 of 2025, and so went public quite early in their monetization journey, although it should be noted that many of their key model launches that put them on the map outside of China came in the back half of 2025.

Zhipu has two main offerings: An on-premise deployment where they can help either fine-tune models and host them locally within a customer’s own environment and a cloud offering where anybody, including individual developers, can use their models as a service via an API.

The on-premise deployment accounted for 84.5% of revenue. The economics of the two offerings are quite different. The on-premise deployment has only 95 customers and so much higher ACVs while the cloud offering is used by individuals and teams across thousands of enterprises. Additionally, their on-prem deployments have a gross margin of about 60%-65% depending on the quarter. Their cloud deployment is running on a gross margin of 0% to 5% depending on the quarter.

Given the on-prem model driving majority of their revenue today, it’s perhaps not surprising that their revenue is also quite concentrated. The top 5 customers represent about 40% of the revenue in H1 2025, with the largest being 11%.

MiniMax

MiniMax monetizes through a two-pronged strategy that balances AI-native consumer applications (B2C) with a B2B Open Platform for developers and enterprises. The company generated no revenue in 2022 during its initial R&D phase, but revenue grew to $3.5m in 2023, jumped to $31m in 2024, and reached $53m in the first nine months of 2025. Similar to Zhipu, MiniMax is entering the public market at an early stage of commercialisation.

While Mainland China accounted for 81% of revenue in 2023, the business has moved globally; by the first nine months of 2025, Mainland China represented only 27% of revenue, with Singapore and the United States contributing 24% and 20% respectively.

On the B2C side, the company operates four core applications that served over 212M users as of September 2025. Its largest revenue driver is the entertainment platform Talkie (Xingye), which features emotionally responsive virtual characters and recorded 20M MAUs and $19M in revenue for the 2025 period. The fastest-growing app, Hailuo AI, focuses on cinematic visual and video generation, contributing $17M. The suite is rounded out by MiniMax Audio, which provides speech and music synthesis and a specialized intelligent agent for professional tasks like coding and research. Interestingly, given the discussion about ChatGPT ads, it should be noted that their core app Talkie primarily monetizes via advertising, with Hailuo and others primarily monetizing via subscriptions and in-app purchases.

The economics of its two segments differ significantly. The AI-native products (B2C) segment accounts for ~71% of revenue but operates on thin gross margins of ~5%, having only recently recovered from deep negative margins as inference efficiency improved. In contrast, the Open Platform (B2B) segment, which represents ~29% of revenue, has ~70% gross margins. This platform provides a mix of usage-based cloud APIs and licensed deliverables that allow enterprises to deploy and operate models locally within their own internal systems.

3) Financial Profiles

It’s worth touching a bit on some of the financials in aggregate for the businesses. If you take the reported numbers given and convert them to annnualized numbers, the shape of the two businesses looks roughly as follows.

Revenue: MiniMax is a bit larger and growing faster, though Zhipu’s 2025 numbers may meaningfully accelerate in H2 ‘25 with their model launches in the back half of 2025.

Zhipu went from $45M in 2024 revenue to ~$54M in annualized revenue

MiniMax went from $30M in revenue to ~$71.2M in annualized revenue

Gross Margins: Zhipu has strong gross margins given it’s more enterprise / on-deployment focus.

Zhipu’s aggregate gross margins were around 50% in H1 2025, down a bit from ~56% in 2024

MiniMax’s gross margins were 23% in Q1-Q3 2025, up from 12% in 2024.

Losses: Both companies are burning a lot of money as one might imagine, with R&D and more specifically cloud services for model inference and training being the primary drivers of spend, at around 70% of R&D spend and R&D itself being about 65-80% of revenue for each company.

Zhipu lost 415M in 2024, with true cash burn of ~$300M, and plans to burn ~550M in 2025

MiniMax lost ~465M in 2024, with true cash burn of ~$260M and plans to burn ~340M in 2025

Cash: Both companies had raised over $1B prior to IPO and raised ~500M each in the IPO itself. Interestingly, at their high levels of cash burn, Zhipu in particular was down to <1 year of runway on their liquid cash and equivalents prior to the IPO.

4) IPO Reception

Both companies raised large IPO proceeds by any normal standard, and a small round by the standards of AI labs in the US that we’re routinely seeing these days.

Zhipu raised over $550M and MiniMax raised over $600M in their IPO. Both IPOs have fared really well, with Zhipu up almost 80% and MiniMax popping over 100% on its IPO day, with both pricing their IPOs in the ~$6.5B range.

Currently, MiniMax trades at a valuation of $15.6B, and Zhipu trades at a valuation of $11.7B. At these valuations, MiniMax and Zhipu trade at 2025 annualized revenue multiples of ~220.4x and ~215x respectively!

Seems like a good sign for all the various AI labs globally that perhaps want more capital or go public. In closing, here’s an infographic based on this post.

Since they went public in Hong Kong, the filing isn’t called an S-1 but I think it’s clear what I mean :)