The AI TAM Expansion Opportunity

How companies can truly capture labor budgets and avoid price compression

This is a weekly newsletter about the business of the technology industry. To receive Tanay’s Newsletter in your inbox, subscribe here for free:

Hi friends,

Over the last decade, SaaS companies have steadily grown by selling seats, charging for incremental productivity gains. But now, we're seeing startups pitch something fundamentally bigger: AI that doesn't just improve workflows but fully owns them. This sets the stage for a transformative shift, moving the TAM from the software budgets to include the entire labour spend as well.

But is all of the labour spend the new TAM for software? Let’s dive in.

The AI TAM Expansion Story

When companies buy software, they're ultimately looking for improved productivity or better outcomes for their business.

Traditional software has delivered some of these improvements, but required humans to use them and were typically priced per seat. Recent waves of AI have pushed productivity further initially through AI copilots, generally also seen as being as assisting humans to do things faster.

However, as AI capabilities have evolved, we’re seeing the emergence of agents capable of handling tasks end-to-end. These agents don't merely augment human workflows; they often automate tasks entirely, significantly boosting productivity. Moreover, agents can potentially enhance outcomes by making superior decisions or refining processes beyond human capability.

This shift towards sophisticated AI agents is why founders increasingly believe they can significantly reduce or replace labor spending. By directly tackling tasks traditionally performed by humans, agents can claim budgets previously allocated to payroll. This isn’t just theoretical. We've seen concrete examples from companies like EvenUp, which generate demand packages end-to-end, or companies like Decagon and Sierra, which can resolve ~50% of customer support queries end to end.

In short: small productivity enhancements grow software spend incrementally, but autonomous agents can transform the market by tapping directly into labor budgets more clearly.

Where Startups Can Charge Like Labor

Capturing payroll dollars isn’t automatic. Most companies may not be actively looking to replace employees with agents quite yet or want to pay indexed to their labour spend.

Agents win first in contexts where buyers already think in “cost‑per‑outcome” and the hand‑off can be clean, particularly when coupled with improvements in getting the task done beyond cost (reliability, speed, etc).

But where specifically will this shift happen? There are a few clear signals startups can follow to identify fertile ground:

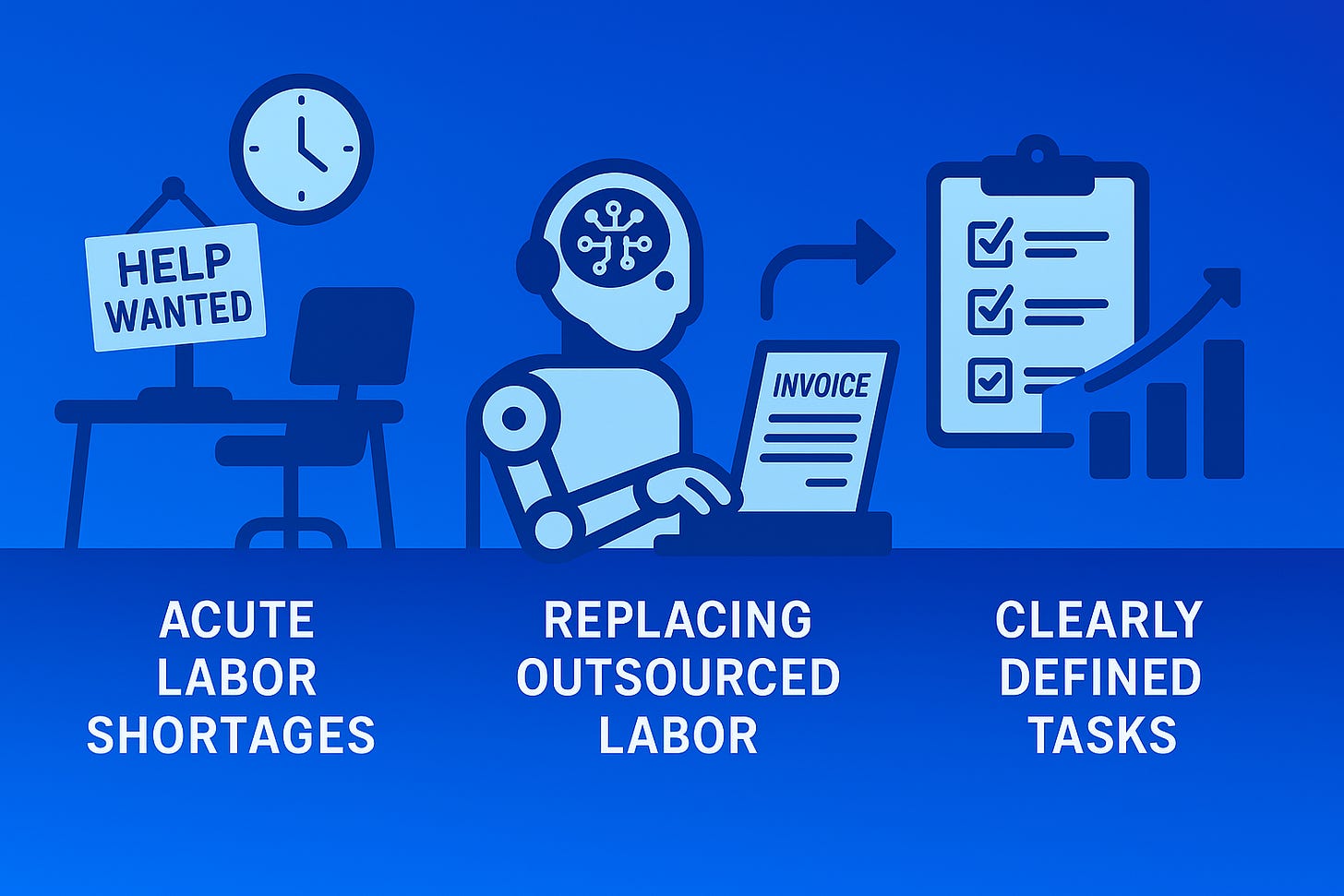

Acute labor shortages: Fast-growing industries or functions where companies simply can’t hire quickly enough. For example, healthcare coding, cybersecurity monitoring, or sales outreach are areas starved for reliable labor. AI here doesn’t replace existing jobs, it fills roles companies can't staff.

Replacing outsourced labor: Companies already comfortable paying external providers (think call centers, invoice processing, or basic legal work) are more likely to quickly adopt agentic solutions. The leap from paying a human contractor $10 per ticket to paying an AI agent $3 per ticket feels natural, not revolutionary.

Clearly defined tasks: Where the job scope is well-defined, routine back-office work, standardized support queries, lead generation, agents can deliver clear, quantifiable results. The simpler the ROI calculation (“We spent $100K on this function last year; an agent does it for $20K”), the quicker the adoption.

The common thread is clear: If buyers can directly match what an agent does to existing labor spend, they’re more comfortable reallocating that budget from people to software.

Navigating the inevitable price compression

As more startups rush in, prices per task will inevitably drop. Competition is unavoidable. But there are structural ways to resist the race to zero:

Deep cross-system integration: Agents embedded across multiple core systems (CRM, ERP, communication platforms) are incredibly sticky. Replacing them is painful and expensive, preserving pricing power over time.

Multi-tenant learning advantages: Products trained on a broad customer base consistently outperform single-tenant or internally built tools. Each customer benefits from insights drawn across millions of tasks, creating a significant competitive moat.

Together, deep integration and cross-customer learning help sustain long-term margin even in competitive markets.

Sizing the Opportunity: A Quick Reality Check

Let’s do some rough math to see how significant this TAM expansion might be:

Size of Labour Spend: Total U.S. wages and benefits were roughly $11 trillion last year1. Assume knowledge workers make up about 45% of this—around $5 trillion2.

Percent addressable by AI in near term: McKinsey and Goldman estimates that roughly 25-30%3 of this work could realistically be automated in the near-term, equating to $1.2 trillion worth of work.

Vendor Pricing: Its unrealistic for AI providers to charge the cost of labour since displacement will be difficult given no ROI for the customer (unless the AI results in substantially better outcomes). Let’s say vendors charge 20% of the displaced labor cost (giving buyers a compelling 5x ROI). That creates a $240 billion net-new market, equivalent to around 1.7x of the current U.S. SaaS market (~$140B annually4).

What this means going forward is clear: even conservative estimates suggest that agentic AI has the potential to almost triple today’s software TAM. Even if price compression results in another 50% decline in pricing, that still almost doubles the size of the market.

Closing Thoughts

Agents, by capturing real labor spend, promise a much more substantial market expansion in software, conservatively almost tripling the size of the market. Early winners will likely emerge in areas with clearly defined tasks, acute labor shortages, or industries already familiar with outsourcing work.

Longer-term success, however, will depend on structural defensibility through deep integrations and continuous learning across customers.

Data from Dept for Professional Employees

Data from Grand View Research