Stripe vs Adyen Financials: 2023 Update

On Adyen's higher payments volume and Stripe's much higher net revenue

This is a weekly newsletter about the business of the technology industry. To receive Tanay’s Newsletter in your inbox, subscribe here for free:

Hi friends,

Stripe released their annual letter this past week, and combined with Adyen’s from a few months ago, gives us a better sense of how the two businesses are doing as of early 2023.

This should be a relatively short piece, so let’s get to it. I’ll cover:

Comparison of financials

Drivers of differences

What to keep an eye on going forward

Comparisons of Financials

I. Total Payments Volume

Adyen surpassed Stripe in 2022 in terms of total payments volume, though the two are pretty close.

Adyen did $829B in 2022 TPV, growing ~49% y/y

Stripe did $817B in 2022 TPV, growing ~28% y/y

If you look at a 2 year period from 2020 to 2022,

Adyen went from $328B to $829B growing ~59% y/y

Stripe went from $400B to $817B growing 43% y/y

So, Stripe was ahead during the pandemic, but Adyen continued to grow strongly in 2022.

II. Gross Revenue

Though the two have similar TPVs, Stripe has a 50% higher gross revenue than Adyen!

Stripe’s gross revenue was ~$14.3B and grew ~19% y/y (slower than TPV)

Adyen’s gross revenue was ~$9.7B and grew 52% (roughly in line with TPV growth)

Looking at it in terms of take rate: Stripe’s gross revenue take rate is 1.75% and Adyen’s is 1.16%, so Stripe is able to extract 50% more revenue on a same-sized transaction as Adyen.

Of note, however, is that Adyen’s gross take rate is holding steady over time, while Stripe’s has been declining.

III. Net Revenue

Stripe makes almost double the amount of net revenue as Adyen!

Stripe’s net revenue was $2.8B in 2022 growing 12% y/y

Adyen’s net revenue was $1.44B in 2022 growing 33% y/y

Adyen’s take rate is 1.16% gross take rate and 0.17% net take rate. Stripe’s take rate is 1.75% gross take rate and 0.34% net take rate.

On a net take rate basis, Stripe’s 0.34% is exactly double that of Adyen’s 0.17%. What’s going on?

A large part of it is driven by Stripe having a 50% higher gross take rate to begin with. In addition, Stripe pays out ~80% of its gross revenue to other institutions, while Adyen pays out 85% of its gross revenue, so that compounds the net revenue differential!

Note that if you consider Stripe’s gross revenue as revenue, you can think of Stripe’s gross margin as under 20%. However, it is more likely they consider their net revenue as their revenue, on which they likely have 70%+ gross margins.

IV. EBITDA

So what about the bottom line?

Adyen had $0.8B of EBITDA in 2022, corresponding to 55% EBITDA margins on Net revenue

Meanwhile, Stripe had negative EBITDA in 2022. In 2021, it made hundreds of millions of EBITDA, so it went from profitable to not during the course of 2022.

2024 Update: In 2023, Stripe had an EBITDA of $100M, which would put its EBITDA margin at around 3% of Net Revenue.

V. Market Cap

Adyen trades in the public markets at a market cap of $48B

Stripe recently raised a down round at a market cap of $50B

Adyen is more profitable, has higher TPV, and is growing faster, so from that perspective, the $50B of Stripe may seem a bit high, though Stripe does have double the revenue base if it can increase its efficiency and profitability. Below are some of the market cap multiples on various metrics:

Financials Summary

To summarize:

Stripe and Adyen have similar TPV ($817B vs $829B). In other words, currently, the Stripe vs Adyen market share is basically 49.5%/50.5%. However, Adyen is growing faster (49% vs 28%).

Stripe has ~1.5x the gross revenue of Adyen ($14.3B vs $9.7B)

Stripe has ~2x the net revenue of Adyen ($2.8B vs $1.4B)

Adyen has close to a billion $ more in EBITDA (negative vs 0.8B) and much higher EBITDA margins.

Stripe has a slightly higher market cap ($50B private vs $48B public)

If you don’t yet receive Tanay's newsletter in your email inbox, please join the 5,000+ subscribers who do:z

Drivers of differences

Adyen’s Enterprise vs Stripe’s SMB origins: Given that Adyen focused on Enterprise from the off, they tend to serve fewer customers with higher payment volumes. These customers negotiate lower rates. Stripe started with SMB, and while they today serve enterprises like Amazon, their blended take rates are higher because the SMB take rates tend to be higher. The customer mix is also likely the reason that Adyen grew revenue in 2022 more strongly than Stripe, as some SMBs struggled. While we don’t have precise numbers, Stripe serves an estimated 2M customers, vs ~100K for Adyen.

Adyen’s EU vs Stripe’s US origins: In Europe, take rates are generally lower on payments compared to the US. Adyen began in Europe, and so tends to have more European customers. On the flip side, Stripe began in the US. However, both are now expanding globally – Adyen’s fastest-growing market is the US, and over half of Stripe’s new businesses are not based in the US.

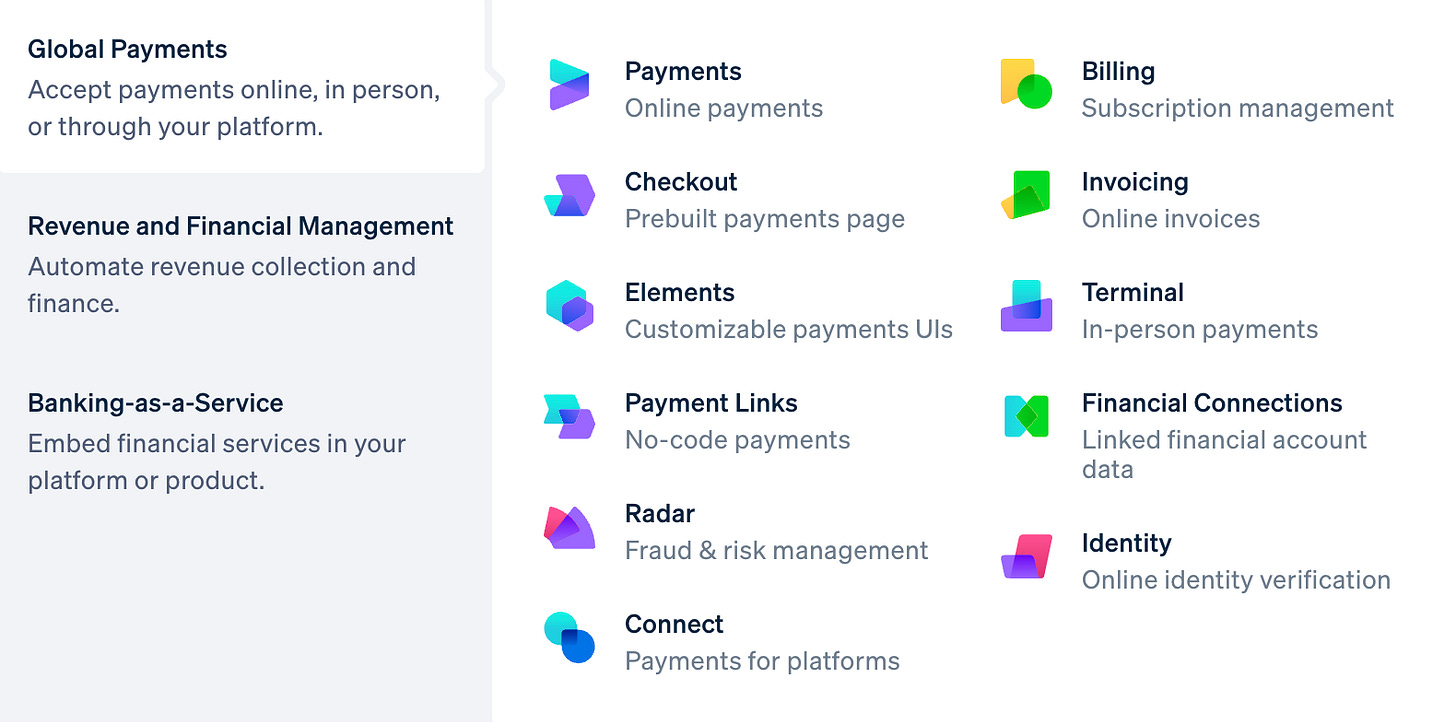

Stripe’s broader product suite: Stripe has been more aggressive in terms of R&D focused on expanding beyond payments. They have products to help incorporate, prevent fraud, automate taxes, and so on, each of which can be seen as slightly increasing the take rate if attached to payments. Adyen has also begun to add more products over the years, but it’s more limited compared to Stripe.

Stripe’s much larger employee base: Ultimately, the two companies handle the same payments volume, but Adyen has ~3300 employees vs Stripe has ~7000 (post layoffs). So on a TPV basis, Adyen processes more than 2x the TPV per employee as Adyen. However, we just discussed that given Stripe invests more in R&D and has a broader product suite, so comparing TPV per employee does a disservice to Stripe. The most charitable metric to look at it on for Stripe would be net revenue/employee? On that basis, the two are pretty close - Adyen is only 7% more efficient. But Adyen is run leaner, no matter how you cut it.

Stripe’s much higher per-employee costs: Putting aside the number of employees for a second, Stripe’s location means a much higher fully loaded cost per employee relative to Adyen. This is best illustrated in comparing the net revenue per employee with the EBITDA per employee:

Net revenue per employee: Stripe is $403K vs Adyen is $430K

EBITDA per employee: Stripe is negative vs Adyen is $236K

So not only is Adyen run leaner in terms of the number of employees, its run much more efficiently in terms of employee compensation and other operational costs related to employees (employee mix, travel, compensation, etc).

Things to Watch

Both Adyen and Stripe are phenomenal companies, and the market is extremely large and by no means does one “need to win”. However, here are some of the things that I think are interesting to pay attention to over the coming years, aside from the eventual Stripe IPO.

Adyen’s growth rate: Stripe saw its growth rate fall dramatically in 2022 as one might expect, while Adyen’s growth rate remained relatively strong. It will be interesting to see how Adyen’s growth fares in 2023 and whether Stripe can maintain or even reaccelerate its growth.

Stripe’s SMB advantage: Adyen does not have the operational infrastructure to support small SMBs today based on former employees. Since many things that start small may grow into meaningful size, for example, ChatGPT uses Stripe for payments and may process large amounts of dollar volume in the future, it will be interesting to see if Adyen is able to compete in the SMB space, or win customers as they scale on price.

Stripe’s gross take rates: As Stripe expands globally and goes upmarket, its gross take rates may decline over time. In fact, between 2020 and 2022 its gross take rate declined from 1.85% to 1.75%. While I expect them to always remain significantly above Adyen’s it will be interesting to watch how it changes over time.

Stripe’s product suite investments: Stripe has obviously invested heavily in its product suite which has helped drive up its take rate somewhat. However, aside from Atlas and Connect, it’s unclear externally if any have been breakaway successes. As Adyen fast-follows in some of these areas, will Stripe’s investments pay off? Particularly, their consumer payment products such as Payment Links are worth keeping an eye on.

Thanks for reading! If you liked this post, give it a heart up above to help others find it or share it with your friends.

If you have any comments or thoughts, feel free to tweet at me.

If you’re not a subscriber, you can subscribe for free below. I write about things related to technology and business once a week on Mondays.

Interesting to see these businesses compared. The take-away for merchants is probably to use Adyen (if they'll have you) once your volumes get high enough, and increase their profitability per transaction.

The question is how many businesses convert from low volume to high volume every year, and how many of them jump from Stripe to Adyen for cost or service reasons.

The service reasons could be technical reliability/availability, reliability and speed of settlement, or unique product features.

How do Stripe and Adyen compare on those for the low volume -> high volume transitioning businesses?

Stripe's extra services should provide stickiness despite all these things, but at what point doesn't that work when the merchant's CFO is hunting for more margin?

Hi, where the financial results of Stripe taken from?

I looked at Stripe's annual letter and it doesn't contain financial information such as new revenue, EBITDA, etc, it only reveals Stripe's annual Total Payment Volume

It also make sense as Stripe is a privately held company and isn't obligated to publish its financial results