Section 174 and its Impact on Tech Startups

On Expensing vs Amortizing R&D for Taxes

This is a weekly newsletter about the business of the technology industry. To receive Tanay’s Newsletter in your inbox, subscribe here for free:

Hi friends,

This week, I’ll be discussing a US tax law code amendment that kicked in last year. Why that of all the things I could be writing about? Because I think it’s been quite under discussed and could play a big role in the market for software engineering and the operating of many tech/software focused businesses in future years were it to continue to remain in effect.

The change to Section 174

As part of the Tax Cuts and Jobs Act, the IRS Section 174, related to how to account for R&D as it relates to tax bills was amended starting for the 2022 year.

The amendment required that companies, rather than immediately expensing all their R&D, had to amortize R&D costs over five years (or fifteen if it was tied to foreign workers).

Practically, R&D includes most software engineering salaries, although certain portions of it tied to maintenance can still be expensed.

This amendment which kicked in for the 2022 tax period, caught many businesses by surprise early 2023 as they finalized their returns, and will hit more businesses for the first time this year as they finalize their 2023 returns.

An Illustrative Example

A simple example should help illustrate the change to the tax code.

Let’s say a firm earns $500K, and has $200K in marketing costs and $300K in R&D costs (from engineering labor costs). Prior to the amendment, the firm would recognize the $200K in marketing costs + $300K in R&D as expenses, meaning their operating income would be $500K - $500K = 0. It would therefore not pay any tax.

Under the amended code, they would only be able to recognize 10% of the $300K in R&D as expenses in the first year, meaning their total expenses for the year for tax purposes for be 200K + 10% of 300K = $230K. Therefore, they would have a profit of $270K for tax purposes. At a 21% tax rate, they would end up paying $56.7K in taxes.

The issue is that from a cash flow perspective, it’s likely the company actually made no profit that year, since they paid engineering salaries and other costs in full. They now have to somehow find $57K in cash to pay the govt, despite not making a real profit.

This can pose a huge challenge, particularly for businesses that are self-funded (though other businesses are also not immune from this). And if you think this example is too simplistic, a small business owner tweeted that she broke even but owes over $100K in taxes because of the change.

Why This Matters

This amendment undoubtedly hurts software businesses, since in most cases it results in the taxes that they have to pay every year. While some may see that as just, particularly for the larger tech companies given how profitable they are anyway, the reality is that it hurts smaller businesses much more than large businesses.

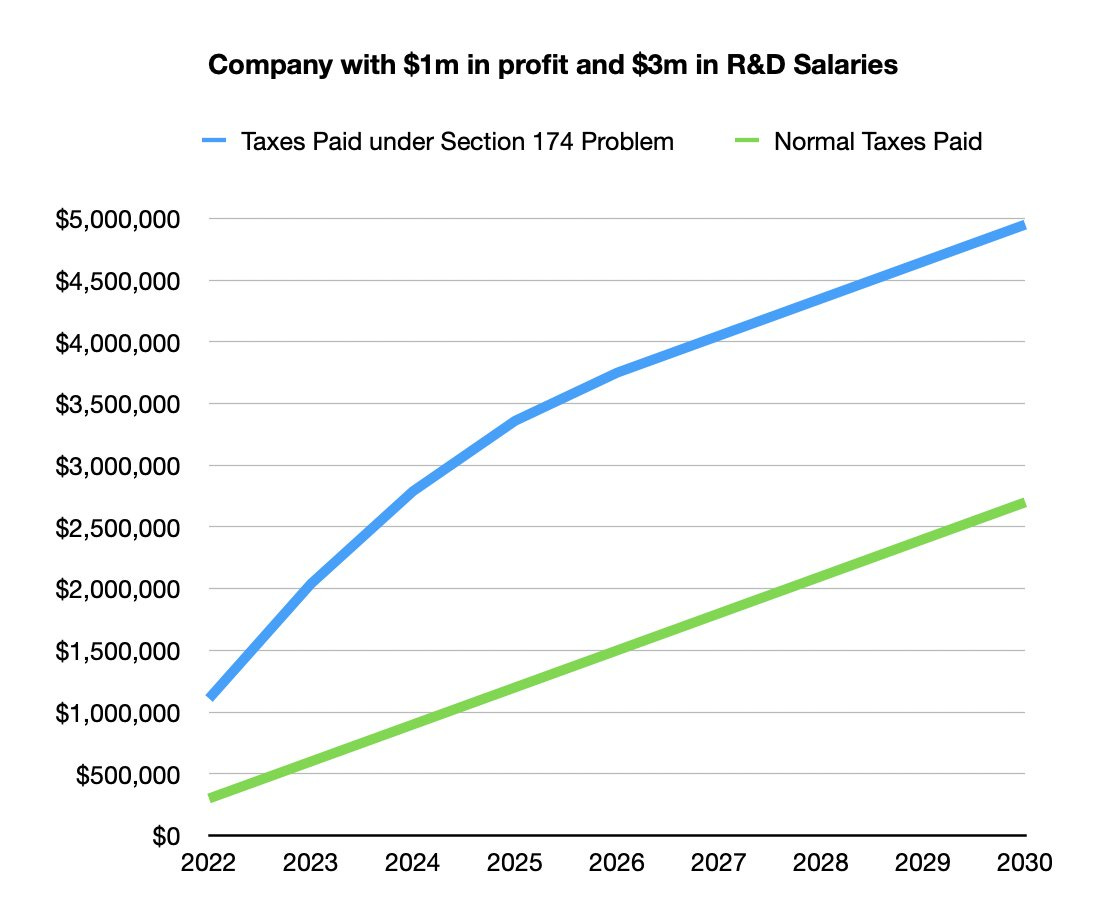

Higher taxes: Whether you’re a large tech company or a small bootstrapped startup, the reality is these companies will be paying more taxes in the short term, if they are profitable. While big tech has the cash cushion to manage these, smaller companies will be harder hit, and many in 2023 itself faced cash flow challenges to pay taxes, resorting to personal loans. While in theory one can make the case that the tax impact of this evens out in 5 (or 15 years), how many small businesses actually survive to that point?1 Besides, the below graph of a simplified examples shows that under the new rules, businesses will always be “fronting” extra taxes to the government relative to old rules.

Source: Michael Minard Layoffs and Business Shutdowns: There have been many many anecdotes, particularly in bootstrapped software companies, that these changes forced leadership to lay off a number of software engineers, because the cash flow profile of their business has flipped upside down because of this amendment (One way to think about the change now is that if you’re close to a profitable business, you have to pay taxes on 90% of your engineers salaries. That is untenable for most small software businesses). A group of 800+ small businesses have created an alliance to highlight just how disastrous this will be to their businesses and its employees because of the layoffs it will force.

A potential reduction in overseas engineering talent: This bill will hurt all talent, but may hurt talent overseas even more. While talent overseas may be cheaper from a cost perspective, the 15 year amortization period increases their relative cost from an immediate term cash flow perspective for profitable companies compared to domestic talent. This could result in a slight preference for domestic talent in some cases, or other creative methods to avoid this amortization window.

While thus far, the impact on startups has been somewhat limited in 2023, in the sense that they generate revenue a bit later in their journey, and may have sufficient cash cushions to meet the tax burden when they generate profits even under these amortization schedules, since the vast majority of startups main expense is labor costs, a large chunk in R&D, this will start to play a bigger role in the hiring plan of startups as years go on if it is not adjusted.

What’s next?

There is some hope on the horizon. The Tax Relief for American Families and Workers Act of 2024 (H.R. 7024) included a provision to give firms the option to expense R&D costs, but only for domestic workers. It would still require R&D associated with foreign workers to be amortized over 15 years.

This bill was passed in the House at the end of January this year, and will now make its way to the Senate. If passed, it would resolve the tax and cash flow related issue for many companies, and if passed, could also encourage more of them, particularly smaller firms to hire domestic R&D talent, given the much more favorable tax policies related to expensing their salaries vs amortizing over 15 years for foreign talent.

As John Maynard Keynes once noted, “In the long run we are all dead”; this is particularly true for small businesses

Good post, thanks for sharing! Could this be dealt with by "outsourcing" the R&D (ie: Park your devs in a separate corporate structure and have them invoice the main business that handles PM, sales etc). The way I see it, for large companies that will want to avoid large tax bills, they will likely have to get closer to PE and Credit funds and hence, generate fees etc for another industry.

thanks for writing this.

Quick Question: when we say 'software engineers' > does the same also include other roles in a software company like product managers, UX teams, program managers?

another question: does this also impact salaries paid to immigrant works working and living in US in terms of salary paid amortization over 5 years?