Reddit S-1 Breakdown

On community and engagement, revenue and profitability, data and AI, and meme stocks

This is a weekly newsletter about the business of the technology industry. To receive Tanay’s Newsletter in your inbox, subscribe here for free:

Hi friends,

Reddit filed to go public last week. This week, let’s dive into Reddit’s IPO filing, dissecting the core elements that define its march towards becoming a publicly-listed company.

I’ll discuss:

product and user base

revenue and monetization

spending and profitability

data and AI

shareholders and IPO dynamics

Without further ado, let’s jump into it.

Product and Engagement

Reddit describes itself as a “global, digital city where anyone in the world can join a community”. In essence, it is the largest community platform in the world, boasting over 100,000+ different communities. SimilarWeb ranks it as the 17th most popular website in the world.

For social media websites, there are three key drivers that affect the business: the number of users, how engaged they are, and how you can monetize them.

On users, one of the more unique aspects about Reddit relative to what are traditionally considered social media such as Facebook, Instagram and Snapchat, is that many users come across reddit posts through Search and other means and may use the product not very actively or in a logged out state. This is evident when we dig into Reddit’s user base numbers:

Monthly Actives: In December of 2023, Reddit had over 500M monthly active users.

Weekly actives: In Q4 of 2023, Reddit had 267.5M weekly active users. That means roughly 53% of users who used Reddit monthly used it weekly.

Daily actives: In Q4 of 2023, Reddit had 73.1M daily active users. That represents a DAU/MAU ratio of only ~15%. In addition, of those daily actives, only about 50% of them were logged in, which makes them likely to have lower engagement levels and lower monetization rates. On the plus side, daily active users have grown strong at 27% y/y.

From an engagement perspective, one key measure of engagement is the DAU/MAU ratio. As shown in the chart below, when comparing Reddit’s engagement with Facebook and Snap, it doesn’t stack up well. Reddit appears to have a lot less of a frequent use case for the vast majority of its user base, as evidenced by its low DAU/MAU ratio. In some ways, it’s usage is closer to Pinterest which also has ~500M MAU but doesn’t disclose its DAU.

The other key measure is time spent. Reddit doesn’t disclose full metrics, but does note that the average minutes per logged in user is about 20 minutes per day, but goes up as they have been on Reddit longer — 35 minutes a day for those who have been on Reddit for over five years and over 45 minutes a day for those who have been on Reddit for over seven years. That’s not bad, but not comparable to Snap, TikTok and FB/IG which have upwards of 30 minutes per day on average across much larger user bases.

The tough part however, is that only about half of the daily active users are logged in, and only a small percent of overall users are actively daily.

Revenue and Monetization

Reddit primarily monetizes via advertising today and made $804M in 2023, up 21% y/y, of which 98% came from advertising.

Reddit notes that it is relatively early in their advertising journey in terms of the tools they have to build. While they have been in the ads business since 2006, the note they only meaningfully started to built adtech solutions in 2018. Reddit also has a few other sources which it intends to layer in over time, including Data Licensing, which we’ll discuss shortly, and a user economy (tips, commerce, creators, etc), but let’s first focus on advertising.

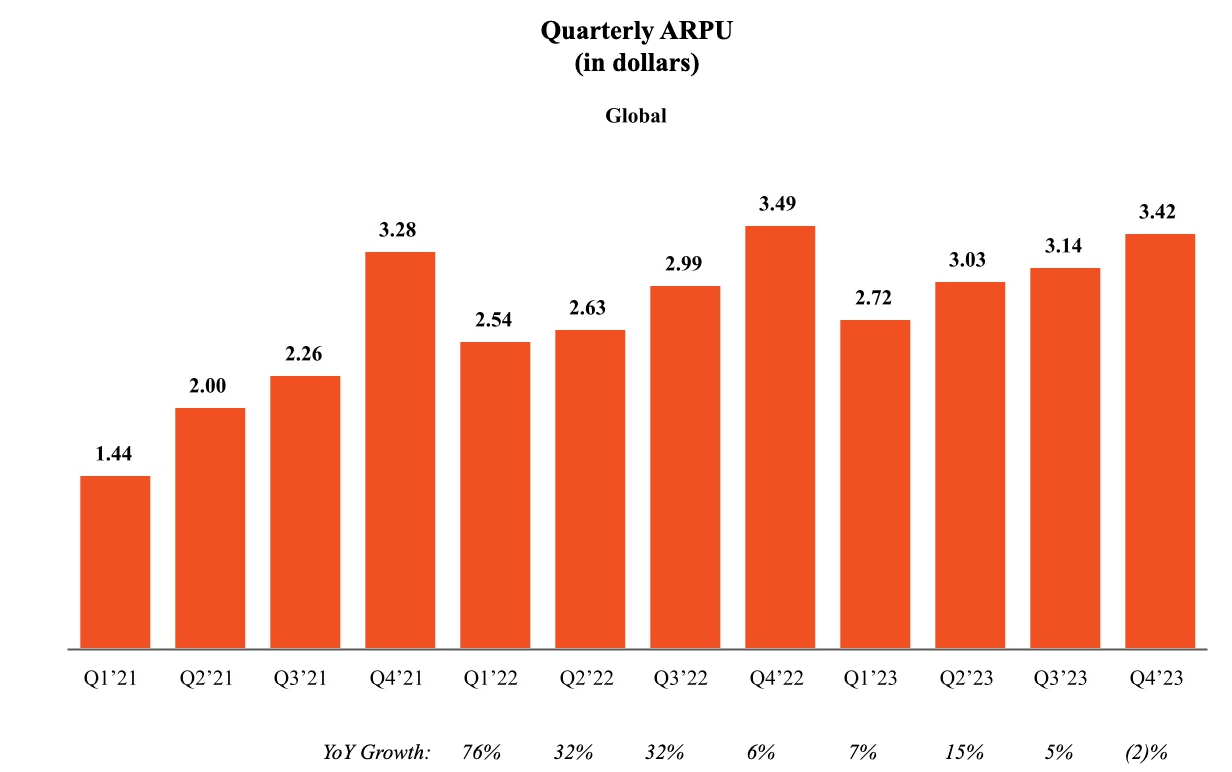

Looking at their ad revenue per user, one concern is that it seems to be plateauing a bit at about ~$12.5/DAU/year in the recent year or two.

From a product perspective, some of the benefits Reddit has as it relates to ads are:

Interest based advertising: Given Reddit is made up of clear communities (Subreddits), ads can be clearly targeted based on interest to certain communities while respecting user privacy.

Unduplicated audience: Reddit can allow advertisers to reach an audience that in some cases can’t be reached via other social media, as the chart below illustrates.

Higher Intent of Audience: Compared to other social media, since users occasionally reach reddit from search engines or other places when seeking out recommendations or similar, they can often have higher intent than say somebody scrolling through a FB/TikTok/Snap feed. This can allow reddit to earn higher CPMs.

However, Reddit also faces downsides in terms of: having fewer logged in users, less engagement, and being relatively more text based compared to other platforms, which result in ads sometimes either sticking out or not feeling as organic.

On a per daily user basis, Reddit actually fairs better at monetization than Snap. However, it’s user base is almost 1/5th the size. Similarly, Pinterest, which has a similar monthly active user base to Reddit earns almost 3.8x the revenue. So depending on how you look at it, the “issue” with Reddit may be that it under monetizes relative to a higher intent platform, or that it is too niche to be as big as a Snap/Instagram.

Spending and Profitability

On the surface, things look pretty good for reddit. ~804M in revenue in 2023, with those sweet 86% advertising gross margins. But Reddit still lost ~$100M in 2023, though losses did decline from ~150M the previous year.

What’s going on? As a percentage of revenue, Reddit’s spending breaks down is as follows:

COGS: 14% which is quite reasonable for an ads business at its scale.

G&A: 20% on G&A which has been trending down over time which is relatively reasonable.

Sales and Marketing: 29% which is slightly high, but given the ads business investments are relatively recent and still has room for growth is justifiable.

R&D: 55% which is quite shocking for it’s scale. Reddit after all is largely a UGC text only website that has been around for almost 20 years, and isn’t investing in things like AR (Snap), AI/VR (Meta), multiple platforms or apps or anything else.

Many will be concerned that if an ads business that is 20 years into its journey is still losing money, will it ever really be profitable? In some ways, Reddit’s income statement paints a clear reason why and a path to fix it.

I once noted that Twitter was spending almost $900M a year in R&D without any clear change in their product (we know how that played out). I think the same can apply to Reddit today, which is spending ~480M/yr in R&D.1

If their R&D spend as a percent of revenue was brought in line with their peers such as Pinterest and Meta at around ~30%-35% of Revenue, Reddit would be a profitable business with 5-10% margins absent any other changes. While that’s not great, that clearly indicates that the path, should Reddit aim to get there, is quite achievable and entirely controllable.

The good thing for Reddit is that it has a war chest of $1.2B in cash and given its losses of ~$100M/yr, it’s well on the path to becoming profitable without needing more money as its revenue grows even if it doesn’t adjust its R&D efficiency.

Data and AI

While Reddit’s primary source of revenue in 2023 is advertising, they’re going public at an interesting time amidst the AI boom.

Reddit is one of the few large scale UGC corpuses, and perhaps one of the most interesting ones when it comes to text given its anonymity and authenticity. It has a corpus of over 1 billion posts and over 16 billion comments, generally well categorized across thousands of different niches and communities. In the age of LLMs, this is one of the most valuable sources of conversational data and knowledge. Reddit is now looking to monetise this data for model use. This is still a business and market in its early stages, and no one knows exactly how it plays out, but it stands to reason that there will be a number of buyers willing to pay for access to this data and could provide a compelling upside revenue opportunity for the company.

Earlier this year, Reddit entered into a $203M ACV data licensing agreement with Google based on Google’s announcement, for a 2-3 year period. Reddit expects to recognize $66M in revenue this year and the remaining over the next two years. As part of the agreement, Reddit will provide access to a data API, as well as quarterly transfers of the Reddit API. Nothing stated in the S-1 indicates this is an exclusive agreement, so one would expect Reddit to also look to strike these agreements with other parties such as OpenAI.

At the same time, AI could pose a threat. If all these models are trained on Reddit data, people could seek to use these models and ask them questions directly instead of coming to Reddit.

Reddit itself notes that users “arrive at Reddit organically or even by appending “Reddit” to their searches for better results”. This behavior may change over time with people asking models questions directly.

Shareholders and IPO Reaction

Most startups journeys are rarely up and to the right continuously but instead full of ups and downs along the way. Reddit certainly has been that, with it finally making its way onto the public markets, 19 years since starting and numerous CEOs and ownership changes along the way.

The key stockholders of Reddit ahead of its IPO include:

Advance Magazine Publishers, the parent company of Conde Nast, which purchased Reddit in 2006, which owns 30.1%

Tencent, which invested in Reddit and owns 11%

Sam Altman, who invested >$50M in Reddit and was the CEO for 8 days and owns 8.7%

Steve Huffman who was one of the co-founders of Reddit and is the current CEO who owns 3.3%

Directed Share Program

As part of their IPO, Reddit is allowing active users and moderators to participate in its offering via a directed share program as below. While this is a nice gesture and allows retail investors to purchase reddit stock at its offering price (as opposed to after the first trade), I don’t place too much weight on this given that in the current market it’s not a given that there will even be a big IPO pop as such. Besides, platforms such as Robinhood and others have allowed users to participate in IPOs more generally recently. In fact, this may also increase increase the likelihood that some redditors band together to pull some shenanigans around meme stocks, as touched on below.

IPO Pricing

While Reddit's most recent financing valued them at $10 billion in the private markets, it is likely based on their current financials and the market that they go public somewhere in the $5 billion range, although I would be hesitant to venture too many guesses on how this ends up trading.

Why? Because how often do you see a company go public that lists as a risk factor that it may become a meme stock.

Interest in our Class A common stock from retail and other individual investors, for reasons unrelated to our underlying business or macroeconomic or industry fundamentals, could result in increased volatility in the market price of our Class A common stock.

In 2021, the market prices and trading volumes of certain securities, such as GameStop Corp., AMC Entertainment Holdings, Inc., and other “meme” stocks, experienced extreme volatility. The rapid and substantial increases or decreases in the market prices of “meme” stocks may be unrelated to the respective issuer’s operating performance or macroeconomic or industry fundamentals, and the substantial increases may be significantly inconsistent with the risks and uncertainties that the issuer faces. This volatility has been attributed, in part, to strong and atypical retail investor interest, including as may be expressed on financial trading and other social media sites and online forums such as r/ wallstreetbets, one of our subreddits. Given the broad awareness and brand recognition of Reddit, including as a result of the popularity of r/ wallstreetbets among retail investors, and the direct access by retail investors to broadly available trading platforms, the market price and trading volume of our Class A common stock could experience extreme volatility for reasons unrelated to our underlying business or macroeconomic or industry fundamentals, which could cause you to lose all or part of your investment if you are unable to sell your shares at or above the initial offering price.

But that’s prospect that the Reddit IPO has in store. For those wondering, r/wallstreetbets was mentioned 5 times in the S-1.

Until next time,

Tanay

While many will point out that running a platform at scale is much harder than people think, which I do appreciate having worked at one of these platforms, it’s not $480M/yr hard for something like Reddit.

Reddit's such a strange company:

✅ As the best source of authentic information on the internet, it could become as valuable as META.

❌ Its ad product is decades behind in terms of user experience and ROAS

✅ The core product has resisted the enshittification that's undermined so much of the internet's UX since the mid 2010s...

❌ ...through a sort of salutary neglect where most R&D has gone to benign, meaningless features like NFT avatars and UI overhauls

✅ A useful on-site search feature would PRINT money with search ads. Currently Google is free-riding Reddit's content this way. LLMs + RAG on individual subreddits would be incredibly useful

❌ Reddit has failed to develop better search and ad products for a decade. Nobody knows why.

✅ The timing is excellent for a big cash infusion via IPO to capitalize on AI and Google's slipping search quality. AI search relies heavily on Reddit content, and the time is right to acquire or partner with other search and ad platforms.

❌ Public companies suffer from short-term pressures to maximize revenue, which makes ambitious long-term pivots harder. If Reddit couldn't execute a strategic vision as a private company, I'm worried it will sell out its user experience for short-term gains post-IPO

✅ Reddit's alienated its users before with no long-term detriment (e.g. closing its APIs). Community network effects can keep a declining product going a long time (Cf. Twitter)