Monetizing AI surfaces: Ads in the age of AI

Ads in AI today, OpenAI's Ads Plans and What "Ads for Agents" Might Mean

I’m Tanay Jaipuria, a partner at Wing and this is a weekly newsletter about the business of the technology industry. To receive Tanay’s Newsletter in your inbox, subscribe here for free:

Hi friends,

ChatGPT is finally starting to look like a real consumer internet product, in the most obvious way: ads. If you’re going to offer a free plan at scale, you can’t subsidize inference forever absent another cash cow business. The question was always when OpenAI would do it, and what the first ad products would look like.

I want to walk through (1) what other AI surfaces have done with ads (2) what we know so far about OpenAI’s approach (3) what the initial opportunity might look like and (4) where this goes once “the user” becomes “the agent.”

Let’s get started.

I. Ads in AI today

OpenAI is by far the most prominent and at-scale surface to start AI surface starts out in ads, but it’s not the first one. A bunch of AI products already monetize various forms of AI surfaces via ads, including:

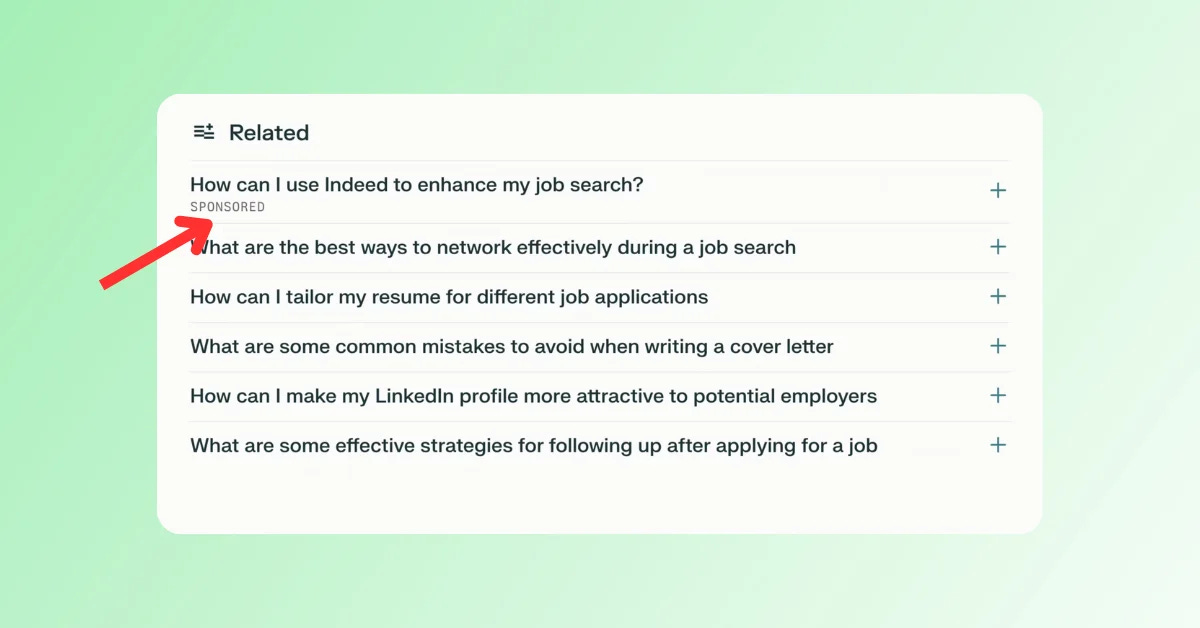

Perplexity which has been explicit that advertisers shouldn’t influence answers, and the ad unit they shipped is basically “sponsored follow-up questions” plus paid media alongside an answer.

OpenEvidence in medicine where intent is unusually high and budgets are concentrated (pharma, devices). They’re free to doctors and ad-supported, and they’ve been public about ads being a meaningful revenue driver, reportedly close to / in the 9 figures of revenue.

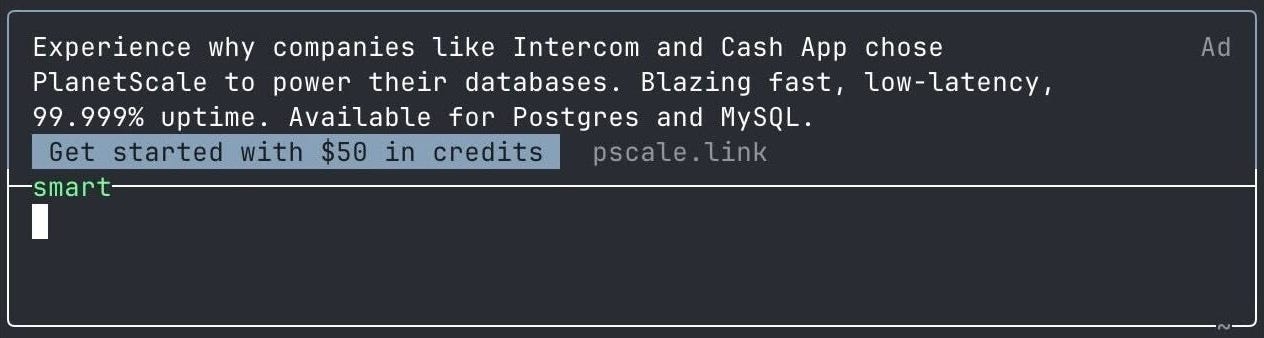

Amp Free from Amp Code which offers a free agentic coding experience that is ad supported.

Talkie (owned by Chinese AI lab Minimax) is a Character.AI style app where people can chat with different characters and generates revenue primarily through advertising (on the free tier) in the form of banners and interstitials and in-app purchases. Talkie notes that their eCPMs range from $2-$10.

The way to think about these early AI ad systems is simple: they’re still advertising to humans. The ad is shown to a person, the person clicks (or doesn’t), and measurement is ultimately downstream conversion and lift. The “AI” part mostly changes targeting (more intent signals because of clear queries/intent) and the canvas (the answer box can absorb a lot of context).

II. OpenAI’s Ads Plans

From what’s been reported so far, OpenAI is taking two approaches to monetize their free tier and capture more of the value they create:

1) Classic intent-based ad formats

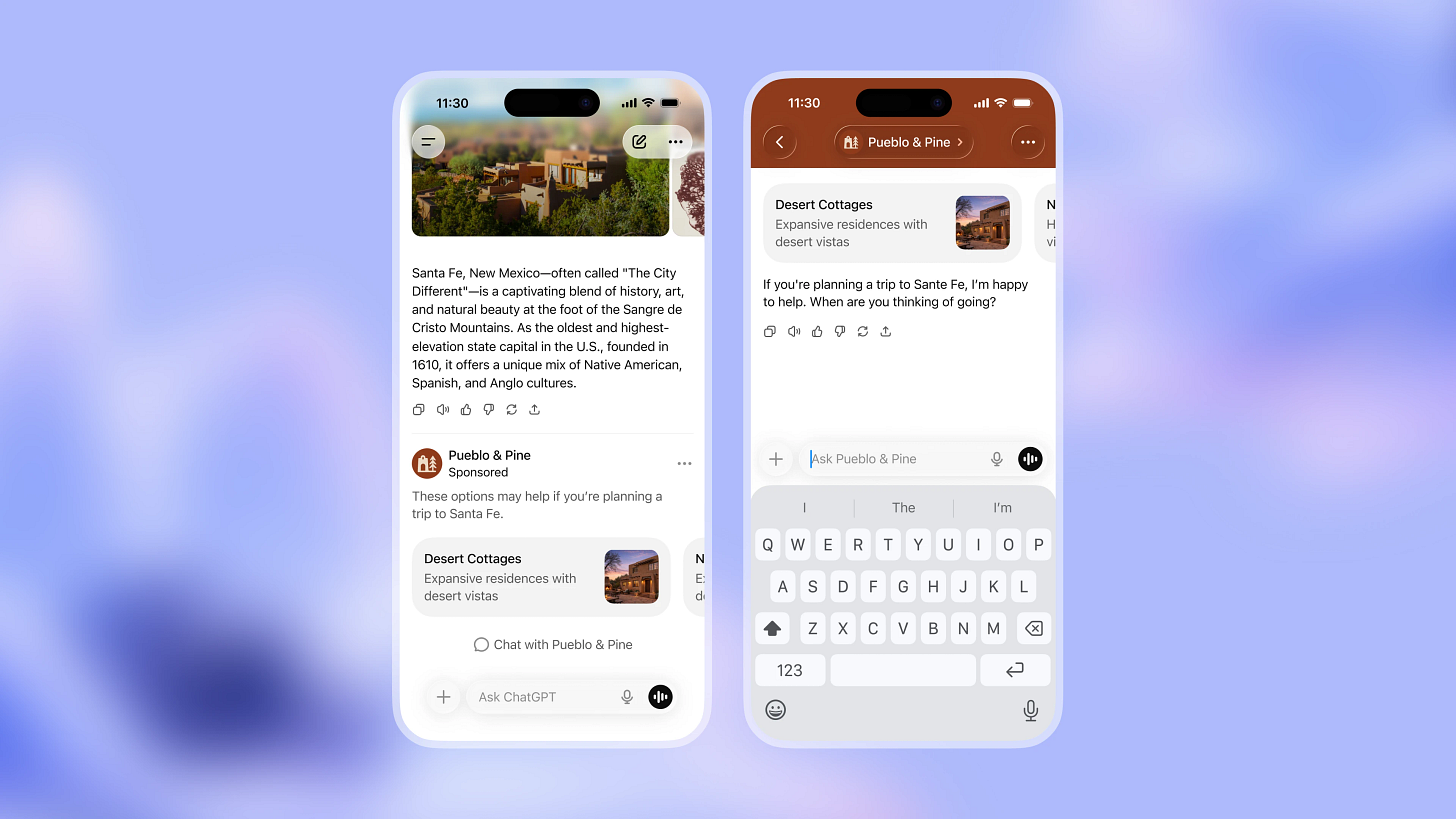

The most obvious format OpenAI is starting with is intent-based ads within select conversation as part of the response but clearly separated from the LLM response). OpenAI has also been careful to communicate this fact that ads shouldn’t change the actual answers of the LLM and that they’ll be clearly labeled.

These ads will look more similar to Google’s ads in that targeting will be based on the intent of the queries themselves, but interestingly seem to have a component where you can click through to chat with the Business AI (the action upon click is more similar to “click to chat” ads on Meta). It remains to be seen if users and advertisers will prefer that to clicking through to the website.

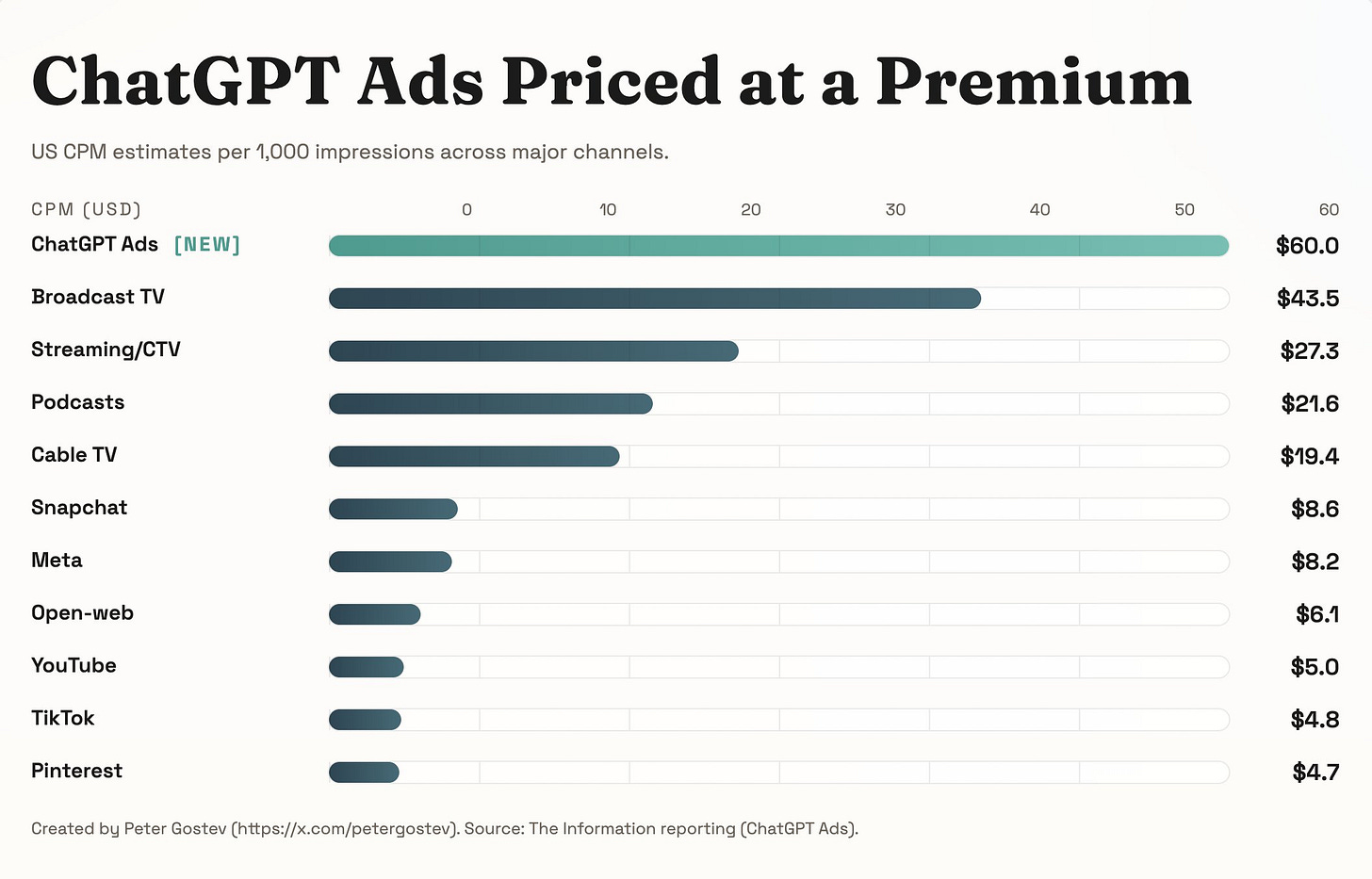

The early chatter suggests high CPMs in the $60 range which is shown below (and pricing based on impressions rather than clicks or other forms of downstream performance), limited inventory, and non-self-serve buying to start, which is exactly how you’d expect this to launch. If you’re an advertiser, you’re paying for novelty, perceived intent, and scarcity, and in being early to shape the advertising product to what the ideal is over time (various ad formats, measurement, targeting, brand safety, etc). My guess is these premium CPM driven ads don’t scale and ChatGPT adopts a more classic performance-based model driving real results (leads, conversions, clicks) and charging based on those outcomes (on a per click basis).

2) Affiliate fees on native checkout

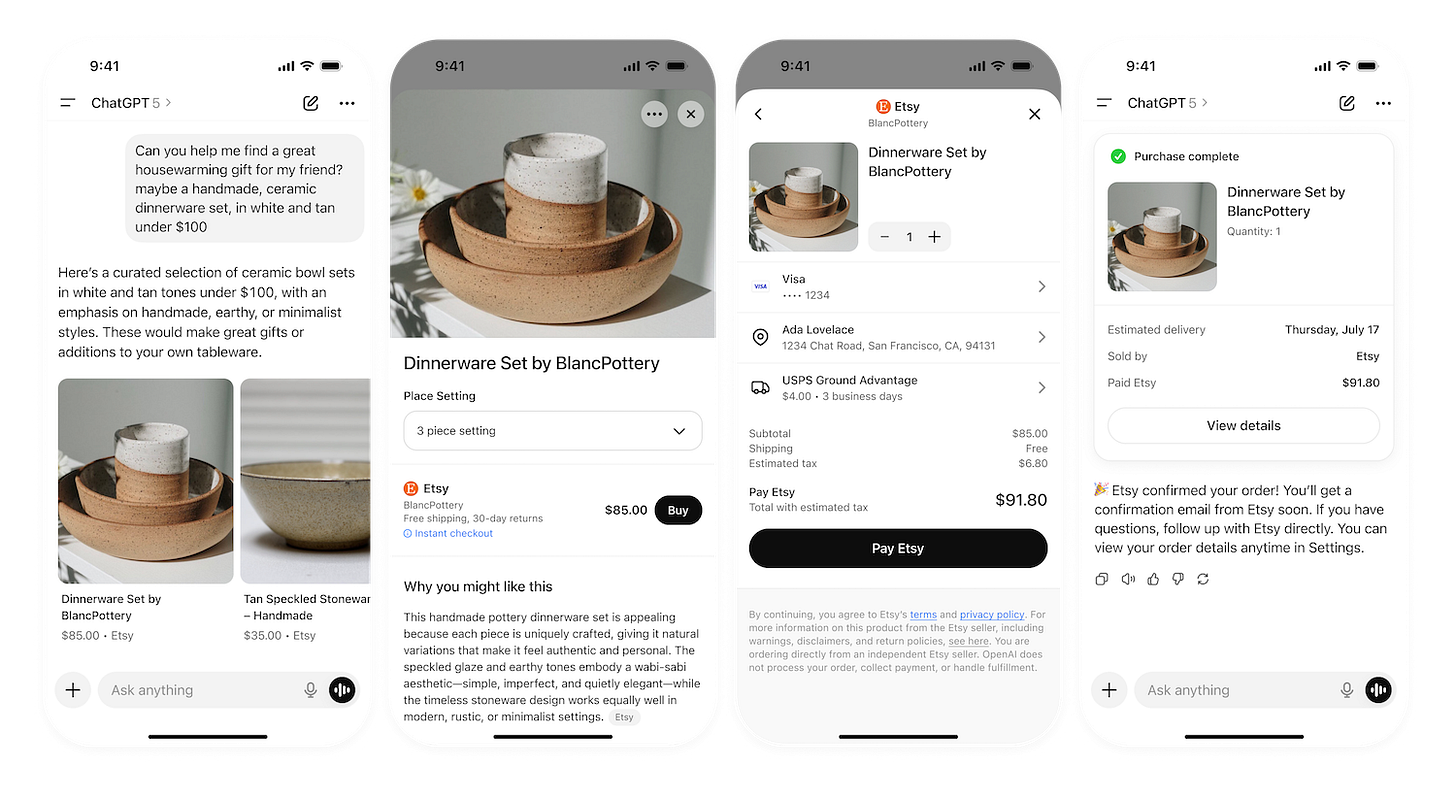

The other announcement was related to affiliate commerce. ChatGPT will start supporting direct native checkout of products across Shopify, Walmart and Etsy among other platforms. As part of that, OpenAI will take a 4% cut of any transaction for merchants that choose to allow native checkout (for now, just from Shopify merchants).

This method is aligned with merchants and doesn’t require adapting LLM responses, and only charges them for native checkout which is optional (they can still show up as they would in the response for no cost if native checkout is not enabled).

The importance of this is two-fold:

Another monetization avenue: It provides another monetization path around the commerce-related queries on ChatGPT for purchases that happen directly on the platform, without having to directly sign up every brand as an advertiser. Brands are used to paying affiliates across channels and this allows them to view OpenAI as a paid channel for native checkout as they treat some other marketplaces such as Amazon, etc.

Higher value capture of Commerce Ads budgets in future: Commerce is a very important vertical (typically 35%+ of ad revenue from Meta and Google) and so if native purchasing behavior on ChatGPT happens and improved conversion rates, that makes it easier to measure impact/outcomes and incrementally and later capture larger budgets but also more value per transaction from this universe of advertisers.

III. The OpenAI Ads Opportunity

Long-term, the Ads opportunity for OpenAI is massive and could even be a Google, Meta or TikTok scale opportunity ($50-200B). But to help contextualize the shorter term path, below is what the opportunity might look like in the short term across both avenues.

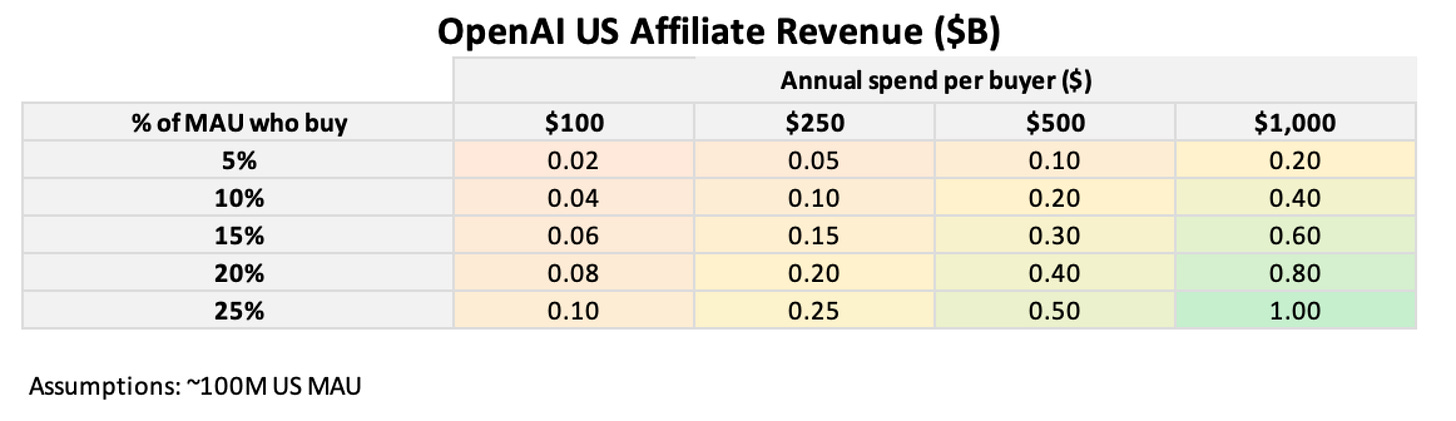

Affiliate commerce and native checkout is a relatively new phenomenon and so may take a while to get going and as you can see need aggressive adoption and annual spend to get to even a $1B business.

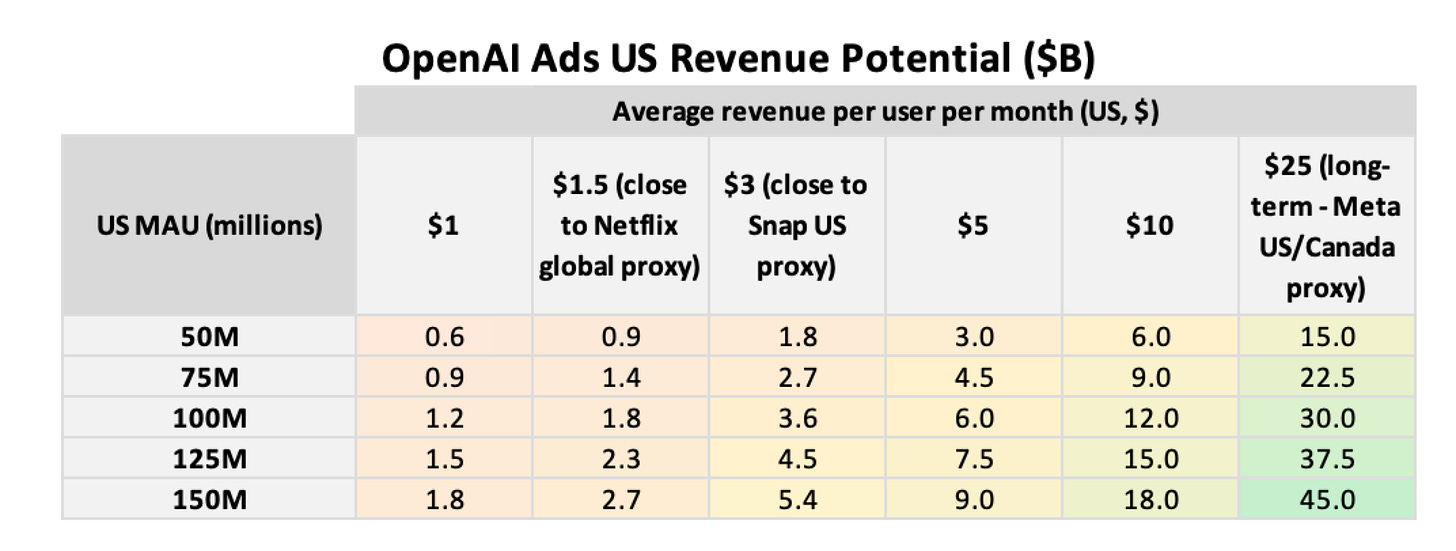

Intent ads in chat are relatively familiar to users, but may take OpenAI a year or two to build the required infrastructure to support self-serve advertising, measurement, the right targeting and so on to really command large budgets. As you can see below, relatively conservative assumptions based on the current scale can see this being a $2-4B business in the coming few yeas, depending on how many users stay on and continue to use the free plans. Long-term, the potential for it to be a $10B+ business even just in the US is quite clear, if they can get to high levels of ARPU.

IV. Ads for Agents

So far, we’ve been talking about ads shown to humans. I think a larger shift will happen when the interface isn’t “chat” but rather “an agent completing a task.”

If an agent is buying running shoes for you, it’s going to do the research anyway. You can’t really “persuade” it with a banner. Doing so would mean it chooses the advertisers interests over the user and users will not like that.

The way you could influence the agent is by changing the utility function in a way that is positive for the consumer.

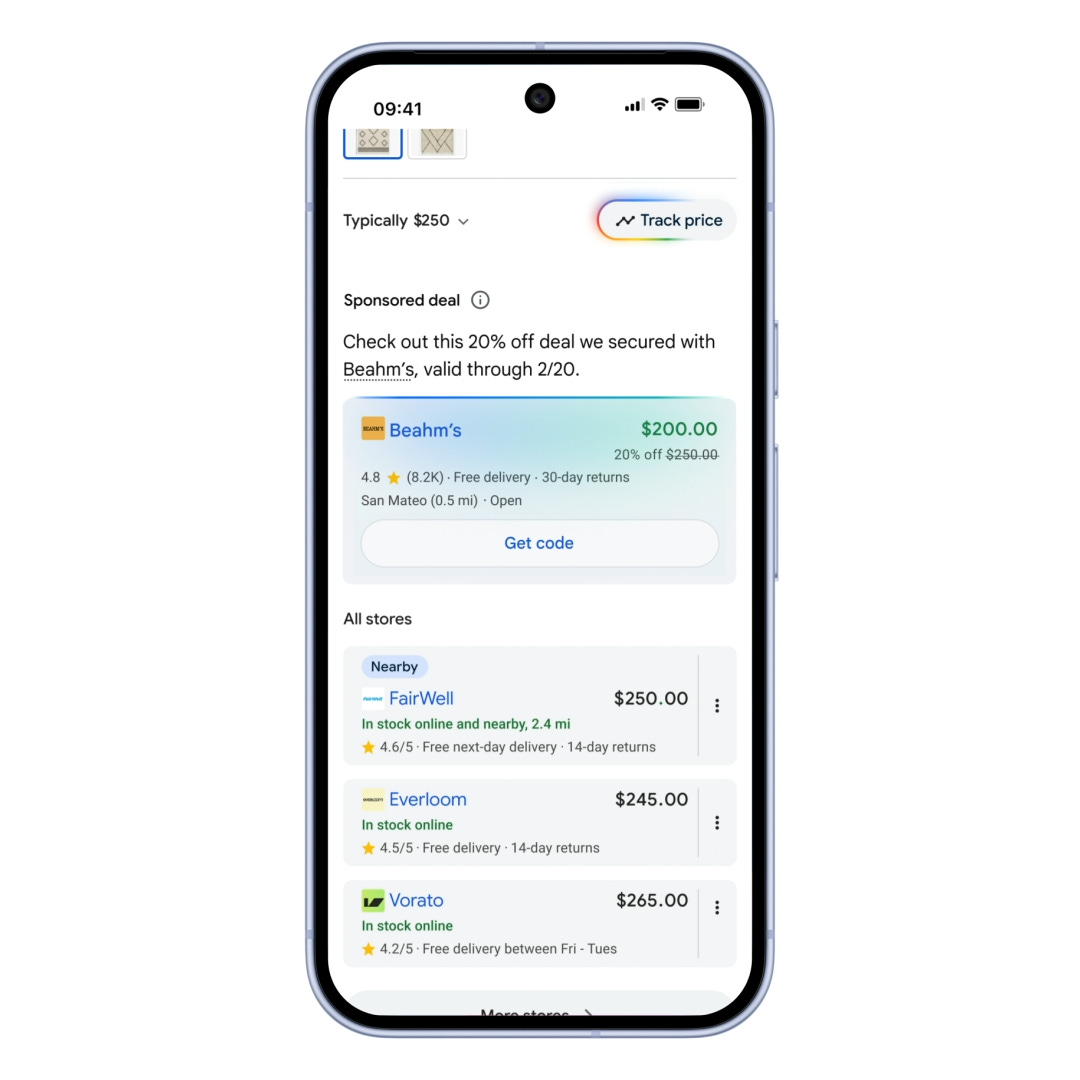

That’s why I find Google’s direction around “Direct Offers” interesting. Direct offers allows merchants present exclusive discounts directly inside AI Mode when Google determines a shopper has high purchase intent. It’s essentially a merchant trying to convince or negotiate the agent to go with a given brand’s product to help drive the sale.

This is how they position Direct Offers:

“Advertisers should think of Direct Offers less like a standard ad and more like a salesperson negotiating a deal on your behalf. It allows you to offer special discounts to high-intent shoppers to turn browsers into buyers.”

If we stop using chat interfaces and start to delegating more decision and purchases fully to agents without being in the loop as much, my guess is ads will have to evolve on these surfaces to look like the above. Something that influences the agent, while still driving towards better outcomes for the user.

V. Opportunities for Startups

This could be a post in and of itself, but I figured it’s worth touching on what opportunities for startups this ecosystem presents1. We’ve already seen the rise of AEO/GEO companies like Profound and AirOps to support brands in AI channels organically, and the advertising/affiliate ecosystem brings forth new opportunities for founders:

Monetization rails for AI surfaces: OpenAI will obviously build their own ad platform, but the long tail of AI services and chatbots may want to plug into an existing network that brings both advertiser demand and the SDKs for targeting, brand safety, formats, and measurement. Companies like Koah, Kontext, and Gravity are building in this category.

An “AI-channel DSP” for brands: A buying and measurement layer that helps advertisers manage spend across AI surfaces as more of them support ads, similar to how DSPs helped coordinate spend across social platforms and CTV. The core product is cross‑channel budget allocation, creative management, and measurement and reporting built for chat outcomes (leads, conversions, purchases).

Agentic commerce enablement for merchants: Infrastructure that helps brands support native checkout and “offers” across emerging agentic commerce standards, especially for merchants outside Shopify’s ecosystem. Think products that let merchants quickly support agentic commerce and native checkout with connectors for catalog, inventory, pricing, and payments, without forcing a full eCommerce replatform. I’ve previously written about other opportunities in agentic commerce.

V. Closing Thoughts

I’m excited to watch OpenAI’s execution over the next year around both these monetization avenues: classic intent ads and affiliate checkout. The first one is about building a real ads product, pacing supply, proving measurement, and doing it without users feeling like answers are getting “shaped” by budgets. The second one is about behavior change and whether ChatGPT actually become a place where purchases happen.

I’m also curious how quickly the rest of the ecosystem follows. Some players will copy the search-like ad unit, some like Anthropic may ignore all this completely and some will outsource monetization to companies like Koah and Kontext to get going faster. And then longer term, the agent shift could change the fundamental nature of what ads look like on these channels2. Once models start completing tasks end-to-end, the winning “ads” probably look less like banners / units to persuade humans and more like offers that make the user better off (price/discounts, guarantees).

If you’re building in and around this space, I’d love to hear from you at tanay@wing.vc

Note that I’m specifically talking about monetizing AI channels and not applying AI in traditional advertising on other channels.

I don’t think they threaten what ads look like on channels where human attention still exist such as Meta, YouTube, TV, etc

Really good write up! I might be stating the obvious but two things comes to mind Sean Frank from Ridge wallet has said that customers through ChatGPT have a 3X conversion rate compared to search (I suppose this might vary across industries) and second, I’ve learned that Asian markets tend to research more before making a decision so curious to see how the effectiveness of this new channel varies across geographies and how much it affects how companies invest across channels