Marqeta S-1 teardown

Modern card issuing, financial infrastructure and usage-based pricing

Hi friends!

If you’ve ever used Doordash, Instacart, Square, Brex, or Affirm, your experience was in part powered by a company called Marqeta, even though you never came across them directly.

Marqeta is a financial infrastructure startup that provides the platform and APIs to allow companies to issue virtual or physical cards and process transactions. It enables customizable payment experiences for tech-driven and developer-led companies, and just filed to go public.

Think of it as a Stripe or Twilio for Cards.

I’ll go into a few key highlights from their filing and cover:

What they do (Product)

Who uses them (Customers)

How they make money (Business Model and Economics)

How they are performing (Financials)

The Product

At its core, Marqeta provides a set of APIs and the corresponding platform which allows any company to issue virtual or physical cards and manage these cards and the transactions that occur through them.

Similar to Twilio, Marqeta has a strategic focus on developers, with their CPO Kevin Doerr quoted in Protocol as saying the following:

"Developers are a unique cohort of the population at a technical level and if you can win [their] hearts and minds because you're doing the things that appeal to them, then ultimately you can win the business"

Broadly, Marqeta has three main products:

I. Marqeta Issuing: Marqeta provides the tools to allow customers to issue physical, virtual, and tokenized cards. This allows customers to set up and manage their own card programs or even create customized cards for internal use.

Marqeta launched credit servicing capabilities in February 2021, which makes them the only modern card issuing platform that currently supports every card type—prepaid, debit, and credit.

As of Q1 2021, Marqeta had issued over 320M cards! These cards processed over 1.6B transactions in 2020 alone!

Marqeta’s issuing powers some of the most innovative card programs in the world include Square’s Merchant debit card and Square’s Cash App.

II. Marqeta Processing: Aside from just issuing cards, Marqeta allows to limit the processing of transactions on those cards to specific locations, and also fund the cards programmatically on a just-in-time basis to reduce fraud and misuse.

This enables customers like Instacart and Doordash to provision virtual cards for the exact order amount (that work in the exact location) such that their contractors can pay for the transaction at the grocery store/restaurant. It minimizes misuse and accidentally paying for other orders.

III. Marqeta Applications: Marqeta also offers a suite of applications for customers to manage their cards include developer sandboxes, a case management center for disputes, fraud protection, reporting, and so on.

Customers

Marqeta had 160 customers at the end of 2020 (up 24% y/y), across a range of categories:

On-demand services including Doordash, Uber, and Instacart, use the cards to allow their gig workers to pay for orders at restaurants/grocery stores

Buy Now, Pay Later providers such as Affirm and Klarna use the cards to programmatically pay merchants on behalf of the BNPL customer.

Expense Management providers such as Brex and Ramp which leverage Marqeta to build their card programs

Digital Banks such as Square which leverages Marqeta for their cash app and their merchant debit card

Financial Institutions such as J.P. Morgan, which leverages Marqeta to provision digital commercial cards instantly for their customers.

Square accounts for 70% of Marqeta’s revenue, a crazy high customer concentration. Marqeta does have contracts in place with Square that run until 2024 but is definitely a risk for the business.

I also found it interesting that Marqeta has issued options in Marqeta to some of its customers, pending usage milestones being hit.

Square has warrants of 1.1M shares (worth ~$40M)1

Uber has warrants of 750K shares (worth ~$26M)

Ramp has warrants of 50K shares (worth ~$2M)

Business Model and Transaction Economics

Without going too deep into the payments stack, at a high level, the issuing bank that issued a card is entitled to transaction and volume-based fees called interchange fees on the transactions that happen on cards they issued which are paid for by the acquiring bank (i.e., the merchant’s bank).

So if Square or Uber were to become issuing banks (or partner with one) and issue cards for their customers or drivers respectively, they would get most of the interchange for themselves.

Marqeta’s value proposition is essentially this:

We’ll provide all the infrastructure and tools to customize things and we’ve figured out all the partnerships already (Marqeta uses Sutton bank as the issuing bank), and you can just use us to issue cards a lot more easily. In return, we’ll take a portion of that interchange for ourselves and give you the rest.

Marqeta, therefore, has a usage-based pricing model that scales with the transaction volume processed by their customers.

The vast majority of their revenue comes from interchange fees, with some additional revenue from processing fees and other services which is primarily related to the fulfillment of physical cards.

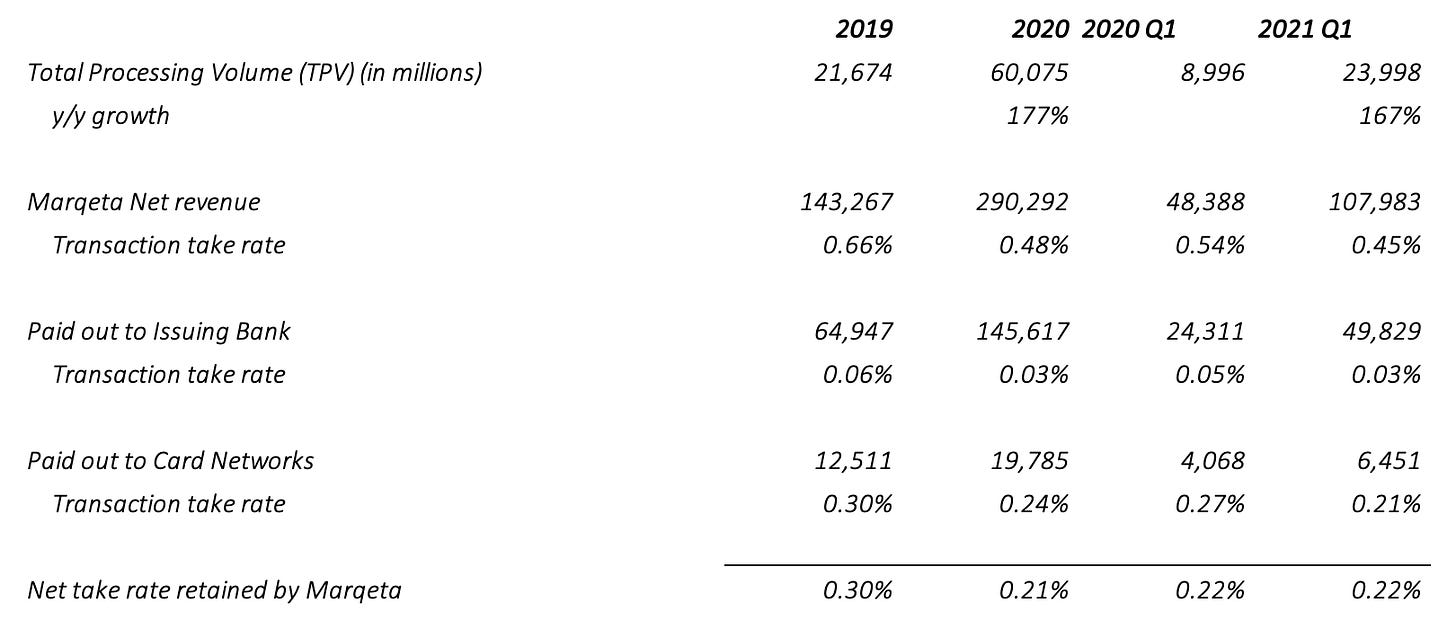

Overall, Marqeta’s performance is highly dependent on their net transaction take rate, and their total processing volume.

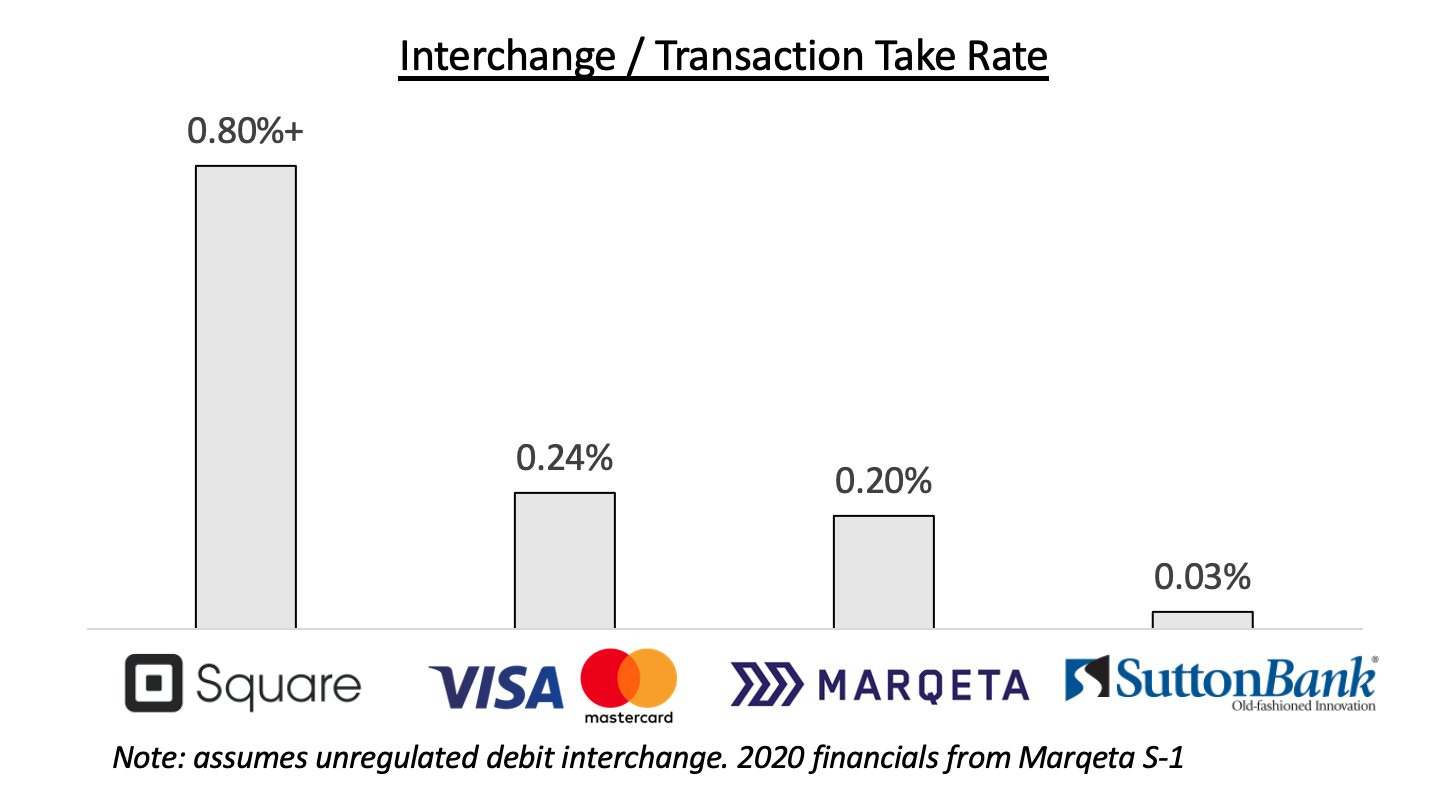

They record revenue net of the revenue shared with their customers and then pay out their issuing bank (Sutton) and the card networks (Visa/MasterCard).

Their own take rate is highly dependent on customer mix and the nature of transactions (card present vs not present, commercial vs retail) as is seen in their take rate dropping from 0.66% to 0.48%.

On the flip side, their agreements with Sutton and the card networks mean that as volumes go up those takes rates could also drop over time, as we see somewhat below (0.06% → 0.03% for Sutton and 0.30% → 0.20% for card networks between 2019 and 2020).

James Ho has outlined what the average split looks like below including the customer’s take rate as well (which varies depending on the customer).

Financials

Overall, Marqeta’s numbers are pretty impressive, fueled by a usage-based pricing model which means that Marqeta grows as its customers grow (and the pandemic-related boom for many of its customers).

Processing Volume

Marqeta’s total processing volume (TPV) grew 177% y/y in 2020 to ~$60B.

The transaction volume through US issuers in 2020 was ~$6.7T, so in some sense, they’re at <1% share of their US TAM indicating a huge room to grow.

As visible above, they have strong retention of cohorts with cohorts increasing TPV over time. The dollar-based net revenue retention was over 200% for both 2019 and 2020, which is one of the highest I’ve ever seen, and the above graph which doesn’t include Square is pretty impressive.

Revenue and Cost of Revenue

As detailed above, the increase in TPV translated into a >103% y/y revenue growth from $143M to $290M, and Marqeta’s gross margins are ~41% after the payouts to card networks and the issuing bank.

Their transaction take rate was down from 2019 to 2020 due to a change in customer mix and payment mix, but at the same time as their scale increasing the take rate to card networks and issuing banks is also decreasing slightly.

However, given that payouts to card networks and issuing banks will always somewhat variable, even at scale, and don’t see Marqeta having better than 55% gross margins on this line of business at least.

Other Costs and Overall Margins

Given somewhat lower Gross Margins compared to other tech businesses, I was generally impressed that the other costs were kept somewhat in check and seem to be trending in the right direction.

Personnel is the other main cost item at 45% of revenue (~500 employees, of which 80 were salespeople), with the other cost line items including professional services, technology, and marketing in aggregate at 10-15% of revenue.

I was impressed how low sales and marketing spend was, even if you include the ~6th of employees on the sales side.

It will be important for Marqeta to keep personnel costs in check (or essentially not grow employees 1:1 with revenue growth) to maintain profitability.

Marqeta had a positive adjusted EBITDA in the first quarter of 2021. And the high revenue expansion coupled with the way their costs have been trending suggests that Marqeta is on a good trajectory to be GAAP profitable when it leans away from growth.

Valuation

Marqeta’s most recent fundraise came at a $4.2B valuation. However, shares have been trading in secondary markets at $33-$35 per share, implying a valuation of ~$16-17B.

At a current median ~20X NTM revenue multiple for high growth SaaS2, the implied valuation assuming 100% y/y revenue growth rate would be ~$12-13B. However, Marqeta’s strong growth rate coupled with high dollar-based expansion as well as the general market the company is in (financial infrastructure which could be an index for fintech) could warrant a higher multiple. On the flip side, the lower gross margins and incredibly high customer concentration could lead to a lower multiple. That is to say, it could go either way, and I’m curious to see where it ends up trading at (with my guess being ~$12B).

Closing Thoughts

Overall, there is a lot to like about Marqeta. It was a pioneer in modern card issuing and enabled a lot of interesting use cases to happen more easily and quickly.

It has a strong set of customers across use cases and a usage-based pricing model where its growth is aligned with customer’s growth (and usage) which has resulted in strong dollar-based net expansion rates.

Yes, the customer concentration (Square) is a risk, but other cohorts of customers also seem to be increasing spending. And yes, it won’t have pure-tech gross margins, but we’ve seen with companies like Twilio that it isn’t necessarily a bad thing.

A bigger risk I see is that from the competition. Marqeta originally competed against legacy players such as Global Payments (TSYS), Fiserv (First Data), and FIS, which were slower and had a worse offering. However, over time, Stripe and others vertical-focused players have also entered the space. While currently, Marqeta’s platform is a stronger offering, if Stripe or Adyen were to heavily invest in issuing and cross-sell and perhaps subsidize their customers, that could pose a threat to Marqeta, and perhaps lead to reduced take rates for it as it has to compete more heavily on “price” to retain customers.

Another thing to keep an eye on is international growth and expansion. Currently, less than 2% of Marqeta's revenue comes from international customers. However, they are certified to operate in over 36 countries and talk about international expansion as a big growth lever.

In closing, here are a few additional reads:

Colossus Podcast on Twilio and why low gross margins can sometimes be a good thing

Finix piece on the payment stack

Thanks for reading! If you liked this post, give it a heart up above to help others find it or share it with your friends.

If you have any comments or thoughts, feel free to tweet at me.

If you’re not a subscriber, you can subscribe below. I write about things related to technology and business once a week on Mondays.

Based on current share prices in secondary markets of $33-35 per share

Based on Public Comps

Good analysis. There are a lot of good things about MQ but the valuation is still very rich when compared to SQ when it went public. MQ and SQ businesses are different -- one is on issuing side and the other on acquiring (at least when SQ started). SQ IPO’d @ $9 / $2.9B market cap. SQ’s TPV/NR in 2015 were 3X - 4X of MQ in 2020 and revenue concentration with Starbucks was also minimal. What SQ came out with is disruptive and transformational, which really isn’t the case with MQ. In fact, the CEO punted a little in a recent investor call with Citi where he was asked if MQ is disrupting or creating new market. There is a lot to like about MQ but think $10B valuation may seem reasonable in a frothy market which otherwise is fairly rich. As they get more into credit card business, there is a possibility for MQ to earn higher interchange revenue in value if not in % of IR.

Finix link not working. Also, is the reason Square doesn't do this itself because of Durbin, do you think?