M&A as R&D in Technology

How tech companies have used acquisitions as a form of R&D

This is a weekly newsletter about the business of the technology industry. To receive Tanay’s Newsletter in your inbox, subscribe here for free:

When people think about acquisitions in technology, they usually think about the large ones that helped take a business to the next level or stem a decline in the core business.

Google buying YouTube. Facebook buying Instagram. EMC buying VMware. Microsoft buying GitHub.

But one of the more under-discussed aspects is that many of the successful tech companies today have used relatively small acquisitions to expand into new areas and serve as a form of R&D.

The Approach

When doing these acquisitions, more so than really buying the existing “business”, these companies are buying a mix of:

A talented team

Experience, know-how, and passion in a specific area

A product that is unreleased or in its early stages but has not quite taken off as a business

They then take a fresh crack at the space or supercharge the existing product they’re buying with more resources and distribution or use the team and the product built so far to cut their time to market significantly.

This approach has been taken by even what is considered the very innovative companies of today or those known to have a mentality of building it themselves or the know-how to do so. Let’s look at a few companies to illustrate.

Snap

Evan Spiegel has been one of the best consumer product thinkers over the past 15+ years, with Snap arguably one of the most innovative consumer social companies.

But at the same time, they’ve been incredibly acquisitive of ~small startups working on adjacent areas to themselves, which they’ve then built into relatively core features of the Snap platform.

Some of these acquisitions include:

Zenly, which they acquired for $213M, served as the basis for Snap Map1.

AI Factory, which they acquired for $166M, served as the basis for the selfie-video messaging feature Cameo

Looksery, which they acquired for $150M in 2015, served as the basis for their selfie lenses, which have now since been adopted by most social apps

Fit Analytics for $134M in 2021, served as the basis for AR try-on features in Snap

Vurb, which they acquired for $115M, served as the basis for Context Cards in Snap, a way for users to learn more about places.

Bitstrips, which they acquired for $65M, was the maker of Bitmoji, which Snap integrated into its platform.

Scan Me, which they acquired for $50M, served as the basis for Snaptags, a way for users to add friends by scanning QR codes.

Addlive, which they acquired for $30M, served as the basis for Video Chat in Snap.

Vergence Labs, which they acquired for $15M, was developing video hardware which then became Snap Spectacles

PlayCanvas, which they acquired in 2018, was developing mobile games and ended up building out Snap’s multiplayer Snap Games product.

Screenshop, which they acquired in 2021, was integrated into the core Snap product as a feature called Screenshop, which allows users to scan others’ outfits and shop their looks.

Google

Even Google, the classic company with the “let’s build it ourselves” mentality (as has been true for a lot of their internal tooling) and one of the highest concentrations of supply of engineering talent, has made some pretty key acquisitions along the way which helped jumpstart their expansion into key areas/products.

Google has made over 200 acquisitions and we all know about YouTube and DeepMind and others that were largely kept independent, so I’ll focus on just highlighting a few key ones which gave birth to interesting products.

Applied Semantics, which was acquired for ~$100M in 2003, formed the basis for Google Adsense, which allowed Google to vastly improve their contextually targeted ads product and make a real push into expanding beyond search ads.

Where2 which was acquired in 2004, served as the basis for the first version of Google Maps launched a year later. The founders initially built it as a desktop application, but post-acquisition it was released as a web version.

Android, which they acquired for $50M in 2005, and in some sense kept independent but invested more heavily in, and grew to the largest mobile operating system and as an alternative to iOS.

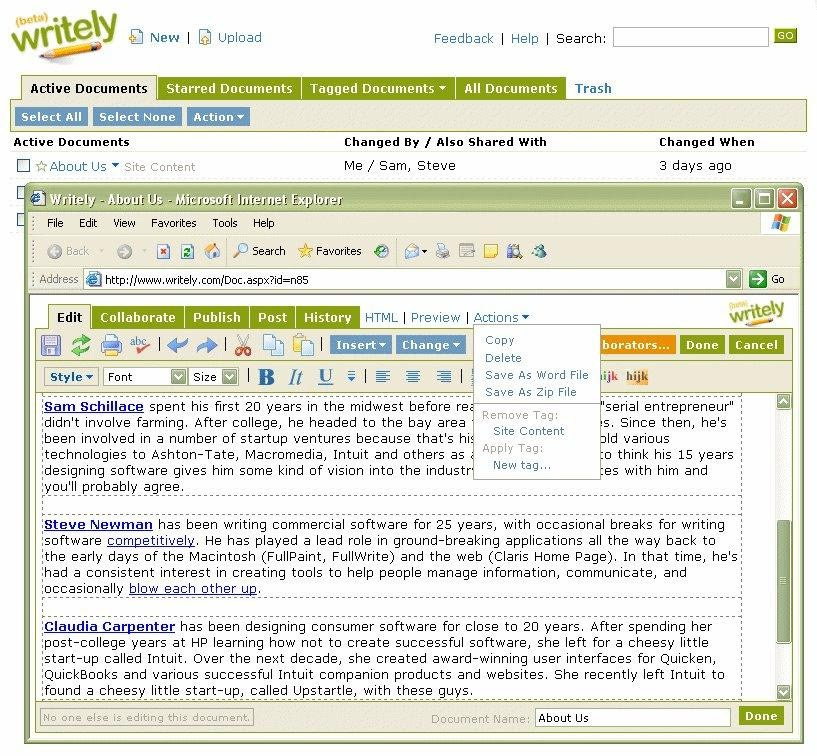

Writely, which was acquired in 2006, formed the basis for Google docs, which launched in 2007.

Writely, the precursor to Google Docs (source) Tonic Systems and Zenter, which were acquired in 2007, were both working on presentations in the browser and helped get out the first version of Google slides, launched in 2008.

Grand Central which was acquired for ~50M in 2007, was building a phone management service and was leveraged to launch Google Voice two years later.

DoubleClick, which was acquired for $3.1B in 2007, formed the basis for improvements in core parts of Google’s Ads business.

Admob, which was acquired for $750M in 2009, was a mobile ads platform that Google integrated into its core ads offerings and generates over $1B in revenue per year.

ReCaptcha which was acquired in 2009, was integrated as a security measure to tell humans and bots apart into Google’s products and is offered for free to other developers while allowing Google to collect valuable data.

Closing Thoughts

While these days, it may seem that this form of acquisition is less valuable if they don’t come with networks of users since every product can be “replicated”, it still serves as a valuable way to acquire new technologies, knowledge, and personnel and short circuit the time to enter a new market and get up to speed in a new area.

In addition, while the two companies I’ve illustrated are consumer companies, the strategy is by no means restricted to them. Many B2B companies have also used this approach successfully as they expanded from a single product to a platform.

What are some of the other companies you admire that have pulled this approach off well?

Thanks for reading! If you liked this post, give it a heart up above to help others find it or share it with your friends.

If you have any comments or thoughts, feel free to tweet at me.

If you’re not a subscriber, you can subscribe for free below. I write about things related to technology and business once a week on Mondays.

Zenly did continue to run as a standalone product, but Snap Map launched on the same day the acquisition was announced and Zenly was believed to be powering Snap Map.

I believe Unity is attempting to replicate this acquisition strategy. However The results have yet to be fruitful.