Klarna S-1 Breakdown

On Buy Now Pay Later, Commerce networks, AI to drive efficiency and the comparison with Affirm

This is a weekly newsletter about the business of the technology industry. To receive Tanay’s Newsletter in your inbox, subscribe here for free:

Hi friends,

Klarna has just filed its F-11 to go public, and there’s a lot here to dive deep into. Klarna, widely known for pioneering the "buy now, pay later" (BNPL) market has expanded into a more diversified commerce network that's worth unpacking. It’s also been one of the darlings in terms of using AI to drive efficiency, which we go deeper into.

I'll discuss:

Overview

Product Suite

Business Model

Financials and Profitability

AI Efficiency

Let's get started.

I. Overview & Market Context

Klarna is a leading global fintech company originally known for its Buy Now Pay Later (BNPL) solutions but has since evolved into a comprehensive financial services ecosystem.

Klarna’s business spans 26 countries, with a significant presence in the U.S. and Europe. Klarna began in 2005 in Sweden, with a “Pay Later” offering for consumers, pioneering the BNPL market.

Klarna today views itself as a “next-generation commerce network” that connects consumers and merchants globally. It reaches over 93 million active consumers and more than 675,000 merchant partners.

II. Product Suite

Klarna began with it’s “Pay Later” offering in 2005, which was embedded on merchant websites and made available to consumers during online checkout flows. Initially, it was more of a “Pay After Delivery” model than the pay in installments that is common today aiming to increase trust.

Since then, the companies product suite has expanded over time as they go beyond a payment processor into a broader network in eCommerce facilitating more of the transaction flow including discovery.

Consumers

Klarna enhances everyday shopping by offering personalized product discovery, flexible and convenient payment methods, and intuitive financial management tools.

Payment Options: Klarna offers flexible payment methods, including "Pay Later," allowing consumers to delay payments or split them into installments, and "Pay Now," settling payments instantly. They also provide longer-term "Fair Financing" loans on which they charge interest.

Klarna App: With 32 million Monthly Active Users (MAU), Klarna's app serves as a hub for discovering new products, managing purchases, tracking orders and returns, and receiving personalized shopping and financial insights.

Merchants

Klarna helps merchants attract, convert, and retain customers through seamless checkouts, targeted incentives, flexible payment solutions, and reliable technology that drives long-term loyalty. Today, it serves 30-50% of the top 100 merchants in most of its key markets.

Payment Processing: Klarna offers solutions to merchants for offering Klarna’s payment options (Pay Now, Pay Later, Fair Financing) online or in-store.

Advertising Solutions: Klarna provides solutions for merchants to reach more customers in a mix of placements including the Klarna App as well as leveraging Klarna’s data to target high-intent customers.

III. Business Model & Revenue Breakdown

Klarna has a few revenue streams, including merchant fees, consumer fees, advertising revenue and interest revenue.

In general, on its core offerings, Klarna does not charge consumers or fees but instead earns fees from the Merchant, who it pays immediately upon checkout as illustrated below.

However, on their Fair Financing loans product, they do charge interest, which comprises of ~24% of their total revenue but only 5% of their GMV.

Klarna breaks down its fees into transaction and service revenue (76% of revenue) and interest income (remaining 24%). Transaction and Service revenue includes merchant fee revenue, advertising revenue and consumer service revenue, described below:

Merchant Fee Revenue (~57% of revenue): Merchants pay Klarna each time a consumer uses Klarna’s payment options (Pay Later, Pay Now, or Fair Financing). These fees represent Klarna’s largest revenue stream and drive its core business model.

Consumer Fees (~12% of revenue): Klarna generally avoids charging consumers fees for its most common services like Pay Later and Pay Now, as these are typically interest-free. However, Klarna does earn revenue from a smaller segment of consumer fees, mainly late payment fees, or specific premium features.

Interest Income (~24% of revenue): Klarna earns additional revenue through interest generated from consumer financing (primarily from longer-duration loans) on their “Fair Financing” product line.

Advertising Revenue (~6% of revenue): Klarna leverages its large consumer base and detailed purchasing data to offer targeted advertising solutions to merchants primarily for ads shown on the Klarna app. This business has rapidly grown, scaling from approximately $13 million in 2020 to $180 million in 2024, contributing meaningfully to overall revenue diversification.

If you put it together, about two thirds of Klarna’s revenue comes from the Merchant side, and the other third from the consumer side.

IV. Financial Performance

Klarna now does over $100B in GMV, and $2.8B in revenue on that GMV.

GMV growth accelerated in 2024 to 14%, and revenue growth likewise reaccelerated to 24%.

Revenue growth has been driven by both more transactions but also an improved overall net take rate which has gone up to 2.7% as Klarna has further diversified expanded and diversified its revenue streams (and gone broader in the transaction flow) as discussed above.

A few points to note on the costs and margins side:

Profitability: From a margins perspective, Klarna is profitable on net income basis, and close to profitable on an operating margin basis. Klarna was profitable for the first 14 years of its operations until 2019, before it started to invest more heavily in growth

Transaction Margin: While it doesn’t report gross margin, transaction margin dollars, which is the revenue - processing, servicing, credit losses and funding costs is the best proxy, which has grown to the mid 40s.

Deposits as Funding Source: Klarna has a banking license in Europe, and so are able to tap into deposits from customers to fund the “loans” they make2, which allows them to have a much lower funding rate than if they relied on non-bank funding strategies.

Over the last few years, overall operating costs have decreased from almost 150% of revenue to just over 100%, thanks to improvements across the board, including AI as discussed below.

V. AI-Powered Efficiency

Klarna has made much news about some of their AI initiatives, from the past rumours that they got rid of software such as Salesforce and Workday in lieu of internally built with AI alternatives, to their being early at large scale AI-powered customer support.

Klarna notes that their average annual revenue per employee increased from $344,000 in 2022 to $821,000 in 2024, and credits AI partly for this improvement. The filing goes into some detail on their AI initiatives which are worth touching on, across the various dimensions:

Product features: Klarna has a number of AI powered customer facing features such as personalized shopping feeds and an AI powered shopping assistant that allow brand discovery.

Underwriting Algorithms: Naturally, Klarna’s underwriting algorithms are heavily ML powered, and as a percent of revenue their consumer credit losses have declined to under 20% of revenue and <0.5% of GMV.

General Employee Productivity: Klarna notes that 96% of our employees used generative AI in their daily work. This includes 85% of engineers using copilots, their legal team using conract review software, and an internal knowledge chatbot to find information called Kiki.

Customer Service Automation: Klarna’s AI assistant, developed in partnership with OpenAI, now manages 62% of all customer inquiries, cutting response times from 12 minutes to 2 minutes and saving around $39M annually in operational costs and doing the work of the equivalent of 800 human agents3.

Reduced Reliance on Third Party Services: Klarna also used Generative AI across their marketing department to reduce their spend on third party agencies such as marketing and translation agencies. It reduced marketing agency spend (translation, production, etc) from $33M to $8M, and in general reduced copyrighting, production and creative costs while increasing output. Klarna also notes that they reduced or canceled contracts with over 1,390 suppliers following their AI adoption and standardization measures, though the dollar impact of that wasn’t quantified.

Interestingly, the direct AI savings mentioned are only on the order of $55-70M which is a small percentage of the cost basis of $2.9B. However, it is clear that there are a few areas of large tangible improvements such as customer support (direct savings are 20% of total support costs) and marketing (direct savings are 5-10% of total marketing spend) as well as areas with a lot of adoption such as R&D where the direct impact is less clear but where R&D as a percentage of revenue has clearly declined by 7 percentage points.

VI. Closing Thoughts

Klarna has clearly built a great global business, at tremendous scale (almost 3x the GMV of Affirm!) and has also been at the forefront of infusing AI internally in the company to drive efficiencies, though the results of that are still early.

Congrats to the team on the progress so far and I’ll be watching closely to see how it trades when it goes public.

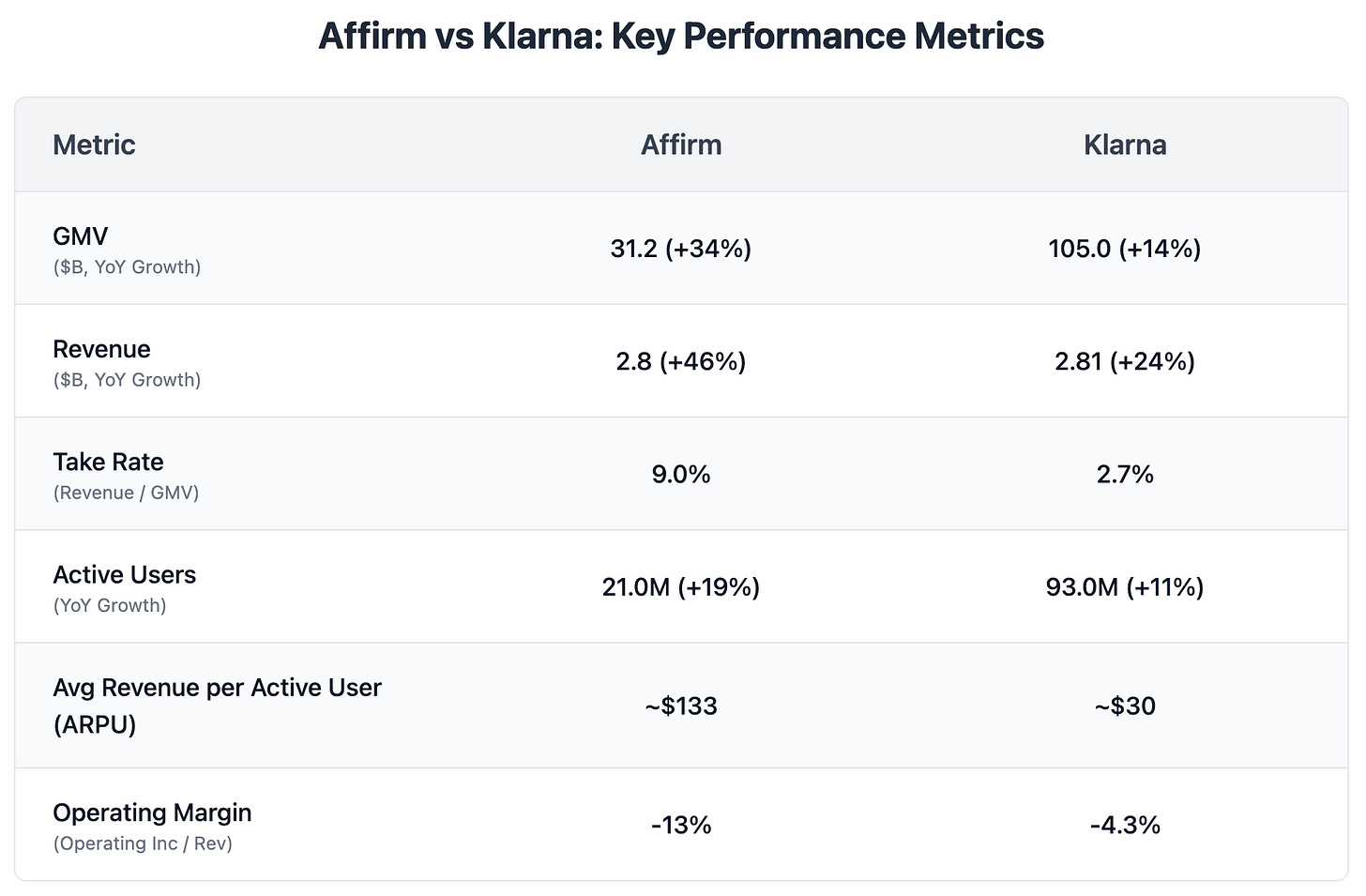

To end, I wanted to share a comparison to Affirm, which is basically at the same revenue scale as Klarna, although the two models are a bit different as evidenced by the difference in take rates and active users. Affirm is growing faster, but is less profitable. On the flipside, Klarna is at much higher GMV and user scale and is less reliant on consumer fees, and has a cheaper funding source in the form of customer deposits. Affirm is currently valued at $14.6B, which is a good proxy for where Klarna likely trades, perhaps at a slight discount.

The F-1 is the equivalent of the S-1 for international companies)

Klarna held $9.5B in customer deposits at the end of 2024, primarily from customers in Germany and Netherlands

This would imply Klarna’s cost was ~$50K/support agent, possibly indicating it resolves the more simple / Tier 1 queries

Should the sentence ending with the phrase to reduce trust actually be aiming to INCREASE trust?

“Initially, it was more of a “Pay After Delivery” model than the pay in installments that is common today aiming to reduce trust.”

Hi Tanay, thank you for this writeup! Do you know why Affirm's take rate is much higher than Klarna? BNPL seems like a commodity-ish product so this is a very surprising number.