Instacart S-1 Breakdown

On the grocery market, ads, memberships, profitability, and valuation

This is a weekly newsletter about the business of the technology industry. To receive Tanay’s Newsletter in your inbox, subscribe here for free:

Hi friends,

This week, I’ll be breaking down Instacart’s (also known as Maplebear Inc’s) S-1. The company, which filed for an IPO the week before last, intends to list under the ticker CART, and will likely go public before the end of the year.

I’ll discuss:

Instacart’s Product

The Grocery Market

Scale and Stakeholders

Financials and Metrics

Ads and Membership

COVID-19 Impact

Closing Thoughts

I. Product

Instacart bills itself as a grocery technology company. While most probably know Instacart for its core grocery delivery marketplace offering, that is only one of three broad products it highlights, as below.

1/ Instacart Marketplace

Instacart’s core product is an online grocery marketplace which is the largest in America and has cumulatively done over $100B in gross transaction volume and fulfilled over 900M orders.

2/ Instacart Enterprise Platform

Instacart Enterprise Platform is an end-to-end technology solution that powers retailers across all aspects of their business, on their owned and operated storefronts. It was launched in 2022 and offers eCommerce, fulfillment, and other capabilities to grocers on their owned and operated storefronts.

Customers include Publix, Sprouts, and The Fresh Market.

3/ Instacart Ads

The Instacart ads product is targeted at CPG brands, that want to reach Instacart’s users at the point of purchase (i.e., as they are about to place an order on Instacart’s marketplace) through brand or direct response ads. In some ways, the ads offering is another monetization lever for the marketplace business, as we shall discuss later.

II. Market

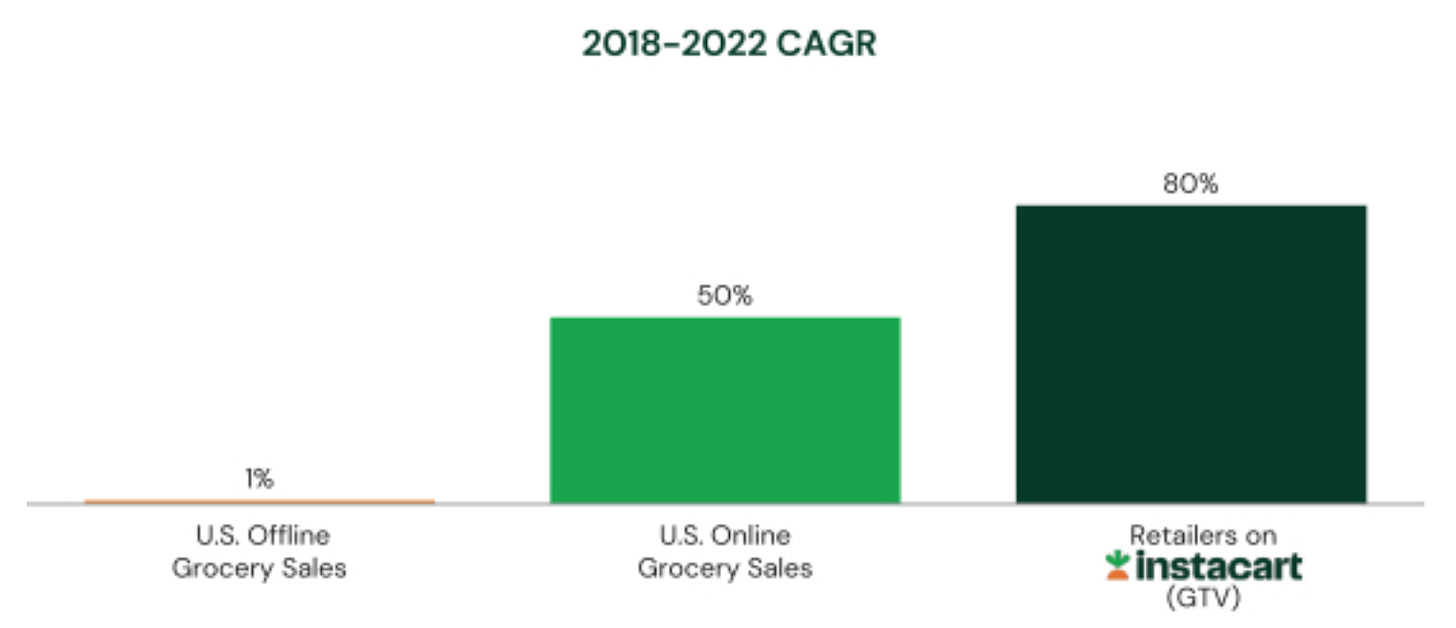

Instacart operates in the US grocery market, which is the largest segment of retail in the US.

The size of the grocery market in the US is $1.1T, but only 12% of that is online today, representing ~$132B in online volume.

Online grocery penetration took 10 years to triple from 1% of total grocery sales in 2009 to 3% in 2019 and just three years to quadruple to 12% in 2022, largely thanks to COVID-19.

Grocery has one of the lowest online penetrations among categories: 66% of consumer electronics, 38% of apparel, 23% of consumer food service, and 20% of home goods take place online vs. the 12% for grocery.

While the aggregate grocery market itself will likely only grow with inflation, the size of the online pie may grow faster. Instacart believes that the share online may even double over time.

To make matters a bit more complicated, the online share of grocery is divided between digital platforms (Instacart, Doordash, GoPuff, etc) and the grocer’s own stores and channels, and the split varies widely between pickup and delivery. The net of it is that only about ~30% of the total online volume happens on digital platforms such as Instacart.

III. Scale and Stakeholders

Instacart’s core grocery marketplace is a three-sided marketplace of retailers/grocers, customers/users and “shoppers”. But there’s also a fourth stakeholder that’s important to Instacart: the CPG brands whose products Instacart is indirectly selling.

Let’s go through the rough scale Instacart operates at and the value they provide to each of these stakeholders

Retailers

Value Prop: Grocers can use Instacart to reach new customers and make online pickup and delivery available to their existing customers. Instacart’s recently launched enterprise platform also aims to give smaller grocers the same tech that bigger ones may have, including an owned and operated eCommerce platform, fulfillment, etc

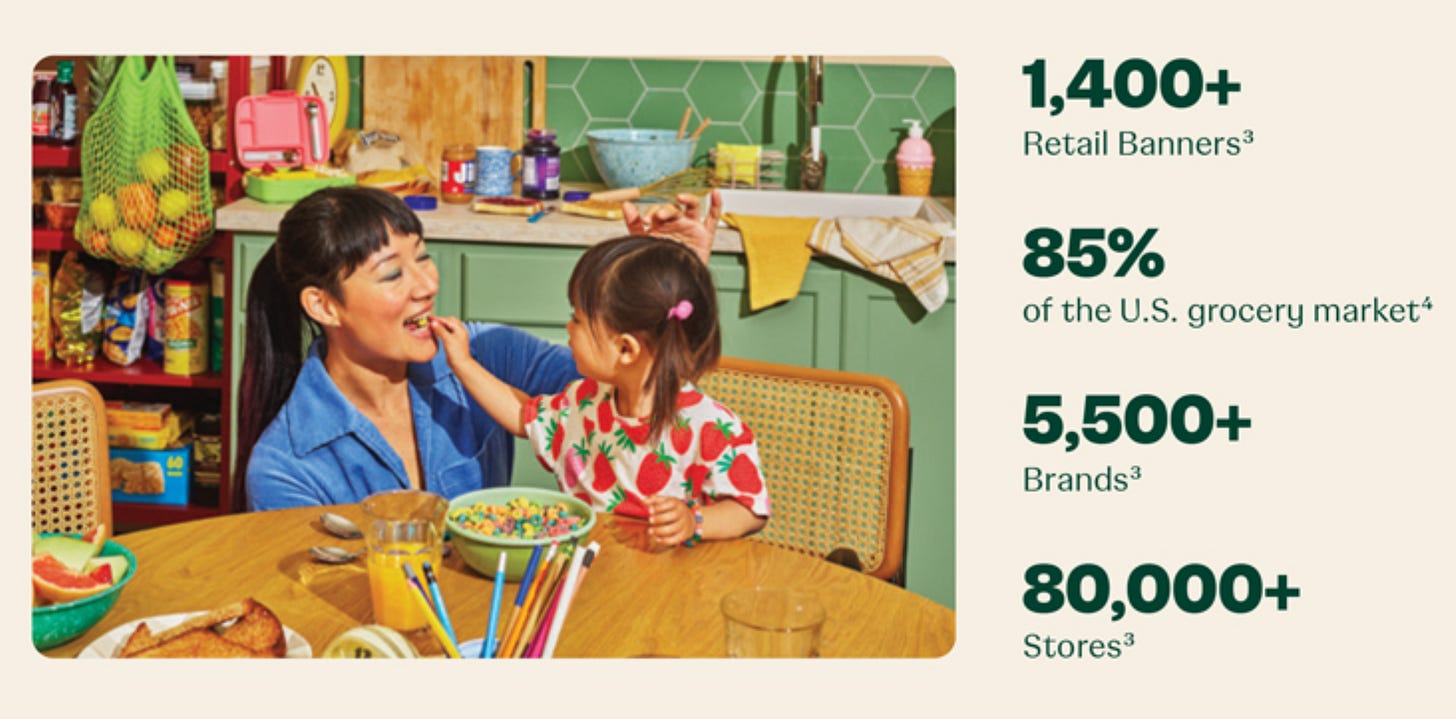

Scale: Instacart has tremendous scale. Over 1400 retail banners/chains partner with Instacart, with Instacart supporting delivery/pickup from 80K+ stores. This represents partnerships with 85% of the grocery market by volume (excluding alcohol). Retail partners include Aldi, Costco, Kroger, Publix as well as Best Buy, Walgreens and Sephora for specific use cases. Instacart powers about 5% of the total sales for their top 20 retail partners.

Consumers

Value Prop: Instacart provides consumers an easy-to-use online grocery shopping experience with optimal selection, convenience, and value.

Scale: Instacart has 7.7 monthly active orderers, who spend ~$317/mo on average on Instacart. Over 900M total orders have been placed, and $100B of gross transaction volume since Instacart’s inception. We’ll go into more of the numbers soon.

Shoppers

Value Prop: Shoppers are the individuals who shop for and deliver the items to customers. Instacart offers them an immediate, flexible earnings opportunity. Relative to other delivery job opportunities, over half the time is spent in the store, and work can be done throughout the day

Scale: Instacart currently has ~600,000 shoppers, and has paid them out over $15B in total since inception. Shoppers are about two-thirds female, about half of them are parents, and they work on average about 9 hours per week, nearly half of which is spent shopping not driving. On average, shoppers make about 8-9% of an order’s value, corresponding to ~$10 per order (+100% of tips).

Brands

Value Prop: Instacart indirectly drives purchasing for brands through grocery/retail stores. In addition, through their brand-focused advertising products, Instacart provides a way for brands to be discovered at the point of purchase.

Scale: Over 5,500 CPG brands use Instacart Ads to reach more customers. This includes household brands such as Campbell’s, Nestlé, and Pepsi and emerging brands such as Banza, Chloe’s Fruit Pops, and Whisps. Instacart estimates that on average their ads deliver more than a 15% incremental sales lift for their brand partners. In 2022, brand partners spent over ~$700M on Instacart Ads.

IV. Business Model and Financials

Let’s now discuss Instacart’s business model and financials.

Business Model

In terms of the business model, Instacart’s revenue breakdown is as follows:

Net Transaction revenue: Instacart generates transaction revenue on every order through fees paid by both retail partners and customers which is then netted out against shopper earnings and coupons. Retailers are charged a fee per order completed, and buyers are charged a delivery fee and a service fee. In 2022, the overall gross fees was roughly 14.9% of gross transaction volume. Shopper’s earnings is netted out against transaction revenue. Shopper earnings are the fees paid out to the Shoppers who do the buying and delivery and were roughly at 8.2% of GTV. After we remove that and coupons/refunds, the net transaction revenue is 6.3% of GTV.

Ads and other revenue: Instacart also generates ad revenue through fees paid by brands to gain additional discovery for their products. These fees are generated on a per-click or on an impression or fixed fee basis. These fees can also be considered a “take rate” on the gross transaction volume, and as of 2022, was roughly at 2.6% of GTV.

This implies a total take rate of ~8.9%.

Given a typical order size of ~$110, the unit economics look something like this: Instacart pays out ~$9 to shoppers, keeps ~$10 itself as revenue, and then has COGS of ~$3. This is demonstrated below.

Key Drivers and Financials

The key drivers of Instacart’s topline are the number of orders in a given time period, the average value of the orders, and its net take rate from those orders, which when multiplied together give its revenue. Then, COGs and operating costs determine its overall margins.

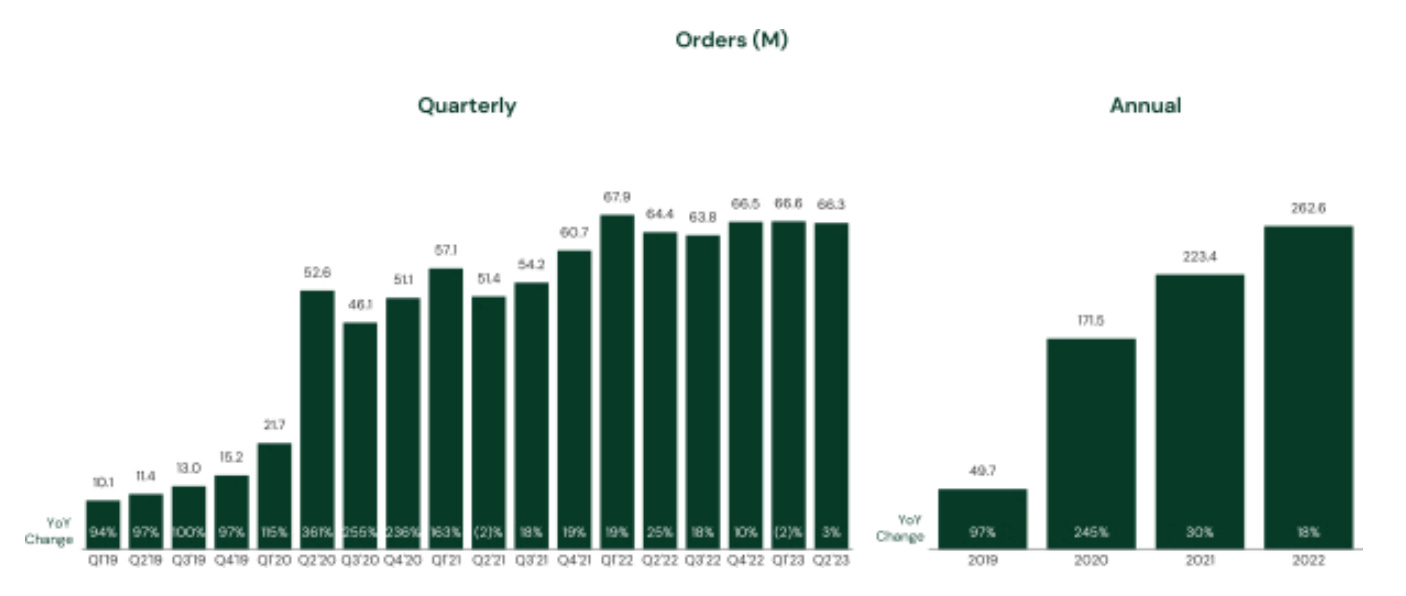

Instacart naturally saw a huge jump in orders and correspondingly gross transaction volume in 2020 because of COVID-19, as in the graphs below which did sustain post-COVID-19, but growth has slowed. It’s worth digging into each of the metrics in terms of where future growth may come from.

Number of Orders: In 2022, Instacart saw 262M orders, growing 18% y/y. However, in Q2 of 2023, orders only grew about 3% y/y. Flatlining order growth may be the biggest risk to Instacart

Average Order Volume: Order values increased slightly during COVID but then came back down into the ~$110 range. While some growth here is possible, it likely won’t be a major driver of future growth.

Gross Transaction Volume: Gross Transaction Volume at Instacart was ~$30B in 2022 growing 16% y/y. However, given slowing order growth, GTV growth in 2023 is also now in the 3-5% y/y range.

Net Take Rate: Instacart has done a good job growing its net take rate, up from 4.2% in 2019 to 8.8% in 2022. In 2023, they’ve managed to grow it further, seeing take rates of 9.6-10.2%, with transaction rate rates around 7.5% and ads around 2.8-3%.

Revenue: Instacart made $2.5B in revenue in 2022, growing 39% y/y. In H1 2023, despite slowing order and GTV growth, they’ve made ~$1.48B, representing a 30% growth. This has largely been driven by improving take rates and to a small extent by order/GTV growth.

Gross Margins: Instacart has done a great job improving their profitability over the years as they’ve scaled, with gross profit going from ~0% of GTV to 7%. On a revenue basis, gross margins have increased to ~72%, up from 60% in 2020 and 0% in 2019.

Operating Income: As Instacart has continued to scale, they’ve also done a great job in the past few years reducing their operating costs as a percent of revenue. Overall, operating expenses as a percent of revenue has gone down from over 200% pre-COVID and even 65% during COVID to about ~57%. In 2022, Instacart made an operating profit of 62M (4% margin) and in H1 2023, their operating margins have been 18%, making a profit of $269M. As they continue to scale and improve efficiencies, its not too crazy to see a 30% margin business in the base case in the medium term.

Overall, Instacart has some pretty impressive numbers. $2.5B/yr in revenue growing 30% y/y, with ~18% operating margins. The big risk, however, is that with orders and GTV growth slowing and revenue growth being driven by higher fees, just how much runway for topline growth is there?

V. Membership and Ads

It’s worth discussing Instacart’s Membership and Ads products, given they’re pretty interesting.

Membership

Doordash and Uber Eats have long discussed their subscription products, noting that subscribers order frequently more than non-subscribers In Instacart’s case, that’s even more pronounced, as we see with their membership program Instacart+.

What it is: Instacart+ offers expanded customer benefits including unlimited free delivery on orders over a certain size, a reduced service fee, credit back on eligible pickup orders, and exclusive benefits.

Scale: Instacart has grown to 5.1 million members at the end of H1 2023 with a member count growing 11% per year. At an annual price of ~$100/yr, that’s over $500M in annual membership fees.

Impact: Instacart members order more frequently and spend more on Instacart compared to other members. On average, an Instacart+ member spends an aggregate of $461 over 4.0 orders per month, compared to an aggregate of $223 spent over 2.0 orders by a non-member, basically more than double. Amazingly, over 57% of GTV was driven by Instacart+ members in H1, highlighting the importance of the program.

Ads

We’ve touched on the ads business before but its worth discussing in a bit more depth.

What it is: Instacart’s advertising product allows CPG brands to drive discovery and purchase very close to the point of purchase via prominent shelf placement. Think of it as the virtual version of slotting fees that brands pay grocers!

Scale: Over 5700 Brands use Instacart Ads, and advertising and other revenue generated over $740M growing over 30%. This has grown from less than 1% of GTV to almost 2.6% of GTV, and provides for additional extremely high-margin revenue to Instacart. Instacart represents one of the largest and fastest growing eCommerce channels for CPG brands and customers include Campbell’s, Nestlé, and Pepsi.

Impact: Ads represent almost 30% of Instacart’s revenue, much higher than Uber and Doordash. This year, Instacart will likely do ~800M+ of ads revenue. Its operating income will likely be in the $600M range. Therefore, one way of thinking about Instacart is that the core business will run at breakeven, and all the profit will come from the ads business!

VI. COVID-19 Impact

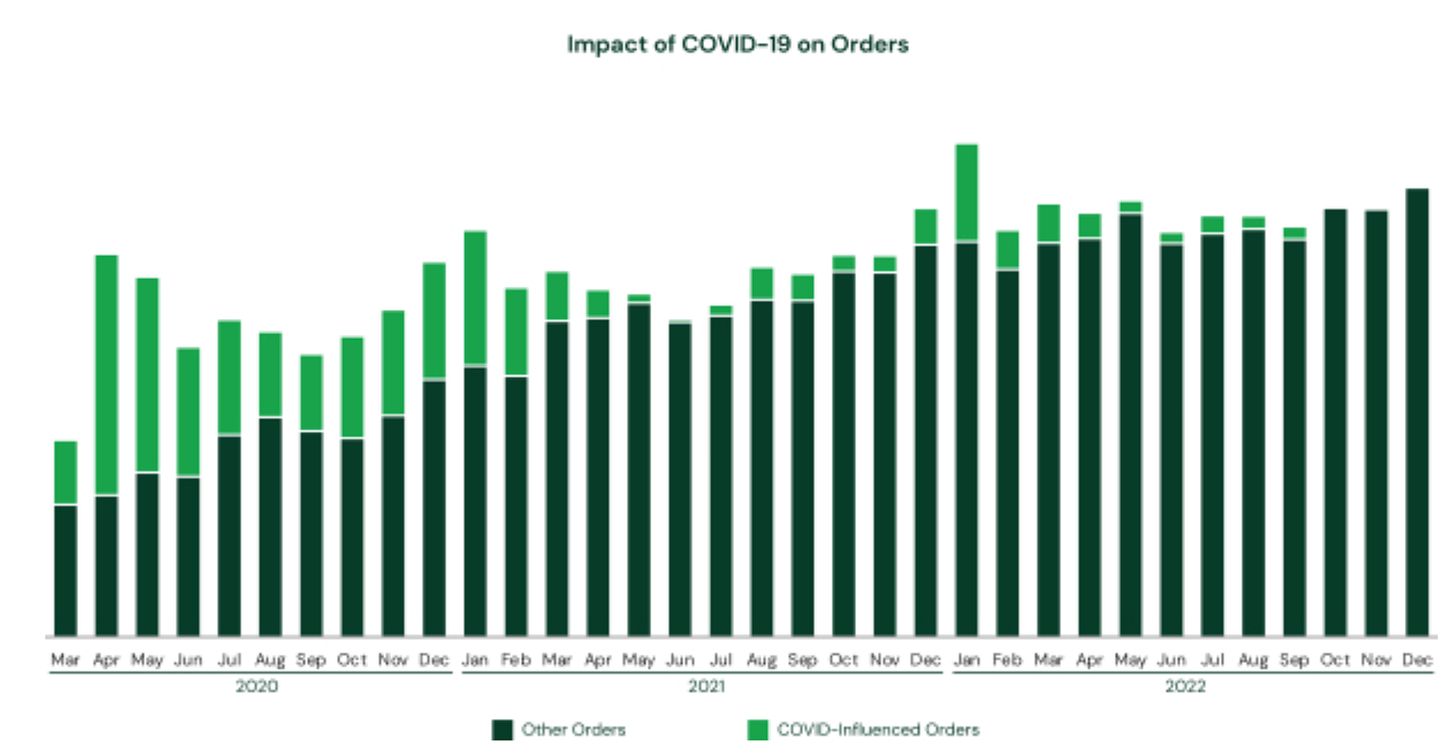

In some ways, COVID is what propelled Instacart from a great to amazing1 business. Topline metrics grew 4x in 2020, more than triple that of prior years. In addition, the larger scale helped bring costs under control.

Looking at the GTV by cohort graph below, its clear that existing customers massively expanded during 2020 and beyond. Similarly, the number of customers and the order volumes of new cohorts was much higher than in the past.

But what is promising for Instacart is that usage among cohorts has stayed roughly the same or declined only slightly from COVID-19 levels, and they’ve continued to build on their COVID-19 growth.

At this point, COVID-19 influenced orders have more or less died down, but Instacart still has the users who joined then and continued to see those order levels, albeit with order growth flatlining.

COVID-19 helped pull forward online grocery from 3% of grocery sales to 12% in 3 years, and Instacart was just the biggest beneficiary.

VII. Closing Thoughts

Instacart has built an impressive and category-defining business - they’re the leader in online grocery in the US with $2.5B/yr in revenue growing 30% y/y, and ~18% operating margins.

The big risk, however, is that with orders and GTV growth slowing to 3-5% and revenue growth now primarily being driven by higher fees, just how much runway for topline growth is there?

Today, given their ~$30B in GTV and an online grocery market size in the US of ~$132B, they already have 22% of the market. But if you dig deeper, of the $132B in market size, 46% is delivery and 54% is pickup. Of those, 95% of the pickup and 48% of the delivery happens on grocers-owned and operated channels. So the net of that is that digital platform market size is only ~$35-40B of which Instacart has the majority, as also seen below.

This is why market growth, expanding into the 70% that happens on owned and operated channels via Instacart’s Enterprise Platform, and other expansions such as further into alcohol or prescriptions or even outside the US will be critical for Instacart to continue growing GTV and Orders.

In terms of valuation, let’s look at a few comps in Doordash and Uber. Now, they account for revenue slightly differently, but these will be at least somewhat indicative

Depending on which multiple we use, we get pretty different valuations, ranging from $8B (using EV/Rev multiple for Uber) to $24B (EV/GTV multiple for Uber). I think the highest fidelity ones are the EV/Gross Profit or EV/Cash Flow multiples, since the toplines and take rates of these companies vary. On that basis, the range we get is $12.5-21.3B for the Enterprise Value of Instacart. For context, the last primary private funding round valued Instacart at $39B, while its latest internal valuation after the post-COVID cuts is around $10B.

One other way to think about Instacart’s valuation is that it will do about $ 550M-600M of cash flow this year. What is that worth with the topline growing 30%? 30-35x that cash flow seems reasonable. That gets you in the $16-20B range if you believe the topline growth can be sustained.

Thanks for reading! If you liked this post, give it a heart up above to help others find it or share it with your friends.

If you have any comments or thoughts, feel free to tweet at me.

If you’re not a subscriber, you can subscribe for free below. I write about things related to technology and business once a week on Mondays.

Or good to great, depending on how high your bar is

>On average, shoppers make about 8-9% of an order value, corresponding ot

Cliffhanger! Think you forgot to finish that sentence. Great article so far