Figma S-1 Breakdown

On time-to-market, going multi-product, PLG, and profitable growth

This is a weekly newsletter about the business of the technology industry. To receive Tanay’s Newsletter in your inbox, subscribe here for free:

Hi friends,

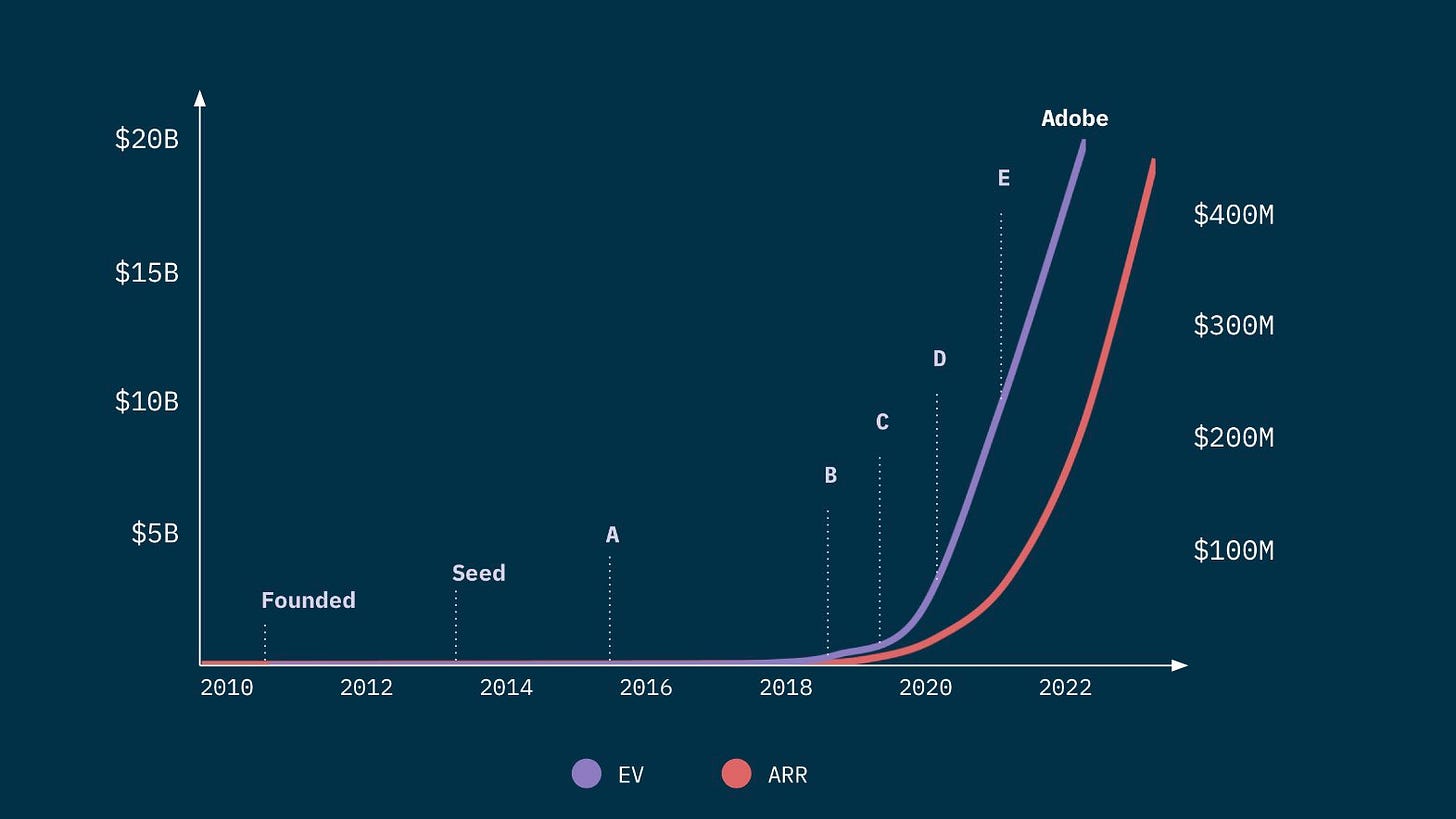

Figma just dropped its S-1, and it's a fascinating one. The company, famously at the center of then abandoned $20 billion acquisition by Adobe, has emerged stronger and more compelling than ever. There’s a lot to unpack, from its patient origins to becoming an elite, multi-product platform nearing a billion dollars in ARR. And it's navigating all this at a critical moment in AI.

Here’s how I’m breaking it down today:

Origin Story and Core Product

Product Vision and Multi-Product Evolution

Business Model

Financial Profile and Efficiency

The Go-to-Market Engine

The AI Wildcard

Let's jump in.

Origin Story and Core Product

Dylan Field and Evan Wallace founded Figma in 2012, aiming to create a browser-based alternative to traditional design tools like Photoshop. Unlike many startups today that chase immediate revenue, Figma spent over four years focused exclusively on product development. The company launched publicly in 2016 and only began generating revenue a year later.

Relative to some of the $0 to $10M ARR in a year from founding type of companies of today, Figma was a slow burn and took a long time to get the product right. Figma was founded in 2012, raised a seed and Series A pre-launch, launched in 2016 and started to monetise in 2017.

Figma’s founders and early investors deserve significant credit for their patience and foresight, prioritizing getting an MVP with a high bar and focusing on the leading indicator of user engagement over early monetization. The chart illustrates this idea that it took a while to get escape velocity, and many of the early rounds were pre-product and very early revenue. Vision and then product engagement were the leading indicators.

The foundational thesis was ambitious: browser-native, real-time collaborative design powered by the enabling tech of WebGL for desktop-level performance. This collaborative approach became central to Figma's value, enabling product teams across roles, not just designers, to work seamlessly within a single tool.

Today, two-thirds of Figma’s 13 million monthly active users are non-designers, highlighting how broadly its vision has resonated.

Product Vision and Multi-Product Evolution

Figma has evolved far beyond its original design tool, becoming an essential platform for entire product development cycles. Its products span all stages of the cycle as below:

Ideate and Align:

FigJam (launched April 2021): An online whiteboard for ideation, brainstorming, and rapid communication, designed for users of all skill levels with features like timers, voting, diagramming, and AI-generated templates.

Figma Slides (launched June 2024): A collaborative presentation tool that combines high-fidelity design with real-time multiplayer editing, enabling teams to create engaging presentations, embed prototypes, and seamlessly transition from brainstorming to slides.

Visualize

Figma Design (launched September 2016): The core browser-based UI design tool, offering high-performance vector editing, prototyping, and a robust design system to visualize ideas at any fidelity and enable collaborative design at scale.

Figma Draw (launched May 2025): A dedicated space for advanced vector editing within Figma, tailored for creating detailed iconography and product illustrations that require fine control.

Build and Handoff:

Dev Mode (launched June 2023): A specialized workspace for developers to inspect designs, access specs, generate platform-specific code, and connect design systems to codebases, streamlining the design-to-development handoff.

Ship:

Figma Sites (launched May 2025): Lets users design and directly publish responsive websites to the web with custom URLs, supporting features like breakpoints, code layers, and a built-in CMS for easy content updates.

Figma Buzz (launched May 2025): A tool for creating and scaling marketing assets such as social media graphics and digital ads, offering templates, bulk asset generation, and AI-powered editing for users of any skill level.

The evolution of this over time is interesting as well and show below, which highlights the signaling an increasing acceleration in the multi-product journey around their vision above particularly since 2023.

The core product remains the Figma Design tool, which holds a somewhat monopolistic position in the core product design market, with as high as 80% according to some surveys. But Figma has leveraged that core product to expand into adjacencies as part of the product development process well.

Per the most recent quarter, 76% of customers now use multiple Figma products, confirming early success in cross-selling and platform expansion.

Business Model

Figma operates a straightforward SaaS subscription model, charging customers based on seat-based licenses. Pricing tiers range from free plans (individual users and small teams) to Professional, Organization, and Enterprise plans, scaling with additional features, admin controls, and collaboration capabilities.

There are different types of seats depending on the use type and the suite of products they need, but range from $5/mo to $90/mo depending on the tier and type of seat.

Figma has 13M MAUs, and 450K paying customers. Customers have multiple seats and the paid MAU isn’t disclosed, but it’s likely that the vast majority of the 13M MAUs are on a free plan.

Historically pricing has been seat-based and relatively straightforward, allowing easy adoption and predictable revenue growth. However, with the integration of AI-driven products like Figma Make there is potential for the business model to evolve potentially introducing usage-based or value-based pricing models to reflect enhanced productivity from AI tools.

If you don’t yet receive Tanay's newsletter in your email inbox, please join the 10,000+ subscribers who do:

Financial Profile and Efficiency

Figma’s financial profile is impressive, characterized by strong revenue growth at an impressive scale nearing a billion in ARR, coupled with profitability and an efficient business with strong retention

A few key metrics:

Revenue and growth: Figma is at $912M in ARR growing 46% y/y

Gross margins have consistently been around ~88-91% range

Operating Margins are now at 16% based on Q1’25, non-GAAP operating margins slightly higher around ~18%

Free Cash Flow Margins (adjusted) are around 27%

Rule of X: Figma’s Rule of X is in the ~62% range (using Revenue Growth + GAAP operating margin) or if using Revenue Growth + FCF (with adjustments) would be at 73%. Whichever way you look at it, this would put it very close to the top of the public software universe.

Net Dollar Retention Rate of 132% (for users paying >$10K) and Gross Dollar Retention Rate of 96% which is excellent although defined slightly oddly1.

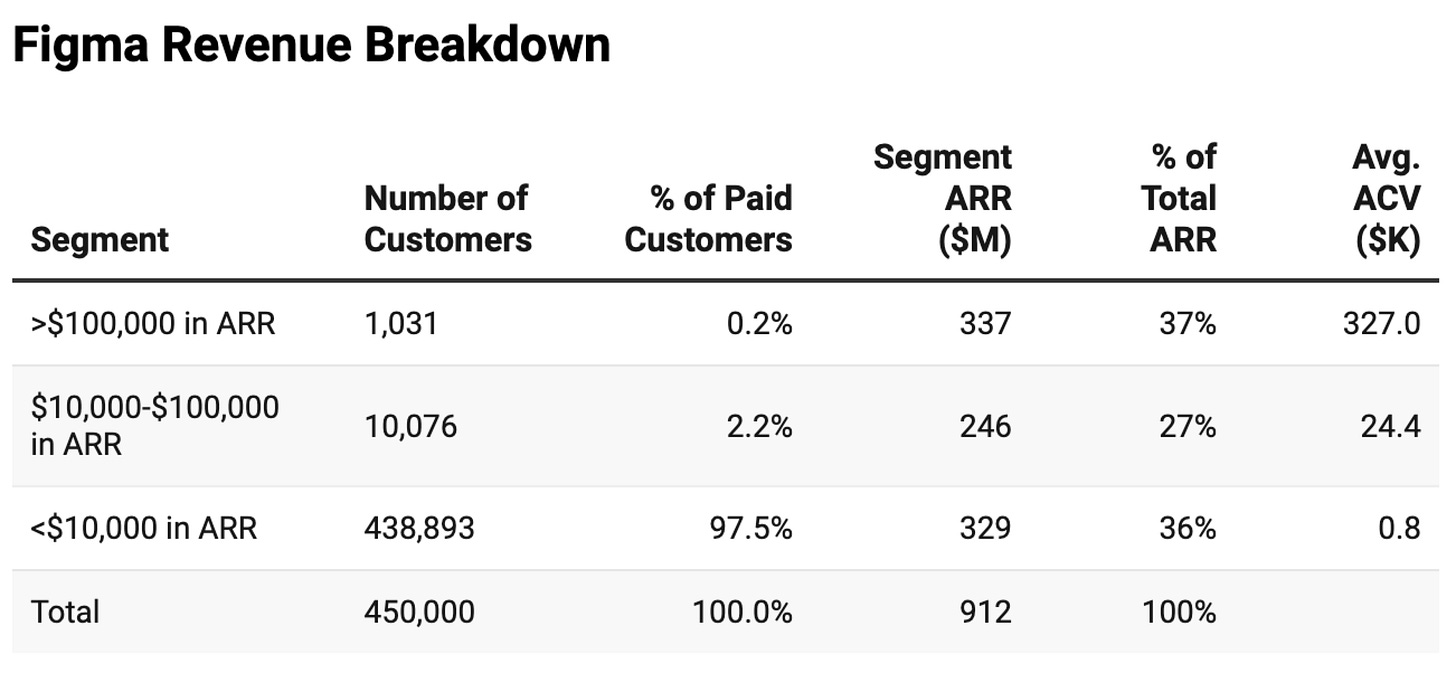

Revenue breakdown

Figma has 450k paying customers, and $912M in ARR. That corresponds to an aggregate ACV of ~2K. However, the distribution is quite wide, particularly given the PLG motion and plan, and so a better breakdown is as below. About 2/3 of the revenue comes from customers paying >10K/yr.

78% of the Fortune 2000 and 95% of the Fortune 500 use Figma highlighting their reach. At the same time, only 28% of the Fortune 2000 spend >100K on Figma highlighting the potential ahead.

Cost Structure

As in the chart below, Figma has become more efficient over the last few years, particularly on G&A as well as a little bit on the sales and marketing side. Figma now spends more on R&D than it does on sales and marketing and on a GAAP basis has +16% operating margins.

Burn over Lifetime

Figma has been an extremely efficient business over its history. It currently has ~$1.5B in cash on hand as a business. In its aggregate over the course of being private, it raised $333M in primary capital until 2021 (and another $400M in 2024 out of which arguably only $60M was truly primary). It obviously received $1B from Adobe as part of break-up fee, of which ~$297M was paid in taxes/transaction costs, meaning $703M net cash received.

So Figma raised ~$393M in true primary capital and received another ~$703M net received from Adobe which is $1096M, but has $1.5B in cash on hand, and so has actually generated almost $400M in free cash flow as a business over its lifetime, net of the additional from Adobe.2 Very few venture-backed businesses go public burning a small amount, let alone a negative burn of that magnitude!

Magic Number

Another metric to highlight Figma’s efficiency is the magic number which has tended to hover in the 0.75-1.25 range which is quite impressive given the scale of the business. I’ll touch on it next, but part of the reason for this is the PLG engine the business has been able to build over time

Go-to-Market Engine

Figma is one of the poster children of the Product-Led Growth (PLG) movement. With around 450,000 paying customers and 13 million monthly active users, the company's growth has been driven primarily by bottoms up adoption and word-of-mouth growth within and across companies.

About 70% of now Organization and Enterprise plan customers initially adopted Figma through the Professional plan in that at least one user was on that plan, illustrating their effective land-and-expand strategy fueled by their product-led growth motion.

A few points to note which has enabled their growth motion and become part of the PLG playbook of sorts:

Free Starter Plan: Figma offers a free Starter plan designed for personal projects and new users. This plan provides an easy entry point for individuals to try Figma’s design and collaboration tools without any upfront cost

Easy self-serve onboarding: Users can sign up, onboard, and start using Figma directly through the website, without needing to interact with sales which now feels quaint and commonplace, but wasn’t the norm at the time, particularly for this kind of software.

Built-in virality with URL sharing: Figma’s real-time, browser-based collaboration means any file can be shared instantly via a URL. This makes it effortless for users to invite teammates, clients, or stakeholders, driving organic adoption within organizations

Figma for Education Program: Figma offers the Professional plan free for educators and students and the Organization plan free for K-12. This initiative seeds Figma’s usage among the next generation of designers and product builders, creating early familiarity and loyalty

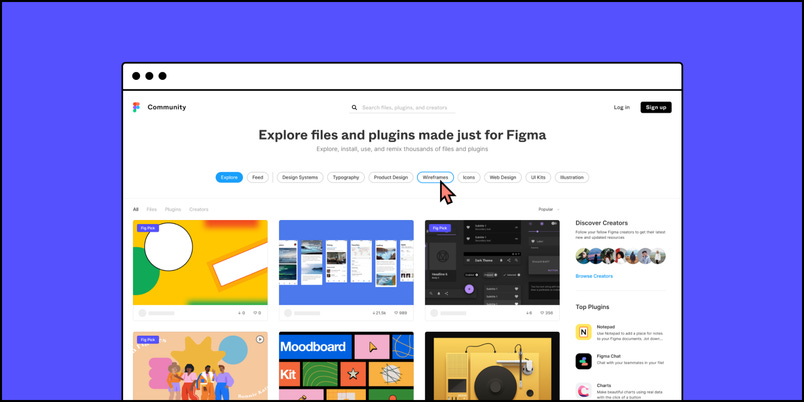

Strong Community efforts: Community has also been a driver of growth. Over 250,000 community resources and 10,000+ plugins/widgets help users customize and extend Figma. There are over 200 Friends of Figma chapters worldwide, from Lagos to Los Angeles which host over 650+ events globally.

Over time, Figma has complemented its core PLG motion with a stronger sales-driven approach. Figma started adding dedicated sales personnel around 2018, marking a pivotal shift toward enterprise adoption.Approximately 70% of its revenue now comes from Organization and Enterprise plans, demonstrating significant traction among larger enterprises. This blend of bottom-up PLG and targeted enterprise sales significantly enhances Figma’s market strategy and scalability.

The AI Wildcard

By all accounts, Figma is an extremely strong business: retentive, growing well, and profitable. But perhaps the only real “gotcha” for Figma is the question around AI.

AI represents both a major risk and a large opportunity, as well as the most significant uncertainty facing Figma. The rapidly evolving generative AI landscape is already starting to change the way the product development process works.

With the rise of tools such as v0, or vibecoding tools such as Lovable and Bolt, some people are leaving design to the AI for at least the lower-tier of personal use/internal use applications, and doing it as part of the integrated process.

The company openly acknowledges this AI risk and that AI could commoditize parts of the design process, potentially impacting pricing power and user engagement.

[AI has the potential to] alter.. how consumers and businesses interact with websites and apps and consume content in ways that may result in a reduction in the overall value of interface design, or by otherwise making aspects of our platform obsolete or decreasing the number of designers, developers, and other collaborators that utilize our platform

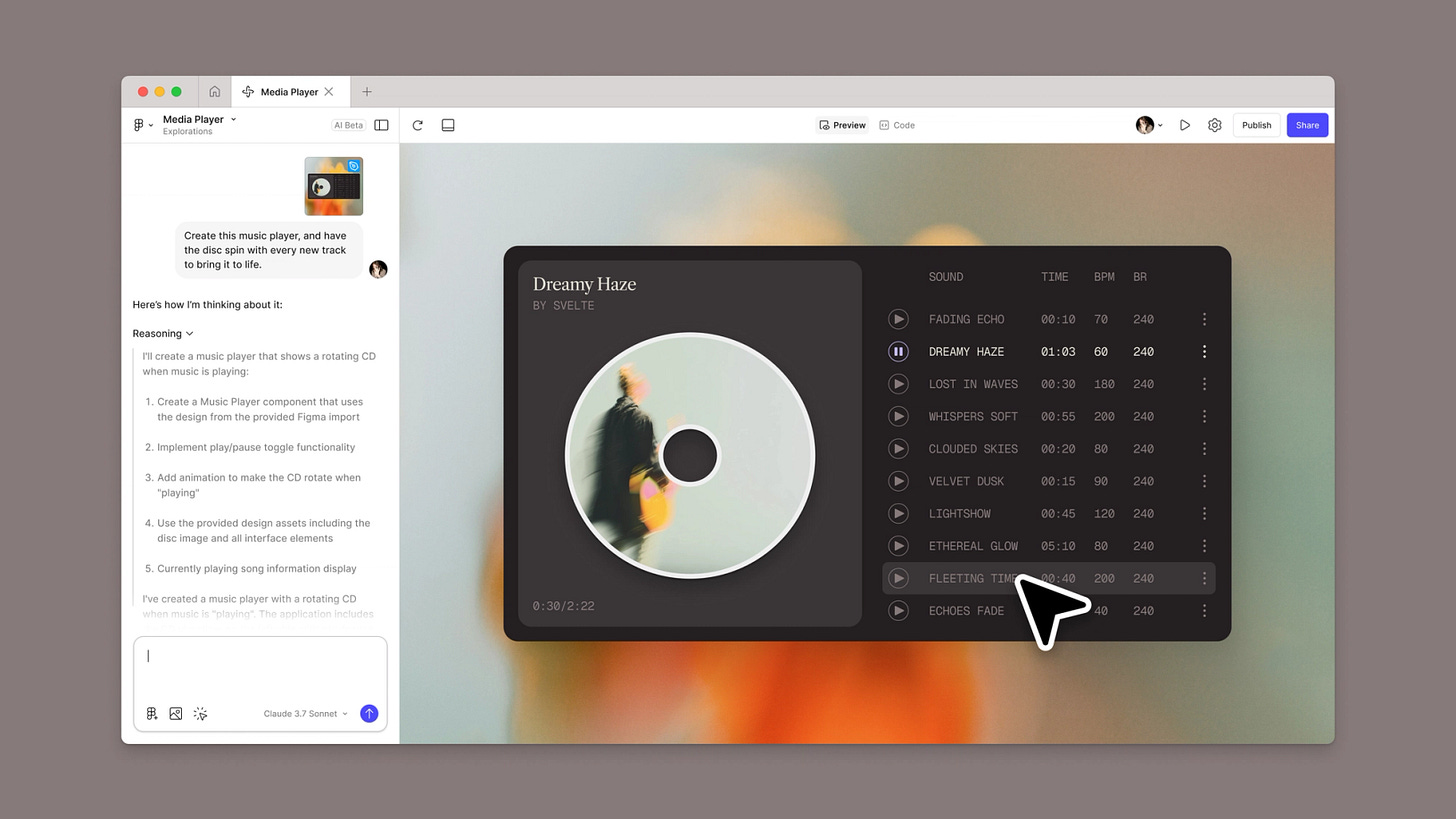

At the same time, AI represents a significant opportunity for Figma as well. Figma has proactively integrated AI capabilities across its product suite. Offerings like Figma Make leverage AI for faster prototyping, with management positioning Figma as the central collaborative platform even as AI automates routine tasks.

The company talks about the potential of AI to lower the floor and raise the ceiling in the design process, which is phrasing I quite liked:

With Figma Make, we believe even more people will be able to create functional, dynamic prototypes and software, as it lowers the floor to let absolutely anyone transform their idea into something that works. At the same time, it raises the ceiling of what’s possible by giving people access to capabilities that weren’t possible in their current tools, whether that’s allowing designers to tap into the power and expressiveness of code, or allowing developers to enjoy the freedom and speed of visual manipulation

The introduction of AI-driven tools may also increase short-term hosting and computational expenses, potentially impacting gross margins. Long-term, Figma's success in navigating the AI shift will hinge on how effectively it integrates these tools into its ecosystem without sacrificing pricing power or user retention.

Closing Thoughts

Figma’s IPO underscores the value of patience, product-led growth, and strategic evolution. Its financial metrics including rapid growth, impressive margins and capital efficiency are outstanding. The transition from a single-product design tool to a comprehensive, enterprise-focused suite has been exceptionally well-executed.

Nevertheless, the AI wildcard presents significant uncertainty, making Figma’s ability to adapt and innovate crucial to its future success. I'll be closely watching how the company continues to evolve its business model, manage enterprise adoption, and navigate the evolving AI landscape.

Overall, Figma stands out as a true generational company that began a lot of the PLG and cloud-based collaboration movement and one of the highest quality application layer SaaS companies going public we’ve seen recently.

Based on the quality of the business and the current comps on a Rule of X / NTM growth basis, I expect it to trade at an ARR multiple of ~19-22x which should put it at ~$18-20B range (they also have 1.5b in cash). I won’t be surprised if the IPO sees strong demand and so trades above that range from the get go either.

The company also deserves a lot of credit for the way they handled the post-Adobe failed acquisition state. The business was at $400M at the time the acquisition was announced. The company has remained focused and executed and more than doubled ARR over the next 2.5 years, and done so while being profitable and efficient and accelerating their multi-product vision and should be rewarded with a valuation around what they would have gotten with Adobe if not a bit more as they start trading.

Figma only uses the >$10K ARR cohort (which is okay) but requires that they spend >$10K in both periods to count, which essentially means that churned customers don’t count, which is not super common. Here’s the definition: “We calculate Net Dollar Retention Rate as of the applicable period of measurement by starting with the ARR as of the date of measurement from all Paid Customers with more than $10,000 in ARR that were also Paid Customers with more than $10,000 in ARR as of twelve months prior to such date of measurement (“Current Period ARR”). We then calculate the ARR for those same customers as of twelve months prior to the date of measurement (“Previous Period ARR”). We then divide Current Period ARR by Previous Period ARR to calculate our Net Dollar Retention Rate for the applicable period of measurement.”

Even if you include the full $400M they raised in 2024 and consider that primary capital that went into and remained in the business, it would still be a negative net burn over the course of the history of the company, though on the order of <$100M.