Zoom's earnings and the importance and perils of forecasting

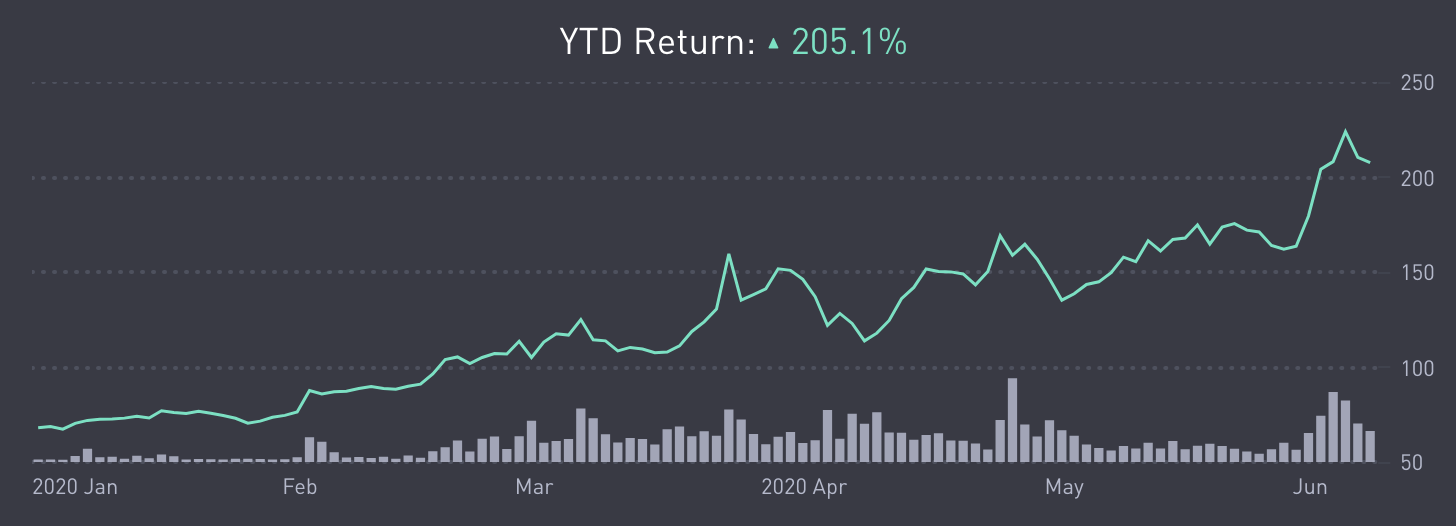

Zoom is a poster-child of the shift towards remote work during COVID-19 and went from an enterprise-only product to also a consumer one almost overnight. Its usage grew from under 10M daily meeting participants to over 300M daily meeting participants and its stock is up >200% year to date.

With that backdrop, Zoom reported its quarterly earnings this past week for Q1 FY 2021 and had arguably one of the best quarters ever in software history.

I’ll touch on their performance briefly, but use it as a lens to discuss the importance of forecasting, the dangers of forecasting assuming things remain the same and why growth stocks always look overvalued.

The quarter at a glance

Zoom had a very strong quarter, greatly accelerating revenue growth from 88% to 169%, and doing so extremely profitably.

Revenue: Zoom made $328.2M in revenue, a growth of 169% year over year.

Customers: Customers over 10 employees grew 354% y/y to over 250,000, and customers who spend more than 100K per year on Zoom grew 90% year over year. In addition, the net dollar expansion rate (the amount that the cohort of customers spend this year relative to the previous year) continued to remain above 130% for the 8th consecutive quarter.

Cash Flow: Zoom made $251.7M in free cash flow this past quarter, a FCF margin of 77% (!)

GAAP operating income: $33.2M, a 10.1% operating margin. Notice the difference between this and the FCF margin, primarily because of changes in working capital since Zoom collects payments for annual contracts upfront and had a large increase in new customers this quarter.

Two things surprised me when reading the discussion about Zoom’s quarter: the people argue that it’s overvalued because it trades at 68 times twelve trailing month revenue today, and those that extrapolate pretending that nothing will change and think it will produce free cash flow margins of 75+% going forward.

The importance of forecasting into the future

Today Zoom trades at 68X twelve trailing month revenue or a P/E ratio of ~1150. When the stock market as a whole trades around 20 times earnings, its easy to say Zoom is very overvalued.

However, high growth stocks always look expensive in the near term when measured on P/E ratios or even EV/Revenue ratios, because some of the growth expectations are embedded into their prices, and so they carry high multiples. Their stock price is a reflection of the earnings they can produce in the future, not what they did in the past.

Zoom just grew revenues at 169% year over year. It only takes a few years of continued explosive growth for a company that’s growing like that and looked very expensive to look very underpriced.

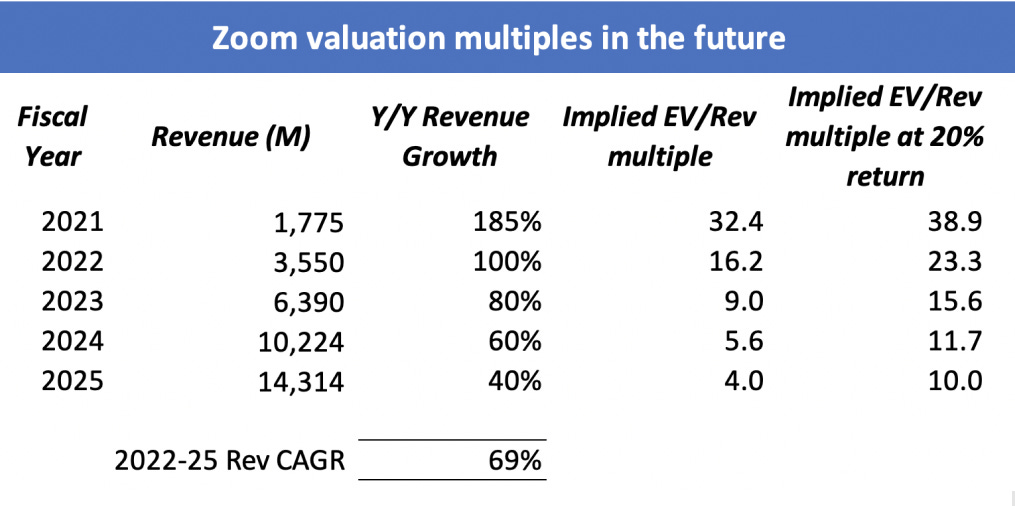

Let’s play it out for Zoom to illustrate. Today, Zoom has an enterprise value of 57.5B and made $828M in the last twelve months, giving it a 68X revenue multiple.

But Zoom provided revenue guidance for FY 2021, of $1.775-1.8B, which would imply around 185% y/y growth vs 2019, which gives it a 32.5X revenue multiple assuming the enterprise value doesn’t increase. Much more reasonable than 68X, but still high.

But hey, what happens if you play that out a bit further? As the table below illustrates, if they can grow at ~70% CAGR for 4 years beyond 2020, then at current valuations they would be only worth 4X revenue which is actually pretty cheap for a recurring revenue business. In fact, if they can grow at that rate, even if their stock appreciates at 20% per year (an excellent return), they would still be valued at ~10X revenue in 2024, which again is pretty reasonable.

Now, different people will have different opinions on whether such growth rates are achievable, but in some sense, if the market believes growth rates will look like that, then today’s prices aren’t absurd.

The perils of extrapolating into the future

Just as it’s important to not consider things like P/E ratios in the short-term when stocks are growing quickly and forecast into the future, it’s equally important not to extrapolate metrics based on once-in-a-lifetime results which may not recur.

Zoom had a very special quarter by any metric, but take the case of its 77% free cash flow margin. On the flip side of the Zoom bears arguing that the stock is overvalued because of the high P/E or P/S ratios, are those who believe that it is undervalued because of the high FCF margin.

Digging a bit further, it’s important to note that the GAAP operating margin was 10%, and a large portion of the FCF was driven by the fact that there were no capital expenditures this quarter and the large benefits of working capital through upfront payments of the new contracts signed in this quarter.

Since Zoom had an over 100% quarter over quarter growth driven by signing up many new customers, this working capital benefit was abnormally large. As its quarter over quarter growth rates slows down, the working capital benefit won’t be anywhere quite as big for the rest of the fiscal year. In addition, Zoom expects to increase capital expenditure for data center infrastructure and sees cash outflows for its ESPP plans in Q2 and Q4.

Last year’s aggregate FCF margin was ~25%, and this year will probably be significantly higher but is unlikely to be close to the 77% of this quarter.

More generally, while forecasting is important, it is important to think about two things: what are one-time costs and benefits vs recurring ones and what metrics look like on a normalized basis after adjusting for those.

For another example of the danger of extrapolating blindly in the context of Zoom is that of their gross margin. Zoom had gross margins of 65% this quarter, compared to 80% for the previous fiscal year. Is 65% the new normal?

The gross margin dropped as Zoom’s free tier usage increased dramatically because of the consumer and educational use cases and Zoom used the public cloud to meet the growing demand since they couldn’t build out additional data centers so quickly. So what will happen over time? As Zoom invests in data center capacity and as some of the free usage declines as shelter in place is lifted over time, their gross margins will likely rise, and management calls out the same, expecting to see margins in the mid-70s over time.

What are views on zoom now?🤔