Understanding the Twitter Acquisition

How it compares to other leveraged buyouts

Hi friends,

Many of you are probably sick of reading about Elon Musk and Twitter, but a few readers were curious to know more about the Musk acquisition of Twitter from a financial point of view, which is what this piece is about.

I’ll discuss:

The structure of the deal

How is compares to other LBOs

The financial implications for Twitter

I. The deal structure

Leveraged Buyouts, also known as LBOs for short, refer to the acquisition of a company using a large amount of debt to finance it.

The Twitter take-private acquisition falls under this category, and in fact, is the largest leveraged buyout in history to date in terms of deal value, as in the table below.

The funding

The ~$46B purchase price was funded by debt and equity. The debt portion represented ~$13B of the purchase price, with the equity portion representing the remaining ~$33B.

The debt portion includes:

$6.5 billion term loan facility

$500 million revolving loan facility

$3 billion secured bridge loans

$3 billion unsecured bridge loans

This debt is arranged by several banks jointly, including BofA, Barclays, BNP Paribas, Mizuho, Morgan Stanley, MUFG, and Societe Generale

The equity portion is largely funded by Musk himself, with a few external investors coming along for the ride. The external investors came in for ~$7.1B, as detailed below.

The remaining $26B in equity was provided by Musk himself, mainly by selling down his Tesla stake.

II. Twitter Compared to Other LBOs

Typically when they conduct leveraged buyouts, private equity firms face a trade-off when deciding how much debt to put into the business.

The more debt and the more leverage they put on, the lower the equity financing needed, and the higher the potential upside on the equity if things go well. But, putting on too much debt can burden the business with too much interest or make it difficult to pay back the debt or meet the covenants and various other stipulations of the loans and increase the risk in the business.

To choose the right amount, time is spent understanding the cash flows of the business, the risk inherent in the cash flows, the interest rates, and other things.

At the same time, a few common short hands or metrics are used, with some rough ranges that people want to be within.

Some of these metrics include:

Net Debt as a percentage of enterprise value (what portion of the company value is debt vs equity)

Debt/EBITDA (what is the ratio of the debt the company has to its earnings)

Interest Coverage Ratio (how many times over can a company pay its interest expense with its income)

How do these metrics fare for this transaction?

Net Debt as a percentage of the enterprise value of ~28%, which is on the lower for a leveraged buyout (which is a good thing). However, if one believes that Twitter isn’t worth ~$46B but rather ~$20-25B or even lower given the current market and financials, this ratio “in reality” could be >60%, which is still okay (by itself) but a bit higher than the median which is about ~50% these days, as below.

Range of Net Debt / EV of LBOs via Institute for Private Capital

Debt/EBITDA of ~54x which is worryingly high. A lower number is better / safer, and typically private equity leverage buyouts don’t go beyond the 5-7x range. In fact, Twitter’s Debt/Revenue ratio of almost ~3x might be where many non-PE backed public firms operate on the Debt/EBITDA ratio.

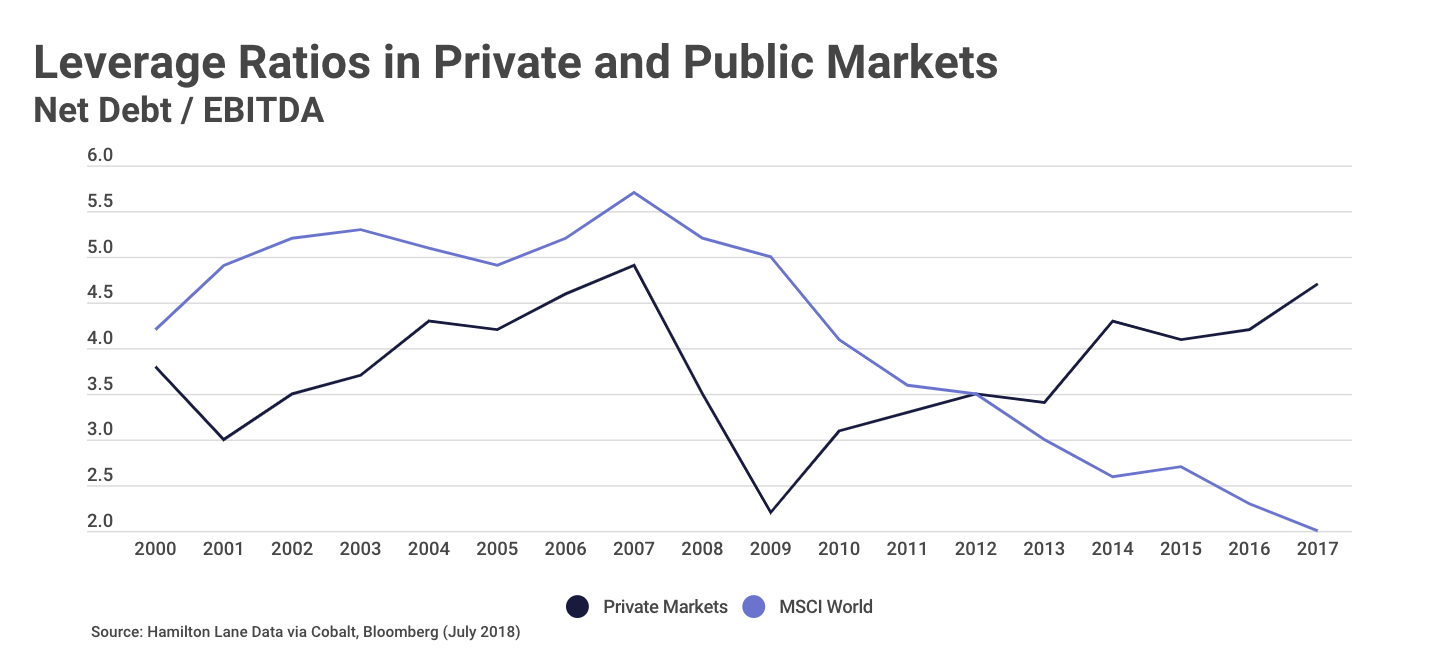

via Cobalt Interest Coverage Ratio of 0.25 which is worryingly low. A higher number is better and typically companies want to have an interest coverage ratio of at least 1.5-2x at the minimum, indicating that the company would be able to make interest payments with some cushion.

If you don’t yet receive Tanay's newsletter in your email inbox, please join the 5,000+ subscribers who do:

III. Financial Implications

Musk has been quick, perhaps even too quick, to make changes at Twitter. But it’s not entirely surprising considering the financial situation, which shows the need.

On the day it was taken over, Twitter was the same company as before, except it had ~$13B in additional debt (its net debt at the time of the acquisition was in the ~$0.5B which is a rounding error now).

The interest payments on this debt are $1B annually.

And this is how Twitter’s key financials stacked up in their last twelve months (as a public company):

Revenue of ~$5.2B

Gross Profit of ~3.2B (~70% gross margins)

SG&A expense of ~2B (39% of revenue)

R&D expense of ~1.5B (29% of revenue)

Operating losses of ~281M

EBITDA of +210M

Now add the $1B of annual interest payments, and Twitter would be losing over a billion dollars every year without any changes. In addition, it likely would not have the operating cash flows to cover interest payments, drawing down on its cash reserve (potentially tripping various debt covenants beyond a point).

Musk noted this himself, in a tweet:

Its clear Musk needs to act, and the changes he’s making so far have been the following:

Reduced cloud/infra spend: Twitter’s cost of revenue is $2B/yr — a lot of that comes from cloud infrastructure and data center expenses. Musk is trying to find as much as ~$1B in savings, which may take gross margins up to 80% on the core business.

50% Headcount reduction: The unfortunate, but from Musk’s perspective needed headcount reductions affected 50% of the workforce. Assuming that about 75% of the R&D, SG&A, and G&A buckets represent employee wages, etc, the 50% headcount cuts may reduce spending by as much as ~$1.3B.

Growing Twitter blue: Twitter is trying to grow Twitter blue, which currently only has ~50K subs by offering blue checks and improving the offering over time. However, if they reduce ad load on Twitter blue by 50%, I think it will be net neutral (or maybe even negative). But for now, we can assume that Twitter blue will in the best case more or less cover the lost revenue from advertisers boycotting the platform for now.

If this works, Twitter could look something like this:

Revenue of ~$5B

Gross Profit of ~4B

Expenses of ~2.1B

Operating Income of ~$1.9B, which is more than enough to cover the interest of ~$1B, and allows Twitter to pay back its debt over time

However, this requires finding various cost savings while maintaining revenue, in the light of boycotts from prominent individuals and advertisers. The first few weeks have been both entertaining and devastating so far, and we’ll see how the next few months play out.

Thanks for reading! If you liked this post, give it a heart up above to help others find it or share it with your friends.

If you have any comments or thoughts, feel free to tweet at me.

If you’re not a subscriber, you can subscribe for free below. I write about things related to technology and business once a week on Mondays.

Tanay, this is excellent info that I have come back to several times. There seems to be some confusion out there on whether or not Musk took on personal debt (via margin loans) to fund the Twitter acquisition. While margin loans were part of the original package they were later dropped. Some reporting indicates that he does have margin loans (backed by Tesla) on Twitter. I see he has a significant number of his Tesla stock pledged for personal loans, which predated the acquisition, but nothing definitive on any personal loans to fund Twitter. Is Musk personally on the hook for any of Twitter's debt, or does it all fall on Twitter and the banks?

I consider this a very skillfully written, easy to understand and well-detailed analysis of the twitter deal. Thank you for taking time to explain this.

PS: I dont know if all Tanay wrote is factually correct, but my opinion above still holds.