The OpenAI Effect

How single OpenAI headlines are repricing stocks across the board

I’m Tanay Jaipuria, a partner at Wing and this is a weekly newsletter about the business of the technology industry. To receive Tanay’s Newsletter in your inbox, subscribe here for free:

Hi friends,

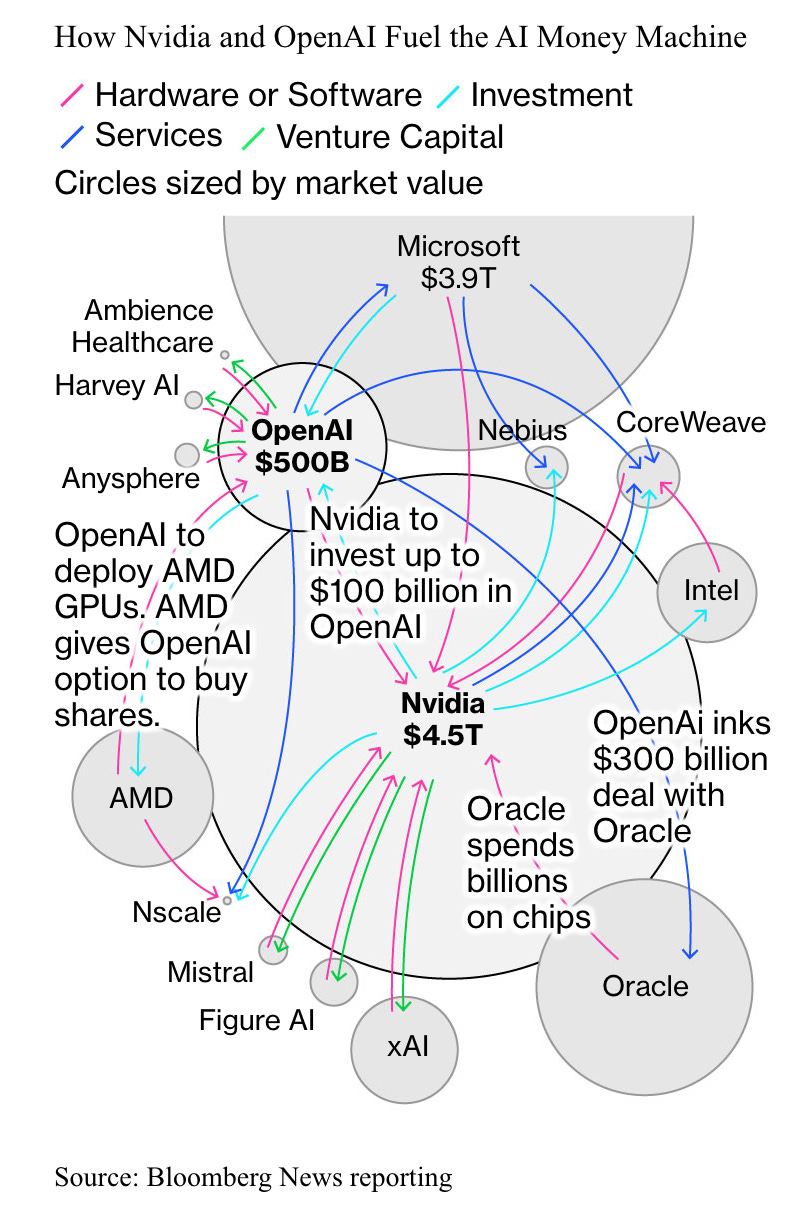

It’s OpenAI’s world and we’re just living in it. Over the past few months, news tying a company to OpenAI, whether official partnerships or announcements or just chatter has moved stock prices of large companies across chips, cloud, commerce, and beyond.

OpenAI seems to be having a kingmaker effect in the public markets unlike anything we’ve seen before. Great for partners and those who can be aligned with their direction, terrible for those in the firing line.

Note that I won’t focus on the accounting treatment or circular nature of these deals, but instead on just how broad and impactful announcements with OpenAI are proving in the stock markets across the board.

Compute & Cloud

NVIDIA

On September 22, 2025, NVIDIA and OpenAI outlined a plan to deploy at least 10 gigawatts of NVIDIA systems for OpenAI’s next wave of infrastructure, alongside press about a large prospective NVIDIA investment linked to deployments. NVIDIA Stock surged 5% on the news, adding hundreds of billions in market cap.

AMD

On October 6, 2025, AMD announced a multi year agreement with OpenAI to stand up roughly 6 gigawatts of capacity, beginning with 1 GW targeted for 2H26, plus a warrant package for up to 160 million AMD shares for OpenAI. AMD rose almost 30% that day adding ~$100B in market cap.

Broadcom

On September 13, 2025, reports tied OpenAI to a roughly ten billion dollar custom accelerator program at Broadcom, and AVGO pushed to fresh highs into late September. On October 13, 2025, Broadcom and OpenAI formally announced a 10 gigawatt custom accelerator collaboration, and the stock surged nearly 10%, adding ~$100B in market cap.

Oracle

On September 11, 2025, coverage of a very large multi year OpenAI capacity agreement in the ~$300B range resulted in Oracle logging its biggest one day gain in decades, up over 35% adding over ~$300B in market cap.

Commerce

OpenAI’s agentic commerce announcements also saw a number of beneficiaries that have been early with them to partner to support agentic checkout in ChatGPT.

Etsy

On September 30, 2025, OpenAI launched Instant Checkout inside ChatGPT with Etsy as the first live surface. Etsy jumped about 16% on the news, adding ~$1B to its market cap.

Shopify

Around the same time as above, OpenAI said the same Instant Checkout surface would extend to Shopify merchants soon, implying better discovery and potential for higher sales and purchase volume over time for Shopify merchants. Shopify gained ~6% on the news, adding ~$10B in market cap.

Walmart

Earlier today on October 14, 2025, Walmart announced a partnership with OpenAI to enable shopping through ChatGPT using Instant Checkout. Walmart is up over 5% adding ~$40B in market cap.

Negative Moves

Moves aren’t always positive however as some of the examples below show

Reddit

On October 1, 2025, third party data showed ChatGPT referencing Reddit less than it had in mid September. Reddit fell roughly 10 percent on the day as the market repriced how it expected Reddit user growth, referral traffic and data licensing revenue to fair over time with decreased ChatGPT visibility, losing almost ~$1B in market cap.

Docusign

On October 1, 2025, DocuSign plunged ~12% immediately after OpenAI revealed its internal contracting agent, DocuGPT, despite it just being a demo about an internal tool. Investors got spooked about the threat to SaaS products like Docusign with LLM advancements. The drop translated into a ~$1.5B decrease in market cap.

Closing thoughts

OpenAI has become a market scale allocator of demand. One announcement of some relationship with OpenAI can send a stock soaring. One news article about OpenAI encroaching in some way can send a stock tanking. A private company’s roadmap has become one of the major inputs for the public markets writ large. The tweet below encapsulates it well.

https://open.substack.com/pub/pramodhmallipatna/p/ais-race-to-the-bottom-artificial