📉 The impact of COVID-19 on the S&P500

An analysis of the S&P500 performance over the last 3 months

In what’s been a very crazy ~3 month period between Fri, Feb 21 - Fri, May 15, the S&P500 is down 14.2%, although in that period it first went down by 33% before then going up 32% from the bottom. I was curious if there were there was anything interesting one might discern by looking at market capitalizations and stock prices then and now, so I did a quick analysis (data courtesy of CapitalIQ), which is presented below.

Note that while there has been a lot of talk about how the market is not in touch with the reality of the economy, this piece is not about that per se, though I might touch on that in the future.

Overall Performance

The total market capitalization of the S&P500 on Feb 21 was $29.2T, representing ~80% of the US equity markets. Three months later the market capitalization stands at $25.2T, down $4T or ~14%.

However, the loss in equity values was anything but uniform. While the loss in equity value was ~14%, the median company was down 22%, implying that the larger companies (by market cap) were able to perform somewhat better on average.

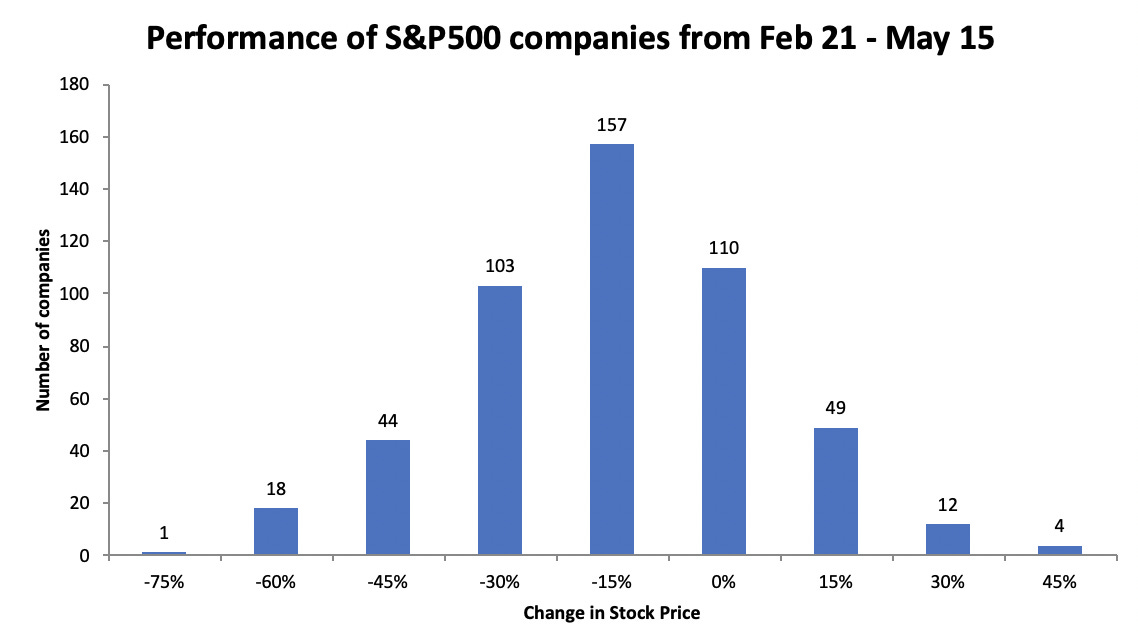

In addition, 65 (~13%) of the companies in the S&P actually saw increases in their stock price, while 166 companies (33%) saw their stock prices decline by more than 30%, as highlighted below.

Performance by Sector

Looking at things on a sector level was also interesting. While every sector was down, some sectors such as tech, healthcare, consumer discretionary, and communications held up pretty well, while energy, financials, and industrials were hit hardest, as evident in the chart below. Interestingly, every sector in aggregate was down, although some only very slightly.

Also, in terms of the ~4T in equity value lost by the market, half of it comes from financials and industrials, as the chart below shows.

Biggest Winners and Losers

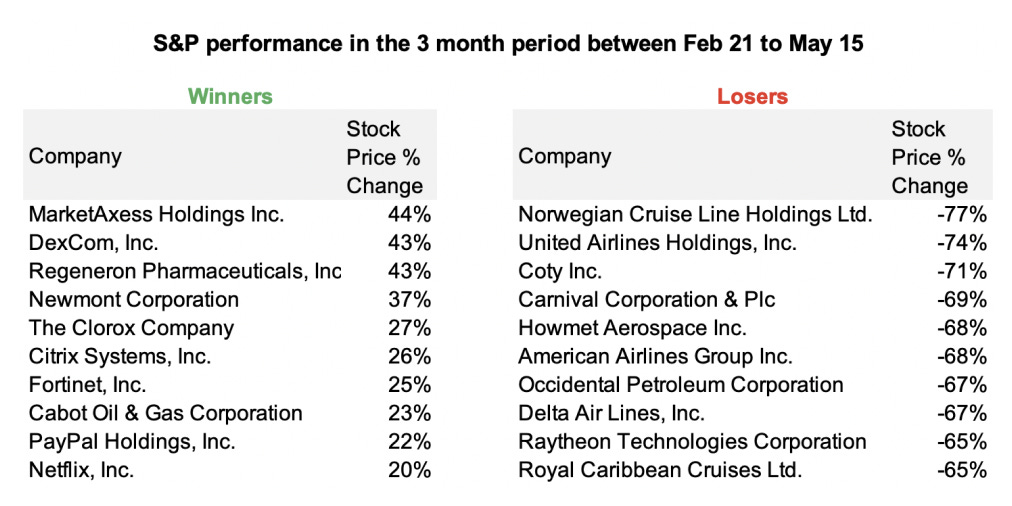

Looking at individual stocks, the biggest winners tended to be healthcare or technology companies, with the biggest losers largely cruises, airlines, and energy companies. The chart below shows the biggest winners in terms of the percentage change in stock price.

45 companies have lost over half of their market capitalization, but the best performing company in the S&P was only up 44% (note that companies such as Zoom which were up more are not in the S&P).

Looking at the companies by absolute change in market cap, just ~20 companies are responsible 35% of the $4T decline of equity value, with JP Morgan, Berkshire, Boeing, Bank of America and Wells Fargo each losing over $100B of market cap. Amazon is the only company to gain more than $50B of market gain, gaining $158B!

That’s all for this analysis. Feel free to tweet at me or DM me in case you’re interested in playing around with the data or have any thoughts or questions about the analysis.