This is a weekly newsletter about the business of the technology industry. To receive Tanay’s Newsletter in your inbox, subscribe here for free:

Hi friends,

For years, the seat-based pricing model has been the go-to standard in the SaaS industry. This model charges companies based on the number of user licenses or "seats" they purchase. However, with the integration of AI into SaaS platforms, this approach is being challenged, and will require some adjustments at the very least. AI's ability to automate tasks traditionally performed by humans means that fewer seats may be needed, challenging the relevance of seat-based pricing. Let’s discuss this further today.

The Decline of Seats

As AI continues to evolve, it automates many tasks that once required human intervention. This shift reduces the need for multiple user licenses, making the traditional seat-based model less practical. For instance, AI-driven customer support systems can resolve issues without human involvement, reducing the number of seats needed. As a result, the value derived from the software is less about the number of users and more about the amount of work being accomplished by the AI.

And while we’re very much in the early innings, we’re starting to see a few examples of the pressure on seats already.

NICE, a contact center support software, shared the case study of one of their clients which reduced the number of seats they needed from 1,000 to 750 when they rolled out NICE’s AI solution, a 25% reduction in seat volume. (h/t

)Anecdotally, sales engineers at Salesforce note that some large accounts are reducing seats by 10% because of the use of Einstein AI which is increases productivity

“I also spoke to a Salesforce sales engineer who handles 90 enterprise accounts on the Service Cloud side. He said across his customers, they’re seeing a 10% reduction in seats / headcount because Einstein is making their customer service agents that much more efficient. There is a slight offset from revenue coming in on Data Cloud, but otherwise they haven’t shifted the pricing model on Service yet so they are slightly losing out.” –

In a world like this, where seats may reduce or in some cases be completely orthogonal from the value created by SaaS, it’s clear that there will be at the very least be some additions if not wholesale changes in pricing models.

In terms of emerging pricing models, I think two interesting ones are worth discussing: work/usage based pricing and outcomes based pricing. Both of them share roughly the same philosophy, charging based on some proxy of the work that AI is actually doing. In the work-based case, the metrics to price on can be more softer “proof of work metrics” such as credits / work handled or processed or similar. In the outcome-based pricing case, it will be based on pricing on the actual end outcomes and metrics that the customer cares about.

Work-Based or Usage-Based Pricing

This model charges customers based on the amount of “work” the software performs or in other words some measure of the usage of the software/AI agents. Usage-based pricing is already the de-facto in infrastructure services like cloud computing platforms (think AWS and Azure) and other independent databases or developer tools (as well as AI model providers themselves) and is usually some function of storage and compute.

In SaaS, while the metrics will look slightly different from storage/compute, using the same philosophy to proxy the amount of work performed by the AI could make a lot of sense, especially since many of them will increasingly be “selling the work” and so it is natural they price based on the work sold rather than the number of users.

One thing to note is that this isn’t necessarily a completely new concept in SaaS. Many of the email marketing tools (Mailchimp), GTM data vendors (Apollo) and others did price on some proxy of usage. However, the concept will likely be relevant to many more companies that in the past, and the metrics may get closer to some proxy of “work performed”.

Some examples:

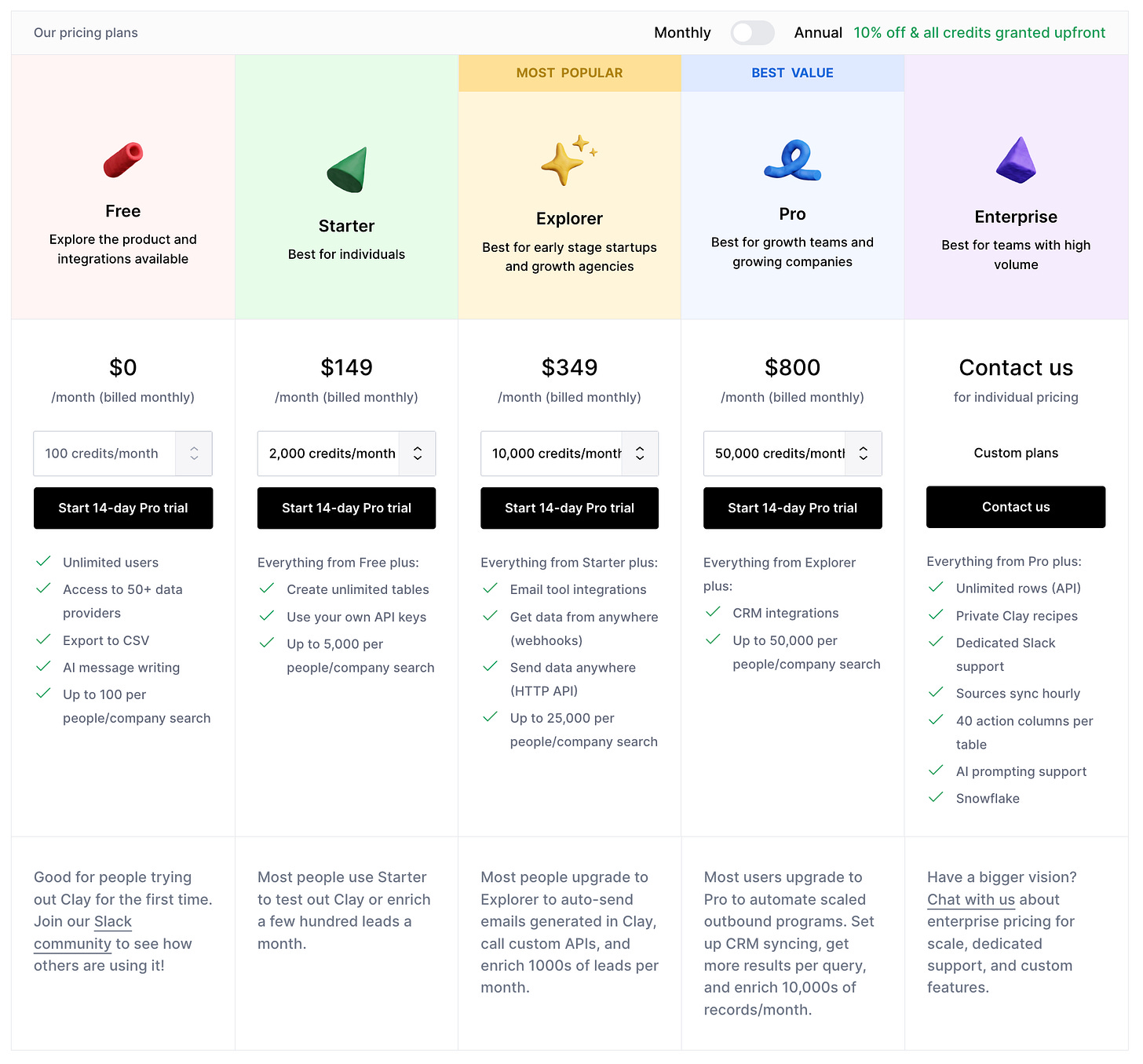

Clay: Clay is an AI-powered workflow automation tool for sales. Since the number of seats is less relevant it charges on a function of work or usage. Specifically, Clay has various subscription offerings based on the amount of expected credits needed by the customer, where every automation is associated with a certain number of credits. .

Heygen and Synthesia are both AI-powered avatar video creation platforms. Both of them have various subscription tiers that are largely tied to the number of minutes of videos produced, their core unit of work.

AirOps: AirOps is an AI-powered workflow product for content and growth teams, which charges in a tiered manner based on the number of tasks it performs (posts written, landing pages created, etc)

One common cited concern of work-based models is that while they are flexible, they provide a high level of uncertainty to the end customer (and to businesses itself in that they aren’t truly recurring). To counteract that, particularly early in the transition, most startups may find it beneficial to tier their pricing so that customers can opt to pay relatively stable amounts per month, but with the tiers based on the volume of work (and perhaps with some aspect of seats in tiers seat limits). Clay’s pricing structure below is a good example.

Outcome-Based Pricing

This model ties the cost of the software to the outcomes achieved using the software. In some ways, it involves taking work-based pricing to it’s natural extreme, and pricing based on the outcome metric of relevance to the end customer with a focus on measuring the value provided to them.

Often, one of the challenges is identifying the right metric, in terms of both being willing to charge on it (since some factors may be out of the vendors control) and the customer willing to pay on it (since they may feel like they’re paying too much in some cases or the pricing is too uncertain). Some metrics can range from the number of resolved tickets (support) to meetings booked (sales) to leads generated (marketing) to more refined outcome metrics that align with business goals, such as increased sales or cost savings.

It should be noted that a strong form of outcome-based pricing (very specific outcome metrics) is unlikely to make sense for many categories of software. While I don’t expect too see very many AI companies charge on outcomes immediately, we may see it in a few select areas of software sooner.

Examples:

Customer Support AI agents: One area where we’re starting to see it commonly used is in customer support. AI agents such as Fin from Intercom and startups in this space seem to be landing on a pricing structure of charging in the $1-2 range per successful ticket resolution. In these cases, AI agents try to handle every incoming ticket, succeed on some, fail on others (and deflect them to humans), and only charge for the ones they succeeded on.

Vendr and Chargeflow are a few others examples of companies that have used outcome-based pricing prior to this AI era. Vendr is a SaaS management platform that charges customers typically around 20% of the savings it is able to generate for them by negotiating their SaaS subscriptions. Chargeflow charges companies 25% of the chargebacks they are able to successfully reverse for their customers.

One middle-ground to pricing based on specific outcomes is to price compared to equivalent humans at some discount to the humans. For example:

11x: 11x is building AI agents for Sales, specifically AI-based SDRs. 11x sells its products in units of an its AI SDR called Alice, where each unit of Alice costs a certain amount per month and does some specific amount of work (# of accounts researched, # of emails sent, etc). 11x, also references the notion of “hiring” their AI agent Alice, a parallel to hiring a human SDR, and compares the work one Alice does to a human SDR. An approach like this can allow for a value-based pricing where the comp of value is a human equivalent.

Devin: Devin is an AI software engineer and similar to 11x above, allows companies to hire instances of Devin, which are capable of doing a certain amount of work. Its pricing can run into the 1000s of dollars per Devin per month, a portion of what a junior engineer may cost to hire.

The Transition

While innovative pricing models offer significant advantages, most incumbent companies will still rely on seat-based pricing, particularly if the core of the software is still based on user seats (CRMs, Docs, etc) but with added work-based components. For example, many companies such as Notion, Salesforce and others today treat AI as an add-on per seat which users pay extra for. This hybrid approach allows them to transition gradually while still leveraging AI's capabilities, and capture some of the potential benefit of the AI features they launch. In fact, if the AI they offer is largely the AI-copilot type, as I discussed in my previous piece, that will likely continue to remain the right form of pricing to offer.

Conversely, startups, particularly AI-agentic ones rather than copilots can adopt closer to work-based pricing models to give them an edge. In fact, the pricing model itself may help them counterposition themselves vs the incumbents, which may find it harder to overturn their seat-based models given the revenue that is at risk.

In closing, many companies, particularly established ones, may view AI and the potential loss of seats as a risk. But it also represents a big opportunity. Let’s turn back to the example of NICE and the case study they shared.

Even though seats declined by 25% for NICE owing to the less labour needed with AI, since they also sold an AI solution as well to the customer which was able to resolve some tickets autonomously, they were able to grow their ACV in the account from $3M to $4.5M. At the same time, given that the customer needed less labor and fewer seats, their actual aggregate cost to provide customer support went down from $50M to $37.5M. So NICE was able to get a higher ACV and the customer was able to save money on aggregate spend resulting in a win-win for both.

If you’re experimenting with pricing plans in the age of AI for your company and want to chat/brainstorm or have learnings to share, feel free to reach out. I’m Tanay at wing.vc