Hi friends,

I wanted to discuss the evolution of SaaS companies and business models through the embedding of financial services.

Many of the initial SaaS companies generated most of their revenue from subscriptions. Typically, the only other source of revenue was professional services, which was meant to kickstart subscription revenue for a given customer more than anything else.

These days, more and more companies are layering on and embedding other forms of monetization over time or from day one. I’ll cover:

The evolution of SaaS companies

Benefits of layering / embedding additional services

Overview of the Services

While I discuss these from the perspective of a SaaS business, all the ideas here are applicable to pretty much any platform or marketplace as well.

Evolution of SaaS Model

At a high level, we can think of the SaaS business model and product suite evolving in three phases, as in the graph below (via Stripe).

In SaaS 1.0 companies made all their revenue from subscriptions

In SaaS 2.0, companies embedded online payments and started monetizing the transaction volume flowing through their platform directly.

In SaaS 3.0 is an extension of that model to provide even more (typically financial) services to the customers on the platform.

The goal of the SaaS 3.0 model, especially for vertical SaaS type companies that serve a well-defined customer base (e.g., restaurants, eCommerce platforms, breweries, barbers, etc.), is to try to become the one-stop shop for their customer segment, including being the go-to for their lending, spending, protecting and operating needs.

Note that SaaS companies have the option of taking two approaches as they think about helping solve the needs of these customers:

Referral based approach, where the goal is mostly to help connect these customers to other providers, and take a small cut (in the form of lead generation fees)

Embedded approach, where the goal is to build a tightly integrated solution either in-house or leveraging a third party and serve as the merchant and provider of the solution to these customers.

SaaS companies may choose to use a mix of both these approaches for different services.

Benefits of the SaaS 2.0 and SaaS 3.0 approach

Layering on financial services to a SaaS 1.0 business can have several benefits:

Provide additional revenue streams: It’s common to see companies earn an incremental 2-3% of GMV by incorporating payments and other financial services. Often, subscription revenue as a function of GMV is in the 0.5% range, meaning that the transactional and merchant solutions can grow revenue 3-5X.

Improve margins: SaaS companies with a captive customer base that choose to go the referral-based route can essentially advertise services to this customer base and generate extremely high margin lead generation revenue.

Reduce churn: By becoming the provider of valuable services to customers such as loans or their bank account / corporate card, SaaS companies can improve customer retention by increasing lock-in and customer satisfaction.

Lower acquisition costs: Taking care of core pain points for the customer base means happier customers which are more likely to speak favorably about the SaaS companies, which can drive organic and word-of-mouth-based adoption, which can reduce aggregate customer acquisition costs

Overall, all of this translates to customers that are more satisfied and have a higher customer lifetime value.

Overview of the services

Subscriptions (SaaS 1.0)

Subscriptions is obviously a core revenue stream for all SaaS companies. The key metrics related to understanding the health of the subscription aspect of the business is price per seat / instance and usage / seat expansion.

If we look at some of the more vertical SaaS type companies that report subscription revenue and GMV, we can get a sense of the rough “take rate” of subscription revenue for these companies, which is typically in the 0.4-0.8% range.

Payments (SaaS 2.0)

Payments is one of the first and most common functionalities that SaaS companies add to their platform.

Many companies, including some public ones such Square, Toast and Shopify have all been processing transactions and earning a share of the transactions processed directly through them on their platform for years.

Generally, companies can make as much as 2-3% on the transactions that they process, although (i) not all the GMV on the platform is necessarily processed by them and (ii) there are some direct costs associated with this processing which must be paid out, which means the gross margins on this revenue stream are usually 20-25% (of gross take rate).

While the chart below shows all merchant solutions revenue for a sample of public companies below, the bulk of this portion of revenue is typically from payments. As in the chart, payments and other merchant solutions typically represents the bulk of total revenue for the company.

For companies that want to embed payments, they have the option of using a company such as Stripe or Finix.

One other aspect of payments is being able to accept payments both online and offline depending on the needs of the customer base the SaaS company serves. The latter often requires custom hardware, which can be a source of revenue by itself (but is often more likely given away for free or at cost) to incentivize adoption of the platform and payments solution more broadly. Toast, Squire and Square are all examples of companies which support both online and in-person payments.

If you don’t yet receive Tanay's newsletter in your email inbox, please join the 3,000+ subscribers who do:

SaaS 3.0

One way of thinking about what services that SaaS companies can provide as they move beyond payments is to think about what the pain points and jobs that need solving for their merchants are.

Note, for clarity, I’ll use the term merchant to refer to the customers of the SaaS company and customers to refer to the customers of the merchant.

At a high level, these merchants (typically SMBs) have a few key jobs:

Lending: Being able to access and tap into capital to help them meet their working capital needs and / or grow

Spending: Being able to access their money balance and spend their money easily

Protecting: Being able to have peace of mind that their business and assets are secure

Operations: Being able to easily work with suppliers and customers and automate and reduce the work involved in their operations.

Lending

Access and availability of capital is often one of the biggest pain points for small businesses, so it’s not surprising that many platforms, especially the larger ones have looked at providing loans to businesses.

Square, Shopify and Toast all have a “Capital” arm which provides loans to their merchants and can leverage their unique data about their merchants’ transactions to underwrite these loans.

For a sense of size, Square is facilitating ~$600M of loans a quarter, and Shopify has funded over $2.5B of loans since starting their Capital arm.

Recently, we’ve also seen the rise of companies such as Parafin which offer embedded lending as a service to make it easier for SaaS companies’ and platforms to offer loans to their merchants.

Spending

These merchants also often want to be able to get paid quickly and / or spend the money they have already earned but not yet received.

SaaS companies can offer two products to serve this need:

Issuing charge cards or credit cards or a money management account to allow their merchants to spend their balance (or provide short term credit to them). Typically, SaaS companies can use a service such as Lithic or Marqeta if they are looking for a high level of customization, or a solution which white labels cards. Typically, SaaS companies can earn 30-50 basis points as interchange fees on the volume processed on these credit cards and so don’t need to charge the merchants directly. As an example, Shopify, offers Shopify Balance, a no-fee money management account to merchants which includes a card and features rewards.

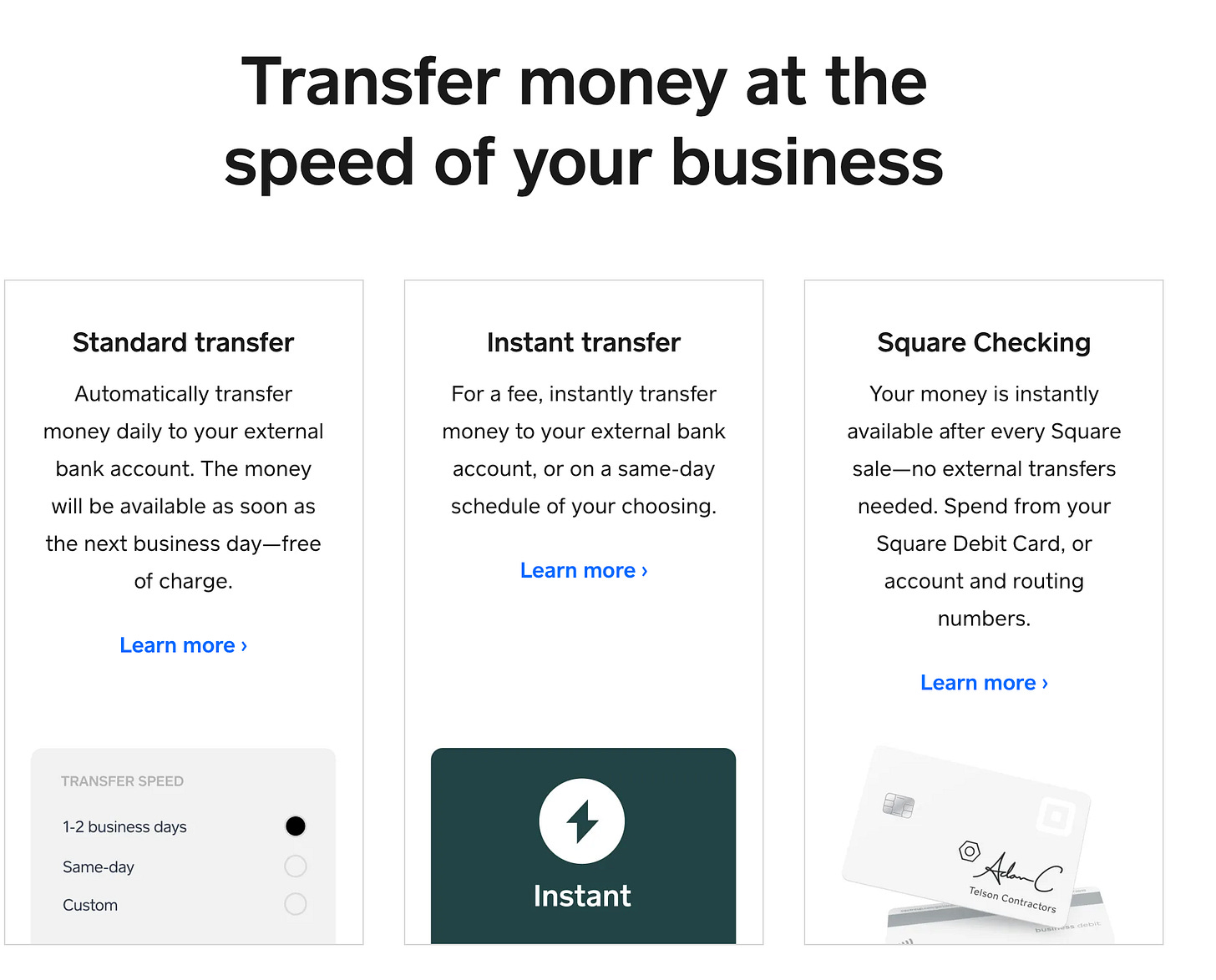

Instant Payouts to allow merchants to instantly receive their money rather than waiting the typical period. SaaS companies can charge a nominal fee for this service per transaction, while helping their merchants. For example, Square offers Instant Transfer, where merchants can instantly transfer their balance with Square to a bank account of their choice, for a 1.5% fee.

BNPL solutions where the merchants can get paid upfront or instantly while their own customers can pay over time in installments which also drives up transaction conversion rates. Square and Shopify have both enabled this for their merchants through the acquisition of and partnership with Afterpay and Affirm respectively.

Protecting

The merchants of SaaS companies often need protection either for their business (insurance of supplies) as a whole or on the transactions that they perform through their platform (protection from fraud, etc.).

SaaS companies are well-positioned to either upsell insurance providers to these merchants or provide the insurance themselves.

While we haven’t seen too many examples of fully embedded insurance offerings for merchants where the SaaS company leverages all their data to price risk, companies have started to make small strides in this direction. For example, Shopify offers Shipping Insurance to its merchants to protect them from any theft or losses during fulfilling eCommerce orders. Toast on the other hand, has a partnership with AP Intego, to allow its restaurants to purchase insurance.

We’ve also seen many marketplaces and platforms go this route. For example, Airbnb offers host protection and Uber and Lyft offer insurance for drivers.

Operations

From an operational perspective, every merchant is looking to work more smoothly with their customers and suppliers and work more efficiently by automating unnecessary tasks.

So how can SaaS companies help their merchants with this pain point?

The ideal end-state would be to become the core operating system for their merchants by allowing them to seamlessly interact with their suppliers and customers. A few concrete things SaaS companies can build which also open additional revenue streams include:

A marketplace to allow customers to directly or indirectly (by hiring experts or via an app store) help customize or improve their use of the SaaS product to provide a better customer experience. Companies can typically charge a 5-15% take rate for transactions that happen through these marketplaces. As an example, Shopify has three marketplaces:

A themes marketplace to download themes to spruce up what their online storefront looks like

A developer app store to install integrations and apps to supercharge the Shopify experience for customers

An expert marketplace to find an expert to help with any of the above customizations and setup

A marketplace for customers to transact directly with their suppliers and or other customers of the SaaS company. This works best if a SaaS company serves companies across the value chain in a vertical and has already onboarded those customers and / or was intentional about building this marketplace over time. Again, it is possible to take a take rate of the transactions happening on this marketplace. An easier alternative approach to this is to simply allow advertisements from potential suppliers who want to get the attention of the customer base.

Hardware which allows merchants to interact with customers more easily and smoothly. Hardware may be a nice add-on for some companies and may be table-stakes or a must-have for others. While it can be a revenue stream by itself, more often it is provided close to or below cost and is used to drive share of wallet with merchants by making it easier to facilitate their in-person payments and run their business. For example, Toast and Square both provide hardware below cost. SaaS companies can drive incremental value through hardware by over time building functionality which can help automate the operations of parts of the merchant’s business and / or reduce labor needs. For example, providing hardware which can allow for self-checkout in a commerce context or for cashier-less ordering in a food and beverage context.

Selectively building out core functionality which the merchant base finds valuable which can drive up the take rate and fees charged on transactions. Typically, a few common examples of this are:

Shipping and/or delivery: Physical fulfilment of orders is often a big pain point for merchants and one where SaaS companies can leverage their economies of scale and pass on some of the benefits to their merchants. Shopify has built out a fulfillment network which their merchants can use to fulfill commerce transactions. Similarly, Toast (via their Toast Delivery Services product) and ChowNow partner with 3rd party delivery networks to offer flat-fee delivery for merchants.

Invoicing: Billing and Collecting money from customers is often a big pain point for many merchants, especially in certain verticals. SaaS companies can build invoicing solutions to allow companies to invoice clients and get paid quickly, and reduce the labor needed to remind customers, etc. For example, Square has an invoicing product which does $12B of GMV per year and has greatly reduced the time it takes for their merchants to get paid (3 out of 4 Square invoices get paid in one day vs the industry average of 25 days).

Loyalty and Marketing: Providing solutions which allows merchants to provide a loyalty program to retain their customers and / or avenues to reach their customers via email-based or text-based marketing is also often a big value-add which merchants would be willing to pay additional for based on usage. For example, Toast provides loyalty and marketing-based solutions to its merchants to allow them to attract new customers and retain existing ones.

Thanks for reading! If you liked this post, give it a heart up above to help others find it or share it with your friends.

If you have any comments or thoughts, feel free to tweet at me.

If you’re not a subscriber, you can subscribe below. I write about things related to technology and business once a week on Mondays.

Awesome blog! Must read.