Hi friends!

There has also been some activity recently around the potential for retail investors to participate in IPOs at the IPO price - the “democratization of IPOs” so to speak, which is what I’ll go into in this piece.

I’ll cover:

The need for democratizing the IPO

The brokerage-centric approach

The company-centric approach

The need for democratizing the IPO

In Jeff Bezos’s recent shareholder letter, he included a note he received from a couple that bought Amazon shares when it IPO’ed. Given the appreciation, each share is up ~2000X. And so unsurprisingly, their investment in Amazon, which they’ve held until now, can cover a house purchase.

Recently, companies have started to go public much later on in their journeys and be valued at a lot higher valuations. When they do go public, retail investors that have access to just public markets have seen opportunities for such returns as in the case of Amazon diminish, as illustrated in this chart.

As I’ve written about previously, SPACs are one way to address this by encouraging more companies to go public sooner in their life cycle.

But not all companies will choose to go public via a SPAC, some will still want to do an old-fashioned IPO.

Even with companies going public later, there is still perhaps room for a 5X or 10X or more from the IPO for high-quality companies with long runways.

For the retail investor looking to invest in such companies at IPO, one of the frustrating elements is that they typically aren’t able to buy in at the IPO price. By the time they are able to buy in, the shares have already popped, sometimes more than 100%.1

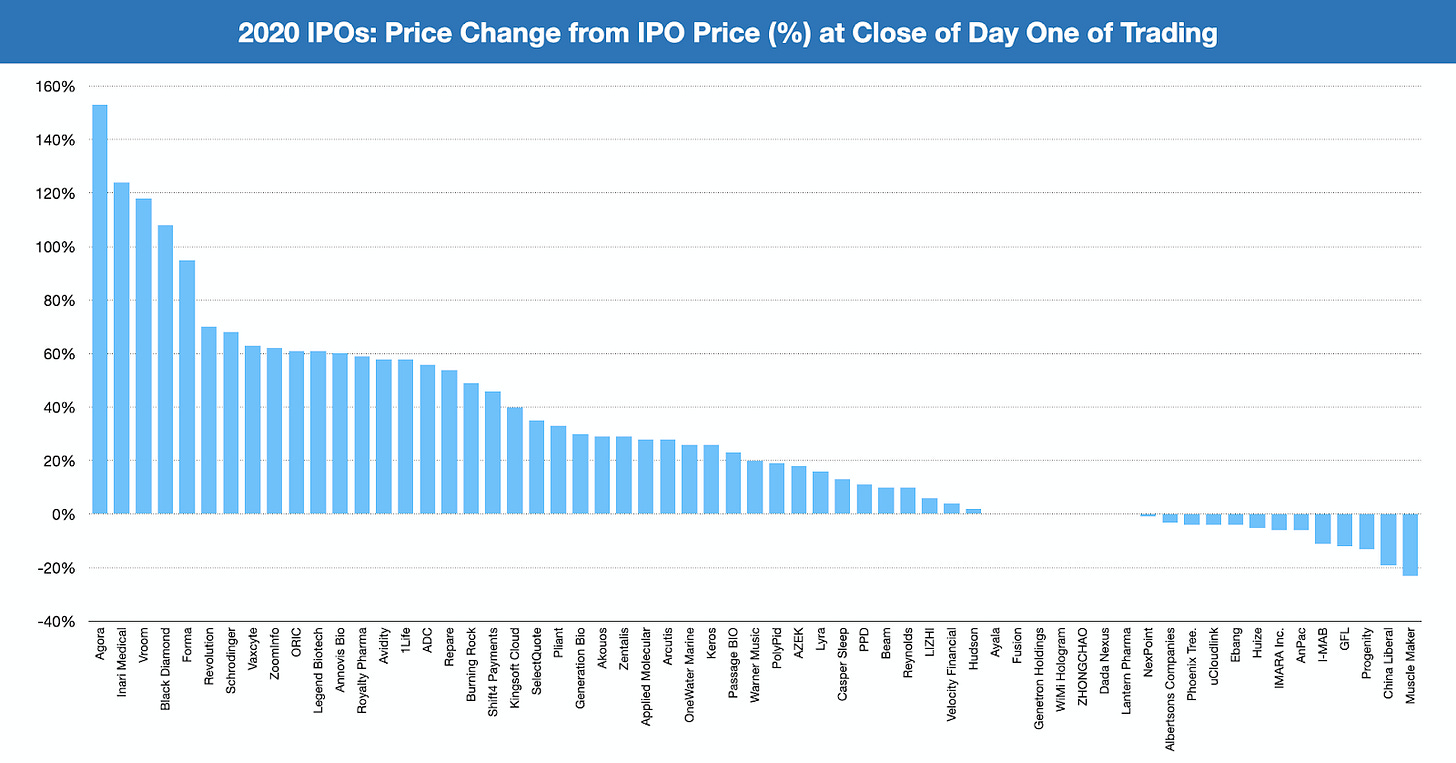

As I’ve written about before, these pops can be quite meaningful, with over a quarter of them popping more than 50%, which essentially means a potential say 5X return from IPO, becomes a potential 3.3X return.

One way around this for companies is to go public via a direct listing, but if they need to raise primary capital then they have to raise a private round and then go public slightly later at a higher valuation anyway (this was somewhat the case in Roblox).2

But for the companies that choose to still IPO, the best case for retail investors is being able to get an allocation in the IPO itself and invest at the IPO price - “a democratization of the IPO”, so to speak.

Let’s dive into the two ways to democratize the IPO: the brokerage-centric approach, and the company-centric approach.

The brokerage-centric approach

In some sense, there has always been an opportunity for *some* retail investors to participate in IPOs. IPOs often have an institutional/retail split in terms of who the shares are allocated to, with ~10% typically earmarked for retail investors.

Brokerages such as Fidelity and TDAmeritrade for example, allow their customers to participate in IPOs (i.e., apply to receive an allocation), but require a minimum account value of $100-500K (depending on the IPO) and $250K respectively.

Besides, given that these IPOs are heavily oversubscribed, and the brokerages prioritize allocations based on the assets in their account or the revenue they bring in for their brokerage, often to actually receive an IPO allocation, the assets one needs can be a lot higher. It's safe to say that so far, participating in IPOs has been restricted to the 1% of retail investors.

That might be changing though.

Recently, brokerages SoFi and Public have announced the ability for customers to invest in IPOs. There have also been reports about Robinhood exploring the same feature.

The way this works for SoFi (and presumably Public) is similar to how TDAmeritrade and Fidelity have done it.

The basic process is that those who are eligible can submit an indication of interest, and then the brokerage will allocate IPO shares based on how much allocation they get from the company going public and the criteria they choose. Customers can then do whatever they want with the shares, pending some restrictions.

I’ve detailed the key aspects below:

Eligibility: SoFi will require a minimum of only $3K in your account to be eligible compared with the typical $100-500K

Allocations: Those in good standing (who haven’t flipped IPOs in the past) will be prioritized by the brokerage based on several factors such as shares requested, account balance, and history.

Restrictions: While one can sell shares immediately, brokerages discourage this “flipping” by limiting the ability of people who do so to participate in future IPOs. For Sofi, that flipping window is 30 days.

While the process is largely the same, the key is that the minimum account balances needed to participate are a lot lower, effectively democratizing the process.

What will be interesting to see is whether these brokerages can secure enough allocations for the IPOs in the hot companies to meet the demand. After all, it won’t be the same level of democratization if only the top customers of these brokerages can get any allocation if they receive too much interest. Or imagine requesting 1000 shares and only receiving one.

The company-centric approach

Another way to democratize the IPO is a more company-centric approach, where companies exercise some judgment in choosing which retail investors participate in these IPOs and reserve some IPO allocation for them through a “directed share program”.

There’s a famous Buffett quote that goes:

In large part, companies obtain the shareholder constituency that they seek and deserve.

Companies know this well, and take great pains to “craft” the shareholder base they want, especially on the institutional side. But there’s an opportunity for more companies to do so on the retail investor side.

This is especially true for many marketplaces and consumer companies where retail investors are not only customers but often also “suppliers” or producers or developers that keep the platforms going.

Companies can use their IPO allocation as a way to allow their most loyal customers or “suppliers” to get in on “Day one”3 and participate in the upside.

We’ve seen a few examples on the “supplier” side, such as:

Uber set aside 3% of shares of its IPO offering for eligible drivers. To be eligible, drivers must have completed >2500 trips and have been active in 2019. 1.1M drivers (~28% of the total drivers) were eligible to participate and could buy up to $10K of shares. They also provided a one-time cash bonus to these drivers.

Airbnb set aside 7% of shares of its IPO offering for eligible hosts. Eligible hosts could pre-register to buy up to 275 shares (ultimately receiving a max of 200 because of excess demand). Given Airbnb’s 115% pop on day one, those hosts that participated more than doubled their investment in one day (though I imagine most continued to hold).

I was surprised Doordash didn’t do something similar (though they did give Dashers cash bonuses) when it went public, and I imagine going forward we’ll see companies like Instacart perhaps go this route when they go public (if they choose to IPO).

On the customer side, Deliveroo which went public recently set aside shares in its IPO for its most loyal customers, who were able to buy up to £1000 worth (via a platform PrimaryBid). 70,000 customers took them up on the offer, buying a total of £50M. While the outcome wasn’t great in this case given that Deliveroo stock plunged ~30%, I think the idea of allowing your most loyal customers to get in slightly earlier is a noble one that will stick around.

Overall, this approach allows companies to “reward” their loyal customers and suppliers, and handpick their customer base to an extent. Also, properly capturing retail demand can also result in potentially higher pricing and so a more efficiently executed IPO (in terms of lower pops). However, execute it “too efficiently” and companies may need to contend with IPO “drops” and their loyal customers feeling hard done by, although the ones that stick it out will presumably be okay in the long run.

Closing Thoughts

With retail participation in the markets increasing writ large, and more scrutiny on the one-day gains available to institutional investors, there have been changes to both the process of going public and also innovation and democratization of retail investors ability to participate in IPOs, from both brokerages and companies themselves. This does reduce some of the “imbalance” in the markets and is a welcome change.

One IPO I’ll be watching closely in this regard is Robinhood’s - after all, they have the ability to both democratize IPOs as a broker (starting with their own), and also allow their most loyal customers to be shareholders in Robinhood itself.

Thanks for reading! If you liked this post, give it a heart up above to help others find it or share it with your friends.

If you have any comments or thoughts, feel free to tweet at me.

If you’re not a subscriber, you can subscribe below. I write about things related to technology and business once a week on Mondays.

Yes sometimes these shares go downwards as the lockup expiration approaches and the float increases, but they often are still higher than the IPO price.