The current state of web3

web3 by the numbers

Hi friends,

I’ve written a bit in the past about NFTs and Crypto and based on a few reader requests, wanted to summarize the current state of web3.

But first, what is web3?

While definitions vary somewhat, people generally refer to web3 as the next era of the internet which shares a few key characteristics:

Open and Decentralized: web3 platforms are built on top of open protocols that don’t require a trusted third party or intermediary.

Ownership: Participants own their data and content and even typically receive ownership of the platforms they participate in.

Generally, people will use a mix of these terms above, along with trustless, permissionless and native wallets to describe what web3 is about. For going further into what web3 is, I recommend this piece.

To create a new version of the internet, we need people to be bought in, companies to be bought in, and the availability of capital. So where are we on these fronts? Let’s dig in.

Crypto Exchanges

One gauge for user interest in web3 is to look at exchanges. While buying crypto by itself could be purely for financial purposes, interacting with a lot of web3 requires wallets with cryptocurrencies, and typically the onramp to wallets is through exchanges. So, let’s talk about that first.

Coinbase has over 68M+ verified users on its platform. Of those, 8.8M retail users are transacting every month to the tune of ~$150B per quarter. In addition, Ethereum, which is arguably the primary onramp currency to web3, has grown in trading volume over 20X in just 15 months, and now is bigger than bitcoin.

Binance is about 4-5X as big as Coinbase based on trading volume, and does ~$30-40B of trading volume per day!

Robinhood which doesn’t give its users access to the crypto they purchased yet is still arguably the easiest way to buy crypto for many people today. In Q2 of 2021, it actually made more money on crypto than from equities and options, and over 9M users traded crypto in the quarter. On the access point, a Robinhood wallet is coming very soon. Over 1M users signed up to the waitlist and it will allow those who own crypto on Robinhood to use it to participate in decentralized apps off-platform.

Wallets

Wallets are core to navigating web3, and so a good indicator of web3 interest and activity. Usage data highlights that interest is growing, and quickly.

Metamask, one of the most popular wallets, grew its userbase over 1800% from ~500K users to over 10M monthly active users in ~1 year.

Coinbase Wallet is routinely within the top 10 apps of the finance category in the App Store

Phantom, a Solana wallet, already has over 500K weekly active users.

NFTs

When it comes to “ownership” in web3, it can take two forms: fungible tokens, where as the name implies, one can be substituted for another (for example, a US dollar is the same as another US dollar), and non-fungible tokens, which are unique.

NFTs have a broad set of use cases around collectibles, digital assets in games, digital art, reputation systems among others but represent one of the areas which has really taken off and highlighted the power of ownership (and speculation) that web3 can bring.

OpenSea has over 600K traders on its platform and is doing trading volume of $3B a month, growing over 500X from the same time last year. For context, its trading volume is 3X the size of Etsy, a $30B public company.

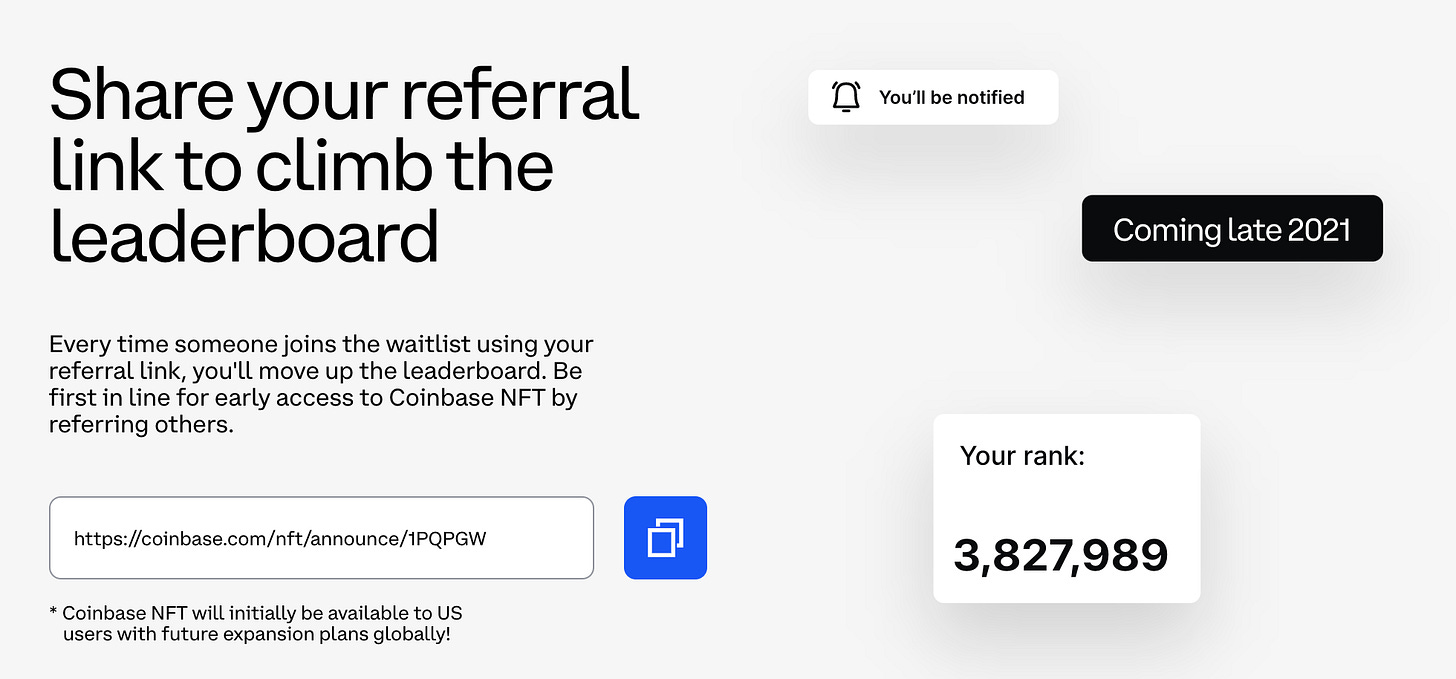

Coinbase announced the launch of an NFT marketplace and already has 3.8M users on its waitlist!

SolanaArt is doing ~3M per day in trading volume, meaning that even Solana based NFTs are doing >$1B in run rate trading volume

FTX also just launched an NFT marketplace, starting first with Solana based NFTs

Aside from the financial activity, NFTs are also becoming key parts of people’s identity and a way they forge community as I wrote about in a previous piece, which highlights where web3 could take us.

Games

Games (especially play-to-earn ones) are another use case which has taken off which provide a prelude to more to come with web3. While the objects within games are either fungible tokens or NFTs, they often serve as a different kind of onramp into Web3 than say NFTs purchased for the purpose of collecting or investing.

Axie Infinity, a play-to-earn game, has over 2.2M monthly active players. Over 500M of trading volume of tokens and Axies has taken place over the last month. In some places such as Philipines, workers have quit their day jobs and are making a living (sometimes earning double their previous income) playing Axie.

SoRare, a global NFT-based fantasy soccer game, was valued at over $4B and has over 500K users with essentially no marketing. It has retention in the 70% range and a DAU/MAU ratio of 60% (source), both incredibly high and comparable to the best Web2 social networks.

Decentraland, a user-owned virtual world which allows users to explore different experiences and games within the world, has a market cap of over $4B and over 100,000 users who own some land or tokens in the virtual world.

If you don’t yet receive Tanay's newsletter in your email inbox, please join the 3,000+ subscribers who do:

DAOs

DAOs stand for decentralized autonomous organizations, and are a way people can co-ordinate around a shared mission or vision. DAOs allow for on-chain governance and decentralized decision-making and ownership. In a web3 world, DAOs are likely to be a meaningful if not the primary way that groups of people coordinate to achieve desired outcomes.

So how are DAOs doing?

Assets under Management: The total assets under management of DAOs is up to ~$14B, almost doubling in just the course of one month. There are 1.3M members who belong to DAOs, per DeepDao.

Use Cases: DAOs are popping up across a myriad of use cases, beyond just protocol and investing. Some of the other use cases include Social DAOs, Charity DAOs, Service DAOs (akin to guilds) as below.

Source: The Generalist

Infrastructure: The infrastructure to support DAOs continues to improve with more and more things popping up to make it easier to handle Formation (DAOHaus), Governance (Snapshot), Treasury Management (Parcel) and Communication (Discourse, Discord) and Coordination (Coordinape).

Capital

Innovation needs capital, and in crypto and web3 there is currently no shortage of it.

VC funding into Crypto: In just the first half of 2021, over $17B of venture capital (and growth capital) was invested into crypto, more than double the entirety of 2020, per Bloomberg. Many top VCs are now investing in crypto even if they didn’t prior and the ones that already did have continued to increase the size of their funds. A16Z’s latest crypto fund is 2.2B, Paradigm’s is $1.5B, NFX has a crypto gaming investment initiative, and Coinbase Ventures did a deal less than every 2 days on average in Q3 of 2021.

Digital Trusts and Index Funds: There is over $50B of capital invested in crypto through digital asset trusts and index funds such as Grayscale ($50B), Pantera ($3.8B) and Bitwise ($1.1B).

Institutional Involvement: Over 9000 institutions are using Coinbase to participate in the crypto economy. These institutions hold almost ~$90B on Coinbase alone, and are doing ~$300B in trading volume per quarter!

Hedge Funds: Per PWC, the Assets under management for crypto hedge funds doubled to ~$3.8B in 2020.

Corporations

Another proxy for web3 activity is web2 or even traditional corporations explore various ways to get involved. We’re seeing a lot of this activity across companies in commerce, payments, gaming, fashion and entertainment.

Brands and NFT drops: Aside from various Sports leagues licensing out NFt collectibles to SoRare and Dapper Labs, many brands such as Nike, Gucci, Burberry, Dolce & Gabbana and Warner Music Group have been dabbling in NFTs sometimes tying the NFTs to their physical products.

Social: Twitter has introduced a number of features such as tipping in crypto and is exploring authentication of NFTs used as profile pictures. Meanwhile, TikTok has explored making popular TikToks on its platform available as NFTs.

Payments and Commerce: Shopify is allowing merchants to sell NFTs through storefronts. Similarly, Stripe is re-entering crypto and has spun up a new team to “build out the future of Web3 payments”. Visa has also shown an interest in the space buying up a Cryptopunk and have stated that they are “working on some new concepts and partnerships that support NFT buyers, sellers, and creators”

Gaming: Ubisoft plans to create its own blockchain based play to earn games. Similarly, EA has been hiring for roles around NFT and blockchain. Epic Games is open to NFT and blockchain based games on its Games Store, although its first party games will not be leveraging the technology for now.

Lastly, I wanted to leave you with this chart, which shows the growth trajectory of crypto users compared to internet users.

Thanks for reading! If you liked this post, give it a heart up above to help others find it or share it with your friends.

If you have any comments or thoughts, feel free to tweet at me.

If you’re not a subscriber, you can subscribe below. I write about things related to technology and business once a week on Mondays.

Hey Tanay, great post with some good information on here! I was curious - do you think a public blockchain can be sustained without a cryptocurrency at it's core? That is, can one have a public blockchain which compensates miners with a centrally governed currency like the USD?

Also, what do you think will the value creation (delta world GDP) ushered in by Web3 as compared to that ushered in by other big paradigm shifts (like PCs or the internet or mobile)?