The Cloud Wars Update: Who’s Winning the AI-Driven Growth Battle

Azure captures the largest share of new cloud dollars as AWS hits capacity limits and Google builds momentum

This is a weekly newsletter about the business of the technology industry. To receive Tanay’s Newsletter in your inbox, subscribe here for free:

Hi friends,

The three hyperscalers just reported earnings, and the cloud wars are heating up. This quarter was especially important because it shows how AI is reshaping not just growth but share dynamics. Let’s break down the numbers, see who captured the most new dollars, and then look at what management is saying about demand.

Note that these numbers are estimates, given the companies don’t report apples-to-apples comparisons on run-rate, etc and break out their cloud divisions in the same manner.

1. Where they stand today

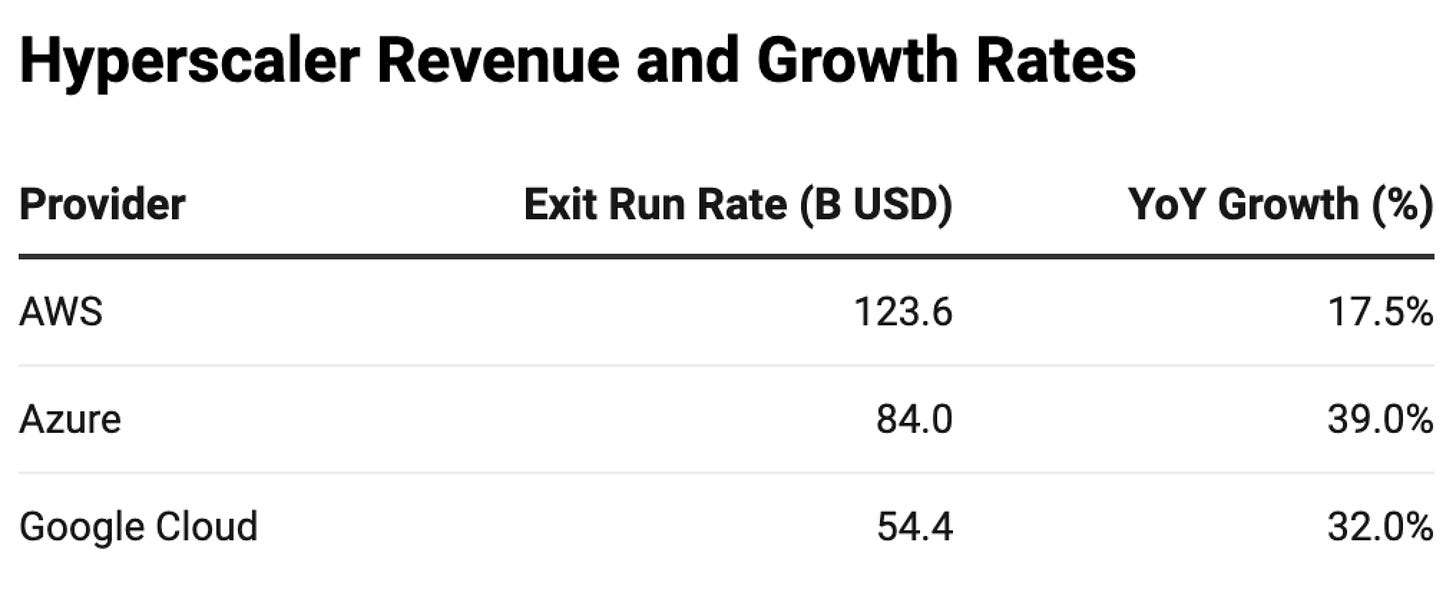

AWS is still the largest by a wide margin, generating about $30.9 billion in cloud revenue last quarter. That translates into an annualized run rate of roughly $124B. Growth came in at 17.5% y/y.

Microsoft Azure continues to close the gap. While Microsoft doesn’t break out Azure run-rate directly, they did reveal that they did 75B in revenue over the llast year which we we can use to estimate their last quarter revenue of around $21B, putting its exit run rate near $84B. That’s up 39% y/y, making it the fastest grower of the three.

Google Cloud reported $13.6 billion in revenue, which annualizes to more than $54.4 billion in run rate. Growth was 32% y/y. It’s important to note, though, that Google’s number includes Workspace (G Suite), which inflates the headline compared to AWS and Azure’s pure cloud businesses. Even adjusting for that, Google is still growing briskly, but from a smaller base.

The numbers are summarized below.

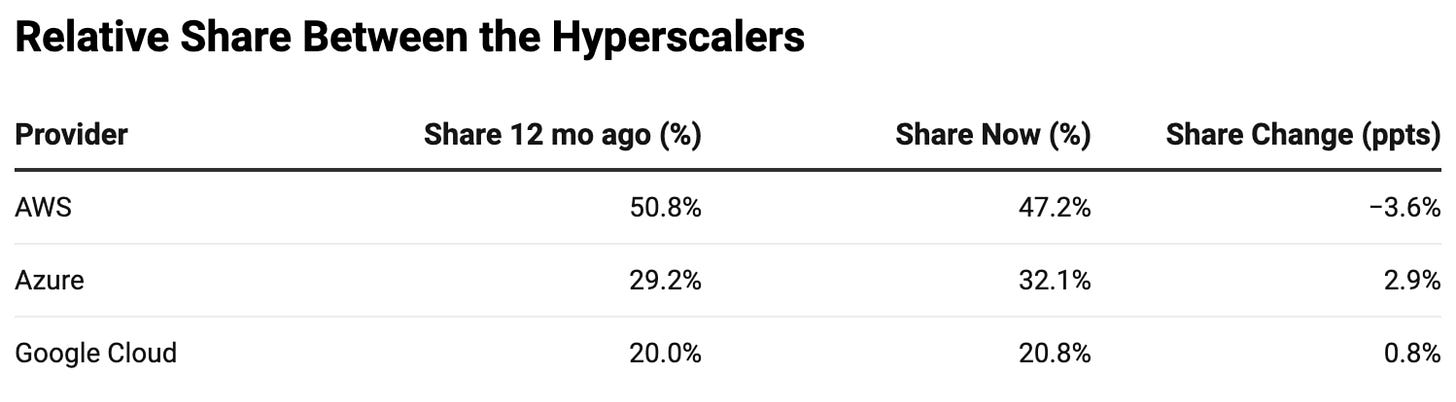

2. Net new run-rate and share capture

It’s one thing to look at total revenue, but the perhaps more interesting lens is to focus on the net new run rate added over the past twelve months. That’s where you see who is truly winning incremental share.

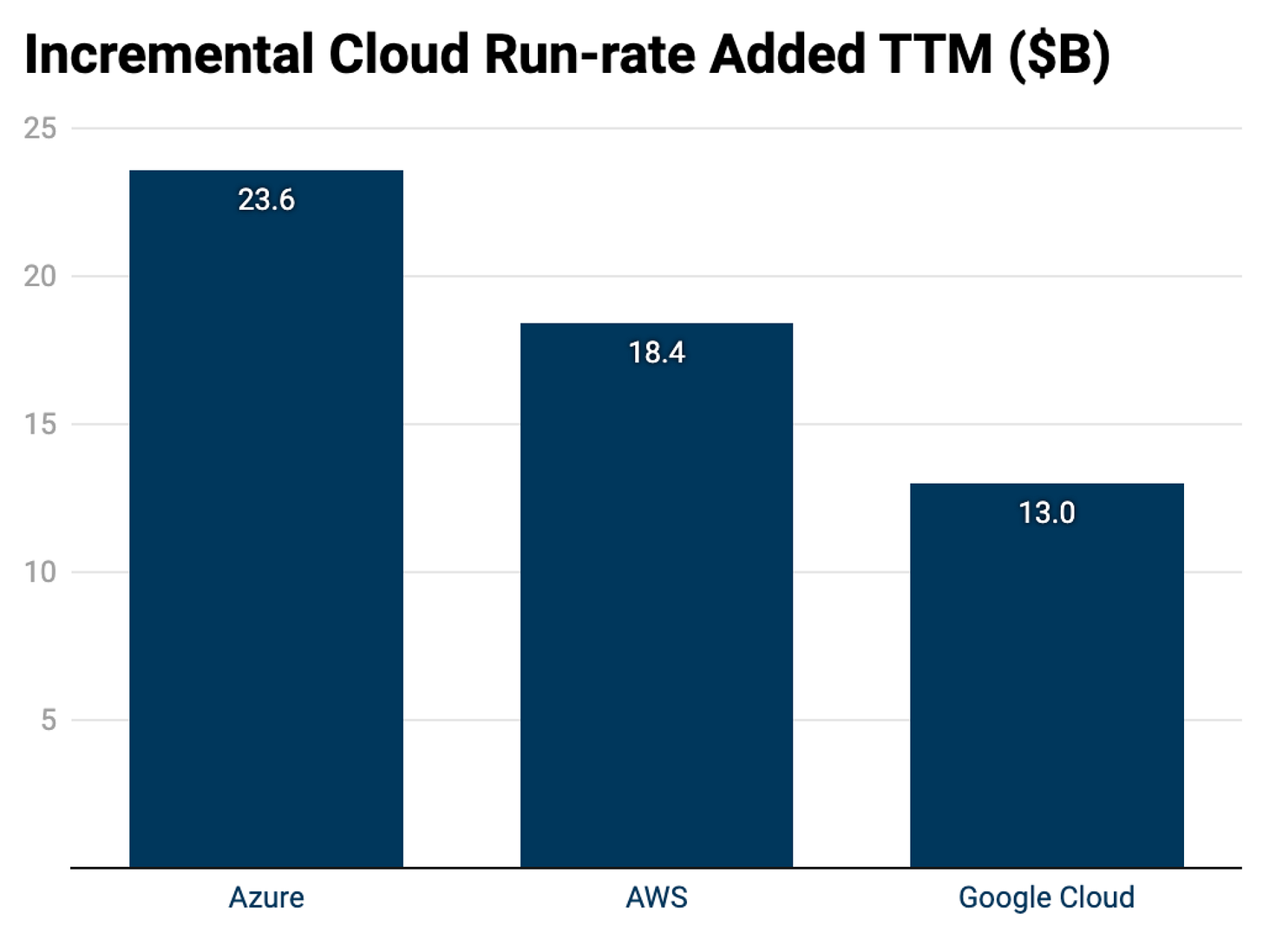

When you add it all up, the three of them added about ~55B in incremental annualized runrate over the last twelve months.

Azure captured the largest slice of new dollars, adding about $23.6B in run rate. That’s roughly 43% of all the incremental spend in the market.

AWS followed with around $18.4B, which equates to 34 percent of the net new pool. Despite its massive base, it’s capturing a smaller share of growth than it used to.

Google Cloud pulled in about $13B, good for 24 percent of the new dollars. It’s still the smallest of the three, but the pace shows it’s carving out a meaningful seat at the table.

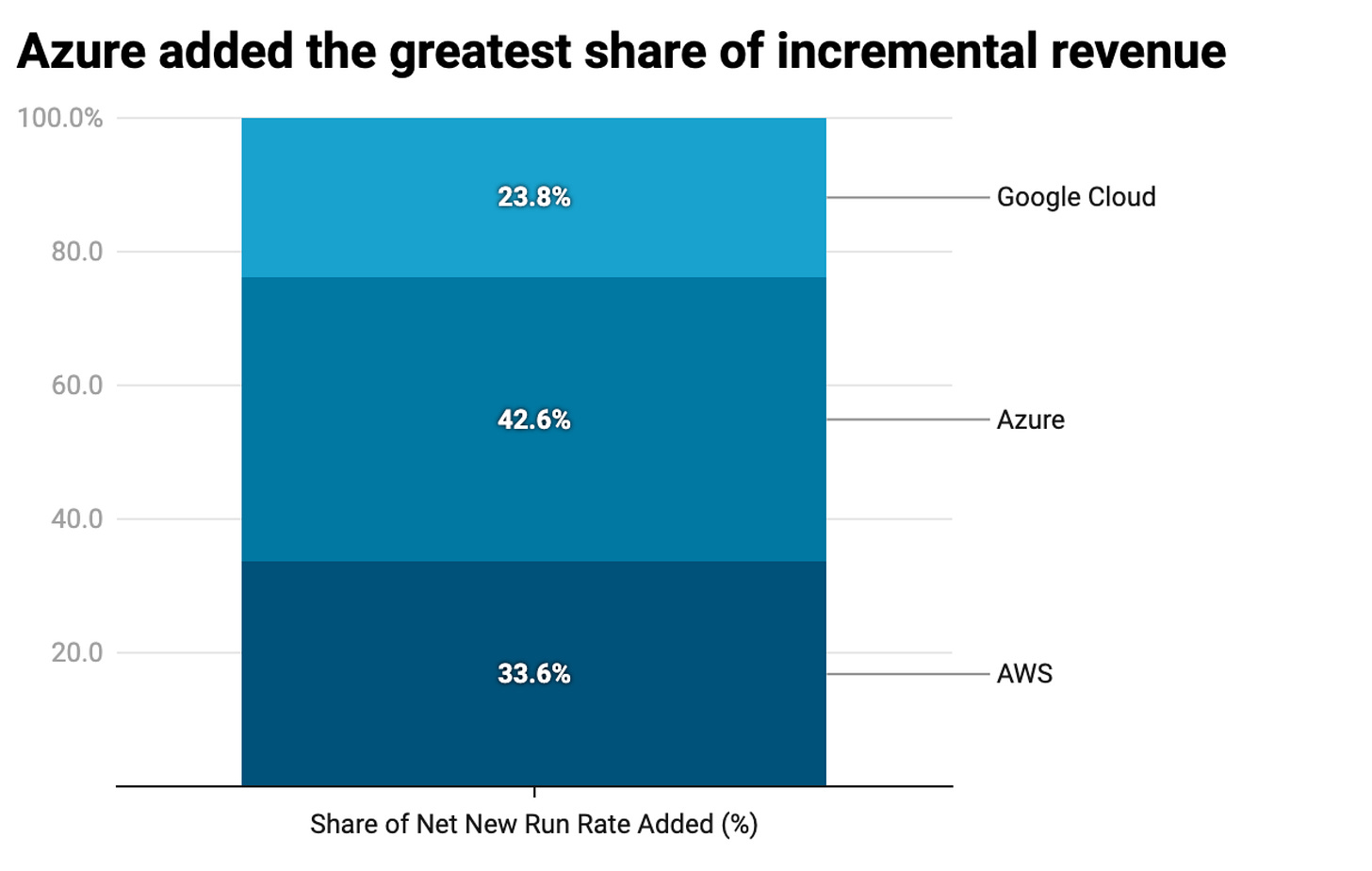

On a relative basis, the share of incremental dollars between the three only looks like below, with Azure taking the crown. Note that since Google Cloud includes Gsuite, it’s actual share is lower and the other’s is higher.

If you don’t yet receive Tanay's newsletter in your email inbox, please join the 10,000+ subscribers who do:

3. What management is saying about AI demand

AWS notes that demand still outstrips capacity

Andy Jassy: “On the supply constraints as it relates to AWS and what we see there, -- as I mentioned, we have more demand than we have capacity at this point. And I think that -- and you see some of the constraints and they kind of exist in multiple places, the single biggest constraint power. But you also see constraints off and on with chips”

… and will continue to invest heavily in capex

“Brian Olsavsky( CFO): “Now turning to our cash CapEx, which was $31.4 billion in Q2. We expect that to be representative of the quarterly rate for the back half of this year, putting us on track for ~$118 billion full-year CapEx.”

Microsoft notes their AI leadership

Satya Nadella: “We continue to lead the AI infrastructure wave and took share every quarter this year.

… and that they also are capacity constrained

“Even as we continue bringing more data center capacity online, we currently expect to remain capacity-constrained through the first half of our fiscal year.”

Google noted their growth in large deal sizes

Sundar Pichai: “We see strong customer demand, driven by our product differentiation and our comprehensive AI product portfolio. Stats show this: One, the number of deals over $250 million, doubling year-over-year; two, in the first half of 2025 we signed the same number of deals over $1 billion that we did in all of 2024; three, the number of new GCP customers increased by nearly 28% quarter-over-quarter.”

…. and their differentiated approach of vertical integration

“We are seeing significant demand for our comprehensive AI product portfolio. Of course, this is all possible because of the long-term investments we have made in our differentiated full stack approach … which spans from AI infrastructure to world-class research, models and tooling and our products and platforms that brings AI to people all over the world”

4. Key takeaways

In closing, what do we take away from all this? A few things stand out to me:

A/ AI is the engine with capacity the bottleneck

All three CEOs hammered on AI demand as the main driver of cloud growth, but each also admitted they’re constrained by infrastructure buildouts. Backlogs continue to grow, with Google’s backlog hitting over $100B.

B/ Azure is the clear share gainer

Capturing the largest slice of new dollars shows Microsoft’s strength in AI. I wonder how much of the share gain is down to the OpenAI relationship and indeed directly serving most of the OpenAI demand.

C/ Capital Expenditure, primarily on AI continues to be significant

Lastly, it continues to be evident that there’s no slowing down on the investment front from any of the hyperscalers. Google raised its 2025 guidance to about $85B, up from $75B, to keep pace with AI-driven demand. Amazon is on track to spend roughly $118B, fueled by investment in chips, datacenters, and power. And Microsoft expects to spend over $80B, with some quarters alone topping $30B.