Hi friends!

One of the interesting changes over the past few years is how people are increasingly investing their money in a more set of asset classes compared to earlier. One could put it down to us being in a historic bull-run amidst low-interest rates and the rampant speculation seemingly everywhere but I think there have also been some other changes that have been taken place, which is what I’ll cover this week.

I’ll go into:

Modern Portfolio Theory and diversification

The democratization of existing assets

The emergence of new assets

Investing beyond returns

Modern Portfolio Theory and Diversification

In 1952, a 25-year old graduate student Henry Markowitz published a paper entitled Portfolio Selection in which he came up with Modern Portfolio Theory for which he later won a Nobel Prize.

Modern Portfolio Theory still influences how a lot of people think about portfolio construction and investing and provides a way to mathematically determine what is the optimal allocation of assets to maximize the expected return for a given level of risk and vice versa.

While the mathematical aspects of it aren’t too important here, here are the key takeaways:

The assumption is that investors want to maximize return for a given level of risk or minimize risk for a given level of return

For the set of assets available to an investor, what matters isn’t just the expected return of the asset, but also the risk and the correlation with other assets.

We can construct an optimal portfolio (known as the “efficient frontier”) given the available set of assets, which can have a better risk-adjusted return than any individual asset.1

One of the key aspects of this theory was that it formalized the importance of diversification, which can increase the risk-adjusted return of a portfolio.

Also, it highlighted options are always good, because any asset, even one with low return and/or high risk could be a good addition to a portfolio if it is uncorrelated with the other assets in a portfolio.

Most people are told to invest in a mix of stocks and bonds (and cash). But given the above findings, it perhaps isn’t too surprising that when we look at how the ultra-rich invest, over one-quarter of their investments are in alternative assets and real estate.

But what about the average investor?

The reality is that many of these assets, aside from stocks, bonds, and a checking account, weren’t readily available to most investors. Over the last decade or so, the number of options for assets available to the average investor has exploded.

This increase in options for the average investor has been driven by two factors:

The democratization of existing assets

The emergence of new assets

Let’s dive in.

The democratization of Existing Assets

Assets which were only available to the 1% are now available more broadly, thanks largely to fractionalization and crowdfunding.

I. Art

The broad art market has provided compound annual returns of 5.7 percent in the last 30 years and 8.8 percent for the last 60 years and has a very low correlation with the index per Art Market Monitor.

This makes a great asset to include in a portfolio, although accessibility has been low and typically only available to the ultra-rich. But with startups such as Otis and Masterworks that allow users to invest in fractional stakes in art, the average investor now has the ability to diversify into it.

II. Real estate

Real estate has seen relatively high returns (especially taking into account leverage) and low correlation with stock markets. But investing in real estate (aside from the home they live in) has typically been rare for the average American.

We’ve seen a number of that help make these more accessible in different ways.

Cadre, Crowdstreet, and Fundrise allow people to invest in residential and commercial real estate projects.

Point and Pacaso make it easier to purchase your first or second home and participate in the equity upside from it.

Airbnb and VRBO has arguably increased the ability of real-estate to generate cash-flows

III. Collectibles

Collectibles is a broad term and a big industry that encompasses many things, but here I’ll use it to refer to vintage cars, trading cards, memorabilia, and other such items. Given the relative lack of liquidity and high ticket prices for most of these items, they were typically not seen as a way to invest for most people. Now, with companies such as Mythic Markets (trading cards) and Rally (vintage cars and beyond), which essentially acquire and “IPO” these assets and allow for fractional investing in them, investors who want to can choose to invest in them more easily.

IV. Wine

Believe it or not, Wine has returned 2X the S&P since 2004 and has a low correlation with the S&P.

Startups such as Vinovest and Vinfolio have made it more simple to build a curated portfolio in Wine and diversify through it.

V. Private Markets

Yale, considered the gold standard in managing endowments, allocates 30-35% to Private Equity and Venture capital.

Now, people are not endowments, but the 1% similarly invests in the private markets, which has been largely out of reach for average investors.

While accreditation requirements mean options are still somewhat limited, we’ve seen some progress in the last few years. On the private equity side, options are somewhat limited but people can buy shares in PE firms that are public, such as KKR or Apollo, or through a private equity ETF such as PSP or PEX.

On the startup side, several options have emerged:

Syndicates and/or rolling funds via AngelList

Secondary markets such as CartaX and EquityZen where people can buy shares in pre-IPO companies

VI. Public Markets

Even when allocating to public markets, the 1% aren’t typically putting it all in a passive index fund. They’re allocating some to hedge funds and perhaps investing in a set of stocks themselves to try to generate some “alpha” above the market return.

The advent of Titan which is essentially a hedge fund accessible to the public and investing and research tools such as Koyfin, Whalewisdom, Atom Finance, and Commonstock allows those who want to take a more active approach the tools to do so wisely.

Also, Robinhood et al introducing fractional investing and making zero-commission trading the norm has reduced the cost of getting started and made it more accessible from a UI perspective. Similarly, Wealthfront and other robo-advisors have automated and made more accessible strategies such as tax-loss harvesting and direct indexing which help increase returns.

The emergence of New Assets

In addition to democratization, we’ve also seen some new assets emerge (or assets that have grown substantially over the last decade or so). The emergence of these new assets has been coupled with the corresponding exchanges and infrastructure around them which enable authenticity and liquidity to make them viable forms of investment.

I. Crypto

Bitcoin was created only ~13 years ago, and now the global market cap of all cryptocurrencies is ~$1.5T. Like it or not, people and corporations are using it as a store of value or means of speculation.

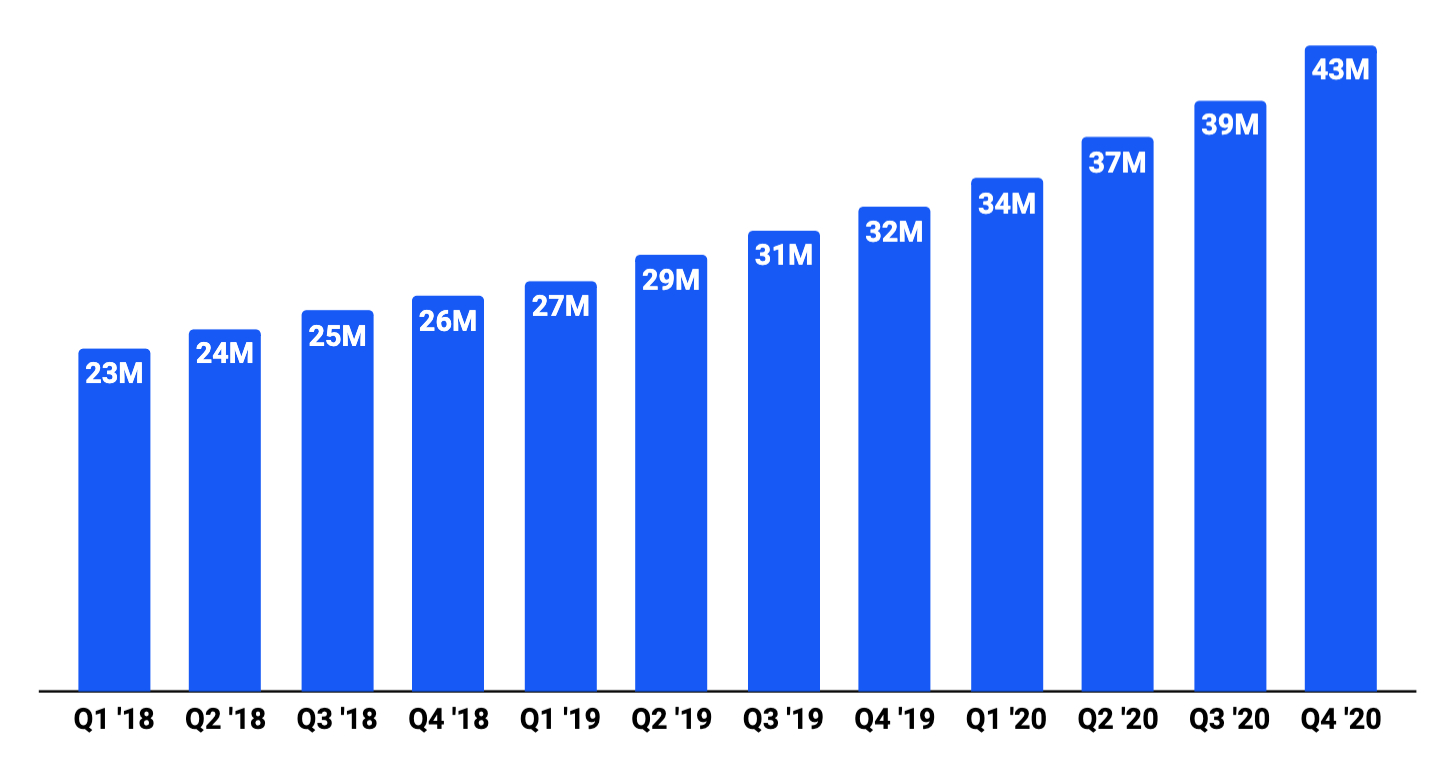

As this chart from Coinbase’s S-1 shows, the number of users on its platform has been growing steadily.

Companies like Coinbase and Gemini allow people and businesses to purchase and store cryptocurrencies and others like Square and Robinhood have also helped make it more accessible.

II. NFTs

NFTs, which stands for Non-fungible tokens have taken off in the last few months and are doing ~$400M/month in transaction volume now. They allow people to invest (and speculate) in digital art and digital collectibles, and we’ve seen all kinds of infrastructure, marketplaces, and games created that use them.

I’ve written more about NFT’s here.

III. Sneakers and other fashion

One might argue that this belongs in collectibles and isn’t really new, but only over the last decade or so have we really seen sneakers, streetwear, and similar emerge as an investment vehicle. For just sneakers alone, the resale market is estimated to be around ~$2B in 2020 and is expected to grow 3x by 2025, per Cowen Equity research.

A report from Art Market Research even showed that handbags outperformed collectibles such as whiskey and art in terms of returns in 2020.

The growing number of drops and demand for drops in combination with vertical-specific marketplaces like Goat, StockX, and TheRealReal providing liquidity and trust means that there is now a healthy and liquid ecosystem around these assets.

Investing beyond Returns

Even if an investor solely cares about financial returns, some of the new assets available to them may make it into their portfolio and help provide better risk-adjusted returns as Markowitz’s theory found. For that reason, the emergence of these options for the average investor is a good thing overall (assuming some level of caution and not rampant speculation).

But some of you may be thinking as you read this post “but that’s not the reason people buy sneakers or collectibles”. I agree.

As touched on earlier, Markowitz (and most economic theories) assume that when people invest they only care about financial risk-adjusted returns and are perfectly rational. I believe this works well in theory but not in practice, especially when it comes to consumers (as opposed to institutional investors).

For people, investment decisions aren’t made just based on financial returns and take into account many other factors such as:

Entertainment

Status

Knowledge/learning

Identity and belonging

I’ll go into this rise of “Passion Investing” next week!

Thanks for reading! If you liked this post, give it a heart up above to help others find it or share it with your friends.

If you have any comments or thoughts, feel free to tweet at me.

If you’re not a subscriber, you can subscribe below. I post about things related to technology and business once a week on Mondays.

Less important to this discussion, it also argues that every investor should hold this efficient frontier, independent of risk preferences, and combine it with t-bills (risk-less asset) depending on their desired level of risk or return.