Hi friends,

A few weeks ago, the 10-week antitrust trial against Google concluded. While we’ll have to wait until May 2023 for a verdict, this trial – the biggest antitrust monopoly case in over 25 years – will be extremely consequential, regardless of the outcome.

As Reuters reported, Judge Amit Mehta said he was undecided on which way to rule. "I have no idea what I'm going to do," he said after setting closing arguments for early May.

As part of the trial, new facts and exhibits were made public, shedding light on Google's search business, particularly the payments made to companies like Apple and Samsung to maintain Google as the default search engine on their devices. They highlighted a few interesting takeaways, which is what I’ll discuss today.

The Case in Brief

Google has a 90%+ market share in search, and the US Government antitrust trial against Google alleges that Google broke antitrust laws to maintain its dominance in online search.

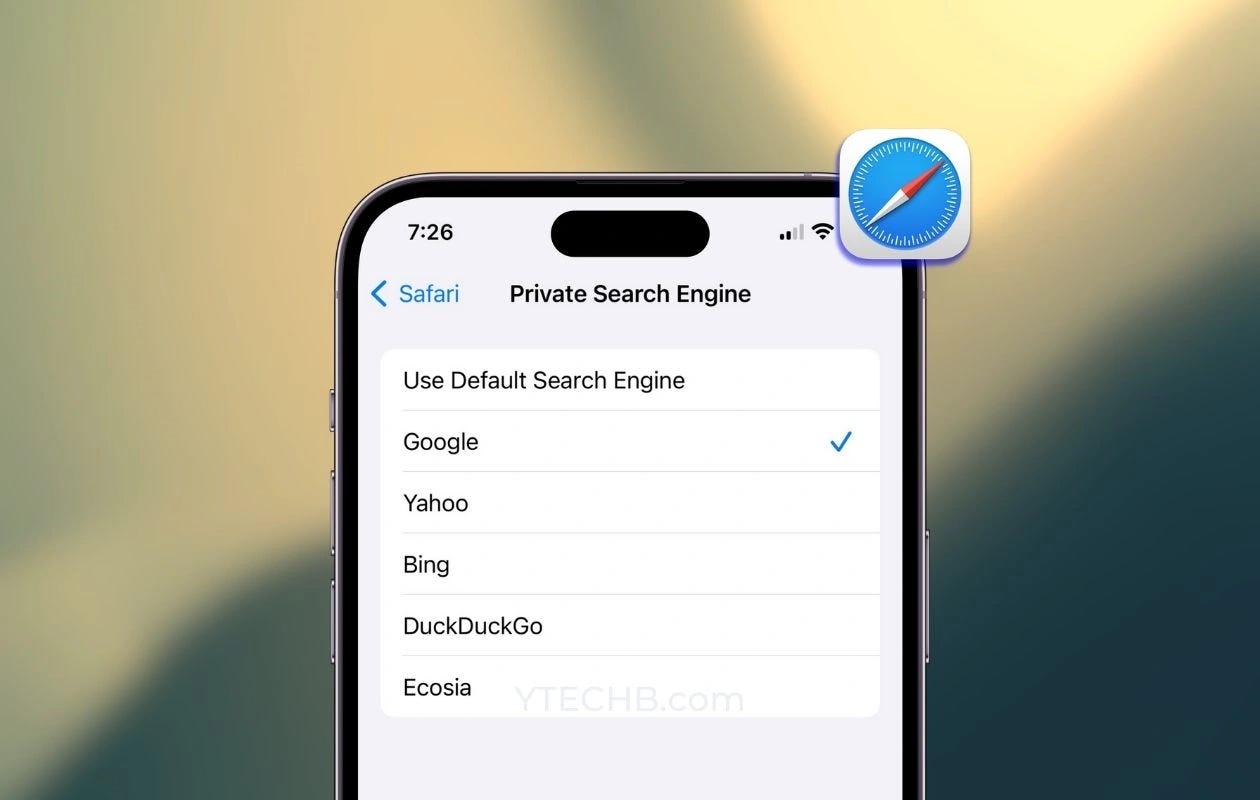

The key question hinges on whether Google illegally cemented its search dominance and hurt competition by paying Apple and others to make its internet search engine the default across various devices and platforms.

The key arguments on both sides are below.

US Government Arguments

Crushing Competition with Default Payments: The government argues that most people stick to defaults. With Google paying billions to become the default, others are unable to compete. Moreover, the feedback loops in search mean that more scale and user data prevent others from catching up.

Consumer Harm through Higher Ad Prices and Lack of Choice: Google's dominance allegedly allows it to raise ad prices on a whim, restricting consumer choice and leading to higher prices for businesses, which may consequently get passed on to consumers.

Google's Defense

Fair Price for Promotion: Google contends it paid a fair price for the default slot on devices like Apple's, benefiting consumers, itself, and device manufacturers. It claims to have placed the highest bid and offered the highest quality search product as the default.

Intense Competition in Search: Google argues that it faces intense competition from non-general search platforms like Amazon, Expedia, and social media platforms like TikTok and Instagram.

Investment in R&D: Google emphasizes its heavy investment in improving the search experience, employing over 9,000 people and spending a significant amount on R&D annually. It argues that these investments negate any consumer harm from its default status.

Key Takeaways

I. Defaults Really Matter

One of the important questions in the case is whether defaults matter. I think it’s hard to make the case that they don’t. Besides plenty of evidence from psychology that defaults influence decision making, the proof is also evident in the facts here.

Google pays Apple, Samsung and others a cumulative of $26.3 billion to secure the status of the default search engine in the various browsers / operating systems. It wouldn’t do so if defaults didn’t matter.

There are a few other pieces of evidence we have as well.

Google really wanted default status: As early as 2011, there were emails internally at Google about the importance of securing default status: "Without the exclusivity, we are not getting anything. Without an exclusive search deal, a large carrier can and will ship alternatives to Google."

Microsoft was willing to take losses to get default status: Microsoft executive Jon Tinker testified that Microsoft was willing to pay Apple in excess of 100% of revenue/gross profit that Microsoft earned in order to secure default status, because they were aware of the long-term benefits of being the default. Nadella testified: “Defaults are the only thing that matter in terms of changing user behavior.”

Google was only willing to pay if they got default status: Back in 2011, Apple suggested a choice screen rather than a strict default. Google made their stance quite clear - they wouldn’t pay if there was no default status.

In aggregate, one estimate thrown around during the hearing was that somewhere between 33-50% of the search market had been closed off to competition owning to the power of defaults. 50% of search query volume went through default placements, and on the a lower bound 33% wouldn’t have switched.

II. The Power of Platforms

Even a business as great as Google search has to pay a tax to Apple and others who by virtue of owning the OS / browser own the customer to a greater degree. And over the course of the trial we learned how big a tax that is.

We learned that Google pays a full 36% of the revenue it generates off iOS devices from search to Apple in order to be the default. That is even higher than the “30% App store tax” that Apple charges all the merchants on the App Store!

The payments to Apple alone in 2021 were estimated to be about $18B of the ~$26B. With a basically 100% profit margin business like that, its no surprise that Apple, which in the past explored building a search engine, decided against it and took the money from Google to be the default.

III. Distribution > Product

There’s an adage that the best products often sell themselves. While that’s true to a certain extent, the reality is that distribution is at least as important if not more important than product. And that is true even for a product such as Google search which in general is universally loved.

Google has continued to heavily invest in its search product, and has over 8,000 engineers and product managers working on its search engine, including about 1,000 people focused on quality. However, the trial revealed an interesting statistic: the amount of money Google spent for R&D on search in 2021 was “many times less” than the $26.3 billion it spent in traffic acquisition costs.

So even for Google, the amount of resources and dollars spent on distribution far outweighs that spent on product.

IV. Search is a phenomenal business

Google’s $160B/yr high-margin search business is probably enough evidence of search being a great category.

But in the trial we heard more on just how great a business it is. Satya Nadella in his testimony called search the largest software category out there by far, even noting: “I used to think of Windows and Office as attractive businesses until I saw search.”

Even though Bing only has a small market share, it is profitable to the tune of billions of dollars for Microsoft.

V. The importance of Chrome and Android

Using some rough math, we can assume Google is paying about 30-35% of the revenue on average it generates to be a default search engine across Apple, Mozilla, Samsung and others. That translates into about 50% of search revenue coming from these default placements, where as another 50% comes from other places, such as other Android Phones and other browsers such as Edge, Chrome, etc.

But on Android devices, which have a high market share, Google can get away with paying less for search deals, because it also has sticks. As Satya Nadella pointed out:

“Google has carrots [revenue shares], and it has massive sticks like we’ll remove Google Play…and without Google Play, an Android phone is a brick.”

In addition, for Chrome browsers, it doesn’t need to pay anything naturally since it owns it.

My estimate would be that about 30-40%+ of the total revenue from search is coming from these placements on which Google is saving $10B/yr+ in traffic acquisition costs for its search business by owning Chrome and Android.

Thanks for reading! If you liked this post, give it a heart up above to help others find it or share it with your friends.

If you have any comments or thoughts, feel free to tweet at me.

If you’re not a subscriber, you can subscribe for free below. I write about things related to technology and business once a week on Mondays.

This is a really good analysis. Thanks!