Robinhood: The good, the bad, and the ugly

Disruption, order flows and gamification

This past week in the financial markets has been quite a rollercoaster, even for those just watching from the sidelines.

Robinhood has gained even more notoriety, and so I decided to write something I’ve been meaning to for a while. While I do touch on events in the last week near the end, I also focus on Robinhood more generally, and some of the good and bad things it’s done.

The Good

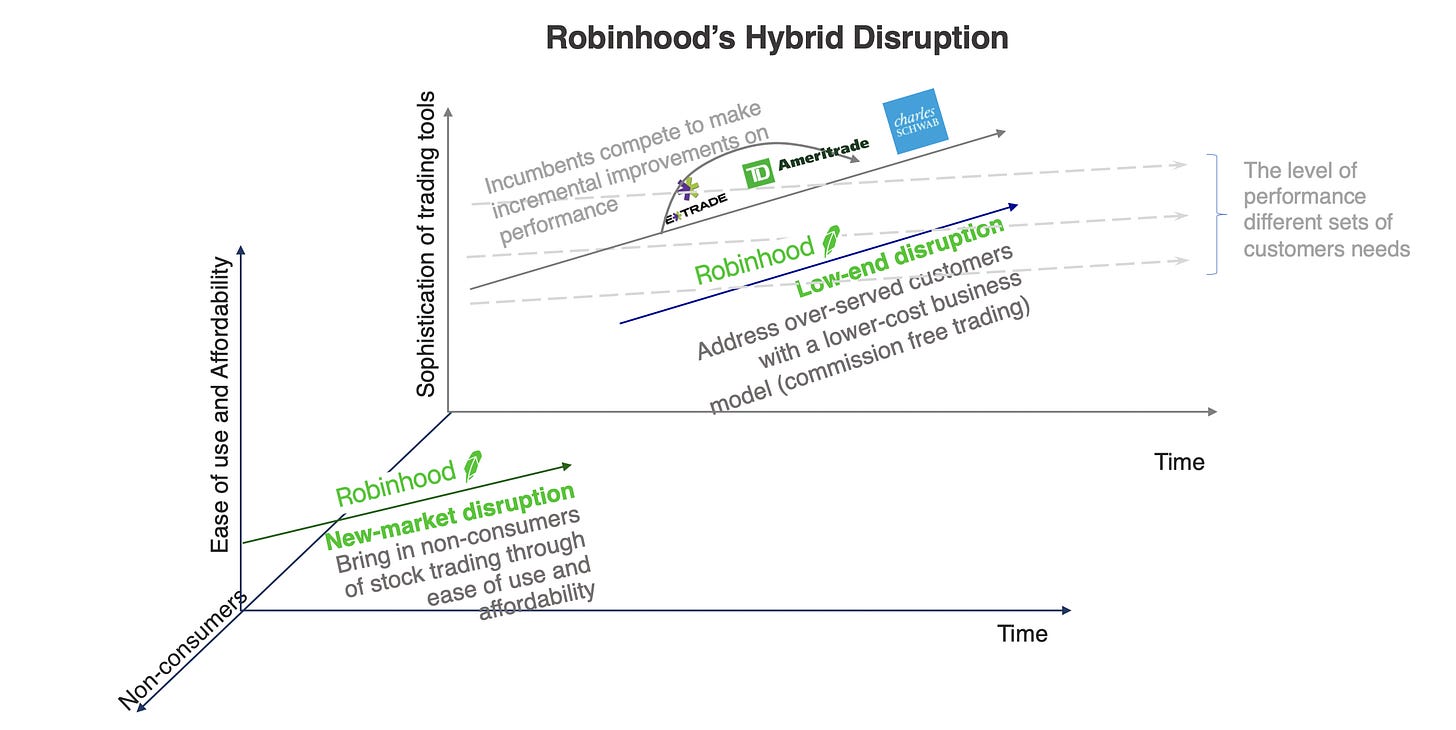

Robinhood is a disruptive company. Not just in the sense that the word is freely thrown around today, but also in the “textbook” sense of disruption. In his theory of disruptive innovation, Clayton Christensen outlined two forms of disruption:

Low-end disruption: Where a new entrant targets the low-end of customers served by existing incumbents, by offering a more affordable and typically less full-fledged product. It isn’t good enough for everyone to switch over, but good enough for the low-end of the market who are over-served by existing incumbents who switch over.

New-market disruption: Where a new entrant competes with “non-consumption” and bring in a new segment of a population into the product by making it simple and affordable to use.

Sometimes companies are hybrid disruptors, where they combine new-market and low-end disruption. And that’s exactly what Robinhood was.

Before Robinhood, brokerages charged trading commissions in the $5-10 range. Especially for those trading online, these were excessively expensive for the value provided (or the costs incurred), although brokerages typically also offered customer support and the ability to place trades by phone.

Robinhood offered a simpler product that was free (i.e., a lot lower cost to consumers). Note that the offering was “worse” in some ways in that it didn’t have anywhere near that level of customer support or things like support for options trading or tax lots. But for most people who wanted to trade relatively small amounts, it was a lot cheaper and simpler, and in this way, Robinhood disrupted the low-end of the market.

But that isn’t all - it’s simple to use mobile app and UI coupled with commission-free trading also brought in many new investors/traders into the market, especially students and young people. In this way, it was a new market disruptor as well.

Incumbents typically find it challenging to respond to disruptors given their cost structures and their business models and after often okay with losing the low-end of customers initially. That’s what happened here as well. The competitors didn’t want to lose their commission revenue stream and so in some sense had their hands tied and didn’t respond.

And so Robinhood continued to grow and grow. Robinhood’s mission was to democratize finance for all, and by making it cheaper and more accessible it was probably doing a good thing.

As an aside, almost half of the households in America don’t hold stock. And reducing that number is good because historically at least for those holding a diversified set of stocks, it has been a phenomenal investment over the long-term, as the chart below with the performance of various asset classes over time shows

Schumpeter described creative destruction as the incessant product and process innovation mechanism by which new production units replace outdated ones. In some ways, Robinhood forced the creative destruction of the retail brokerage market through its innovative no-commissions approach. Competitors eventually recognized they were going to be disrupted and so were impelled to follow suit and cut commissions. TD Ameritrade, Schwab's, and E-Trade were just three of the many brokers who also moved to no commissions.

At the time of the announcement to slash commissions, Schwab, TD Ameritrade, and E-trade said the move would result in the loss of $90-100M, $220-$240M, and 75M of trading revenues respectively per quarter.

Add those up and that’s over $1.5B in trading fees and commissions which consumers would have paid that they no longer need to pay, in part because of Robinhood. It was the price that these incumbents paid to stay in the game.

One could argue that consumer surplus would not happen without Robinhood.

So far, so good, right? Robinhood brought in a bunch of new people into trading and saved money for those it didn’t even bring in by destroying a revenue stream in that market.

Let’s go to the bad.

The bad

Payment for order flows and misleading customers

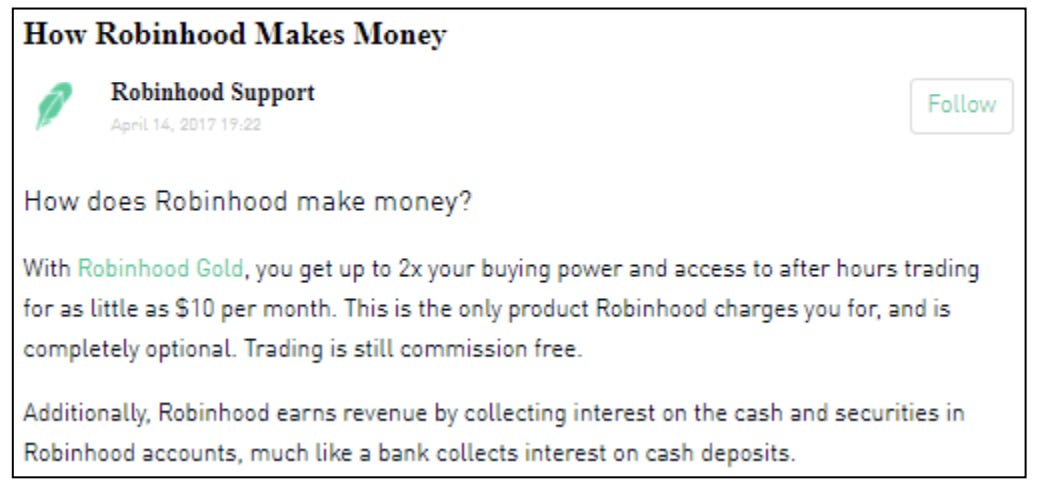

One natural question is how does Robinhood then make money? Their website (now) provides an accurate list of their revenue streams:

Payment for order flow

Robinhood gold subscriptions that cost $5 per month and provide additional data and information and access to margin lending

Interest charged on margin lending

Interest made on customers unused cash

Money from lending stocks

Fees on their debit card

The first one likely makes up the majority and is worth unpacking.

Essentially, when a user places an order on Robinhood, Robinhood passes the information along about that order to market makers such as Citadel and Virtu who can choose to execute the ones they want. They pay Robinhood a small fee for these orders routed to them, typically, a fraction of cents per share.

Robinhood made ~$450M in the first three quarters of 2020 from payment from order flow, from 5 firms: Citadel, Virtu, G1X, Two Sigma, and Wolverine Securities.

Note that this is a fairly common revenue stream in the brokerage world as the chart below shows, and so by itself, it is not necessarily bad.

However, a few things are evident from the chart above which I’ll return to again.

Robinhood gets paid more than other brokers per 100 shares on equity and options (tied with TD Ameritrade on options). Why is their order flow more valuable than other brokers? Perhaps it’s because Robinhood has small retail investors which are more likely to be uncorrelated. Or perhaps there are other reasons.

Options, in general, pay out more per 100 shares than equity trades do, typically by a factor of 3-4X.

Robinhood has the highest share of payment for order flow coming from options, relative to the other brokerages.

What is definitely bad about this whole thing is that Robinhood for years misled customers about this revenue stream.

The “How does Robinhood Make Money” FAQ page on their website, which they even used in marketing campaigns, made no reference to payment for order flow until 2018, while they had been making money this way. Besides, as the SEC found:

Training documents for customer service representatives in early 2018 explicitly instructed them to “avoid” talking about payment for order flow and stated that it was “incorrect” to identify payment for order flow in response to the question how Robinhood makes money.

A History of Poor Trade Execution

So Robinhood sells your order flow which may “cost” you a few cents per share. So what, all the other brokers do it too. So you’re still probably paying similar prices when executing the trades right?

Not quite. Despite advertising in the past that their rates beat out other brokers, the SEC inquiry into them found that based on an internal analysis conducted in March 2019 that “[n]o matter how we cut the data, our % orders receiving price improvement lags behind that of other retail brokerages by a wide margin.”

The kicker is that if the orders were large, it literally would have been better to use another brokerage with fees (never mind that most have now removed the fees).

For most orders of more than 100 shares, the analysis concluded that Robinhood customers would be better off trading at another broker-dealer because the additional price improvement that such orders would receive at other broker-dealers would likely exceed the approximately $5 per-order commission costs that those broker-dealers were then charging. The analysis further determined that the larger the order, the more significant the price improvement losses for Robinhood customers—for orders over 500 shares, the average Robinhood customer order lost over $15 in price improvement compared to Robinhood’s competitors, with that comparative loss rising to more than $23 per order for orders over 2,000 shares.

I guess maybe that consumer surplus argument I used in the good was a bit of a stretch.

If this is the bad, then what is the ugly? While I’m not against democratizing these tools and the idea that people have free choice, I think the ugly with Robinhood is that it is an app designed to monetize bad investing practices.

The ugly

Incentives

We’ve already covered that Robinhood makes most of its money selling order flow. To maximize that money, what do you want people to do?

You want them to trade as much as possible. The “boring” buy and hold investing strategy won’t be nearly as lucrative as churning through trades very quickly.

And what else? Options have a higher payment for order flow relative to shares, so ideally you want people to trade as many options as possible.

And what if they don’t have money to trade, or would trade more if they had more money? Well then, you want to give them margin to trade on! That way you’ll make money when they trade and money on the interest you charge.

But in some sense, all the brokerages have this incentive. However, Robinhood is the one that has truly capitalized on it.

Gamification and “Gamblification”

I don’t think Robinhood is evil per se. They have just applied years of Silicon Valley’s learnings in gamification and addictive product design to drive the incentives in front of them: make people trade as much as possible.

Here are some of the ways this is encouraged

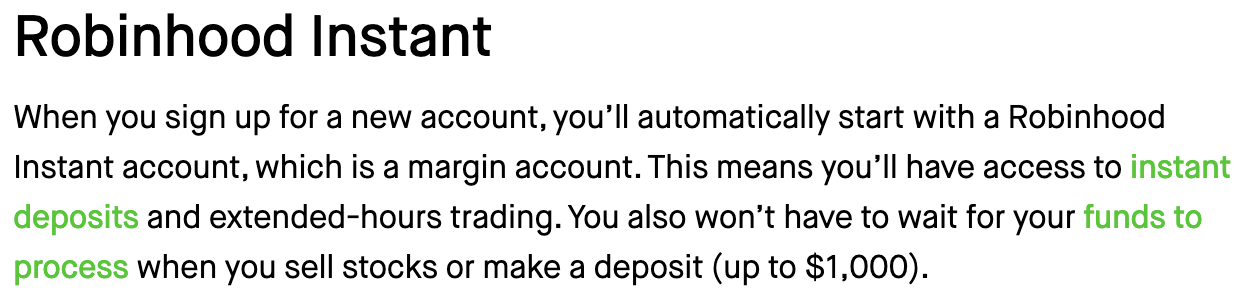

1. Margin Accounts and trading on margin

Typically, when you sign up for a brokerage, it may take 2-4 days for your money to get deposited in. But hey, that is friction, and friction is bad. So what did Robinhood do? Make every account a margin account by default and give people up to $1K in instant deposits when they make a deposit even before it clears. Also, they have been pretty loose with providing margin in general to users (just sign up for Robinhood gold), because a great way to get people to trade more is to lend the heavy traders more money.

2. Scratch cards and confetti:

Let’s use variable rewards and confetti to add a lottery and casino vibe to the market and make Robinhood more engaging. It’s not like the stock market doesn’t have enough of that already.

3. Options for everyone!

Options are risky and dangerous. On Robinhood, you can be approved to trade options within a minute, and it takes up a very prominent position in the UI. Don’t know what they are? Don’t worry - it’s as simple as “I think it’s going up”. It is telling that Robinhood still doesn’t support buying stocks in lots and choosing what lots to sell (who cares about being tax-efficient and capital gains?) but they recently added support buying same-day options (YOLO!).

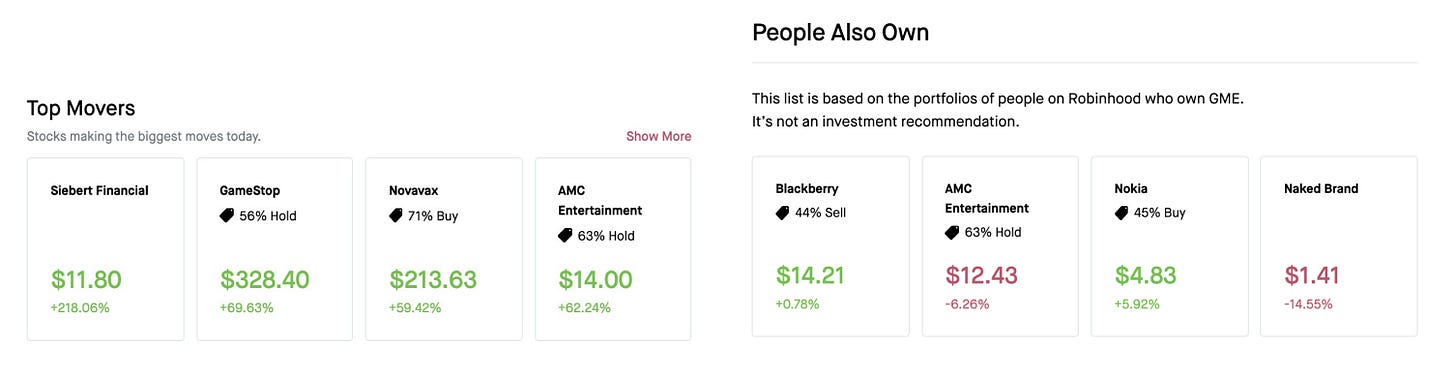

4. FOMO and in-product recommendations:

Robinhood’s product is full of “recommendations” (which they explicitly call out as not investment advice, obviously) which create elements of FOMO.

FOMO is created via the Top Movers section - oh look at all these stocks up and down 70-80%! And then of course you buy a stock, and it will tell you other stocks similar to it. Not harmful by itself, but it’s easy to see how it drives investor behavior

Funnily enough, even as they had limited buying of GME and others, their own recommendation algorithms continued to promote these stocks and give them visibility. It’s also no surprise that people who were in GME were also in AMC, BB, etc. After all, even if you didn’t know what r/wsb was and had bought one of the stocks on Robinhood, you would be recommended the others.

Sadly, they have at times focused on these (“let’s make options more accessible”) over improving the execution of their trades or ensuring their service stays up or always portrays accurate information. Incidents like a 20-year-old committing suicide after getting into options trades and seeing an incorrect 730K balance are the unfortunate outcome of it.

Closing Thoughts and What Happened

So now coming to the Gamestop saga. Robinhood was the weapon of choice for a lot of the people buying Gamestop. And then they decided to stop allowing people to buy Gamestop which caused the stock to crash and in some cases even executed sell orders right at the very low point (including for those who weren’t on margin accounts).

So why did this happen? They had liquidity issues because the collateral requirements were raised (which they denied it on television initially), but the reason Robinhood was hit hard was in some sense a confluence of all the behaviors they encourage:

A lot of their users trading on margin (including new accounts created during the run-up who Robinhood gave money to before their deposits cleared to buy $GME et al)

A lot of their users’ buying options are even more volatile

A concentration of their users being in these “meme” stocks (more than 50% of users of Robinhood held Gamestop). This is in part driven by the user base Robinhood has attracted and partly driven by its own recommendations in the product (Top movers, etc)

Other brokers were hit too, but the reason that Robinhood was the one that received most of the press and slack was that it was where the majority of the people participating in the movement had their money. The percent of users holding these stocks at other brokerages was probably an order of magnitude lower.

It’s also interesting that until the moment before they stopped allowing additional purchases of these stocks, they had no warnings about the volatility or riskiness of these stocks as other brokers did. It was very much a go go go go until the very end where it halted to a crash.

So what’s going to happen to Robinhood? They’re going to be fine, and probably even better off.

One, they’ve raised $3.4B of additional capital which should alleviate any liquidity issues in the short-term.

Two, while they may lose some users, they were top of the App Store for a whole week, and will probably end up gaining more users as a result of this. Also, for casual followers of this story, a key takeaway might be that there is a quick buck to be made in the markets and we can take on the big hedge funds which will lead to even more amateur traders.

Three, this whole thing is in some ways a reflection of how good Robinhood is. Robinhood optimized its app to get as many people to trade as much as possible. And it was working so well (in a coordinated manner such that these people were even more likely to make money) that they were able to move an entire set of stocks and increase general volatility in the entire market.

What is disappointing to me about Robinhood is that they had the ability to teach the new people it brought into the market good investing practices. They could have taught them about the fundamentals of investing and encouraged buy-and-hold behavior.

Instead, they introduced people to options trading, gave them margin to play with, and encouraged short-term trading and overtrading, driven by a business model that monetized these practices. All in the name of removing friction and increasing accessibility. It is now easier (and cheaper on the face of it) to buy a $10,000 call option which has a 95% probability of going to zero than it is to order a pizza. Perhaps some of that friction served a purpose.

Thanks for reading! If you liked this post, give it a heart up above to help others find it or share it with your friends.

If you have any comments or thoughts, feel free to tweet at me.

If you’re not a subscriber, you can subscribe below. I generally post once a week or every other week on Monday about things related to technology or business.

Great analysis and great movie analogy