Hi friends,

This week I’ll be discussing the efficiency of spend on the talent of some of the large tech companies, in light of the news that Elon Musk intends to lay off up to 75% of the Twitter employee base if he goes through with his acquisition of Twitter.

There have been a lot of jokes about how badly Twitter has been run in the past, with its extremely large employee base relative to product innovation being pointed to as the major reason. But just how bad is it?

Measuring Operational Efficiency

One way to measure the “return on talent” or operational efficiency at these companies is to look at a few measures such as:

Revenue per employee

Gross profit per employee

Number of users/customers per employee, where applicable

These give us a sense of how much “leverage” a company is getting on its talent.

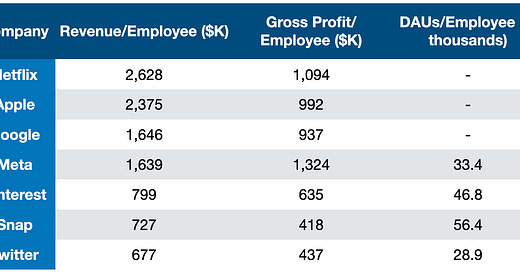

I pulled the data for the large tech companies and some of the closest comparables to Twitter, and as we can see here, Twitter doesn’t fare too well.

A few observations:

The most successful of these companies tend to be in and around ~$1M in gross profit per employee, and over $1.5M in revenue per employee. Twitter is at less than half of that!

Twitter fares the worst, both in terms of revenue per employee and the number of DAUs per employee. In fact, it needs almost twice as many people per DAU as Snap does! Similarly, FB, where each user on average likely uses 2-3 of their 4 main products still needs fewer employees per DAU, and not to mention the multiple thousands of employees working on things like the Metaverse.

Note, I didn’t include Amazon in this analysis since it was difficult to get data on their FTE numbers and it might not make for a reasonable comparison given the difference in its business model.

But what about improving efficiency over time?

Another thing to consider is the idea of improving leverage over time. As a company grows, not all costs need to grow proportionately. The same is true typically of the employee base and the associated costs. While some do scale linearly with revenue, other aspects scale much more slowly.

So another thing to consider is that is a company improving its “return on talent” over time?

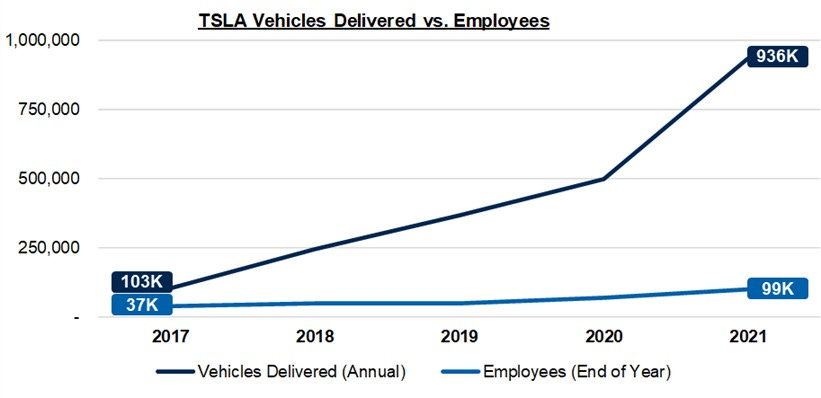

Tesla is one example of a company that has been showing good leverage over time on its talent as evidenced in the chart below:

So what happens when we compare the change in revenue per employee over time for a set of these companies? The graph is shown below.

A few observations:

Twitter is the only company where the revenue per employee has actually decreased since 2017 (by -13%). All the other companies have increased their efficiency or output per employee. When you add that to the fact that it has one of the lowest revenue per employee numbers, that is quite concerning.

Meta is the other company that hasn’t meaningfully increased revenue per employee. Their revenue per employee is up just a total of 3% over 4 years, although they had a much higher number to begin with.

When you consider the leverage inherent in the business models of these companies – once you’ve built out the products and ad systems, you don’t need to hire more people as your users grow necessarily, it’s perhaps a sign that focusing on being lean hasn’t been a priority. But what makes Twitter even more surprising is that unlike Meta, which operates 4 apps and is investing heavily in new areas such as hardware and the Metaverse, Twitter has not significantly increased its product scope either.

The Gross Profit per employee tells a similar story as below. Again, Twitter has gotten worse over time and didn’t start off in a great place either.

It’s also interesting to note that Tesla has made quite significant improvements over time, especially considering its business model is much more difficult and different from some of the other companies on this list.

Closing Thoughts

It should come as no surprise to those familiar with the product or company that Twitter isn’t run particularly well. It’s probably the worst run and arguably most bloated of these companies, even when compared to companies that aren’t known to be extremely lean in the first place.

Given the improvement Musk has made at Tesla in terms of the operating leverage and return on talent shown over time, it’s not surprising that he believes that Twitter is overstaffed and can be run leaner.

While a 75% cut will be difficult given that it might require a full cultural and technical reset and might lead to the very best people who they want to keep deciding to leave anyway given uncertainties around the future, some changes may need to be made, which could also be focused on increasing product velocity and output with the current sized employee base rather than reducing the employee base.

Note that the companies I’ve used above are close comparables, but nowhere near the most efficiently run companies. There are several companies that have done a lot with very few employees, as I touched on in a previous piece on hyper leveraged companies, such as:

When Instagram was acquired by Facebook in 2012 for $1B, it had a total of 13 employees, including the two founders. At ~30M users at the time and a value of $1B, that’s roughly 2.5M users per employee and $75M EV/employees

When WhatsApp was acquired by Facebook in 20 for $19B, it had a total of 55 employees. The 55 employees supported ~400M monthly active users, over 7M users per employee. And the $19B in value represents roughly ~$350M in enterprise value per employee.

The Swedish firm Mojang developed the game Minecraft which had over 100M users and brought in more than $100M in profit each year. It was acquired by Microsoft for $2.5B when it had ~40 employees. That’s 2.5M users per employee and $62.5M in enterprise value per employee.

Craigslist makes over $1B in revenue each year and has ~100M users globally. It operates with just 50 employees. That’s 20M in revenue per year per employee, and 2M users served per employee.

Thanks for reading! If you liked this post, give it a heart up above to help others find it or share it with your friends.

If you have any comments or thoughts, feel free to tweet at me.

If you’re not a subscriber, you can subscribe for free below. I write about things related to technology and business once a week on Mondays.

Tanay, fantastic write up as always. It's staggering to be reminded of the scale that big tech has - while $600k/FTE doesn't look great relative to the other names on that chart, that would be an unworldly rev/FTE ratio in mid-market B2B software.

Minor nit: I believe the phrase is "fares well", rather than "fairs well" :)