Observations from the 2024 Enterprise Tech 30

This is a weekly newsletter about the business of the technology industry. To receive Tanay’s Newsletter in your inbox, subscribe here for free:

Hi friends,

This week, I’ll be sharing a few observations from the 2024 Enterprise Tech 30 list, which we at Wing published earlier today.

For those unfamiliar with the list, at a high level the list identifies the most promising enterprise tech startups by surveying ~100 VCs, who pick 10 companies each by category (early, mid, late, giga), with the category cut-offs determined based on funding amounts raised at the time of voting (detailed methodology). This year was the 6th edition of the list.

1/ Generative AI is creating a see of opportunities for startups

Of the 40 companies, 17 were new to the list, which is a pretty large share of new companies. More strikingly, almost all of these companies are playing into Generative AI in some shape or form.

Seven are directly building AI models or AI infrastructure

Three are building data platforms and tooling, a large use of which is for AI applications

Four are applications which are either basically AI-native apps not possible until 2 years ago (Harvey, Perplexity), or have significantly turbocharged their product with Generative AI (Glean, Clay)

The median age of the early-stage companies in the cohort is less than 2 years old, the youngest since the list began again highlighting that many are playing into the tailwinds and opportunities created in a “post ChatGPT” world.

2/ We’re still largely in the infra/tooling build out phase

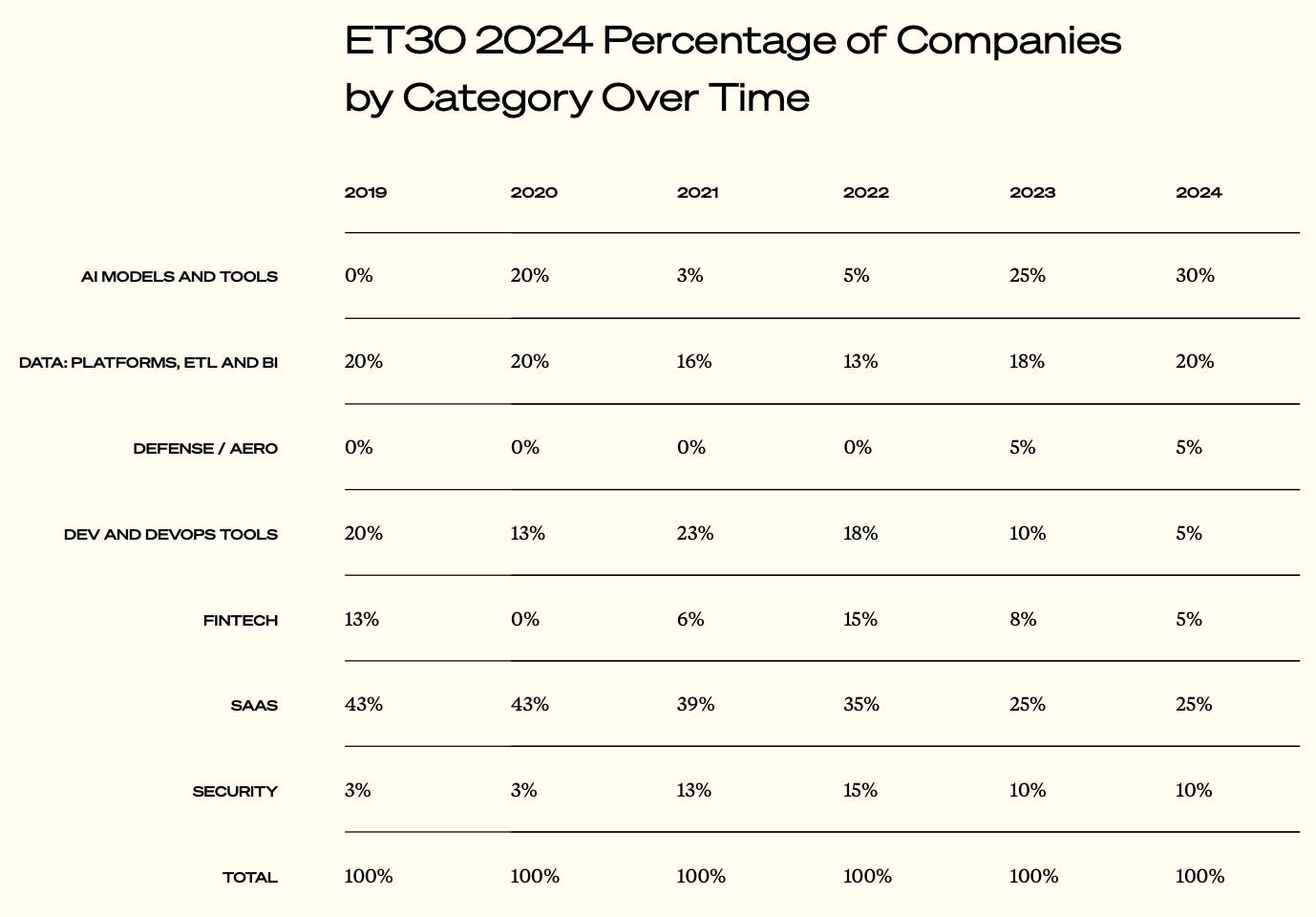

On this year’s list, only 25% of the companies were SaaS — the joint lowest share since the ET30 list began.

It underscores the moment of time we’re in, where many of the most promising companies are those building models, data infrastructure and other tooling to enable the builders of the next generation of products.

Almost half the list fell into the categories of AI models and tools or Data related tooling, which in some ways are the precursor and the enabler too of the next generation of applications.

At the same time, applications are adopting Generative AI features quite quickly. 50% of the applications that made the list had launched significant Generative AI features, and 20% of them, namely Perplexity and Harvey, are those that are Generative AI native, and uniquely enabled by some of the recent advancements.

While questions over whether incumbents or startups will capture value at the application layer still remain, I expect to see a lot more Generative AI applications on the ET30 list in the coming years.

3/ Product-led Growth is still extremely important

While PLG has seen a bit of a decrease in popularity recently as some PLG companies have plateaued or struggled to monetize their user base without layering in a sales motion, the reality is that it remains extremely important.

Of the 40 companies on the list, 30 of them have a significant product-led motion in terms of supporting self-serve onboarding that enables a significant bottoms-up usage.

This is especially true for products that serve technical audiences since we all know that developers and data scientists often don't like to be “sold to”. For the products targeting these audiences, almost all of them support a PLG motion, and indeed for many of these companies, PLG is the primary motion.

Looking at the top company in each stage makes the importance of PLG evident — all of Langchain, Pinecone, Figma and OpenAI had a significant product-led growth motion. I think the tweet below sums it up perfectly.