Network effects and token incentives

On how tokens can be used to jumpstart and breakdown network effects

Hi friends,

One of the things I've been thinking about is the use of tokens in web3 and its impact on network effects.

I'll cover:

An overview of token incentives

Network effects and web2

How tokens can jumpstart network effects

How tokens can break down network effects

Token Incentives

Given the ownership ethos of web3, many projects in crypto have either from the outset or relatively early on issued a token, which is distributed to a variety of stakeholders based on a specific schedule determined at the time of the token launch.

At a high level, token incentives have tended to take two forms:

One-time "airdrops" which are token incentives offered to the users before a given date typically based on the usage/activity ahead of that date.

Recurring token incentives are based on a specific token distribution, known ahead of time and that typically go on for multiple years (if not forever), with various tapering baked in.

These tokens provide a sense of ownership and skin in the game in the projects, which is critical to the read-write-own nature of web3 and for a product to be truly "web3".

But in many cases, these token incentives are being used either to jumpstart or break down network effects. Let's discuss how.

Network Effects and web2

Many of the largest web2 internet businesses today have some kind of network effect inherent in them, given that they are essentially a network of some form.

Metcalfe's law, commonly used as a way to estimate the value of a network, states that a network's impact is the square of the number of nodes in the network. Essentially, network utility quadruples for every doubling of the network.

Considering some common examples of web2 network effects:

For Facebook or other social media / messaging apps, the initial utility was limited, but as more users joined, the utility for every user increased as they had more content and people to interact with.

For Uber, initially, in a new city, the wait times were long and drivers were idle for long periods, but as the rider network grew, driver earnings improved, and as drivers came on board, the wait times went down.

These network effects generally serve as a strong moat once established since a competitor has to create the network from scratch and get to some similar size to match the utility. But the difficulty can be that sometimes they are hard to get going.

Jumpstarting Network effects

Sometimes, ideas don't get to the escape velocity they need where the utility is large enough that the participants join the network and the network takes hold. Or, it can just take forever.

In such cases, tokens can and have been used in web3 to jumpstart these network effects.

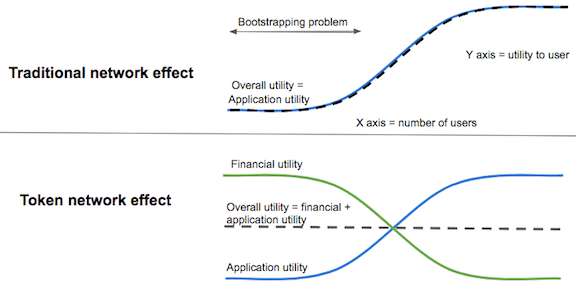

Chris Dixon has written about this quite eloquently, but to summarize the premise is this:

As the network grows, the utility to the participants in the network increases.

There is some network scale where the application utility is high enough, that absent anything else, new participants would continue to join the network.

But, reaching there may be difficult since the utility initially is below that point which disincentivizes anyone from joining (other than the earliest adopters/tinkerers)

So, token incentives are used to provide another form of utility in the early days to encourage users to join the network. Generally, these incentives taper off over time as the network reaches the sizes it needs to self-sustain.

Examples

1. Helium

Helium is the typical go-to example used to illustrate this, which is aiming to provide decentralized wireless connectivity. While Helium has not proven successful by any means yet, what is true is that the attempt to bootstrap the network didn't work in a traditional web2 manner, as reported by the NY Times:

Helium, which was founded in 2013, didn’t start off as a crypto company. Its founders originally tried to build a long-range, peer-to-peer wireless network the old-fashioned way — by persuading people and businesses to set up hot spots and stringing them together. But they struggled to get enough participants, and the network stalled.

Frank Mong, Helium’s chief operating officer, told me that the company was running out of money in 2017 when an engineer suggested, during an all-hands Scotch-drinking session, that more people might be willing to set up hot spots if they could earn cryptocurrency by doing it.

After offering token incentives to both those who set up and use Helium hotspots, the network has managed to grow and there are now over 900,000 hotspots set up in over 182 countries.

The token incentives were as below, with more tokens issued early on and then becoming asymptotic over time. In addition, the various stakeholder distributions varied over time as well.

2. Pollen Mobile

Pollen is another example of a project using token incentives to bootstrap a network effect. Pollen is a decentralized mobile network that leverages an SOL-based token PollenCoin. The project is in its early stages, but supply users can purchase a device to provide network coverage, and consumers will be able to connect to the network using an e-SIM they purchase, and pay per GB of data used. As below, 50% of the entire token supply is earmarked for incentives, with a high fraction being used early on to bring on the initial network users.

Breaking Down Network Effects

On the flip side, token incentives can also be used to break down existing network effects that incumbents have. How is that? By creating a competing network and offering token incentives, of course.

These have sometimes become known as vampire attacks, and involve taking an existing network that so far doesn’t provide ownership (or maybe already does) and providing token incentives to lure over participants from that ecosystem (and net new participants) onto the new network.

While this can result in encouraging a lot of users coming in just to farm or game the tokens, it does have the ability to result in the adoption of a new network, especially if that network over time can iterate on the core user experience as well and match or better the incumbent.

Examples:

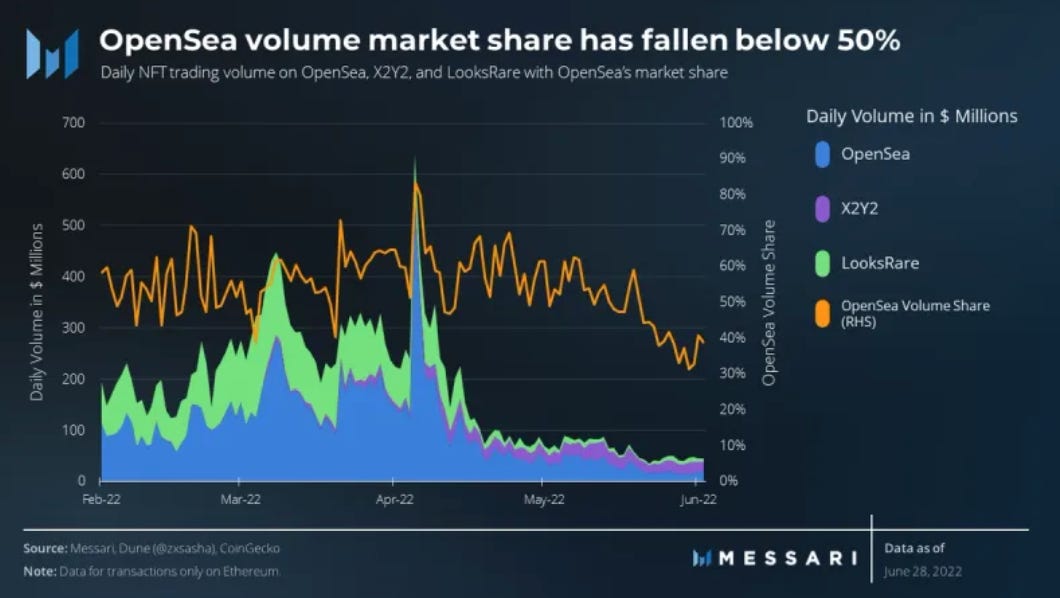

1. Looksrare and X2Y2 aimed to unseat the NFT marketplace Opensea, which was the leading NFT marketplace but didn’t offer its users tokens. To do so, they made all users of Opensea eligible for an airdrop of the new token each one had created, and then also continue to provide token rewards and incentives for continuing to transact on the platform.

Looksrare attracted NFT market share relatively quickly, as in the chart below.

However, many criticized the numbers noting that it’s a lot of whales that were wash trading. This can be seen in the user numbers below.

But one way to think about it is that they were able to create a network 1/10 the size of Opensea in terms of number of users in a relatively short period of time, so it was still quite impressive, even if not a complete unseating the incumbent.

2. Sushiswap aimed to attack Uniswap with a similar move. To encourage liquidity to move to their project, Sushiswap incentivized liquidity providers with the $SUSHI token. In this case, Uniswap at least partially in response to this as a defensive maneuver launched their own token $UNI. This resulted in the attack not being as successful, but Sushiswap still supports over 15K trading pairs, a pretty impressive number, and has 4% of the volume traded as Uniswap.

It is the case that tokens can be used to break down network effect in cases where the incumbent network is also not using tokens. The reason is that users who already have a lot of one token (the incumbent) may be less interested in switching to a new network because it puts their existing “wealth” at risk.

However, there are always net new users yet to have joined any network, or those who felt they were late to say the incumbent, who will be appealed by making their way onto a new network where they can earn a larger share of new tokens.

Thanks for reading! If you liked this post, give it a heart up above to help others find it or share it with your friends.

If you have any comments or thoughts, feel free to tweet at me.

If you’re not a subscriber, you can subscribe for free below. I write about things related to technology and business once a week on Mondays.

Great read.