Narratives and hype in verticals

EVs, The Dot Com Bubble, and what happens when hype emerges around entire verticals

Hi friends! I previously wrote about the importance of narratives in private and public markets and how reflexive processes help make narratives a reality.

This time, I want to cover narratives at a vertical or industry level. I’ll discuss:

Narratives within industries

The Dot Com Bubble

Electric Vehicles Today

I. Narratives within industries

Sometimes a narrative emerges about a certain vertical or industry getting completely disrupted or shaken up, typically based on new technology. This often results in a rush of money into companies that play into that narrative, with many beginning to trade at extremely high valuations ahead of their initial progress.

We’ve seen this with the dot com bubble where the Internet was seen as the next big thing, and I believe we’re seeing this right now with Electric Vehicle companies.

Again, because of reflexivity as I wrote about before, the existence of the narratives and the hype that results helps make the narratives real. But given that entire industries get speculated on and priced up, sometimes even the narratives becoming real might not be enough.

Hype Cycle

What tends to happen during this period is that every company in the space tends to be valued assuming industry (or world) domination, when the reality is that only a couple of them if at all will get there.

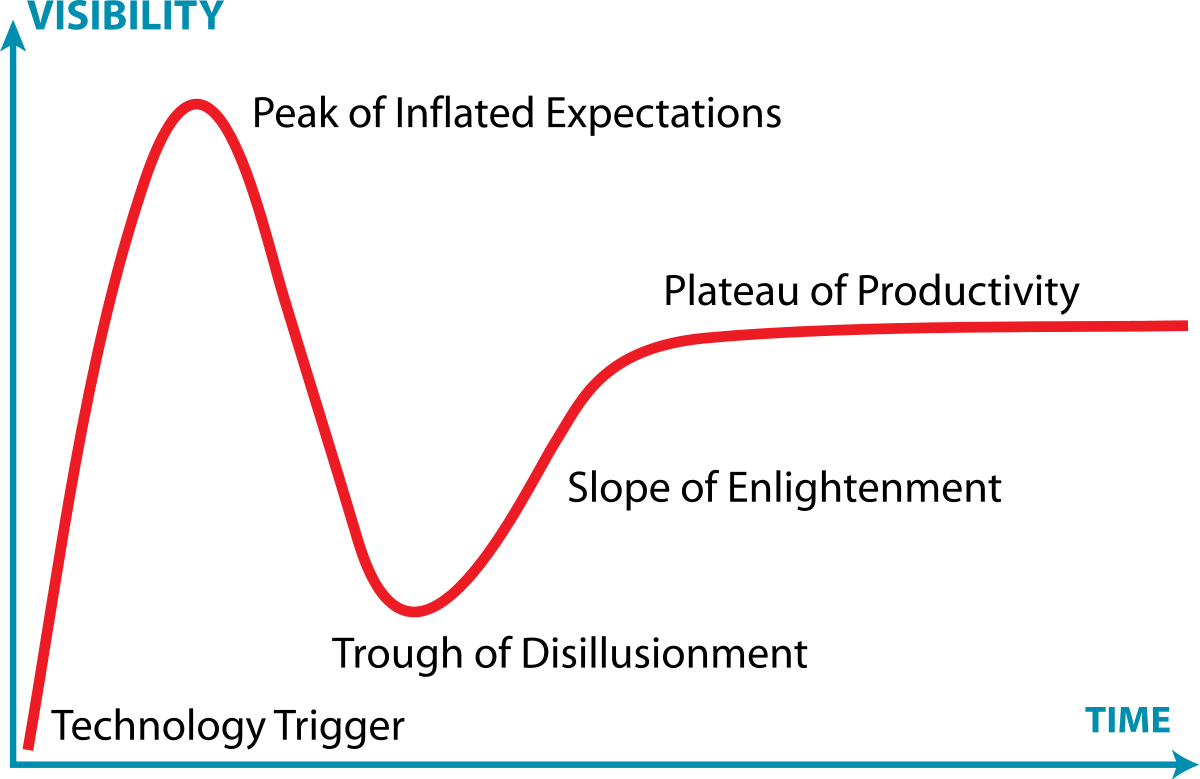

The process is similar to the “hype cycle” which is often used to depict the life cycle of a technology. As the technology hits the scene, everyone imagines every possible use case and how big it might getting which leads to more interest and inflated expectations. The narrative often loses sight of the actual progress in the technology and gets too hyped up, before crashing to reality, only to rebuild more sustainably.

Betting on the Narrative

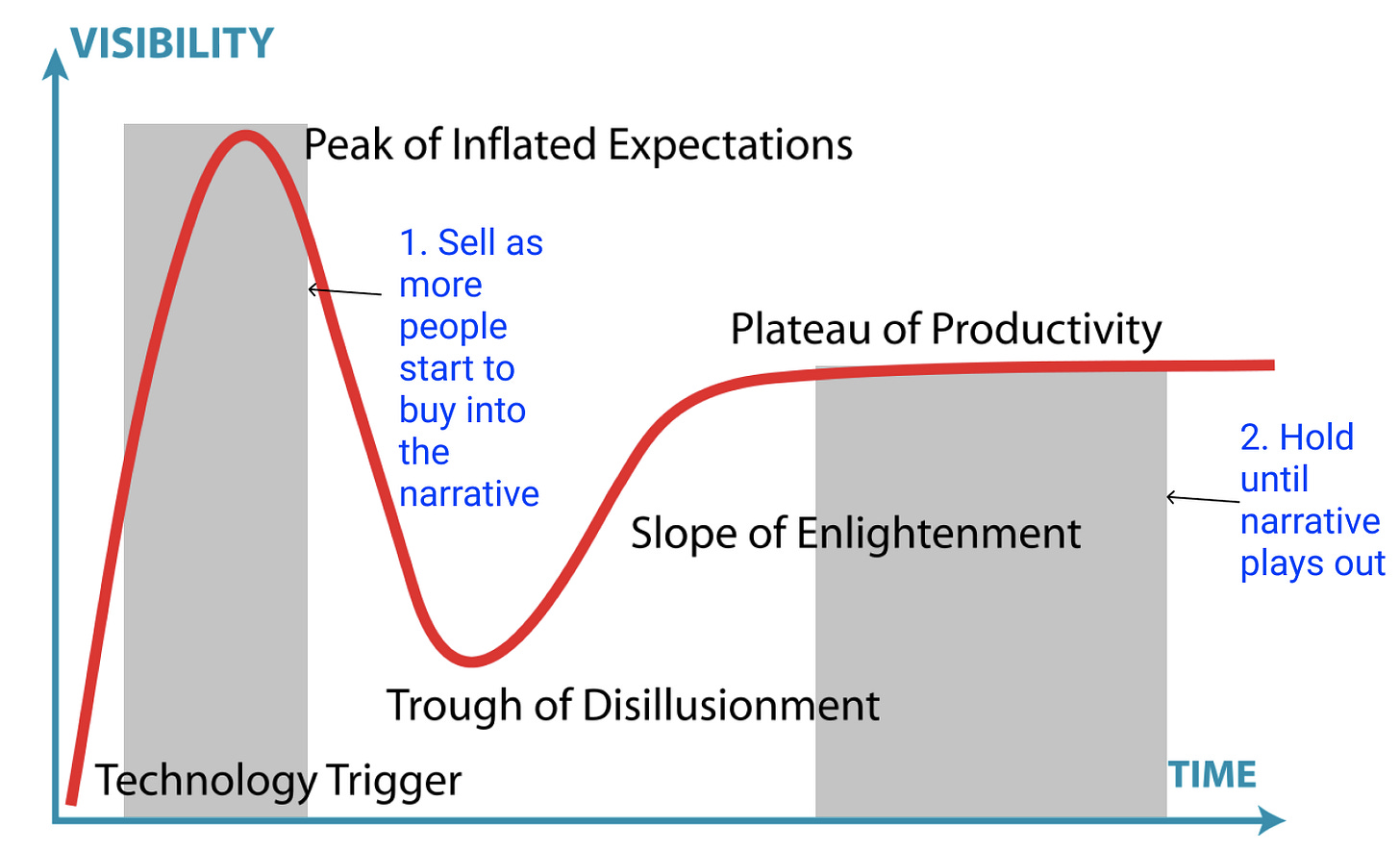

One of the beauties of these narratives is that people can profit from betting on the narrative even if they don’t believe it will play out. Specifically, they could:

Buy for the short term if they believe that more people will believe the narrative in the near future, regardless of their belief in whether the narrative will actually play out.

Buy and hold for the long term if they believe that the narrative will actually play out and the likelihood or the magnitude of it is bigger than priced in.

This is what it might look like overlaid on the hype cycle above in terms of when one tries to exit [note that valuations don’t exactly follow the hype cycle].

The first one is often the motivator of speculation and can lead to bubble behavior.

People know they don’t even need to believe the narrative is real for them to make a profit, just that the narrative has will get more buy-in from the point they enter. At the extremes, everyone buying something knows it’s overpriced but is relying on being able to sell it to a greater fool, as this quote from Devil Takes The Hindmost illustrates:

Many purchasers of shares bought knowing that their long-term prospects were hopeless, since they aimed to get ‘rid of them in the crowded alley to others more credulous than themselves.’

II. Dot Com Bubble

The dot com bubble is a good example of a mania brought about in part by a narrative in a vertical. The rise of the internet and the penetration of computers increasing made people believe the internet was the next big thing and pretty much any company with a one-word dot com domain and some web visitors was going public at billions in valuation.

Hindsight is 20/20, but since we have the benefit of looking back 20 years, at a high level, the idea that the internet would be a disruptive force to change things was correct. However, the narrative emerged a decade or two early, and perhaps it took the mobile phone to really justify the kinds of valuations that were being thrown around at the time.

It was a case of people and markets seeing the future coming much sooner than was likely or not discounting it back enough. There was too much money chasing too few tractable ideas given where the world was at. From its peak in 1999, the NASDAQ was down 78% in 2002.

Reflexivity

But the dot com narrative in part helped shape reality.

As everyone including investors and potential employees believed the dot com narrative, hundreds of companies were founded and money was flung around across ideas. Many of these companies raised far too much money on business models that weren’t viable and went out of business.

But many also raised money in that period and managed to stick it out and survive. In fact, 48% of companies survived the crash and were still operating in 2004.

And some of the promising companies at the time including Microsoft, Intel, Cisco, Amazon, and NVIDIA did go on to achieve things that the valuations they had at the time and the mania suggested they might.

And a lot of the talent which was attracted to the internet and technology in that period of excess stayed in the industry, contributing to the more sustainability built companies in the decades that followed.

It was clearly a time of excess, but the narratives and the mania helped fuel the reality.

'Nothing important has ever been built without irrational exuberance" - Fred Wilson quoting a friend.

Valuations

The dot com bubble was unique in the absurdity of valuations, but considering Microsoft and Amazon, reveals a few interesting lessons.

Looking at Microsoft’s stock price history below shows that it took ~13-15 years for someone who bought near the peak of the bubble to breakeven1. In that time, Microsoft’s revenue had increased >4X, from $20B to $86B, and the return would have been 0%.

But, say someone was patient and held from then all the way to today, a total of over 20 years, they would have outperformed the S&P during that period (obviously, the S&P also declined a lot when the bubble burst). So people who truly believed the narrative around computers and the internet and that Microsoft could be a player in it, and was patient for 20 years would have been okay in the end.

Consider Amazon’s price history, which is up over 30X from the peak of the bubble (not including dividend reinvestment) while the S&P was up ~3X (including dividends).

Now, Amazon was only one of the many many startups at the time, but one could have bought ~5-10 startups, with Amazon being one, and all the others might have gone to zero, and in the long term since the narrative of the Internet actually played out they would have been done relatively well.

Lastly, consider companies like Cisco, which also went on to do very well, where the stock prices still haven’t caught up with prices during the peak.

I take away a few things from this:

Even if you believe a certain narrative is going to play out and a given company is well positioned for it, sometimes the prices are so out of hand that it is better to stay on the sidelines or you’ll have to deal with years and decades of underperformance.

Even though the speculation seems like it embeds world domination into every companies price, sometimes the winners end up still doing remarkably well and can even cover for many losers.

If you got in because you believed the narrative was going to play out, then sometimes the best course of action, if you were unfortunate to see prices decline as the industry went down the hype cycle, is to actually continue to hold (and reinvest) until the narrative plays out (or until interim results suggest that it is playing out).

III. Electric Vehicles Today

Arguably, we’re seeing something similar with Electric Vehicles today. I won’t call it a bubble, but the narrative around the vertical is so strong that pretty much any EV company is being valued at crazy amounts.

The good thing about this is that all the capital and the talent that follows makes it more likely we see an EV future sooner. Many (or any?) EV companies have been able to raise money and go public (via SPACs) at high valuations, which provides them the resources and capital to tap into the talent to make the vision a reality.

But again, because the narrative in the vertical is so strong and prices have been bid up so much, even the best companies today may have to execute for years and years and might still be at the same valuations. That is of course unless we’re still early in the “hype cycle” and more and more people buy further into the narrative in the coming years.

Looking at the projections that each of them put out, they all plan to grow faster than the best companies of the previous generation. Sure, EVs are important and will be big, but will each of these EV companies surpass the very best companies we’ve seen in the past? My guess is no.

Each of the companies is almost being valued assuming it “wins” given the EV narrative, but:

1) The narrative has to play out

2) The narrative has to play out in a reasonable time frame

3) There will likely only be a few winners to this extent

4) Those winners might be existing Automobile companies

5) Even if these companies win, the prices have to be such that winning still provides a return, which if they go continue to go up in the next few years, may no longer be.

P.S. This post was a bit more free-form and a collection of some more half-baked thoughts. Thanks for reading and let me know what you thought!

If you have any comments or thoughts, feel free to tweet at me.

If you’re not a subscriber, you can subscribe below. I write about things related to technology and business once a week on Mondays.

The above chart doesn’t factor in dividend reinvestment but that will only pull it forward by a couple of years.