Marketplaces and layering on advertising

Last week I wrote about the take rate for marketplaces, which is a critical metric that measures how much of the gross transaction volume happening on the marketplace is being captured by a marketplace as revenue.

Marketplaces often face tension when setting their take rate between the short-term and the long-term. A lower commission typically results in more suppliers being willing to be on the platform, which often translates to faster growth. However, it means less revenue per transaction flowing in, and potentially a higher burn. The flip side is that high take rates might mean fewer transactions because fewer suppliers or buyers want to participate, though it could mean more revenue and profit per transaction and in aggregate in the short term.

For unprofitable marketplaces, growing take rates over time is essential to improve revenue per transaction and drive towards profitability as I touched on in pieces about Doordash and Airbnb.

One way to both resolve the short-term vs long-term tension and also to grow take-rates over time is to layer on advertising to the marketplace which is what I’ll go deeper into this time.

Advertising to the rescue

So what does layering advertising on a marketplace mean? It means to supplement the commission-based revenue that marketplaces charge on transactions with ad products that bring in advertising revenue.

Layering advertising to a marketplace typically involves charging suppliers who want additional reach for appearing more frequently in front of the buyers. Given that most marketplaces have aggregated a set of buyers that the sellers want to reach advertising is a natural extension to a marketplace.

Advertising on marketplaces typically takes four common types with most marketplaces supporting multiple of them.

1. Promoted Search Results

In this format, merchants bid for specific keywords on search results and are typically charged on a cost per click basis. In this, advertisers are effectively paying to put their product or service near the top of specific search results.

It is one of the most common formats on marketplaces and some of the marketplaces that adopt this include Amazon, Taobao (Alibaba), Wish, and Etsy.

2. Promoted Listings In Feed

In this format, merchants bid to be shown within a user’s Feed or during the flow of a transaction on a marketplace. Typically, merchants target users based on certain characteristics (prior transaction history on the marketplace, demographics, etc), and marketplaces charge on a cost-per-click basis.

These often work best when users use the marketplace at least occasionally for discovery. It also generally works best on mobile, although is also seen on the desktop often.

Companies that use this include Alibaba, Doordash, and Uber Eats, typically to show suggested products/merchants in the feed on mobile.

3. Display ads

This is similar to in-feed marketing, except that typically advertisers usually pay for these on a CPM basis. These sometimes take the form of banners that direct users to specific products or stores within the marketplace.

It is typically seen on the home screens on Feed or Mobile or the right-hand side on the desktop of marketplaces, with Amazon and Alibaba being two common examples of companies that leverage this.

4. Targeted Offers

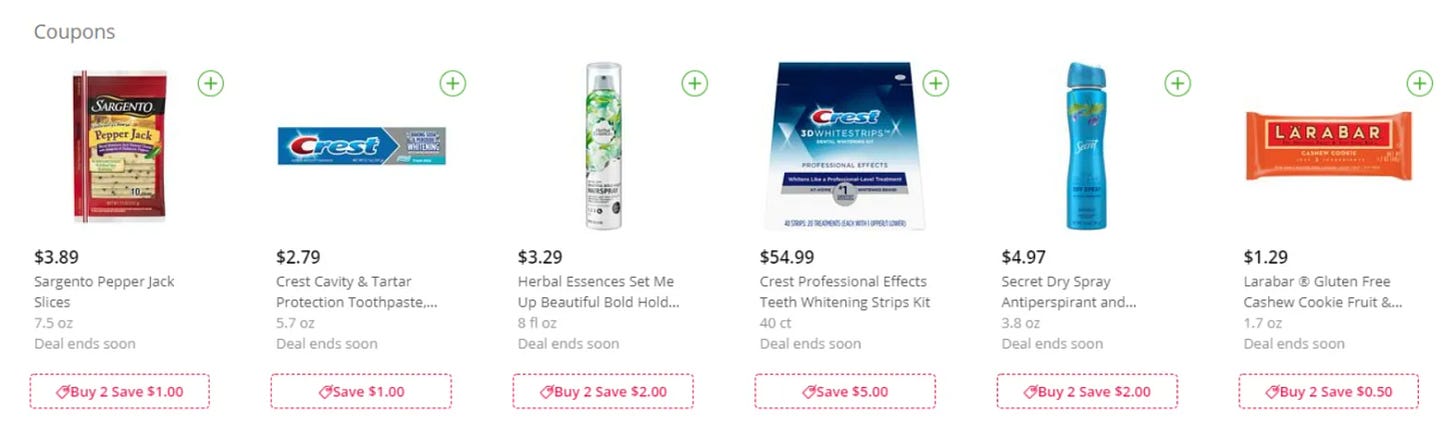

Targeted offers are a type of ad product where merchants provide special offers in the form of discounts, rebates on products or cover delivery fees for typically new users.

Examples of marketplaces that have adopted this include Instacart which allows for merchants to offer coupons and Doordash and Uber Eats which allow merchants to offer discounts to first-time customers of their restaurant.

Benefits of Advertising

Layering on advertising to a marketplace has several benefits.

Raises the effective take rate of the marketplace: The obvious benefit is that advertising provides a revenue stream that grows the effective take rate of the marketplace.

Extremely high margin revenue stream: For commission-based take-rates in the marketplace, there are often some significant costs associated with the transaction. They vary based on the nature of the marketplace, but typically the costs include payment processing fees, insurance, quality control, etc. Meanwhile, the advertising revenue stream tends to have 90-95% gross margins and so often improves the margin structure of the business.

Improves marketplace liquidity: Adding advertising can sometimes help increase marketplace liquidity by making it easier to identify which suppliers have availability to fulfill demand such that they are willing to pay more for the demand.

Allows for some form of price discrimination: Advertising allows for comes the ability to keep the base commission rates the same, but charge additional fees to suppliers who want more demand and are willing to pay more for it. The suppliers who don’t need that demand won’t use it but will still be on the platform vs say if the blanket commission rate was instead higher.

Overall layering on advertising has the ability to reduce some of the negative trade-offs associated with higher take rates mentioned earlier. Using advertising to increase the take rate keeps the take rate for those sellers not interested or not needing to pay for more reach low and keeps them on the platform while allowing for those who want to pay for more reach to pay more and consequently increasing the effective aggregate take rate.

With all these benefits, there are a few things marketplaces should watch out for:

To not hurt the user experience by managing ad load and keeping ads relevant

To ensure that suppliers not paying for ads can still compete on the platform and that new suppliers still see value in the marketplace (since many will first see what results they’re getting before putting money into ads in the marketplace)

Impact of Advertising

We can look at a few existing marketplaces to get a sense of what the incremental impact of advertising is.

As the graph below illustrates, advertising can increase the take rate by 2-4 percentage points. It should be noted that these advertising products are still relatively nascent and their growth can outpace GMV growth for these businesses, meaning the incremental take-rate should increase over time.

The 2-4% increase in take rate typically corresponds to a 15-20% increase in overall revenue coming assuming the platform is also monetizing transactions via commissions. Also even in cases where the incremental revenue may only be 15-20%, the incremental profits can be much higher given the margin structure of advertising. In fact, advertising can often be the lever that makes an unprofitable marketplace a profitable one.

Below are examples of the incremental revenue from advertising for some marketplaces:

Alibaba: Alibaba operates two eCommerce marketplaces, Taobao and Tmall. On Taobao, Alibaba doesn’t charge any commissions on transactions but instead makes all its revenue through advertising. It was one of the reasons they were able to win out and bring on so many merchants onto the platform. On Tmall, Alibaba commissions range from 0.3-5% depending on the product category. Alibaba in aggregate generates roughly ~1% of GMV as commission and 2.4% of GMV through advertising. Its advertising revenue is actually a >$20B business which corresponds to over 70% of its overall marketplace revenue!

Etsy: Etsy introduced Etsy Ads, which offer promoted listings which helped grow its take rate. Currently, it generates 12.4% in core commissions and an additional ~4.2% through advertising.

Wish: Wish has an advertising product called Productboost, which allows sellers to drive additional reach for their products. It is used by 30% of merchants, indicating just how broadly used and important advertising can become for merchants. It generates roughly 16% of its overall marketplace revenue from advertising, indicating an advertising take rate of roughly ~2-2.5% of GMV.

Amazon: Amazon made ~10-12B from advertising in 2019, and that number is close to $20B in 2020. While Amazon’s core transaction revenue of $54B on ~$200B of GMV in 2019 represents a take rate of almost 24%, it includes revenue from fulfillment and other services that have high costs associated with them. Advertising adds an estimated 5.5% of GMV in high margin revenue to its take rate.

Note that while I’ve used some eCommerce examples above because it was possible to triangulate it from filings, this is by no means limited to those marketplaces. Doordash, Uber Eats, Instacart, OpenTable, and Houzz are just a few other marketplaces that offer advertising.

Thanks for reading! If you liked this post, give it a heart up above to help others find it or share it with your friends.

If you have any comments or thoughts, feel free to tweet at me.

If you’re not a subscriber, you can subscribe below. I generally post once a week or every other week on Monday about things related to technology or business.