Making sense of the stock market

Last week, the S&P500 hit all-time highs and is now up over 50% from March lows. With the unemployment rate still at a staggering 10.2% and countless small businesses shutting down over the country, an obvious question to ponder is why there is such a disconnect between the economy and the stock market, and whether we’re in the midst of some kind of bubble (brought about by Robinhood day traders of course…).

While it is certainly possible that the stock market has run up too much, it’s worth considering the reasons why its current levels might not be crazy, a few of which I present below.

The stock market is not the economy

The S&P index is a market-cap weighted index of 500 companies, which naturally tends to be the larger companies in the US. Some of them were hurt by the pandemic, but in aggregate it’s possible that they were hurt less than small businesses were and may even benefit coming out of the pandemic through reduced competition from the SMBs. Think about the big box retailers vs the mom and pop stores.

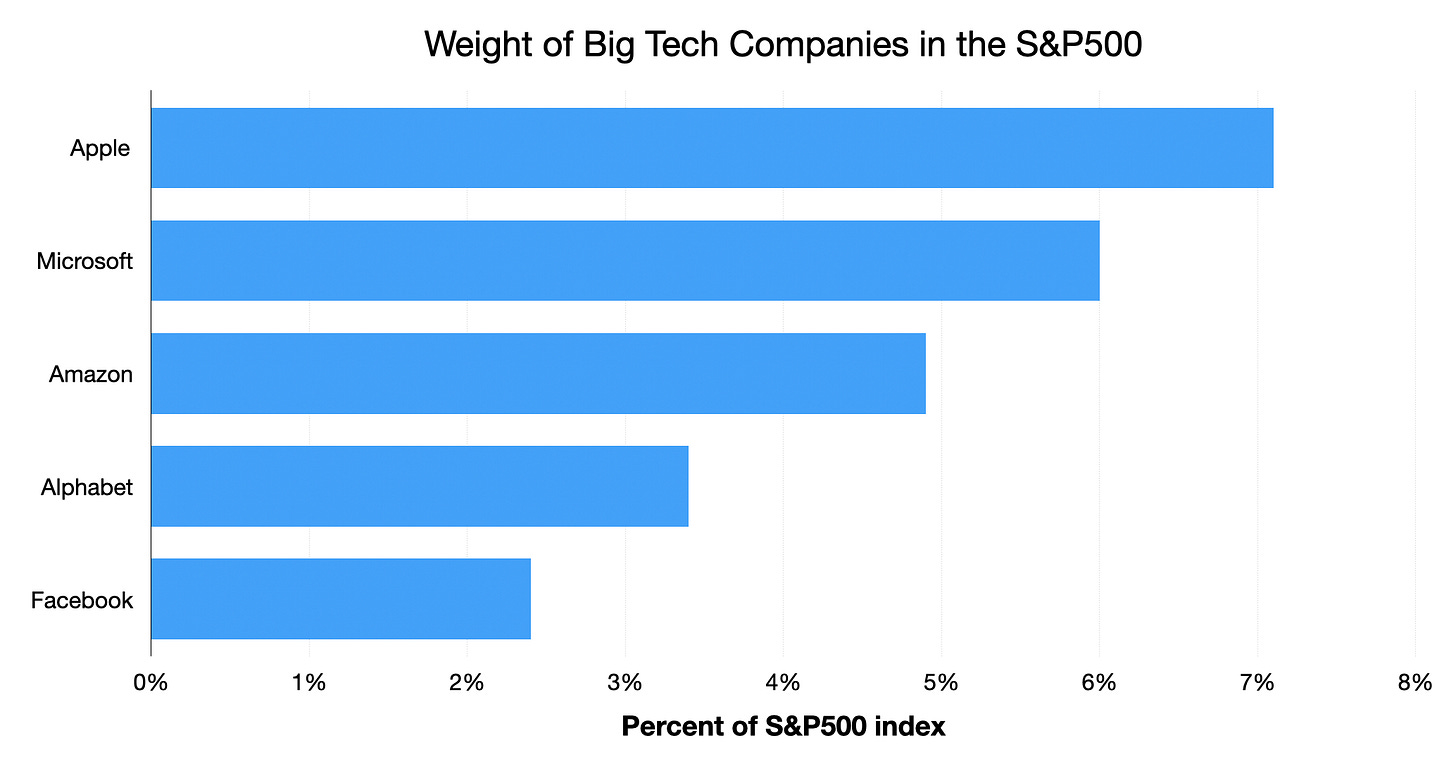

In addition, since the S&P is market-weighted it’s hard to ignore that ~23% of the index is accounted for by just five companies: Apple, Microsoft, Alphabet, Amazon, and Facebook. The crisis has led to an acceleration in e-commerce, digital transformation, and an increase in screen time which has helped these companies. Irrespective of what’s happening in the surrounding economy, that has meant that the index has also been pulled up given the disproportionate weight they have in the index.

The stock market is forward-looking

Stocks are valued on the basis of future cash flows/earnings, and one simple but imperfect gauge of what investors are willing to pay for the index is the P/E ratio of the index as a whole. At the start of 2020, the stock market traded at a P/E ratio of ~25, implying that investors were willing to pay ~25 times 2019 earnings for the index.

Now, ignoring everything else, let’s consider a simple thought experiment. What if we say that during COVID and its recovery, the index will have earnings of zero. And let’s say this period lasts for 3 years (2020, 2021, 2022), and after that things go back to normal, and the earnings return to the expected levels.

If someone were willing to pay 25x 2019 earnings and then COVID hit, they lose out on 3 years of earnings, and so in some sense, they now would want to pay 22x of those 2019 earnings for the index, which implies a drop of ~12% in the index, not the 40% that it was down by in March.

Note that today the P/E ratio of the index is ~30.1X, but if earnings are clearly temporarily depressed in the next year or two given COVID-19, then the ratio as it currently does not mean much.

Interest Rates affect the stock market

In the previous thought experiment, we ignored everything else and only considered how the free cash flows are zero for 3 years, which would imply a drop of 12% in the index. But a more precise way to value a company would be to value all its free cash flows discounted to the present, as below.

Given the formula below, one can see that a lower discount rate will lead to a higher firm (and consequently index value). And that’s exactly what happened.

In 2020, the risk-free rate was ~2.3% and the market risk premium (the excess returns the stock market must give investors given the excess risk over a risk-free asset) was ~5.5%. That gives a discount rate of 7.8%.

Now, when COVID-19 hit, the Fed acted swiftly, dropping the federal funds rate, which in turn reduced the risk-free rate, which is currently ~1.5%. That implies that the new discount rate is ~7%, assuming the risk premium is constant.

If free cash flows are discounted at 7% instead of 7.8%, that stream of cash flows becomes more valuable. This means the value of companies and correspondingly of the index is higher when discount rates are lower. The 7.8% to 7% drop in the discount rate, given no changes in cash flows, leads to an increase in the value of firms by ~12%.

Combining this increase in value with the thought experiment above, it’s not crazy to see the stock market in aggregate back to January levels.

Obviously, these are just some of the factors affecting the index and there are numerous others such as the large stimulus to individuals and businesses and the changing supply and demand for the index as investors seek returns, but it’s helpful in providing a sense of whether the stock market is being completely absurd, which in my opinion is not really, despite appearing as such.

Thanks for reading!

If you liked this post, give it a heart up above to help others find it or share it with your friends and if you have any comments, feel free to tweet me.

If you’re not a subscriber, you can subscribe below. I generally post once every other week on things related to technology or business.

Goes without saying that none of this should be viewed as investment advice.

this is an awesome, not pretentious analysis :) thanks for writing it up

I read Nathan Tankus's piece today on separating risk-free rates, hurdle rates, and discount rates: https://nathantankus.substack.com/p/low-interest-rates-dont-drive-market

Do you think your analysis is in direct opposition to his? Or do they coexist?