Lessons from Jim Simons

On the Magic of Rentech's Medallion Fund

Hi friends,

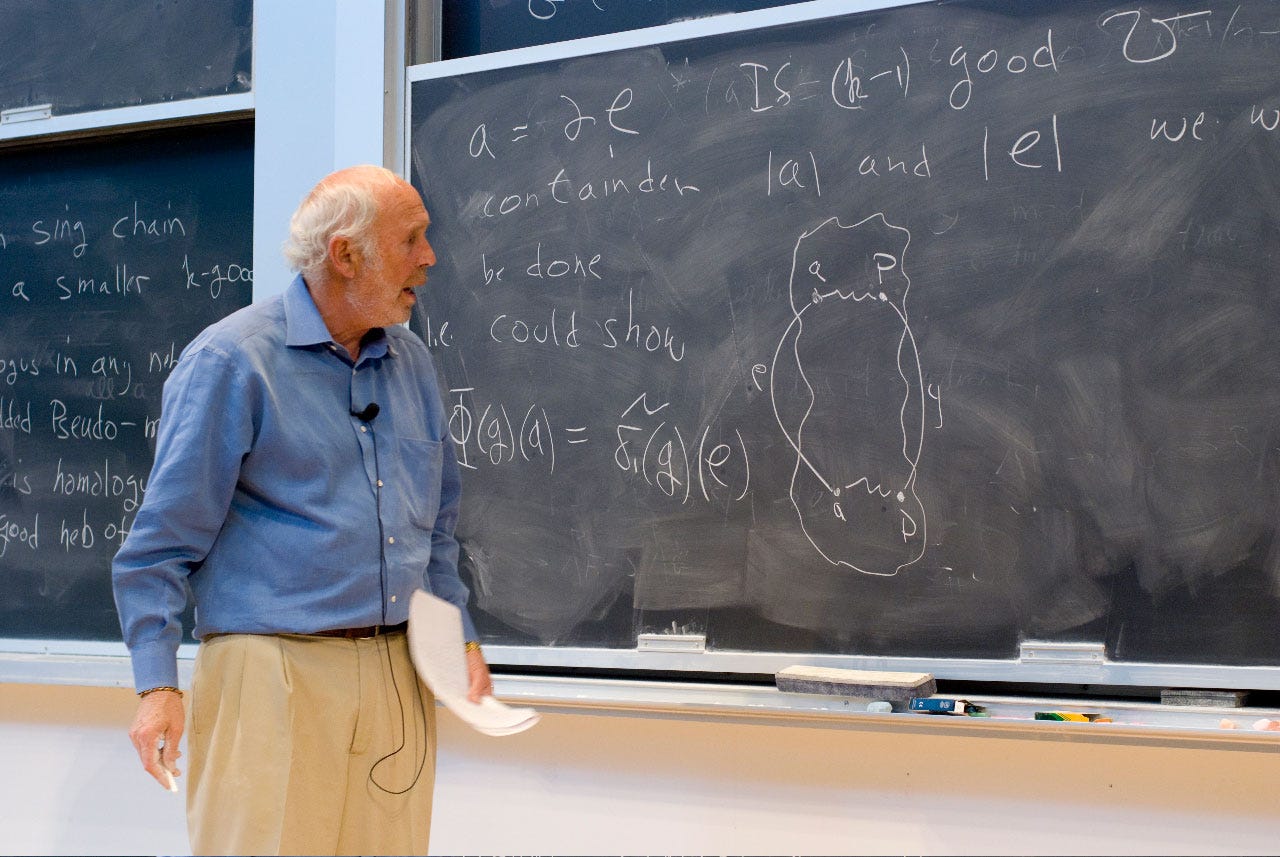

Jim Simons, the founder of the hedge fund Renaissance Technologies and a notable philanthropist passed away last week. He described his life as:

”I did a lot of math. I made a lot of money, and I gave almost all of it away. That's the story of my life.”

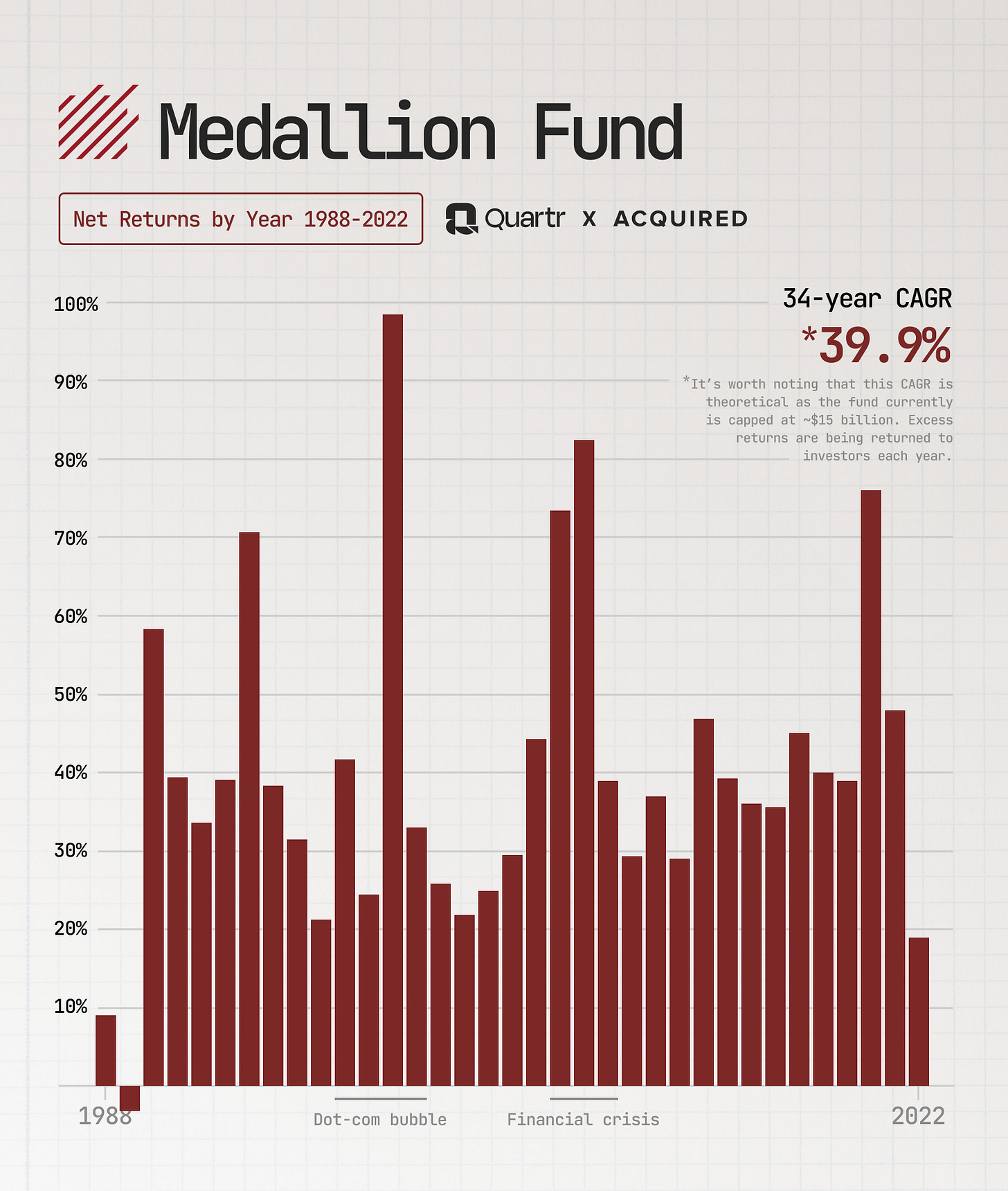

Jim started Renaissance Technologies (“Rentech”) in 1980s, applying his mathematical background to the financial markets. Since inception, it has been one of the best performing hedge funds ever, earning an average annualized return of 40% net of fees and and over 64% gross across a period of over 30 years.

This week, in the same vein as pieces I’ve written in the past on Bezos, Buffett, Musk, and others, I’m going to share some of the lessons from his career. These are largely based on my highlights from the book, The Man Who Solved the Market, and a few talks that Jim has given.

Hire great people and let them flourish

Jim took hiring extremely seriously and famously rather than hiring Wall Street types, instead chose to hire talented mathematicians and other scientists. He believed that these people could learn the finance industry and use their quantitative chops to continue to find new strategies and approaches that would help generate alpha in the markets.

Nick Patterson at Rentech encapsulated it this way: “We can teach you about money… we can’t teach you about smart.”

He also created an environment where they were given a lot of responsibility, and rewarded well. Rentech had a flat organization structure where new ideas were encouraged, and people were given generous profit sharing.

Interestingly, even though Rentech stopped accepting outside capital in 1993 and most of the capital is prior and current employees, it’s 5/44 fee structure, which is one of the highest in the industry, basically represents a form of redistribution of returns from prior employees who may have retired, to younger, newer employees who are still at the firm and still generating the returns.

Jim Simons when talking about his biggest contribution at Rentech called this out.

“My biggest contribution was to hire great young people into the business. We have great leaders, and they carried on. They haven’t missed a beat.”

His advice on creating what he had was to “hire the very best people you possible can … And then, let them carry the ball”

And indeed on Jim himself, an employee summed it up well:

“It’s not his genius. It’s his ability to manage genius.”

Look for Beauty

Despite what seems as a very complicated undertaking of using models to predict markets, there was a sense of beauty and simplicity to what Rentech did, at least in their eyes, as a team of mathematicians and scientists.

The search of beauty and structure in the noise of the financial markets is in some ways what inspired Jim to start Rentech. He was always looking to find that structure and beauty where others saw noise, and believed it was possible with financial markets.

“Simons concluded that markets didn’t always react in explainable or rational ways to news or other events, making it difficult to rely on traditional research, savvy, and insight. Yet, financial prices did seem to feature at least some defined patterns, no matter how chaotic markets appeared, much as the apparent randomness of weather patterns can mask identifiable trends. It looks like there’s some structure here, Simons thought. He just had to find it.”

Even as Rentech continued to operate, they continued to try to simplify their approach to seek the beauty in the data. For instance, while they initially had a number of models and systems, over time they moved to a single system that could meet all their trading requirements.

“Their inputs were the fund’s trading costs, its various leverages, risk parameters, and assorted other limitations and requirements. Given all of those factors, they built the system to solve and construct an ideal portfolio, making optimal decisions, all day long, to maximize returns. The beauty of the approach was that, by combining all their trading signals and portfolio requirements into a single, monolithic model, Renaissance could easily test and add new signals, instantly knowing if the gains from a potential new strategy were likely to top its costs. They also made their system adaptive, or capable of learning and adjusting on its own, much like Henry Laufer’s trading system for futures. If the model’s recommended trades weren’t executed, for whatever reason, it self-corrected, automatically searching for buy-or-sell orders to nudge the portfolio back where it needed to be, a way of solving the issue that had hamstrung Frey’s model.”

They also tried to remain guided by the data, and on seeking out patterns and anomalies in data rather than trying to theorise whythey made sense. For them, the beauty was in the structure identified in the data, and that was enough.

“Simons and his researchers didn’t believe in spending much time proposing and testing their own intuitive trade ideas. They let the data point them to the anomalies signaling opportunity. They also didn’t think it made sense to worry about why these phenomena existed. All that mattered was that they happened frequently enough to include in their updated trading system, and that they could be tested to ensure they weren’t statistical flukes.”

For most other people, looking for beauty probably looks pretty different, but it is good advice nonetheless.

As Jim once shared in a talk:

“Be guided by beauty . . . it can be the way a company runs, or the way an experiment comes out, or the way a theorem comes out, but there’s a sense of beauty when something is working well, almost an aesthetic to it.”

Think Differently

Simons excelled by doing what others weren’t. He famously noted:

"Do something new; don't run with the pack. I am not such a fast runner. If I am one of N people all working on the same problem, there is very little chance I will win. If I can think of a new problem in a new area, that will give me a chance."

This philosophy drove him to explore mathematical models in financial markets—a stark departure from conventional stock market analysis. This was met with skepticism from industry insiders who relied on other methods at the time.

"Simons and his colleagues ignored the basic information most investors focus on, such as earnings, dividends, and corporate news... Instead, they proposed searching for a small number of 'macroscopic variables' capable of predicting the market’s short-term behavior."

Even as others thought there was no edge to be found or the idea didn’t make sense, Jim had strong conviction, and sought out others who were talented that he could convince of the same.

Hope for Luck

People tend to underestimate luck, unless it works against them. In a speech where he talked about his life, one of the lessons Jim shared was “Hope for good luck”.

He acknowledged that he’s been lucky a number of times throughout his life, noting:

People underestimate its importance except when things go badly. Then they’re very happy to ascribe it to bad luck, which it may be, of course. One has to recognize that luck plays a meaningful role in everyone’s lives. You get born to decent parents in a good part of the world, and you’re way ahead of the game. And that certainly doesn’t have much to do with skill or hard work. In my case, I was lucky to collaborate with some very good people when I was doing mathematics. I was also lucky in my choice of partners at Renaissance.

Thanks for reading! If you liked this post, give it a heart up above to help others find it or share it with your friends.

If you have any comments or thoughts, feel free to tweet at me.

If you’re not a subscriber, you can subscribe for free below. I write about things related to technology and business once a week on Mondays.