This is a weekly newsletter about the business of the technology industry. To receive Tanay’s Newsletter in your inbox, subscribe here for free:

Hi friends,

Last week, I suggested that Klaviyo and Instacart were 2 of 5 potential companies that could follow Arm in filing to go public soon. Four days letter, much sooner than I would’ve thought, both of them released their S-1 filings.

S-1s are the first time the public gets a reasonably full picture of a business. Every business offers some lessons, which is why I enjoy going through them.

This week, I’ll break down Klaviyo’s filing, and get around to Instacart and Arm in future weeks. I’ll discuss a few things about Klaviyo:

Product and Market

Financials and Metrics

The Shopify Relationship

Bootstrapping and Efficiency

Valuation

Product and Market

Klayivo is a marketing automation platform that helps predominantly retail and eCommerce businesses to drive revenue growth through digital channels such as email and SMS.

Klaviyo started in 2012 and initially focused on email marketing, aiming to make it easy for brands to bring their first-party data together and use it to create personalized marketing emails.

The product has evolved over the years, but the thesis was to vertically integrate the data layer (collecting and keeping first-party user data) and the application layer (sending of emails) so that you could use the intelligence derived from the former to create and personalize the latter

Three important aspects about Klaviyo’s product stand out:

Vertical Integration: Klaviyo’s platform tightly integrates the data layer and the application layer for improved intelligence and attribution when it comes to marketing automation. The data store supports integrations with 300+ sources and was built from scratch to store user profile data about Klaviyo’s customer’s users which can then be used to inform segmentation, targeting and personalization. This is then used by the application layer, today, a marketing application, to easily use that data to track customer behavior, create targeted campaigns and analyze those campaigns.

Multi-channel: While Klaviyo started off focused on email campaigns, it has expanded beyond that to support other channels such as SMS, Push notifications and has also launched products such as reviews and a CDP. Given their data-forward vertical integration, this makes a lot of sense, since using marketers expect to be able to reach customers multi-channel and Klayvio can leverage the data that they have stored on behalf of their customer to help them do so. Already today, 15% of their customers use the SMS channel.

Intelligence: The vertical integration discussed above also allows for Klaviyo to build in intelligence into the product. They support predictive analytics using ML on the ~7B user profiles stored in the platform and can flag things like churn risk to their customers.

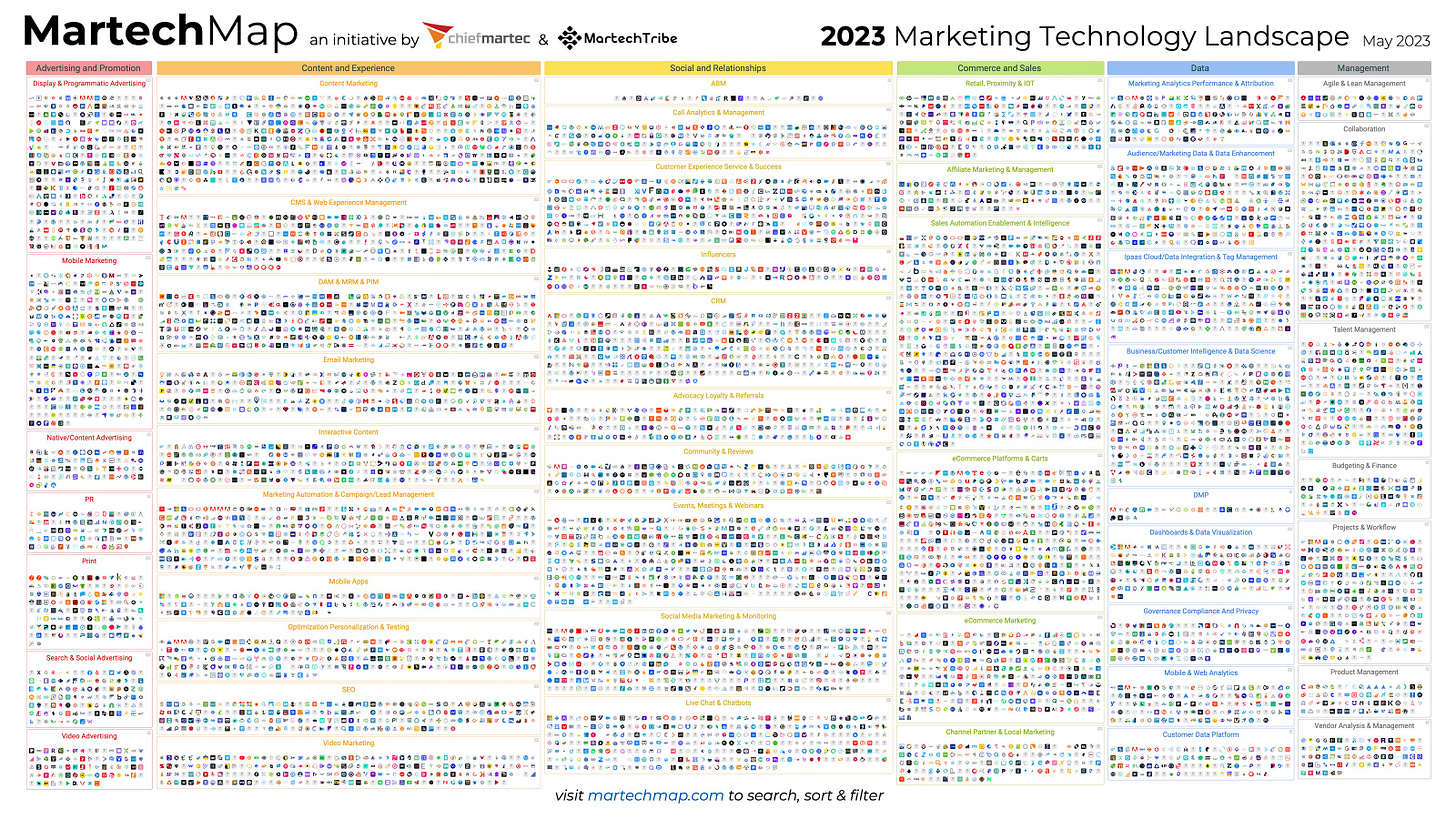

In terms of the market, Martech is seen as a very very competitive and noisy industry with many point solutions and platforms available, as the graphic below which has become somewhat of a meme shows.

But Klaviyo, with its focus on B2C companies, especially those in retail and eCommerce, has managed to cut through the noise and create a compelling platform. They have been able to grow and scale despite competition from companies such incumbents in the category such as Mailchimp (acquired for $12B at ~$800M of revenue in 2021), Adobe, Hubspot, Salesforce which all have a version of a solution in this space, and eCommerce focused upstarts such as Attentive (sms focused) and Omnisend.

Financials and Metrics

Klaviyo’s numbers are quite strong both from a top-line and bottom-line perspective when compared with other public SaaS companies.

Revenue and Growth: They generated $585M in revenue over the last 12 months, with revenue growth of 57%. In the most recent quarter, they made $164M in revenue growing ~50% y/y, implying an annualized revenue run-rate of ~$655M.

Retention and Churn: Klaviyo’s net dollar revenue retention is 119%, which is well above the median and more like top quartile for a public application company in today’s environment. Their gross revenue retention was 87%, which is quite reasonable given that their customers skew smaller.

Margins and Profitability: Klaviyo’s gross margins were 76% in the first half of 2023 and have been rising steadily, up from 70% the previous year. While that’s a bit on the lower side relative to other software companies given that they have larger costs related to data storage/processing as well as sending emails and SMS. In fact, it’s higher than peers such as Braze which is ~69%. Klaviyo was profitable in the first half of this year, with operating margins of 2.5%, which frankly is still quite rare for companies growing as fast as they are. They were also free cash flow profitable, with an 8% FCF margin in the last twelve months.

Customers and ACVs: Klaviyo has 130,000 customers, almost all of whom are in retail and eCommerce which drives 95% of their revenue. If you use the annualized run rate number to calculate ACV, you get an ACV of ~$5K/yr. Klaviyo has been making a move upmarket, and now has 1458 (1.1% of total) customers generating >$50K in ARR, which grew 94% y/y, much faster than the overall business.

The Shopify Relationship

One of the takeaways from Klaviyo’s S-1 is the importance of Shopify to the success of Klaviyo.

As of the end of 2022, 77.5% of Klaviyo’s ARR came from customers on Shopify.

Not all of that revenue originates from the Shopify App Store today, with approximately 10.6% of the new ARR being driven directly through customers who came to Shopify from the App Store. Of course, Klaviyo is available on other eCommerce platforms, but in some sense, it is one of the examples of a successful company built on the back of the Shopify ecosystem.

Klaviyo entered into a strategic partnership with Shopify in mid-2022, which involved:

Revenue sharing: Shopify will provide marketing services to Klaviyo in exchange for a share of Klaviyo's revenue (paid via the common stock warrants below), for a 7-year period. Klaviyo is the recommended solution for Shopify Plus customers globally under their partnership, and so Shopify helps promote its brand by referring new customers. This is a bit awkward in that Shopify has a first-party email product that competes with Klaviyo.

Common Stock Warrants: Shopify was issued warrants at $0.01 per share to purchase 15M units of Klaviyo stock, vesting over 5 years. The fair value of the warrants is ~$370M, which gets expensed as sales and marketing over a 7-year period, meaning that ~$50M/yr of Klaviyo’s marketing expense is tied to the Shopify partnership.

Stock Purchase Agreement: Klaviyo issued and sold ~3M shares of common stock to Shopify Strategic at market value ($34/share), which also has the option to purchase additional shares at a fixed price until 2030.

The net is that Shopify has an 11.2% stake in Klaviyo, with the option of buying more as discussed above.

PLG done right

Klaviyo is an example of a company executing a product-led growth motion well, in a market that isn’t necessarily the easiest to do so. While martech doesn’t exactly have the traditional word of mouth or virality that some categories may have and can be difficult to be set up and see value from, Klaviyo has done a good job offering a product with fast-time-to-value and clearly attributed value (via a measure they call Klaviyo Attributed Value), which can be set up with none to limited salespeople.

Klaviyo attracts the majority of new customers through inbound channels, such as word-of-mouth, agency partnerships, and platform integrations. Many customers come through these channels and are up and running completely without any involvement of sales. Over the past few years, Klaviyo has started to grow a sales team that focuses on larger accounts.

This motion has enabled Klaviyo to get to 130K customers, with average ACVs of ~$5K in a relatively efficient manner. Today, Klaviyo has a CAC payback period of 14 months.

It’s worth touching on some of these partnerships and integrations which are large inbound channels:

Platform Integrations: Aside from Shopify, which is a key driver of self-serve and leads, Klaviyo also has integrations with other third-party eCommerce platforms, such as BigCommerce, Centra, Magento, Nuvemshop, PrestaShop, Salesforce Commerce Cloud, Square, Wix, and WooCommerce and gets self-serve/leads via their app stores. They are also expanding into other markets with integrations with Mindbody (fitness), Olo (food) and others.

Agency Partnerships: Klaviyo has built a deep community of digital marketing agencies, freelancers, and other consulting partners who recommend their clients use Klaviyo to design, run, and measure their marketing campaigns. In 2022, more than 5,000 unique marketing agencies and consulting partners referred leads to Klaviyo.

Bootstrapping and Efficient Growth

Founders Andrew Bialecki and Ed Hallen started Klaviyo in 2012, and bootstrapped the company for the first 3 years, raising a seed when they already had over 100 customers. Efficiency and running lean was part of their DNA, and co-founder and CEO Andrew Bialecki notes:

The fact that we were bootstrapped and had run lean, it was in our culture.

Even as they’ve grown, they’ve stayed relatively efficient and you see that in the metrics:

Net Burn: Klaviyo has raised ~$455M in primary financing, but only burned ~$15M of that.

Rule of 40: Their rule of 40, a measure of efficiency and growth, is ~65%. The median for a public SaaS company is 29%, per Meritech, and only 2 of the ~100 companies they track are higher than 65%. That puts Klaviyo’s efficiency well within the top 3-5% percentile of public SaaS companies.

Implied ARR/FTE: Klaviyo has ~1548 FTEs, putting their implied ARR/FTE ratio at $425K. That is also in the top 20% of public SaaS companies.

The net of this is that co-founder and CEO Andrew Bialecki owns 38.1% of the business, and co-founder and CPO Ed Hallen owns 13.1% of the business.

It’s quite rare for any founder to own 38.1% at IPO for a business at this scale, especially these days. In fact, the only few I can think of with that kind of ownership at IPO in venture-backed companies are Bill Gates and Jeff Bezos who owned just under 50% of their companies at IPO and the two Atlassian founders Mike Cannon-Brookes and Scott Farquhar who each owned 37.7% of Atlassian at IPO.

Conclusion and Potential Valuation

Klaviyo is one of the leaders in martech, especially in eCommerce, and has built an efficient business that stacks up well metrics-wise. Martech has always been a very competitive category and continues to be so, but Klaviyo has found a segment, product, and GTM motion that is able to resonate with that segment.

While questions around competition and the ability to truly go beyond eCommerce (only 5% of their revenue is outside of retail/eComm) will remain, the public markets in this environment should appreciate Klaviyo’s efficient growth model.

For a rough sense of valuation, we can look at a few comps such as Braze and Hubspot, which are its closest peers from a category standpoint. Klaviyo fares better than them growth-wise, and so may earn a slightly higher multiple.

We can use either EV/next 12 months revenue or EV/Implied ARR to get a rough sense. On an EV/Implied ARR basis, Hubspot trades at 11.2x and Braze at 9.2x. I view Braze’s multiple as a rough floor here, and so think that the valuation range for Klaviyo could be 9-12x implied ARR of $655M, which puts it at an Enterprise Value of ~$6-8B. We’ll see how markets react though!

Congrats to the Klaviyo team on building a great business!

Thanks for reading! If you liked this post, give it a heart up above to help others find it or share it with your friends.

If you have any comments or thoughts, feel free to tweet at me.

If you’re not a subscriber, you can subscribe for free below. I write about things related to technology and business once a week on Mondays.