This year, J.P. Morgan CEO Jamie Dimon wrote about the competitive threat of fintech companies to banks in his shareholder letter.

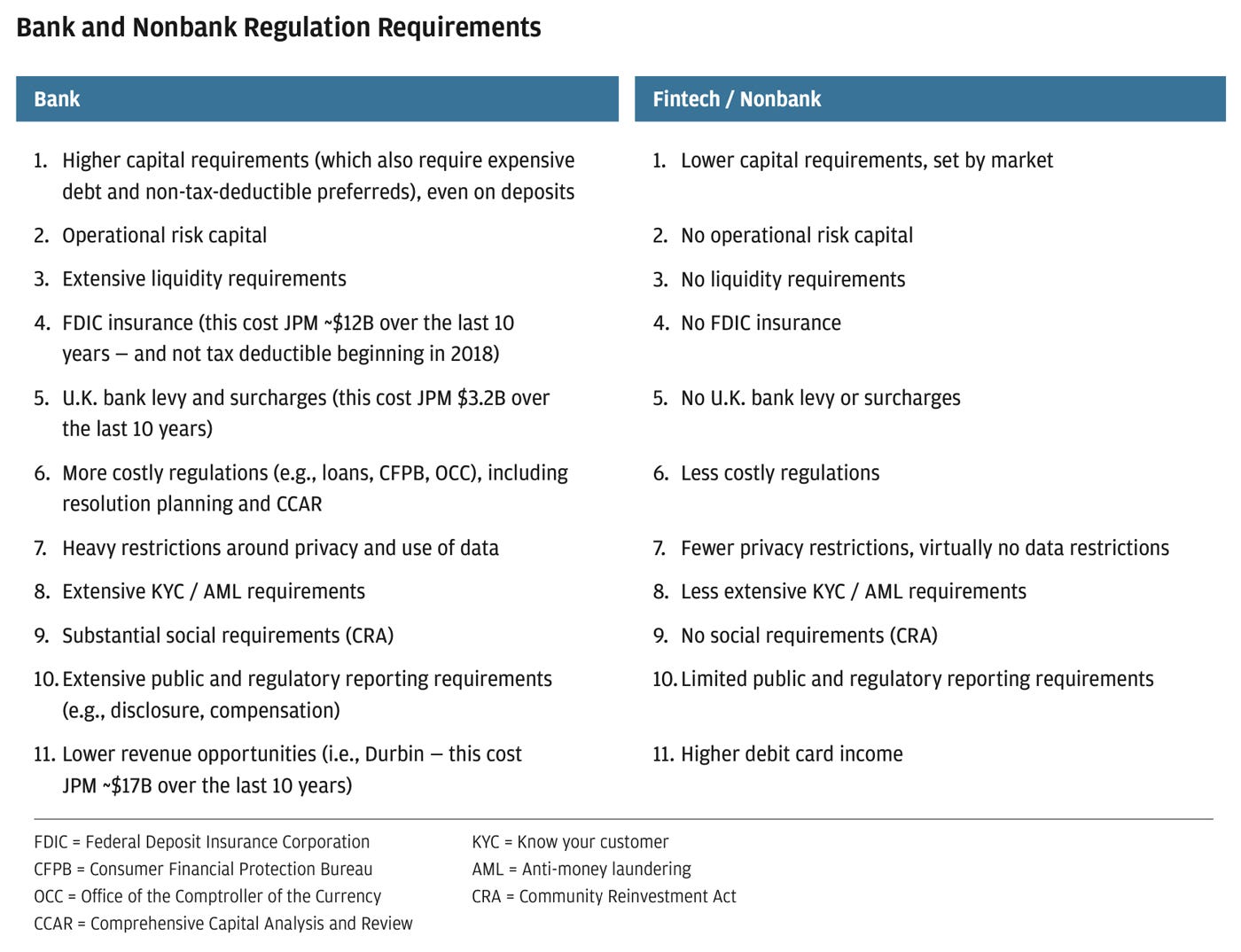

In it, he also highlighted some of the differences between banks and nonbank fintech startups from a regulatory perspective, and how that plays a role.

While a lot of the regulatory differences are related to capital, liquidity, and risk requirements, I think the lower revenue opportunities point called out below is particularly important.

In this piece, I’ll go into more depth into that and on how regulatory arbitrage is key for fintech startups. I’ll cover:

What is the Durbin Amendment

Arbitraging the Durbin Amendment

Closing Thoughts and Response From Big Banks

Durbin Amendment

The Durbin Amendment, named after the Illinois Democratic Senator Dick Durbin, was an extension within the Dodd-Frank Act that passed in 2011 which capped the interchange fees that banks could charge merchants on debit card transactions.

Before the Durbin Amendment, banks made approximately 44 cents per debit card transaction in interchange fees. Many businesses believed that this was an egregiously high number, especially given that in a debit card the risks of non-payment are lower.

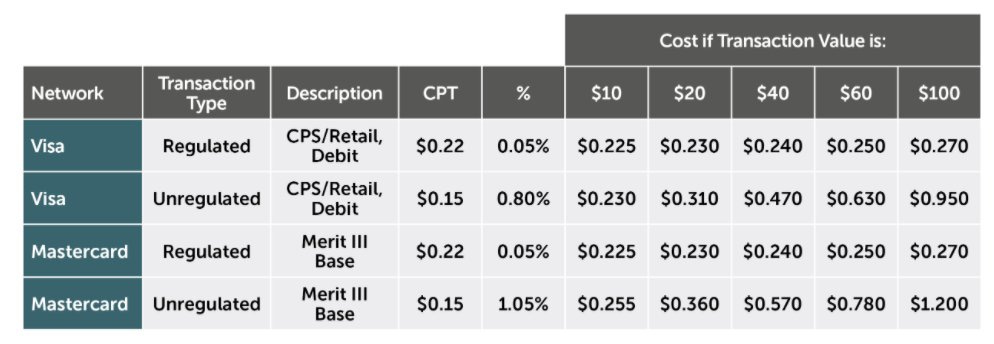

The Durbin Amendment sought to reduce these fees and changed the structure such that banks could only charge interchange fees of a cap of 21 cents plus 0.05% of the transaction (and an additional 1 cent to account for fraud protection costs).

However, there was an important exception: this cap only applied on debit cards issued by banks with over $10B in assets. This exclusion of smaller banks was meant to protect the regional and community banks and allow them to continue to have that revenue stream.

In essence, the Durbin Amendment led to a two-tiered interchange fee model on debit card transactions:

For banks with >=$10B in assets: there is a cap of 21 cents plus 0.05% of the transaction

For banks with <$10B in assets: can charge pre-Durbin rates of up to 0.80%-1.05% plus a $0.15-$0.20 transaction fee.

The immediate impact of this was that it led to a reduction in debit card interchange revenue and profit for big banks, even as they tried to pass on some of the costs to the consumer and removed debit card reward programs.

The impact to merchants is more complicated - many merchants benefited, but small merchants that have many small transactions might have been worse off. The reason for that is that given the “caps” the banks try to charge the amount up to the cap on each transaction, leading to high “fees” as a percentage on small-dollar value transactions (i.e., a $3 cup of coffee might have a 22 cent fee, but a $100 transaction might have a 27 cent fee).

Arbitraging the Durbin Amendment

When the Durbin Amendment was passed, and the exceptions laid out, fintech companies and neobanks were the last things on people’s minds. In 2011, they had just barely begun to crop up, if at all.

But fast forward a decade, and the asymmetry brought about by the Durbin Amendment is critical to most fintech companies and neobanks.

Many of these companies offer debit cards as a financial product (even some that offer “charge” cards or expense cards that appear like credit cards are actually debit cards). In addition, most of these companies are not banks themselves, and typically partner with an existing bank.

The Partnerships

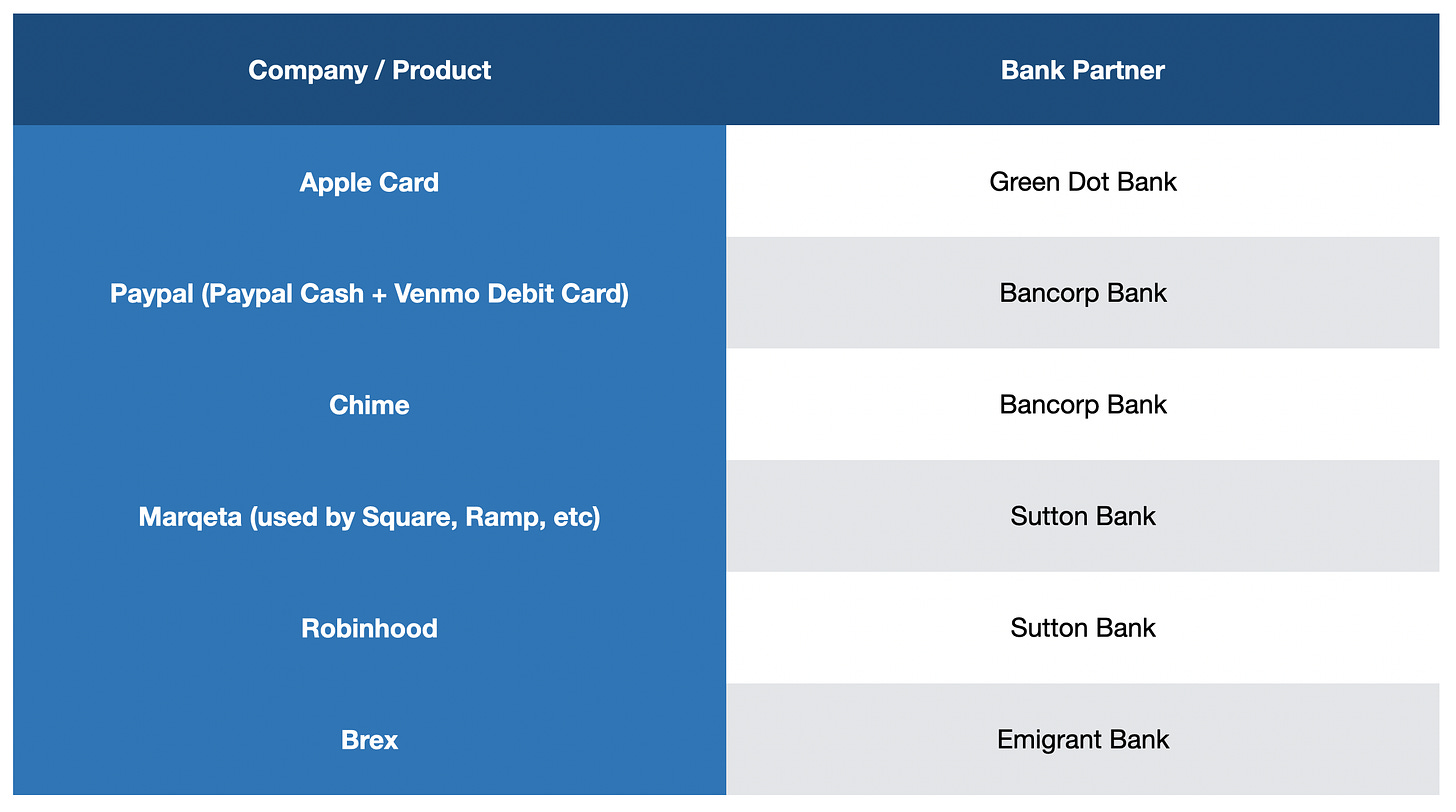

And they don’t partner with just any bank. These companies have partnered with a bank with <$10B in assets when issuing the debit card so that they can still charge higher interchange fees and are exempt from the Durbin Amendment.

Some of the popular banks of choice for these tech partnerships include:

Bancorp Bank in Delaware (<$7B in assets)

Green Dot Bank in Utah (<$3B in assets)

Sutton Bank in Ohio (<$1B in assets)

Emigrant Bank in New York (<$4B in assets)

Below is an overview of some of the bank partners of notable fintech card products.

The Economics

So, companies like Square, Paypal, and Chime can earn higher interchange fees than they might have had the Durbin Amendment applied to them.

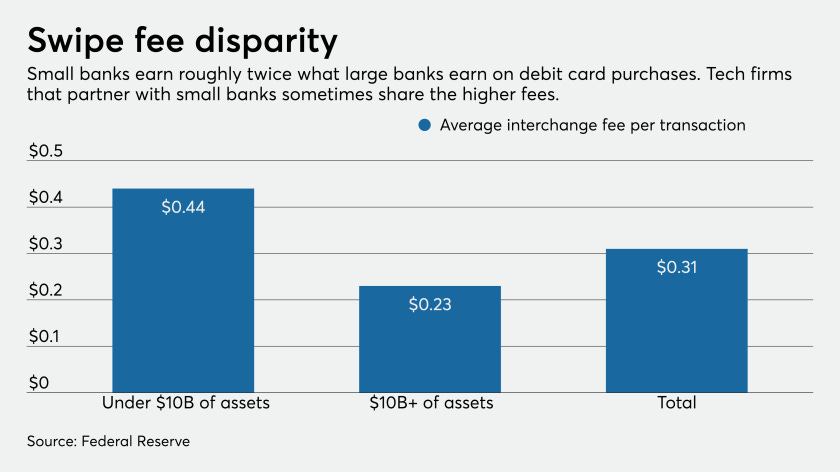

Data from the federal reserve shows that the average interchange on Durbin-exempt bank-issued cards is 44 cents per transaction, almost double that of transactions on debit cards issued by bigger banks.

Jamie Dimon brought up this point in his shareholder letter:

“And because of the Durbin Amendment, if a bank has a customer with a small checking account who spends $20,000 a year on a debit card, the bank will only receive $120 in debit revenue – while a small bank or nonbank would receive $240. This difference may determine whether you can even compete in certain customer segments. It’s important to note that while some of the fintechs have done an excellent job, they may actually be more expensive to the customer”

Marqeta’s S-1 filing (my breakdown) also brought to light that the costs involved to partner with these banks are fairly minimal: the issuing bank typically gets a fee of ~0.03% of transaction volumes while the company itself can get 0.8-1%.

The Impact

The higher economics that some of these firms make on a customer relative to what big banks might make on the same customer has a few major effects:

These startups can spend more on acquiring the same customer because the customer is more valuable to them than to big banks.

These startups can profitably serve some customer niches which may be unprofitable for big banks to go after given the difference in revenue opportunity alone.

These startups can make their product more compelling to customers by leveraging the higher interchange and passing it back to customers in the form of reward programs, early pay-outs, and other features.

These startups can spend more on R&D, customer service on a per-customer basis relative to big banks, since they can spend more to serve these customers.

In practice, we see a mix of all of these being carried out in some shape or form. Examples include Square’s cash card using “boosts” and Chime allowing users to receive their paycheck early.

Note that I’m not saying that all of these are only possible just because of the exemption from Durbin Amendment. In fact, these companies have many other advantages including:

Being tech-native and not having expensive physical footprints to maintain

Having built-in distribution or user bases that lowers acquisition costs

Having existing infrastructure that allows them to launch some of these offerings faster and cheaper.

However, the fact remains that the Durbin amendment means that they can do even more on all these things above relative to big banks, just because of the economics of customers to them relative to big banks.

Closing Thoughts

One could make the case that a new fintech startup getting off the ground should benefit from the higher interchange since they are essentially like the “small banks” exempt from Durbin.

But Paypal and Apple which have almost an order of magnitude more than $10B in assets probably were likely not whom regulators had in mind when they set forth the exemptions.

One of the other dynamics is that for many fintech companies that monetize via debit cards, a path to acquisition by these big banks is essentially not realistic because their revenue would get cut in half if they were acquired by a big bank and were no longer under the exemptions.

Big Banks have also been fighting back through The Clearing House, meeting with the Federal Reserve this past December to discuss the issue.

They contend that current regulations:

Create an uneven regulatory playing field that unfairly disadvantages large financial institution debit and prepaid card issuers that are ineligible for the small issuer exemption (both directly and through relationships with small financial institutions) relative to similarly-sized non-bank competitors.

They propose that to qualify for the exemption:

All customer deposits should be held at the partner bank. Today, most of the fintech companies only hold a small amount with the partner bank.

The combined assets of the issuer and the third party (in case of partnerships) be less than $10 billion. This would mean that companies like Apple and Paypal would not have the exemptions apply to them.

It will be interesting to see how this plays out, and particularly whether some of the larger companies with fintech offerings such as Square, Paypal, and Apple can continue to have an advantage over “banks” through this regulatory asymmetry.

Additional Reading

J.P Morgan Annual Shareholder Letter by Jamie Dimon

Impact of Durbin on Small Ticket Transactions by Cardfellow

Data on Interchange Fees by Federal Reserve

Thanks for reading! If you liked this post, give it a heart up above to help others find it or share it with your friends.

If you have any comments or thoughts, feel free to tweet at me.

If you’re not a subscriber, you can subscribe below. I write about things related to technology and business once a week on Mondays.