FIGS and Successful DTC Companies

Hi friends!

FIGS, a DTC healthcare apparel company, went public a few weeks ago at a ~$5B market cap. In many ways, FIGS exemplifies what a successful “DTC” brand looks like and is worth understanding better. I go into some things that stood out to me from FIGS’ S-1 filing that may also be relevant to more DTC brands generally.

I. De-commoditizing an industry

A lot of what makes FIGS special is that they were able to take a largely commoditized product and de-commoditize it, as evident in their slogan.

“Why wear scrubs, when you can #wearFIGS?”

Before FIGS, scrubs were largely sold by legacy manufacturers with obscure brands who had limited ability to interact with the customer. There was also a lack of product innovation and margins were challenged.

FIGS was able to elevate scrubs and create a brand of reasonably priced premium products for healthcare professionals. In addition, by going direct to the customer, they can reach healthcare professionals through the channel’s healthcare professionals want to be reached and better and more quickly learn and adapt to their needs and preferences.

And it is visible from their performance, both in terms of customer satisfaction and margins: FIGS is profitable (~22%) and has an NPS score of 81.

We branded a previously unbranded industry… Most importantly, we built a community and lifestyle around a profession. As a result, we have become the industry’s category-defining healthcare apparel and lifestyle brand.

II. A Community-Driven Brand

Many DTC brands talk about community, but few actually follow through on it. FIGS has been able to create and leverage a passionate community of healthcare professionals to help foster its brand and customer loyalty.

A couple of things they’ve done that are interesting:

An ambassador program of 250 passionate customers who help engage with and interact with the broader community. They also serve as testbeds for feedback on new products.

Our Ambassadors are inspiring, teaching and mentoring the next generation of healthcare professionals, and their impact goes beyond social media—they’re teaching at conventions, leading organizations and associations, and innovating within their specialties, bringing FIGS with them everywhere they go

Leveraging social media in unique ways to bring healthcare professionals together. FIGS has ~0.5M followers and an engagement rate that is double the industry average. Their use of social media to showcase the daily wins and challenges that healthcare professionals experience has helped keep bring the community together and keep them engaged.

Typically, the best way to see the impact of community is through increased loyalty and retention (and repeat ordering) and through lower acquisition costs (because of word-of-mouth), which I’ll touch on later.

III. Innovating on Product

It is somewhat silly to say, but making a product that customers want is important for any brand, including DTC brands. However, I have used some DTC brands where the products were functionally worse than the “legacy competitors” and they seemed to be more focused on branding, marketing, and packaging. And with many others, the product is largely a commodity (i.e., basically the same as competitors).

FIGS has been able to go one step beyond and create a product that is at least somewhat differentiated from the legacy players by really understanding healthcare professionals’ needs and innovating to meet them.

At the core of their product innovation is an unwavering focus on what healthcare professionals need from their apparel to look, feel and perform at their best.

In addition, they’ve focused their product innovation along four dimensions:

Fabric Innovation: Most of their products are developed using a proprietary fabric technology, called FIONx, which offers four-way stretch, anti-odor, anti-wrinkle, and moisture-wicking properties.

Functional Innovation: Adding specially designed pockets and bungee loops to produce a more functional product for professionals needs

Fit Innovation: More sizes and better-fitting scrubs relative to incumbents

Style Innovation: FIGS created uniforms more comfortable and sophisticated silhouettes

They also have used limited-edition lines and color, and style “drops” well to drive re-engagement and acquisition of new customers.

IV. Strong Retention and Customer Loyalty

Many DTC brands have in the past faced challenges with customer retention or low repeat order rates (owing to a mix of lack of loyalty and low-frequency nature of the market they serve such as mattresses).

In the case of FIGS, cohort data and customer retention have been pretty strong, indicating that their community-driven approach and brand have created a passionate and loyal customer base.

From a customer retention perspective, about 50% of customers return for a second purchase, of whom 63% purchase again in the future.

Dollar-based retention has been improving over time, and in 2020 they retained 75% of the revenues generated by 2019 and prior year cohorts, as in the graph below.

In addition, over time, an increasing share of their revenue is driven by repeat purchases.

V. Declining CACs and Improving Unit Economics

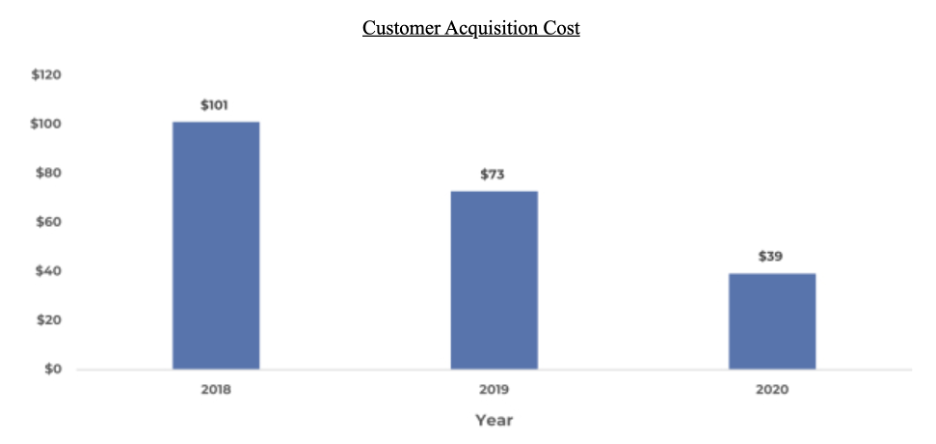

Partially driven by the pandemic, and partially driven by increasing marketing efficiency and the growing awareness of the brand, CACs have been continued to decrease. Note that FIGS definition of CAC includes all customers who purchased the denominator as opposed to just new customers, which I believe Is a bit misleading, but this chart below shows that CAC has been improving sequentially.

Another impressive thing is that on a per-customer basis, the number of orders/year/customers has increased from 1.9 to 2.1, while AOV has stayed flat (~$94), and so LTV has been increasing.

As of 2020, FIGS can pay back the cost to acquire a customer immediately, since they make 1.3x of their CAC on a customer’s first purchase contribution profit.

VI. Data & Technology

FIGS is one of the first companies that is built on top of Shopify to go public.

FIGS has focused on a lot of the data side to drive efficiencies in their supply chain and marketing, but overall, I liked FIGS call out that they would leverage existing software products wherever possible, and only build things if it was core to the differentiated experience they wanted to provide.

We internally develop custom, proprietary technology solutions where doing so would be a true differentiator and core to the unique needs of our community, and we otherwise leverage best-of-breed, third-party components and software to help build out our platform capabilities. By pairing our own in-house technology with cloud software, we have been able to create a truly differentiated user experience that we can adjust as necessary while also leveraging engineering talent from some of the best SAAS companies in the world to scale rapidly and efficiently.

VII. Profitable Growth

FIGS has seen explosive growth in 2020, in part driven by the pandemic, growing customers, and revenues over 100%.

FIGS today has ~1.5M customers, which grew 118% in 2020. Revenue grew from $110.5M to $263M in 2020, a 138% y/y growth rate.

FIGS has gotten to this revenue figure on just ~$60M of equity raised, highlighting that they have been pretty capital efficient.

In addition, margins have improved over time, and they are now profitable on a GAAP and cash flow basis, with operating margins of ~22% and FCF margins of 7%.

The cost buckets are illustrated below.

A few callouts:

Gross margins have been in the 72% range, which is quite good for an apparel brand, and shows they’ve been able to de-commoditize the industry.

Marketing costs as a percentage of revenue have gone down as marketing efficiency has increased and in general highlights the growing brand and repeat behavior.

G&A spend, which includes R&D spend, is relatively low, partially highlighting their choice to not reinvent the wheel with all aspects of technology.

Closing Thoughts

FIGS is a good example of a successful DTC company so far by really understanding healthcare professionals and solving their needs. It will be interesting to see how they perform coming out of the pandemic, and whether they can tap into the various growth opportunities ahead of them including:

Product expansion to serve more apparel (and other) needs for healthcare professionals

International expansion to cater to more healthcare professionals globally

Vertical expansion to enter into other uniform-wearing professional markets outside of healthcare apparel

Thanks for reading! If you liked this post, give it a heart up above to help others find it or share it with your friends.

If you have any comments or thoughts, feel free to tweet at me.

If you’re not a subscriber, you can subscribe below. I write about things related to technology and business once a week on Mondays.