Duolingo and Consumer Subscription Businesses

A few takeaways from Duolingo's S-1 filing

Hi friends!

The language learning app Duolingo filed to go public a few weeks ago.

I had a quick tweet about it which was well received and I got several DMs with questions and thought I would highlight a few takeaways from the filing.

Given that there aren’t too many public consumer subscription businesses in the US despite the increasing popularity of subscriptions for startups, I thought I would highlight a few takeaways from the filing.

1. Incredible Scale

Duolingo’s mission is to develop the best education in the world and make it universally available. So far, they focus on language learning and their language learning app is the world’s most popular way to learn new languages.

It supports over 40 languages and has 40M users. For context, there are more people in the United States learning languages on Duolingo than there are foreign language learners in all US high schools combined.

In my opinion, a few key things are driving their incredible scale:

The content is accessible for free

It is built for the mobile generation: courses are bite-sized, on-demand, and fun

Great use of data and gamification to keep people engaged

2. Free Tier as a Strategy

One of the somewhat unique things about Duolingo is that all the content is accessible completely for free. It is a freemium product in the sense that there is a premium tier, but that premium tier unlocks boosts and benefits and not any “new content” as such.

This has led to two core benefits:

A. Organic Growth:

Compared to a lot of the competition and alternatives for language learning, Duolingo’s “free” price tag is of tremendous value. As such, Duolingo has gotten a lot of organic word-of-mouth growth. It has been downloaded over 500M times and has more than 40M monthly active users.

And in the period between 2011 to the end of 2019, Duolingo spent less than $15M on external marketing, highlighting the importance of organic and word-of-mouth growth.

It has been able to create a brand and almost become synonymous with language learning, as the below snippet highlights:

For example, on Google, people search the term “Duolingo” nine times more often than “learn Spanish.”

This is also illustrated from Vivek’s tweet below, which shows that Duolingo has a low share of sales and marketing spend as a percentage of gross profit compared to other consumer subscription businesses.

B. Generating a lot of data:

The other advantage of the free tier is that the users generate a lot and a lot of data, which improves the product for all users, free and paid.

Duolingo users complete over 500M exercises daily, generating data that can be used to power A/B testing and improve the product for all users, free and paid.

Duolingo calls this their learning flywheel, shown below:

Essentially, more users mean more data which means better and more engaging products.

3. A subscription heavy business model

So we talked about the free tier, but how does Duolingo make money?

Duolingo made $162M in 2020, growing 129% y/y, and made its revenue from three sources:

A. Subscriptions (73% of total revenue)

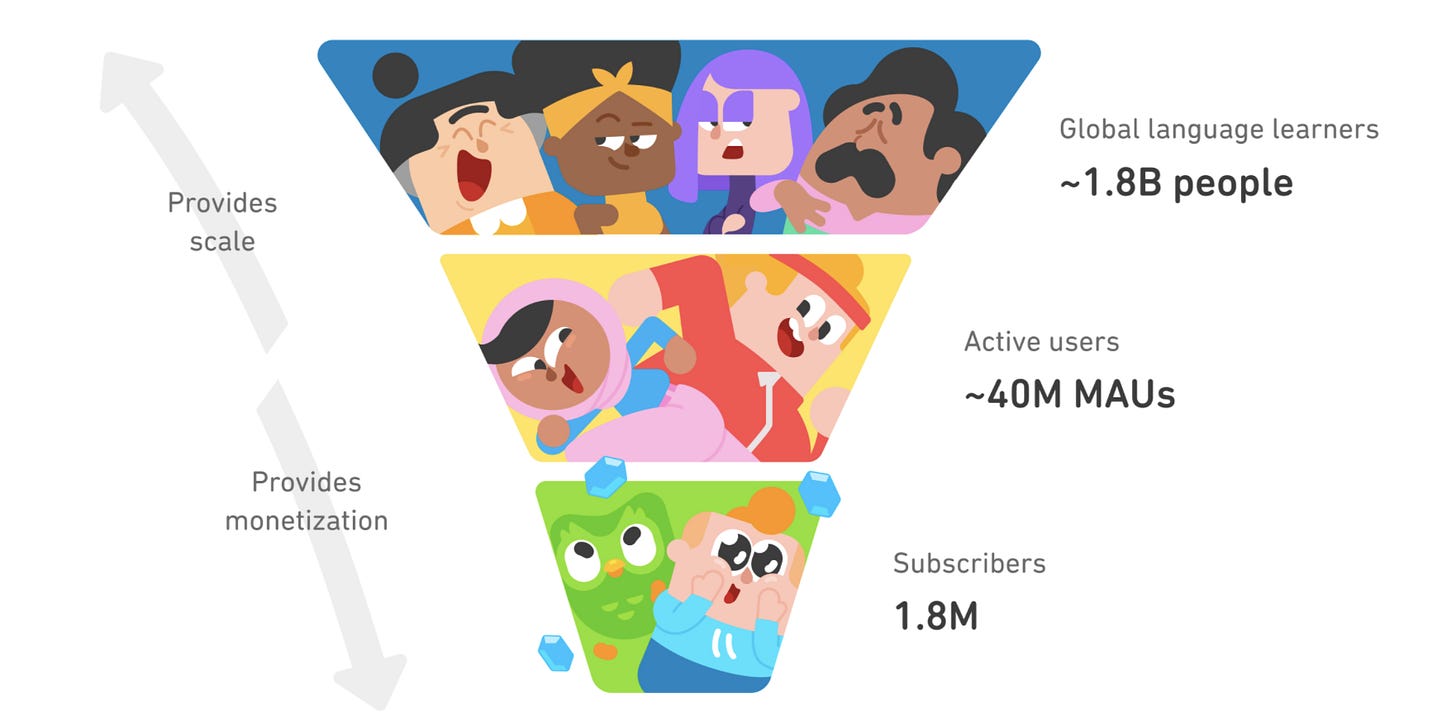

Of the ~40M users, ~5% of them have purchased Duolingo’s premium offering, Duolingo Plus.

Duolingo plus has options for a monthly, six-month, and annual plan, and offers an ad-free experience as well as other benefits outlined below.

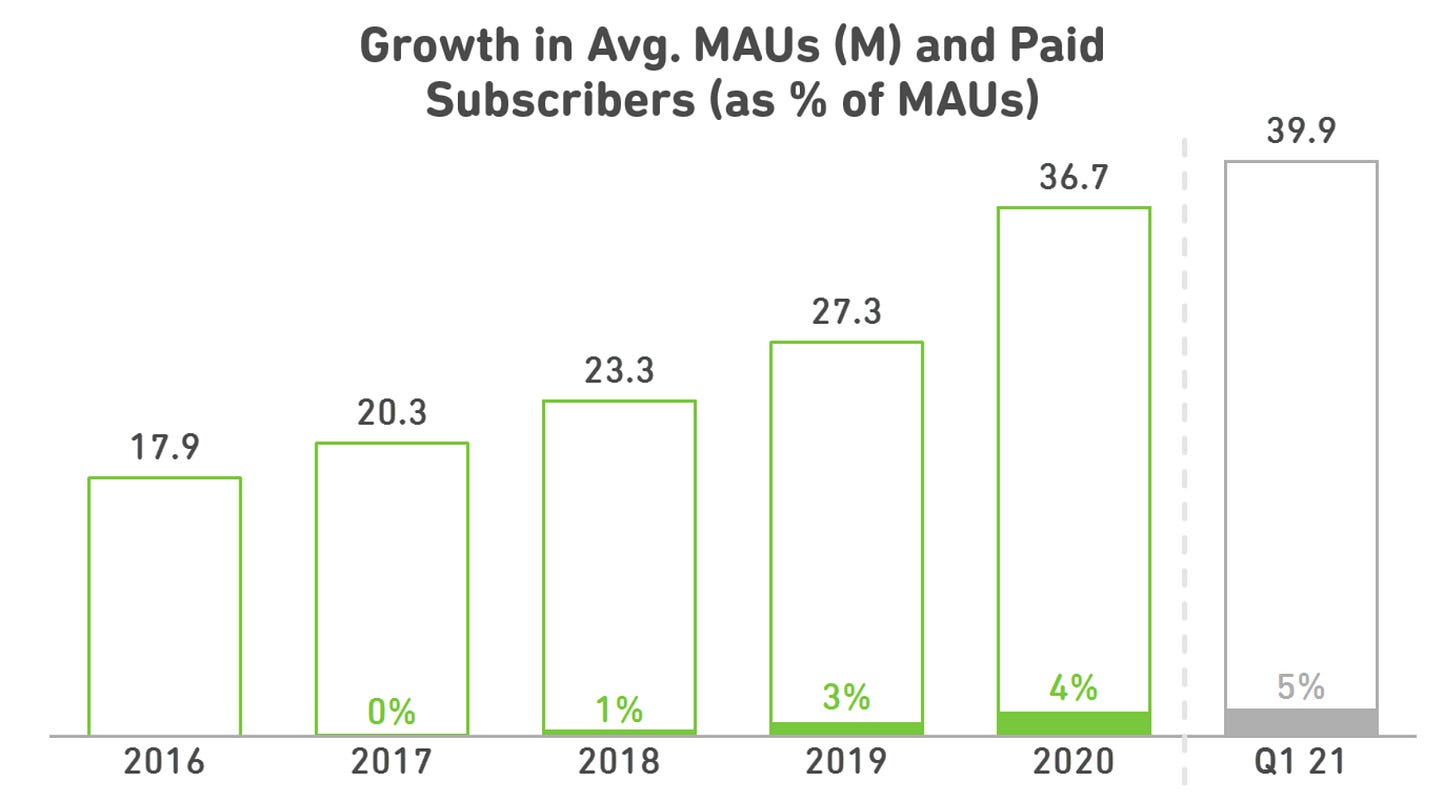

Duolingo Plus was introduced in 2017, and the free-to-paid conversion rate is going up slowly over time, as in the chart below:

Currently, Duolingo’s 1.8M plus subscribers bring in an average revenue per user of ~$75 per year.

B. Advertising and in-app purchases (18%)

On the free users, Duolingo makes money on ads shown to users (17%) and the occasional in-app purchases of virtual items such as “streak freezes” and “timer boosts” (1%).

Overall, for the 95% of free users, Duolingo makes <$1/yr per user from them, highlighting that at least so far this isn’t a big revenue stream, further stressing the importance of the free-as-a-strategy highlighted above rather than trying to monetize these users in itself.

C. Duolingo English Test (9%):

Duolingo also has a now widely accepted test for proof of English proficiency which costs a one-time fee of $49.

It is accepted by over 3000 universities, and revenue grew from ~1M in 2019 to $15M in 2020.

4. Content and Margins

In many ways, Duolingo is a content business like other subscription businesses such as Netflix, Peloton, Spotify, and others.

Duolingo’s content, its courses are “made up of Skills, each of which is divided into Levels, with each Level made up of a series of Lessons. Each Lesson consists of short, bite-sized exercises that help learners practice reading, writing, speaking, and listening skills.”

These courses are “original content” and designed in-house by a team of experts in learning science and second language acquisition.

However, what is interesting is that given that the content is a mix of audio and text content, it is cheaper to create in large volumes than say the video content of Netflix and Peloton or the audio content which Spotify needs to license.

In addition, the use of data and AI to stitch together different discrete pieces of lessons in a personalized manner means that less needs to be spent on “content creation”.

One way to see is that is considering gross margins and amount spent on content.

Spotify has a ~27% gross margin as it pays out >65% of its revenues to labels

Netflix has ~35% gross margins and spends ~$20B per year on content (a mix of the cost of revenue and customer acquisition cost) and has

Peloton’s subscription offering has ~60% gross margins

Meanwhile, Duolingo has ~70% gross margins, with app store fees being the main cost. Note that while content isn’t included in gross margins, it is likely <10% of revenue based on the employee mix Duolingo has highlighted.

5. Gamification

A key reason for Duolingo’s success was they took something that a lot of people wanted to do (learn a new language) and make it free and accessible on mobile and broke it up into bite-sized chunks and made it fun.

Duolingo states:

We believe that the hardest part of learning something new is staying motivated, so we build gamification features into our platform to motivate our learners, and we run thousands of A/B tests to optimize each feature for maximum engagement.

Duolingo has several gamification features that help provide consumers with an engaging and fun learning experience:

XP: Users earn Experience Points, or “XP,” for completing learning activities in Duolingo.

Streaks: Duolingo tracks streaks which are a powerful motivator to keep learners coming back every day.

Crowns: Learners collect crowns upon completion of a Level of a Skill.

Hearts: Duolingo uses “hearts” or “lives” to limit how many mistakes someone can make on the free version on a given day

Leaderboard: Duolingo uses leaderboards and leagues to pit users against each other and add a bit of competition.

Gems: Gems are the Duolingo virtual currency, which allows them to buy virtual items from the Store including to maintain streaks or provide additional hearts

As somewhat of an aside, last week, I wrote about how one can view Robinhood as what you get when you take the decade of learnings in gamification and designing addictive products of Silicon Valley and apply it to stock trading in a way that probably harms the consumers. Duolingo is that but applied to a more noble cause, where the higher engagement is generally a good thing for the consumer as well. Peloton is another example of this.

Gamification is a powerful tool and founders and product managers should be cognizant about what actions they are applying it towards, and whether that is good for the individual in question.

Closing Thoughts

COVID-19 was also a big accelerant for Duolingo, with their revenue growing triple digits amidst a flurry of people looking for new hobbies and with more time on their hands. Duolingo also struck while the iron is hot, spending >$20M on performance marketing in 2020, more than the previous 8 years combined, seeking to capitalize on the opportunity. And with triple-digit growth in 2020 and Q1’21, they were able to do so on the face of it.

Even aside from COVID-19, Duolingo has built a compelling product that could serve the needs of the ~1.8B language learners across the globe.

In closing, I loved CEO and co-founder Luis von Ahn’s two-paragraph investor letter which I’ll leave you with below:

Thanks for reading! Also, congratulations to any Italian fans who may be reading this, and commiserations to my fellow England fans. Fortunately, the next tournament is under 18 months away!

If you liked this post, give it a heart up above to help others find it or share it with your friends.

If you have any comments or thoughts, feel free to tweet at me.

If you’re not a subscriber, you can subscribe below. I write about things related to technology and business once a week on Mondays.

great stuff

great article. One risk worth calling out is the dopamine risk (potential high churn and low conversion rate from free tier-> subscription)

dopamine risk: # of humans motivated to learn new < # of humans who will binge watch netflix. blame it on dopamine!.