Hi friends,

A few weeks ago, in the middle of its meme stock phase, AMC announced its Investor Connect Program, a way to provide perks to AMC shareholders, which included free popcorn among other things.

While pretty hilarious by itself, I find the broader trend underpinning it quite interesting, which is what I’ll discuss this week. I’ve written in the past about the rise of retail investing and this time I’ll focus on the trend around linking customer loyalty and ownership.

Background

Every so often, tweets of the following kind go viral.

“If you had spent the money you did in <year> or every year buying an iPhone/Tesla/Peloton on buying Apple/Tesla/Peloton stock instead, this is what it would have been worth”

While I’ve always found them a bit silly in that they don’t account for at least needing to buy an alternative to that product to fulfill its actual use case, they make an interesting point: that a company’s consumers often might be early to see a company’s potential and should also potentially seek to purchase ownership in them.

Customers and Owners

Warren Buffett famously said that “companies obtain the shareholder constituency that they seek and deserve.”

Ask any management team what kind of shareholders they want, and they’ll tell you they want a base of loyal long-term shareholders. Obviously, a big chunk of them will be institutional, given the dynamics of how most money to the markets is allocated. But an increasing number of retail investors are participating in the markets.

Given that companies will likely have many of these retail investors as shareholders, which ones are likely going to make the best kind of shareholders? The ones who are the loyal customers and actively use the products / services1.

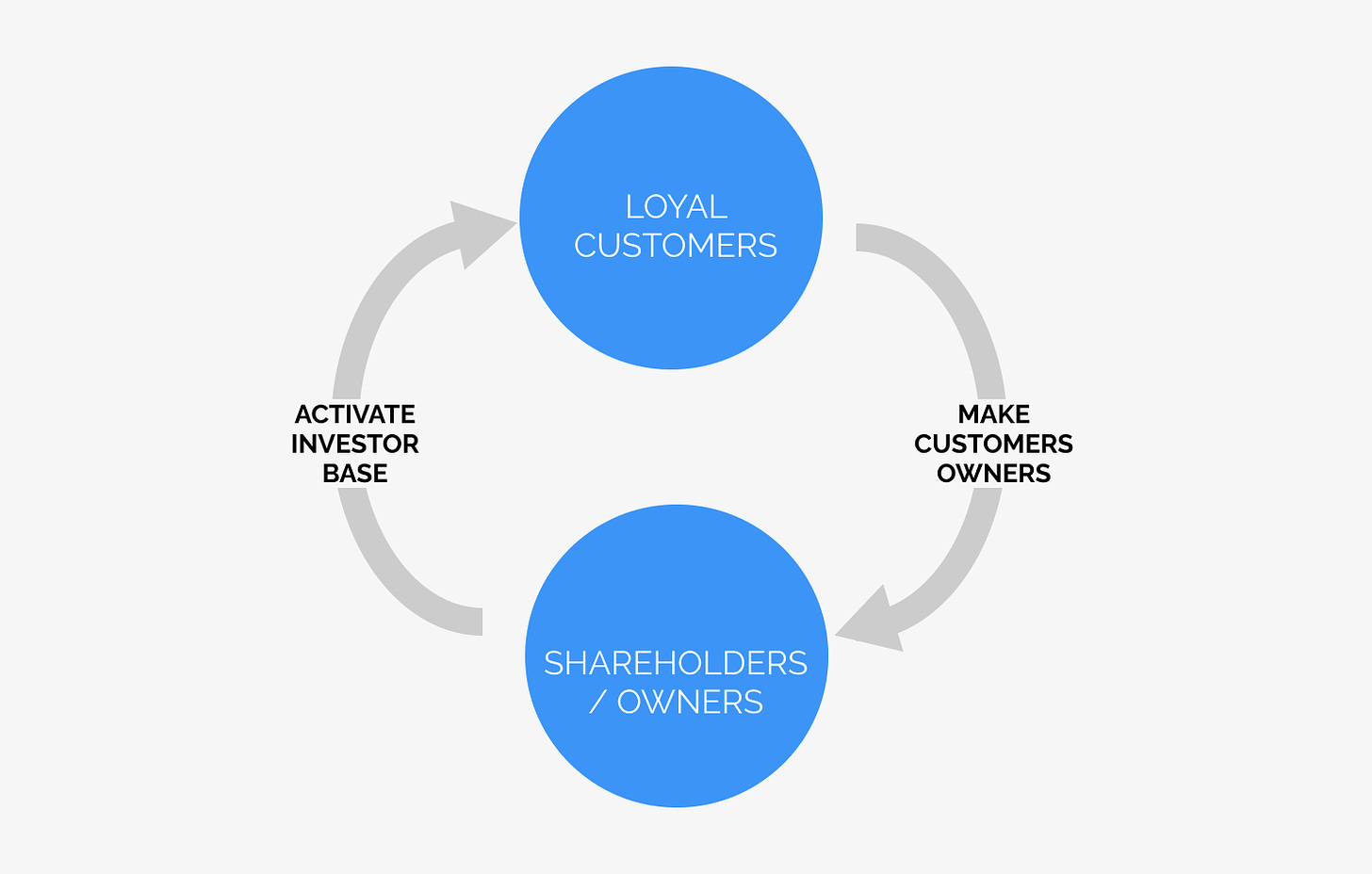

Now, there are two ways to think about this:

Allow your most loyal customers to be owners

“Activate” your shareholder base to make them (more) loyal customers

Let’s go into both of them.

Making Customers Owners

One aspect of this is around creating opportunities for your customers to be “owners” i.e., shareholders of the business.

I’ll touch on a few ways companies are doing this, across both private and public companies. Note that for public companies, anybody can obviously go and purchase shares in a company. But that doesn’t mean that companies can’t do more to enable customers to be shareholders.

Offering users shares in IPO

I’ve written about the democratization of IPOs before where more and more companies are reserving shares in their IPO for participants of their company (consumers, suppliers, etc). Recent examples of this include:

Deliveroo, a leading food delivery platform in Europe, which reserved shares for customers

Doximity, a social network for doctors, which reserved shares for the doctors using the platform

Robinhood, which will reserve shares for its users which can be purchased through its own app

Private companies opening themselves up

While typically only accredited investors have been able to invest in private companies, thanks to new regulations and platforms like Republic anybody can invest, and often in small sizes.

While we haven’t seen it formally too much, I won’t be surprised if private companies start using these platforms especially for their users / early customers to be able to invest in companies.

Stock as a Reward for purchases

One interesting approach a company can take to make their customers owners is by directly giving them fractional shares as rewards for purchases. For example, thanks to a company called Upstreet, some companies are offering 3-5% worth of fractional shares in their company (or a related ETF) as a loyalty/reward program.

Another way of thinking about this is that there could be a credit card or trading platform which automatically provided the 2-2.5% “cash back” in the form of fractional stock at the company where the money was spent rather than cash. Bumped is the closest to this, and allows users to earn fractional stock as rewards for purchases.

Another way companies could enable this is by making share ownership easier through their direct point of engagement with customers. For example, you can imagine companies like Uber, Doordash, Walmart, Amazon, or similar allowing you to buy their stock directly through their apps or websites (perhaps using a broker on the backend to complete the transaction).

Crypto

While this post is more about “Web 2.0”, it’s worth mentioning a lot of the concepts here have a lot of parallels to Web 3.0 and the ownership economy.

The idea of allowing early adopters and users to be owners in the projects/products they use and share in the upside is a core premise of the promise of crypto.

As Jesse Walden writes,

Rather than a platform’s inner circle of founders and investors taking home the value, users are able to earn the majority of value generated from their collective contributions.

Activating Investor Bases

If encouraging and allowing customers to be owners is one aspect of it, the other closely related aspect is activating these investor bases to encourage them to be more frequent and loyal consumers and giving them benefits of ownership.

This typically means providing some rewards or perks of some kind to shareholders. Here are a few ways companies have been doing this: Typically, each of these requires holding a minimum number of shares (held for a certain minimum period in the months) to take advantage of these.

Credits and Discounts: Companies can provide credits and discounts to shareholders on their products. For example, CCL and Norwegian both provide credits to shareholders on their cruises. Similarly, Berkshire Hathaway provides an 8% discount on Insurance to shareholders

Special Events: Special events, either tied to what the company is selling or tied to being better shareholders are other perks that companies can provide. As an example of the former, AMC organizes special screenings for Shareholders as part of its AMC Investor Connect. Similarly, Berkshire Hathaway shareholders receive an invite to the widely attended Annual Shareholders Meeting in Omaha.

Special / Limited Edition products: Similar to special events, companies can offer special editions of products for shareholders. For example, Willamette Valley Vineyards gives shareholders priority and occasionally exclusive access to new or limited releases of samples.

Gift boxes / Samples: Companies can also offer gift boxes and samples containing their products to shareholders. Kimberly Clark and 3M both do this, offering gift boxes containing a wide variety of their products for a nominal fee (~$20-25) which typically have a retail value of double that and which also includes coupons and rebates.

Another reason this is important is that many retail investors don’t just invest for monetary reasons. They also view their investments as fulfilling a sense of belonging, community, and identity and projecting the things they are passionate about, as I wrote about previously.

One way companies can do this is through some of the events mentioned above. The other is to better connect with retail investors to encourage them to stay informed and engaged on shareholder matters and vote on proxies as they come up. I’ve yet to see any companies doing something very compelling here, but please let me know if you do come across any.

A quick parallel to crypto again. Stocks are in some sense social tokens, which have some monetary value (claim on a part of a business), but also could give the individuals some other benefits, both tangible (in the form of perks such as above) as well as intangible (community, belonging and identity).

On that note, Disney offers collectible stock certificates to shareholders (purchased separately). I guess Stocks were the original NFTs.

While this tends to apply to most consumer-facing companies, versions of this can also apply to non-customer-facing companies.

Super interesting Tanay! Thanks :)

I'm actually planning to do some sort of users' ownership with Snowball, my company, which is currently just a newsletter, but with bigger plans. I'll partner with fairmint.io to do so. You should check them out. Super interesting model for private companies to share ownership easily.

Thanks for your information & analysis provided. It make me know more regard this topic somehow. Very impressive with this: "Another reason this is important is that many retail investors don’t just invest for monetary reasons. They also view their investments as fulfilling a sense of belonging, community, and identity and projecting the things they are passionate about."