Crypto meets Consumer Finance

How crypto is faring at the key finance needs which consumers have

Hi friends,

Happy holidays! This will be my last newsletter this year, and I’ll be discussing the intersection of crypto and consumer finance.

I’ll go into the key jobs in finance that consumers need to have done, and how crypto today can or cannot fulfill these jobs and what may lie ahead.

One simple way of breaking down consumer finance is about thinking of them in five key categories as below (also used by Nubank in their S-1).

I’ll cover the first two today and the next three in Part 2.

Spending

Saving

Investing

Borrowing

Protecting

Spending

When it comes to spending some form of money, consumers generally want to be able to do a few things:

Transact digitally or physically for goods and services in that form of money

Transfer that money easily and quickly to peers

Transactions

For cryptocurrencies to solve the job of transactions, they need to be able to be easily used by customers at merchants both online and offline.

Two concerns typically related to transactions through crypto are the underlying volatility of some of the major coins, and the limited scalability, as below, although many new currencies have popped up that address both.

However, Today, most solutions still typically involve a conversion of the underlying crypto into fiat at the time of the transaction, although settlement in currencies like USDC has also taken place.

Overall, for anybody who has crypto, there are relatively straightforward ways to be able to use them to transact with many merchants.

Merchant Acceptance: As cryptocurrencies have become more popular, more and more companies have begun to accept them as a form of payment, with 36% of SMBs accepting payment in bitcoin per a HSB survey. Companies such as Tesla, Overstock, Microsoft among others directly accept Bitcoin as a form of payment. Auction Houses such as Sotheby’s accept both Bitcoin and Ethereum as a form of payment for certain auctions.

Enablers: Companies such as Crypto.com and Bitpay are also making it easier for merchants to accept Crypto and for consumers to use crypto to make payments.

Card Network Solutions: Mastercard has partnered with Bakkt to allow customers to issue branded cards which allow for spending and earning rewards in crypto. Additionally, Visa now support for digital currencies as a settlement currency, starting with USDC, earlier in 2021.

Crypto Cards: Companies such as Coinbase and Crypto.com offer crypto cards which can be used by people to spend against their crypto balance and is accepted absolutely anywhere a regular VISA card is accepted. Customers can earn rewards back in Crypto as well.

For a sense of overall scale, as many as 46 million consumers (18 percent of the adult population) would consider using cryptocurrency for retail purchases, per a bitpay (although note the obvious bias) and pyments.com survey.

Transfers

Cryptocurrencies fare pretty well at peer-to-peer transfers, especially international ones, given their borderless nature since they essentially support being able to send the currency to anybody in the globe at a relatively low cost, without intermediaries.

Remittances, for example, which make up over $500B of volume in a year typically cost $15 (or 6-7% of the size of the average transaction) and take 2-3 days to send through traditional means. Meanwhile cryptocurrencies can be sent close to instantaneously and often at a fraction of the cost. There are also a number of currencies specifically targeting these cross-border use cases, such as Ripple and Stellar.

The graph below provides a sense of scale of the cross-country transfers taking place. Besides transfers popular in general as a way of sending money from workers to their family in Asia, Latin America and Africa primarily as a more efficient way of remitting the money, in some countries such as Lebanon and Venezuela it is also growing in popularity because they would rather hold cryptocurrency over the local currency due to the devaluation of the local currency.

Saving

The job of saving is somewhat tied to the job of spending and involves:

being able to get paid into an account which can then be used to spend from as needed

being able to save ideally safely while earning some interest

being able to save through retirement accounts

So how does crypto fare here?

Getting paid in crypto

Companies like Coinbase have long allowed their employees to receive a part of their paycheck in Crypto. Similarly, professional athletes across leagues in the US have opted to receive part of their paycheck in bitcoin. More recently, the incoming NYC mayor Eric Adams stated he would take his first three paychecks in bitcoin.

More recently, the ability for employers to offer a part of the paycheck in digital currencies to their employees is becoming easier, as more and more high-profile companies such as Twitter consider supporting it.

Coinbase has rolled out an offering which integrates with multiple payroll providers such as ADP and allows users to receive a portion of their paycheck as a direct deposit into their Coinbase account in crypto, which is then available to spend on their Coinbase Card.

Providers such as Gilded and Bitwage allow companies to pay their employees in crypto.

One thing which hasn’t taken place much in the corporate world yet but will be interesting to watch is if salaries actually start getting denominated in crypto (particularly in high inflationary countries) or as remote work (and indeed DAOs which already do this) become more prevalent rather than in USD or local currencies. In those cases, the paycheck will be a “true crypto” paycheck rather than essentially a $ denominated one converted into crypto at the current price at time of paycheck.

Savings accounts

People like to keep some of their savings in a relatively safe place, often using savings accounts as a key vehicle for saving their uninvested money.

In today’s environment, even the highest yielding savings accounts typically only offer a 0.5% interest rate at best (but most in the 0.1-0.2% range). However, one benefit of most banks is that the first $250K is insured by FDIC, and so the savings accounts is essentially riskless.

But when compared to inflation rates in the 5-6% range, for most people in real terms, a dollar saved in a savings account is losing 4-5% of value a year.

Compared to this, crypto offers some real benefits in saving. There are many startups and products out there which offer interest on stablecoins (which can be viewed as similar to “savings”, given that stablecoins are typically pegged to fiat currency and don’t have price volatility in the underlying asset). For example:

Nexo offers yields of 8-10% on a range of stablecoins including USDC

BlockFi offers an interest account product offering yields in the 6-9% range on a number of stablecoins including USDC and USDT

Anchor Protocol offers consumers a yield of 20% on Terra

Now, none of these savings’ instruments are risk free or insured by FDIC. However, they are based on stablecoins which are not volatile (at least in theory), and so the returns here aren’t volatile, though there is always some smart contract risk or risk of bankruptcy.

We’ll cover some of the more “investing-like” approaches, including NFTs/DeFi or just holding onto BTC and ETH in the investing section next time.

Retirement Savings

401Ks and other individual retirement accounts are a primary means of saving for many Americans. There is over $6T in the 401K accounts of Americans. In some ways it is both a savings and investing vehicle, but the typical goal of these accounts is to encourage and incentivize savings among people and invest it for the long-term in assets with reasonable return relative to risk, usually in a tax-advantaged manner.

Naturally, one of the assets that consumers may want to put their 401K savings into is cryptocurrencies. Thanks to a number of companies, that is getting easier and easier:

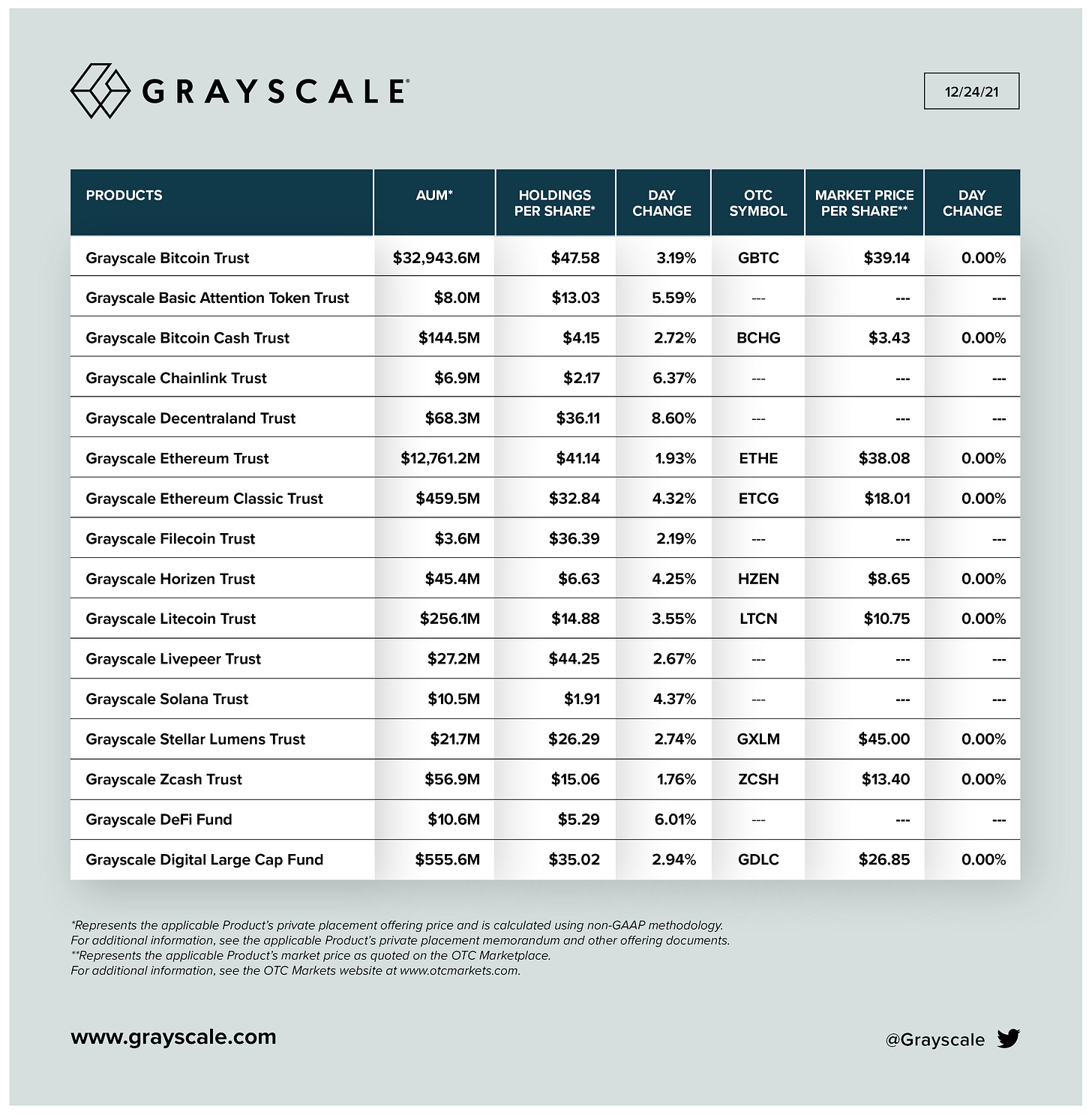

Digital Currency funds and ETFs such as Grayscale (which has an aggregate AuM of over $45B as below) show up in the typical 401Ks in Schwab and Fidelity used by many Americans meaning that they can allocate a percentage of their retirement account to crypto through these funds.

AltoIRA and ForUsAll allow for opening self-directed IRAs which can be directly invested into specific cryptocurrencies based on the individual’s preferences. They integrate with the Coinbase exchange and allows for purchase of any currencies offered on the exchange.

That’s all for this one! In Part 2, I’ll cover the three other key jobs I outlined above: investing, borrowing and protecting.

Thanks for reading! If you liked this post, give it a heart up above to help others find it or share it with your friends.

If you have any comments or thoughts, feel free to tweet at me.

If you’re not a subscriber, you can subscribe below. I write about things related to technology and business once a week on Mondays.

First time stumbling on your newsletter. Really enjoyed reading it and having my crypto development supplemented here! Can't wait for the next one.