Coinbase and the cryptoeconomy

Hi friends!

Coinbase is a leading cryptocurrency exchange and will be going public via a direct listing on April 14th. Its shares last traded hands at a ~$100B valuation in private markets.

With most startups going public these days the key question is “can the economics improve long-term?”. What I find most interesting with Coinbase is that the key question is “can the economics stay this good long-term?”

In this piece I’ll cover:

Coinbase overview

Coinbase business and financials

The bull and bear case for Coinbase

S-1 tidbits

Coinbase overview

Coinbase began in 2012 with the mission to “create an open financial system for the world”.

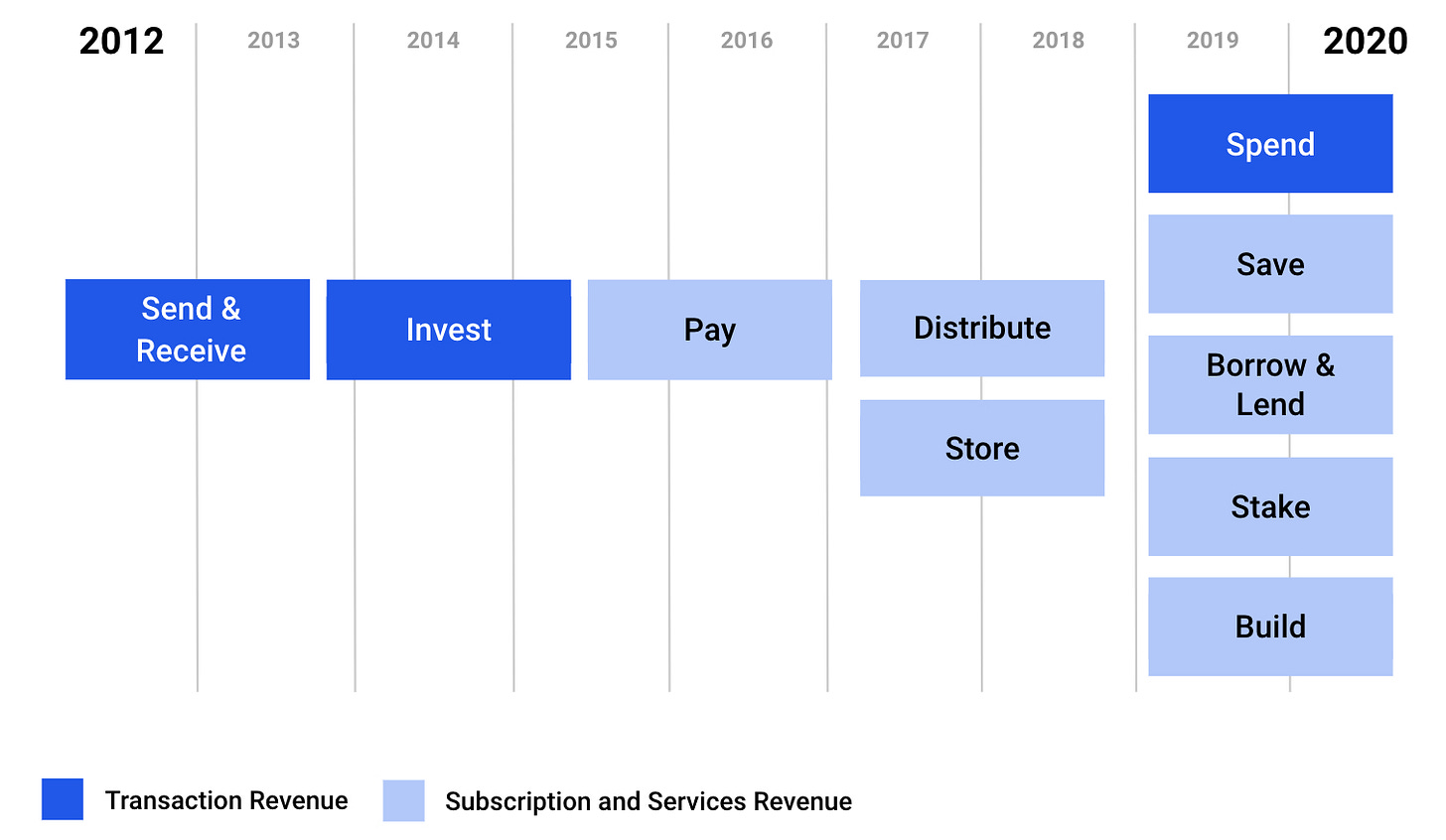

What began as a way for retail investors to buy, send and receive bitcoin via a simple and intuitive interface has over time expanded to a broader portfolio of products and services for retail and institutional investors, as illustrated below.

Coinbase serves three main sets of customers:

Retail users: Coinbase offers its 56M retail users a safe, trusted, and easy-to-use platform to invest, store, spend, earn, and use crypto assets.

Institutions: Coinbase provides 7000 institutions such as hedge funds, money managers, and corporations a one-stop-shop for accessing crypto markets.

Ecosystem partners: Coinbase provides over 115,000 ecosystem partners such as developers and asset issuers a platform with technology and services that enables them to build applications that leverage crypto.

Coinbase business and financials

Coinbase’s financials and metrics are truly mind-boggling.

In Q1 2021, they made ~$1.8 billion in revenue, more than all of 2020 and 2019 combined. And they had ~40% net income margins and over 60% Adjusted EBITDA margins.

They essentially grew ~850% y/y while generating 50%+ EBITDA margins.

The Rule of 40 is a rough rule of thumb that captures the growth and profitability trade-off which says that for a good (typically SaaS) company, their growth rate and profit margin should add up to 40% or more. Coinbase is over 900%.

So how exactly is Coinbase making so much highly profitable revenue? The reason is two-fold:

High take rates on retail transactions

The current state of the Crypto Market Cycle

High Take Rates on Retail Transactions

Coinbase makes money in two ways:

Transaction revenue: This revenue is derived from commissions on the trading volume generated by customers on our platform and tends to align with crypto-asset price cycles. In 2020, Coinbase made~ $1.1B of transaction revenue.

Subscription and services revenue: This revenue is more tied to the assets on the Platform and their use in products such as Store, Save, Borrow/Lend and Stake. In 2020, Coinbase made ~$45M of subscription and services revenue.

Over 95% of the revenue that Coinbase generates comes from transaction revenue, i.e., commissions on trades from retail and institutional clients, so let’s focus on that.

Digging one level further, Coinbase’s institutional trading volume makes up about 60% of total volume. However, Coinbase makes 95% of its transaction revenue (and 90% of its total revenue) from retail trading volume.

So how is Coinbase able to generate so much retail trading revenue?

Coinbase was obviously early in the space and has been able to become the trusted brand for consumers wanting to participate in the cryptoeconomy.

They have 56M retail users, over ~6M of whom transact every month. Their easy-to-use UIs and interfaces as well as their trusted brand make it the go-to onramp platform for consumers for crypto. This is evident in the fact that over 90% of users were acquired organically, and Sales and Marketing spend as a cost of revenue is under 10%.

This has enabled them to command premium pricing, particularly in retail transactions.

The take rates on retail transactions is a lot higher than institutional ones, meaning that retail revenues make up the bulk of revenues, even though they make up only 40% of transactions by dollar volume:

the take rate on retail transactions is ~1.25-1.5%

the take rate on institutional transactions is ~0.05%.

I’ve noted before that Coinbase itself has different take rates for different users based on the “UI” you use (3-4% in the regular flow vs 0.5% for Coinbase pro). Users who use the basic flow pay more in fees than those who use the more sophisticated UI of Coinbase pro.

This “tax” on unsophistication is a big driver of Coinbase’s revenue. If everyone used Coinbase pro (or paid the equivalent of Coinbase Pro rate), Coinbase would make ~60%-67 less money.

The Crypto Market Cycle

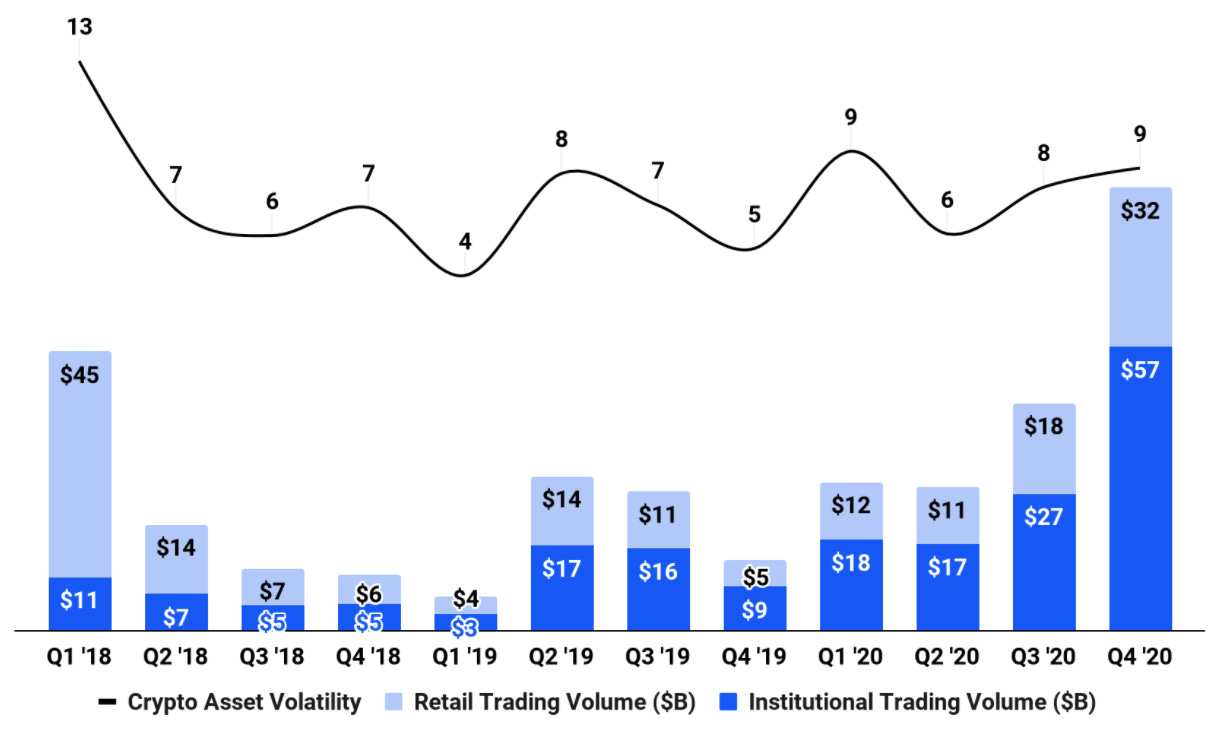

Transaction revenue is dependent on trading volumes, and in particular retail trading volumes, which are correlated with crypto-asset price cycles and bitcoin prices.

Coinbase notes that: “While we have grown rapidly, our growth has not been linear. Instead, it has come in waves aligned with crypto-asset price cycles which tend to be volatile and draw new customers, investors, and developers into the ecosystem.”

And at the time of Coinbase’s going public, we are in the midst of the fourth crypto-asset price cycle.

As the price of Bitcoin has increased from $7K to ~$60K, trading volumes have increased fourfold (16X when annualized) from $80B (2019) to $335B (Q1 2021).

It took almost 2 years for example for Monthly Transacting Users, which is a key metric that determines retail transaction volumes, to reach q1 2018 levels, but now they’re at 6.3M, >100% higher than the previous peak.

They mentioned a few times in the S-1 that rather than quarterly or yearly performance, they prefer to be measured on very long-term horizons and across crypto-asset price cycles. It will be interesting to see as a public company what kind of guidance they provide in quarterly earnings calls.

So far, most of their guidance has been scenarios around the number of monthly transacting users (a range of 4-7M).

The bull and bear case for Coinbase

The bull case for Coinbase is quite clear: they are the trusted brand, with phenomenal top-line and bottom-line numbers, and the cryptoeconomy is still early in its lifecycle.

Coinbase is at a run-rate of $3.2B in net income (based on Q1) and growing top-line at triple digits year over year, which event at a $100B valuation would be a < 35 P/E, which is arguably a lot more reasonable than SaaS companies at >25X revenue.

Also, there is a case that crypto is still relatively nascent if you consider that the crypto addressable market could be ~3B+ people, and Coinbase is currently at ~50M.

And Coinbase is capturing an increasing share of the cryptoeconomy, as in the chart below.

But I think the bear case is more interesting and worth touching on.

Coinbase’s current earnings are hardly “normal” - revenue and transaction volumes are at an extreme given the current state in the cycle and their profitability is unsustainably high.

One bear case is obvious: that crypto dies down and Coinbase consequently does not live up to its lofty valuations.

But the other scenario is worth exploring, what if crypto continues to do well but Coinbase doesn’t do well.

How might that happen?

There’s a classic Jeff Bezos quote that goes:

"Your margin is my opportunity."

And Coinbase’s margins present quite an opportunity. Yes, they are the trusted brand in the wild west of Crypto, and so customers were willing to pay 2% to buy these assets, given their simple and intuitive UI.

But now Crypto has a capitalization of over $1T. As the market has matured, competitors have come in, and I expect more to continue to do so.

On one side, you have the current crop of consumer fintech companies in Robinhood and Square and Paypal, which can at least match the ease of use if not the trusted brand. Yes, their offerings are not as fully-fledged as Coinbase and don’t really give you access to the actual coins. But given that most people want access from an investment perspective they might not care. I’m also certain these companies will invest more heavily in crypto given the current trajectory of the market, and they’re already doing quite well. In fact, Robinhood had 9M people who traded crypto last quarter. That’s more than the 6M who traded on Coinbase each month!

Then, you have the traditional brokerages - the Schwab’s and Fidelity’s who have to be looking at Coinbase’s numbers and crypto prices and thinking that for the benefit of our customers (and our shareholders), we have to be able to give them access to these investments.

Lastly, you have the other crypto native brokerages such as Gemini and Binance, which tend to have lower transaction fees but perhaps not the same level of trust and brand.

To the extent that 90% of Coinbase’s revenue comes from retail trading fees, I do expect that with the maturation of the market and increasing competition (and increasing emphasis from competitors on Crypto), the fees come down.

One of the other benefits for the first two sets of companies above is that they don’t need to monetize through crypto trading, which should further result in more pressure on pricing.

Robinhood for example makes money from the payment for order flow on stocks and options, and as long as free crypto trading is a way to bring customers into their ecosystem cheaply, they can get away with close to zero-fee crypto trading.

Similarly, only 10% of Cash App customers have used it to buy Bitcoin before. But these customers have a gross profit per active customer and engagement in our broader ecosystem as bitcoin actives use of other products, such as Cash Card and direct deposit, more frequently compared to the average Cash App customer.

Coinbase alludes to the fee pressure that may arise:

Similar to other financial products, as the industry matures we anticipate fee pressure to emerge over time. Our strategy is to maintain our position as a trusted brand in the crypto space and develop new products to enhance our customer value proposition and offset the effects of any future fee pressure. If we are unable to capture value through the development of new and existing products and services or if fee pressure emerges more rapidly than we anticipate, our operating results may be adversely affected.

How might they maintain pricing power in retail?

Their trusted brand will definitely help, which is evidenced by them almost becoming synonymous with crypto purchases for the average consumer, and their 90% organic acquisition number.

Growing non-investing use cases: Coinbase states their flywheel is: retail users and institutions store assets and drive liquidity, which they use to expand the depth and breadth of products which then attracts new customers. I’m more skeptical.

While I do believe Coinbase has a big advantage for those users who want to participate in the cryptoeconomy more heavily, for those who just want to buy coins from an investment perspective, I don’t know if the breadth of products necessarily matters.

21% of retail users who invested also engaged with at least one non-investing product per quarter, and if I were Coinbase, I would be trying to drive that number higher, since those users are much more likely to remain on the platform regardless of competition.

The same way brokerages were able to charge fees and commissions which eventually eroded in part because of Robinhood, Coinbase could see a similar thing happen with its retail commissions. Overall, Coinbase is in part a magical business because Crypto was “the wild west”. As that is increasingly no longer the case, it will be interesting to see if Coinbase can remain a magical business.

Other S-1 tidbits

Before the upcoming direct listing, the news around Coinbase centered around Coinbase’s “mission-focused” culture, and the fall-out from that.

While I won’t go into that, their S-1 does provide some tidbits that suggest they are at least opinionated if not unique in some of their approaches.

They “sent” Satoshi Nakamoto a copy of the S-1 as a symbolic gesture, as in the image below.

No address was specified for Coinbase on the S-1, with the footnote that “In May 2020, we became a remote-first company. Accordingly, we do not maintain a headquarters”. I believe this might be the first “address not applicable” on an S-1.

They included a glossary on the cryptoeconomy which makes sense, but also included the world Hodl defined as, “A term used in the crypto community for holding a crypto asset through ups and downs, rather than selling it”.

They listed the identification of Satoshi as a potential risk factor: “the identification of Satoshi Nakamoto, the pseudonymous person or persons who developed Bitcoin, or the transfer of Satoshi’s Bitcoins”

Additional Reading

A few other resources if you’re interested in digging further.

Coinbase S-1

Robinhood note on how Crypto fits in with their broader mission

Square shareholder letter which touches on how Crypto helps Cash App

Meritech Capital’s Coinbase S-1 teardown

Thanks for reading! If you liked this post, give it a heart up above to help others find it or share it with your friends.

If you have any comments or thoughts, feel free to tweet at me.

If you’re not a subscriber, you can subscribe below. I write about things related to technology and business once a week on Mondays.

A very interesting blog related to the coinbase clone software which I stumbled upon, because it's important that we start investing in cryptocurrency during these times to get a good value in ROI. Anyways, thanks for the blog. Will share it with my peers and friends. Cheers. I also found a similar kind of blog in this website. It's very interesting.

https://www.uberdoo.com/coinbase-clone-script.html