Big Tech and investing in AI startups

On strategic rationale, revenue recognition and round-tripping

This is a weekly newsletter about the business of the technology industry. To receive Tanay’s Newsletter in your inbox, subscribe here for free:

Hi friends!

One of the stories of the past year has been big tech, particularly Amazon, Microsoft, Google and NVIDIA driving some of the highest profile fundraises in AI startups, particularly at the growth stage. Today, I’ll be going deeper into that.

Overview

It’s been a busy year for corporates as it relates to investing in AI startups, with over 65 investments over the last year.

A lot of that activity has involved large rounds and checks, as the below graph in an analysis by Ansaf Kareem illustrates.

Notable examples have included:

A $10B round in OpenAI by Microsoft

An up to $4B round in Anthropic from AWS, followed by a $2.5B round in them from Google

A $1.3B round in Inflection by NVIDIA, Microsoft and Google

A $400M round in Coreweave by NVIDIA

A $141M round in Runway by Google and NVIDIA

Let’s discuss the rationale for some of these investments, and also touch on a contentious topic — are some of these companies buying revenue via investments?

Investment Rationale

These investments have been strategic in nature, and so by definition made for reasons not solely driven by investment returns. Overall, some of the additional factors driving these investments have been:

Access to differentiated models: What started with Microsoft’s investment in OpenAI and then was followed by Amazon and Google’s investment in Anthropic, cloud providers have been aligning themselves to model developers in part to make their proprietary models available to their cloud customer base to offer a differentiated offering as they compete for AI and GenAI workloads.

Influencing market structure: In particular with NVIDIA, one of the goals of their investments in companies like Coreweave seems to be to “rainmake” certain companies to alter the cloud landscape and provide more options to end customers, and potentially position themselves as the “4th cloud provider” directly.

Acquire scaled users of infrastructure: Some of the providers recognize that we’re still in the early innings and their infrastructure offerings need scale usage to iterate and improve, and investing in these startups which are heavy users of these workloads is one way to do that. Examples here include Anthropic agreeing to use Amazon’s trainium and inferentium chips for their next-gen of models as part of their investment as well as OpenAI running on Azure, allowing Azure to improve their own products and infrastructure offerings. Taking this to the extreme, the startup can also help provide co-development of technology for the cloud provider, as AWS and Anthropic intend to do in terms of collaborating on the future development of Amazon’s Trainium and Inferentia technology.

Lock-in certain customers: In the case of NVIDIA and perhaps some of the cloud vendors, investing in an already big customer could be perceived as a way of “locking them in” and retaining their workloads as they continue to grow as alternatives may try to offer them incentives to switch platforms or infrastructure.

Direct Revenue: As part of these deals, cloud vendors in particular have been able to informally or formally require that startup to use their particular cloud and so earn the corresponding revenue in what might seem like a bit of a quid-pro-quo arrangement. This is worthy of scrutiny and so worth touching on a bit more.

But first, let’s take a quick tangent to discuss Palantir and how they bought revenue via investments.

Palantir, SPACs and Buying Revenue

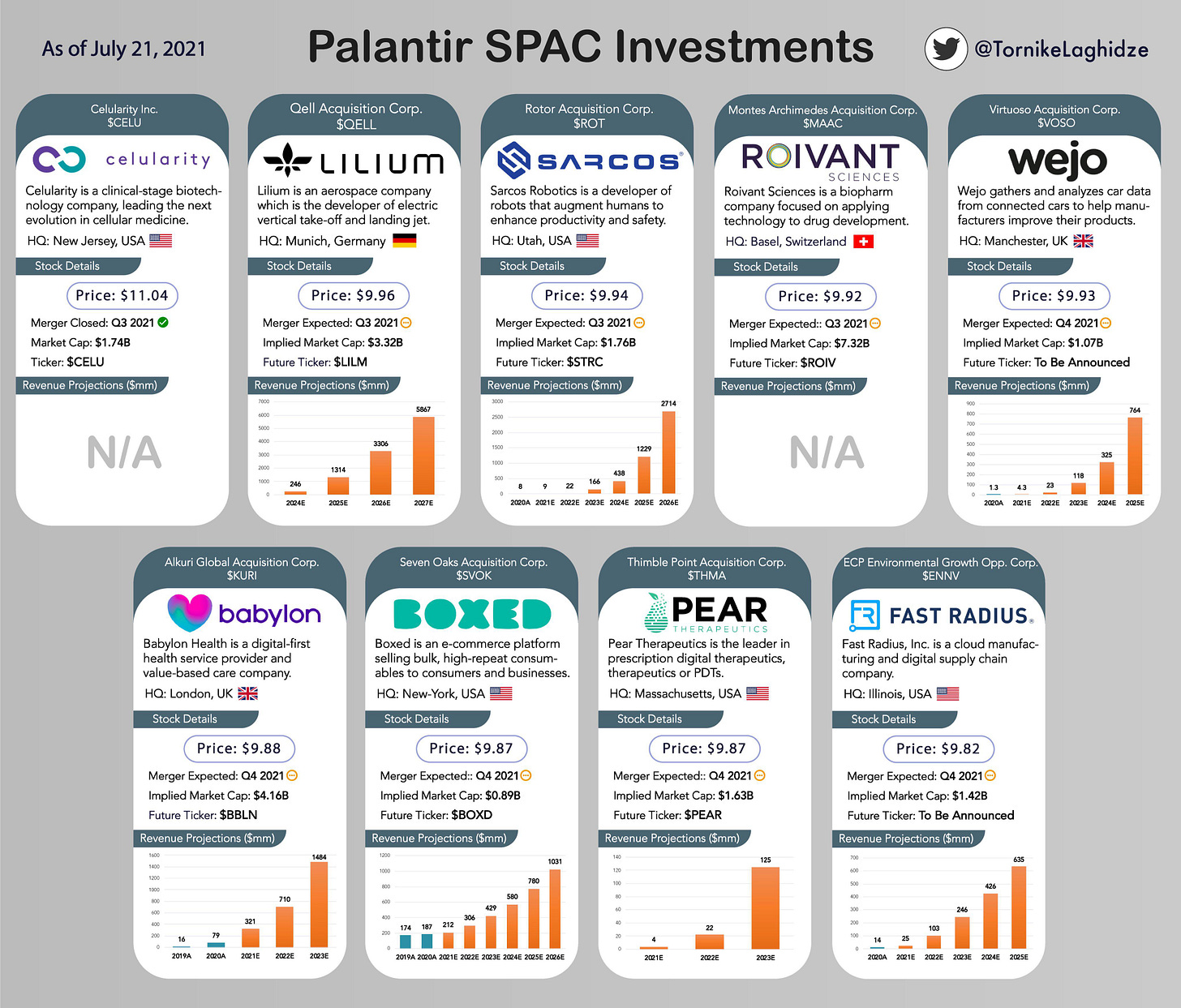

In the heyday of the SPAC boom a few years ago, Palantir did something quite out of the ordinary: They invested $400M into 20 startups that were going public via SPAC simultaneously signing deals with them to buy Palantir’s software. The size of these typically multi-year deals were quite large, often as much as the investment from Palantir into the company.

For example:

Flying Taxi company Lilium received $41M as investment from Palantir and Lilium signed a five-year contract that paid Palantir $50 million.

Online grocery-delivery company Boxed Inc. received $20 million and signed a five-year, $20 million contract. Days after receiving Palantir’s money, Boxed paid $15 million to Palantir as part of the contract.

Fast forward a bit, and most of these SPACs are down 80%+ and consequently Palantir’s investments are not fairing too well. But Palantir was able to “buy revenue” with their investments and show additional revenue growth during the period, partly driven by these deals in what was in some ways a form of “round tripping”.

Palantir has now stated that they will be no longer doing such deals.

Strategic investors and revenue impact of investments

Is that what’s going on here with the strategic investors? Let’s focus on specifically cloud providers and go deeper and discuss three things as it relates to revenue from these investments:

Are the investments driving revenue?

How are they accounting for it?

How meaningful is it?

Are these investments driving revenue?

Yes, it is the case that for cloud provider’s investments as part of these deals, often partner with the startup such that the startup uses their infrastructure (although it is unclear if the investments require it contractually), and so provides an avenue to increase revenue.

For example:

OpenAI uses Azure heavily for its offerings, including Azure’s AI infra to train models, Azure to run their own GPT API offerings, as well as Microsoft’s CosmosDB to help power ChatGPT.

Anthropic, as part of Google’s first investment said it would use Google cloud, and also intends to use Amazon’s chips to train and run inference for its new models, directly providing likely meaningful compute revenue to AWS, considering that Anthropic is likely to spend multiple billion dollars on training their new models, with 80-90% of that cost being driven by compute.

So in short, the investments are driving revenue, although the cloud providers could argue that the company chose them independently as its not clear to the outside whether the investment terms explicitly require it.

How are they accounting for this revenue?

Cloud providers aren’t separately disclosing the amount of revenue that comes from these startups they invested in. While Google and Amazon haven’t said much around accounting, Microsoft has made it pretty clear that its accounts for the revenue from OpenAI in a typical manner as they would for any other customer.

But specifically to your question on how does it show up [in terms of accounting for the OpenAI relationship], it's easiest in this situation, to think about them as a customer of ours like any other customer who would use the Azure infrastructure and our Azure AI services in service of supporting their end customers. And so when they do that, like any other customer who has a commercial relationship with us, we recognize revenue on that behalf. — Amy Hood, Microsoft CFO

How meaningful is this revenue?

Since the numbers aren’t being disclosed, we don’t have a sense of say how large a customer Anthropic is to GCP/AWS or OpenAI to Azure.

But based on a rough assumption is that over the next 2-3 years, about 80% of their investment round may go into compute / infra, and a reasonable fraction of that goes to the cloud provider, you net out at $500M-1B/yr+ for now, though if they were to make more investments that would likely grow.

Here’s a rough sense of scale of the cloud providers:

AWS is on a $92B revenue run-rate adding $10B/yr

Azure on a $65B revenue run-rate adding $14-15B/yr

GCP, inclusive of Gsuite is on a $33B revenue run-rate adding ~$6B/yr

So an extra $1b/yr or so isn’t that large, probably only corresponding to 1-3% of revenue for the provider.

From a revenue growth perspective however, in the period shortly after the partnership, it could provide a relatively large boost and account for 5-15% of the revenue growth in that year if it ramps up quickly.

So, to net out, these cloud providers are likely to see some direct revenue and revenue growth as a result of these investments. While I think it’s okay to account for the revenue and not as obvious case of “round tripping” given that cloud infrastructure is a bit of a utility type product where you can only really pick between 3-4 providers, I think it would be nice for the cloud providers to disclose if any meaningful revenue came as requirements as part of their investments in startups. Perhaps if the number of investments or the size of their spend grows, we’ll see some better reporting and disclosures.

Thanks for reading! If you liked this post, give it a heart up above to help others find it or share it with your friends.

If you have any comments or thoughts, feel free to tweet at me.

If you’re not a subscriber, you can subscribe for free below. I write about things related to technology and business once a week on Mondays.