Airbnb and the COVID-19 Recovery

Last week, I wrote about Doordash, a company which accelerated growth and its path to profitability in the pandemic, and pulled ahead of the competition. This time, I’ll be digging into Airbnb, which was extremely hurt by the pandemic but has recovered quite well as evidenced by some of the numbers in its S-1 filing last week.

I’ll be focusing on a few things: the topline growth and potential pre-COVID, what the business model looks like, the impact of COVID-19, and how profitable Airbnb is and can get.

Scale and Growth

Airbnb might have started out looking like a toy, with hosts renting out space in their living room to guests, but as it has grown it has expanded to much more including entire homes, boutique hotels, and professionally-managed houses and beyond travel itself to experiences.

The word trust is mentioned in the S-1 filing 66 times, highlighting the key role of trust that Airbnb plays in the transaction and the reason why Airbnb was able to unlock some of the unique supply on its platform.

Airbnb’s revenue can be decomposed into # of nights (and experiences) booked x average booking value per night/experience x Airbnb’s take rate.

As can be seen above, prior to the pandemic, Airbnb’s growth was primarily driven by more nights booked and had slowed down but was still an impressive ~30%, at a ~$38B booking run rate.

There were marginal improvements in the take rate to just over 12.5%, and the average booking value per night was roughly flat.

While they don’t break out the “Experiences portion of the business separately, it’s likely that especially prior to 2019 that represented a very small part of their business.

To put their scale in perspective, we can compare them with a few other similar companies. As shown below, Airbnb is the largest “alternative accommodation” provider and is closing in on Marriott, but still has some room to go in terms of catching up with the hotel OTAs like Expedia and Booking. For context, they do close to $90B gross bookings, while Airbnb was under $40B in 2019.

What does stand out is that Airbnb is growing a lot faster than the others which illustrate both their model in terms of the relative ease of adding more rooms relative to say a Marriott, and their ability to grow differentiated supply (which is getting booked on Airbnb rather than other platforms).

It also highlights the massive potential that is ahead of Airbnb. They estimate their Service Addressable Market to be $1.5T and their TAM to be 3.4T.

While I don’t necessarily read too much into these TAM and SAM numbers other than to get a read on the potential runway ahead, if you take the SAM at face value, Airbnb only has a 2.5% share of it (!).

Another way to think about is that both Expedia and Booking each do ~$80-100B in GBV which is ~2-3x of GBV of Airbnb and they’re still growing 10-15%. So getting to ~$100-150B of GBV for Airbnb at least seems reasonable.

Hosts, Guests, Cohorts and Flywheels

Airbnb at its core is a marketplace, and to better understand how the business is doing we need to understand both sides of the marketplace: hosts and guests.

On the Hosts side, Airbnb had 4M hosts and 5.7M listings at the end of 2019. These numbers had grown by ~20% and 30% respectively each year over the last few years.

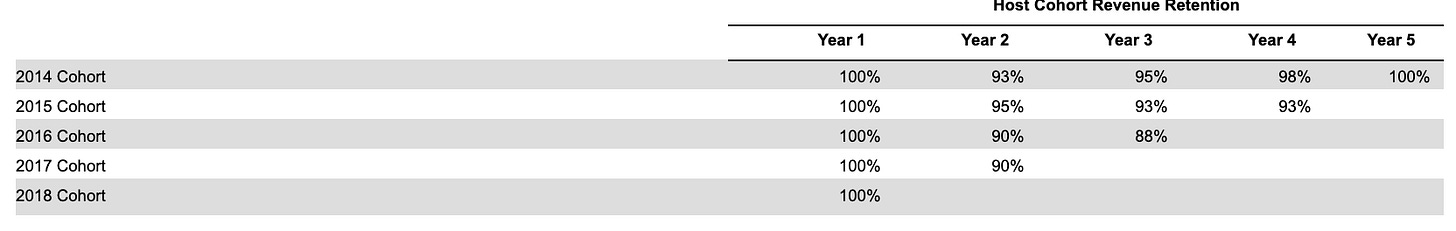

Airbnb also provides data about host retention, which is quite impressive. 90-95% of host revenue tends to retain in future years. That suggests that hosts that make $100 on Airbnb in 1 year, continue to make $90-95 from them in future years, indicating both host loyalty and that Airbnb becomes a reliable and recurring source of income for the hosts. In aggregate, Airbnb has paid out $110B to hosts, which is quite staggering.

84% of Airbnb revenue in 2019 came from stays at Hosts who had previously hosted on Airbnb before. This suggests that at least on the hosts’ side, the listings and the hosts are quite stable (and indeed currently they still have 5.6M active listings, very close to the 5.7M pre-COVID). Airbnb doesn’t need to continue to spend too much to reacquire these hosts or listing. Additionally to the extent that Airbnb can incur lower costs in terms of chargebacks or support and potentially charge higher take rates on these hosts, its economics will improve overtime just with more host maturation.

On the Guests’ side, Airbnb had 54M active bookers and 247M guest arrivals in 2019, pretty impressive numbers. Both bookers and guest arrivals have grown between 30-40% each year over the last few years.

In terms of guest revenue retention, while not as impressive as host revenue retention, it shows that about 40-50% of revenue from guests retains in future years. It makes sense given that Travel isn’t a frequent purchase, and you do see that revenue retention increases in years 3-5 relative to year 2. As the chart below shows, a cohort of guests that spend $100 in one year on Airbnb, spend ~$36 the following year on average, after which it grows to ~$40-45 the following years.

As Airbnb grows and has more listings in more countries, the revenue retention on the guest’s side should continue to increase.

What is most impressive on the guest side, is that 91% of traffic to Airbnb came through organic channels (direct and unpaid) in 2020. Although Airbnb did drastically reduce marketing spend in 2020, it highlights the brand that Airbnb has built.

As they say about their brand:

Our brand is recognized globally, and it is one of our most valuable assets. “Airbnb” is used as a noun and a verb in countries all over the world, and our brand is already deeply embedded in pop culture. According to Google Trends, from January 2016 through September 2020, “Airbnb” was searched worldwide more often than any other major travel brand.

Another interesting element of Airbnb is the global cross-sided network effects in their business model. More hosts means more selection which attract guests, and more guests means the potential to earn more attract hosts. Compared to say rideshare or food delivery apps, which often see very different leaders in different locales, the global network effects coud help Airbnb win or capture a higher share in more markets, although the ease of multihoming means its unlikely that it will be a winner take all market. In addition, it makes it that much harder to displace Airbnb completely, and provides them some sort of defensibility. Interestingly, Airbnb didn’t mention “network effects” or “flywheel” in their S-1, but they did indirectly touch on this point when talking about their global network in 220 countries and 100,000 cities.

Its also worth pointing out that in theory many guest trips (if they lease or own a home) have the potential to become available supply (i.e, their home is empty) which they can host on Airbnb to be used by a different guest, and so Airbnb could create even more supply and has the potential in theory to turn every guest into a host.

COVID-19 Impact

Now that we’ve understood what Airbnb looks like pre-COVID, let’s understand the impact of COVID. Airbnb has fortunately provided granular month by month data which allows us to understand this better.

In February and March, Airbnb did negative nights booked (!) because the net cancellations (including booked in earlier months but canceled in these months) were actually higher than new bookings. Since then, particularly from June travel has recovered well and seems to have flattened a bit at -28%.

For another sense of how big refunds and cancellations were, in previous years they were typically 5% of revenue, but in 2020 it was closer to 14% of revenue.

On top of that, the Gross Daily Rate has increased given a shift in mix and potentially people opting for larger properties, etc. Because of that, Gross Bookings has flattened at around -15% y/y, from literally -127% at the peak of the pandemic.

Amidst this decline, some categories have grown year over year for Airbnb:

Short distance stays within 500 miles of guest origin are up 38% year over year in September

Stays that are for longer periods (28 days or more) are up ~20% Y/Y in terms of number and nights and 50% in terms of gross bookings ignoring cancellations

Airbnb arguably has better properties relative to competitors in terms of both (more local and unique properties for the former, and fully equipped homes for longer stays on the latter), and to the extent that some of the behavior continues after the pandemic, Airbnb could be well-positioned to capture an outsized share of it.

Overall from a topline perspective, the recovery from COVID-19 has been pretty impressive in terms of nights (-28%) and gross bookings (-15%) based on recent months, and arguably a lot faster than what one might have expected.

Airbnb also took some measures to cut costs and sure up their balance sheet during this period.

They cut 25% of the workforce, drastically reduced marketing spend, and significantly reduced discretionary spending.

The marketing side is perhaps the most interesting. With a reduction in marketing spend ($650M in the first 9 months of 2020 relative to 2019), Airbnb now sees 91% instead of 77% of traffic coming from direct channels. They also believe that they can maintain traffic levels while spending less on marketing in aggregate going forward into 2021. In some ways, one could argue that it might have shown them they were overspending or spending less efficiently on marketing than they might have.

Aside from that, they raised $1B from Silver Lake and State Street in a combination of debt and equity at a ~$16B valuations, which is looking like a very good investment.

Lastly, Airbnb has also distributed over 200M from a $250M fund they set up to help hosts in this period by providing them with up to a quarter of their normal earnings, a good way to maintain the loyalty of their hosts and help ease some of the burdens on them during this period.

Profitability

Now let’s talk about profitability. First, let’s talk about their actual profitability pre-COVID and during COVID, and then what Airbnb could do in the future.

As the table below illustrates, Airbnb has never been wildly unprofitable in the last 5 years (compared to other high growth companies where one routinely says operating margins of -50% plus in the high growth phase), with margins hovering around -5%.

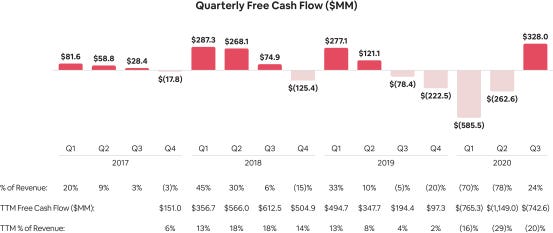

If you look at their adjusted EBITDA and FCF, you see that they had some highly profitable quarters, and are actually back to positive adjusted EBITDA and FCF in Q3, doing 37% adjusted EBITDA margins and 24% FCF margins in the last quarter.

It’s worth understanding the cost drivers to determine where Airbnb could be at in the future:

Cost of revenue is around ~25% of revenue primarily driven by payment processing fees and chargebacks. Since Airbnb acts as a merchant of record on the entire transaction, the payment processing fees it incurs is on the entire booking value which is magnified when you consider its ~12% take rate. For example, if it incurs $2 in payment transaction costs on $100, that corresponds to ~16% of fees on the $12 it earns in revenue.

Support and Operations is around 15-20% of revenue and involves customer service, customer relations and investments in trust and safety. This one has potentially room to go down as they scale and with investments in technology, but is a necessity in some sense of what makes Airbnb work - the investments in safety unlock the trust without which Airbnb wouldn’t have been able to create this market in the first place.

Product Development and G&A are at ~20% and ~15% of revenue respectively. Airbnb has already taken steps to reduce absolute spend on these during COVID-19, and so there is some room for these to go down in the future. In fact, the G&A spend at current levels but pre-COVID revenue would be ~11% of revenue.

Sales and Marketing spend was at ~30-35% pre-COVID and had dropped to ~22% during COVID-19. On an absolute basis, the spend here was cut by over 50% during COVID-19. While some of that spend will pick back up, if they maintain current spend levels at say 2019 revenue, that’s only ~16% of revenue. This one arguably the biggest lever at their disposal in terms of growing profitability.

So what does long-term profitability for Airbnb look like?

Given what we’ve discussed and compared them to some of the OTAs, you see some of Airbnb’s differences in business model translated into some of the numbers in the chart below. While all the buckets aren’t quite comparable due to differences in reporting, it gives us a decent picture.

Airbnb fares better on sales and marketing, but especially poorly on gross margins due to support and payments costs and on G&A due to a mix of efficiency, scale and location.

They’ve built a unique brand that is arguably a lot less reliant on search engines and on marketing than the others and I expect their spend to come down on that over time even further (and this is critical to improving margins).

On the flip side, to make Airbnb work they have to spend a lot more in support and operations, which drags down their Gross Margins given the support costs. Their payment costs are also a lot more than competitors though that will come down with time I suspect.

The other area they’re spending a lot more on is product development and G&A, with the latter in particular being larger. Some of that comes from their location of their HQ and paying up for talent, but I believe they’ll be able to decrease that in the future.

If they do gain more efficiency as they scale, and most importantly if they can maintain traffic while cutting down on marketing spend, as the unique brand they’ve created and some of the numbers in 2020 suggest they can, then I can see Airbnb doing 20-25% operating margins in the future. To do something like 30%, they’ll need to really cut down their support and payment processing costs, the former of which won’t be that easy given the importance of trust and their spend on insurance and safety in making the platform work.

Thanks for reading! Hope you have a safe and wonderful thanksgiving week.

If you liked this post, give it a heart up above to help others find it or share it with your friends and if you have any comments, feel free to tweet at me.

If you’re not a subscriber, you can subscribe below. I generally post once a week or every other week on Monday about things related to technology or business.

Great teardown of Airbnb's business model! Though I couldn't understand how the Quarterly Adjusted EBITDA in Q3-2020 is ~$500MM, when their income (loss) from operations was -19% in the same quarter.

Great post Tanay. Love how easy you make to read these posts for a layman who might not be expert at financial terms. Keep up the good work.