Adobe x Figma acquisition termination: A few observations

On the new normal for startup exits, the real deal price of $30B and the impact of the breakup fee

This is a weekly newsletter about the business of the technology industry. To receive Tanay’s Newsletter in your inbox, subscribe here for free:

Hi friends,

Adobe and Figma announced today that they will terminate the agreement they had for Adobe to acquire Figma owing to not seeing a clear path to get regulatory approvals from the European Commission and the UK Competition and Markets Authority. In this piece, I’ll discuss a few of my observations from the announcement and what lies ahead.

I. New Normal in terms of Startup Exits

In today's environment, where M&As face intense scrutiny, acquiring large startups, has become increasingly challenging.

Yes, Microsoft’s $69B acquisition of Activision did go through. But we’ve seen issues with Visa’s purchase of Plaid, Illumina’s purchase of Grail, and even Meta’s purchase of gif keyboard app Giphy in addition to this one.

It seems clear that regulators feel in hindsight that certain acquisitions such as Instagram and WhatsApp shouldn’t have gone through, and intend on preventing future such scenarios where a strategic acquirer is paying a large sum to buy a scaled or fast growing player in the same space. In addition, companies like Google, Amazon and Meta in particular face intense scrutiny on every potential acquisition they may make.

For the startup world, given that at some reasonable revenue scale ($50M+) or valuation threshold (~500M-1B+), the set of would-be acquirers are usually a short list of 3-5 strategics, if half or more of them cannot feel confident of a potential acquisition to close, that reduces and in some cases may eliminate the potential for a meaningful exit via acquisition for that startup depending on its scale.

This changes the equation for both startup founders and venture capitalists, by vastly reducing the potential for meaningful outcomes by acquisition. This increases the importance for companies approaching some sense of scale to start thinking about their path to IPO.

And at a time like today where we have over 1,000 unicorns on paper, but only a fraction of which are seemingly on a path to be a potential public company in 3-5 years, it highlights just how much potential destruction may lie ahead.

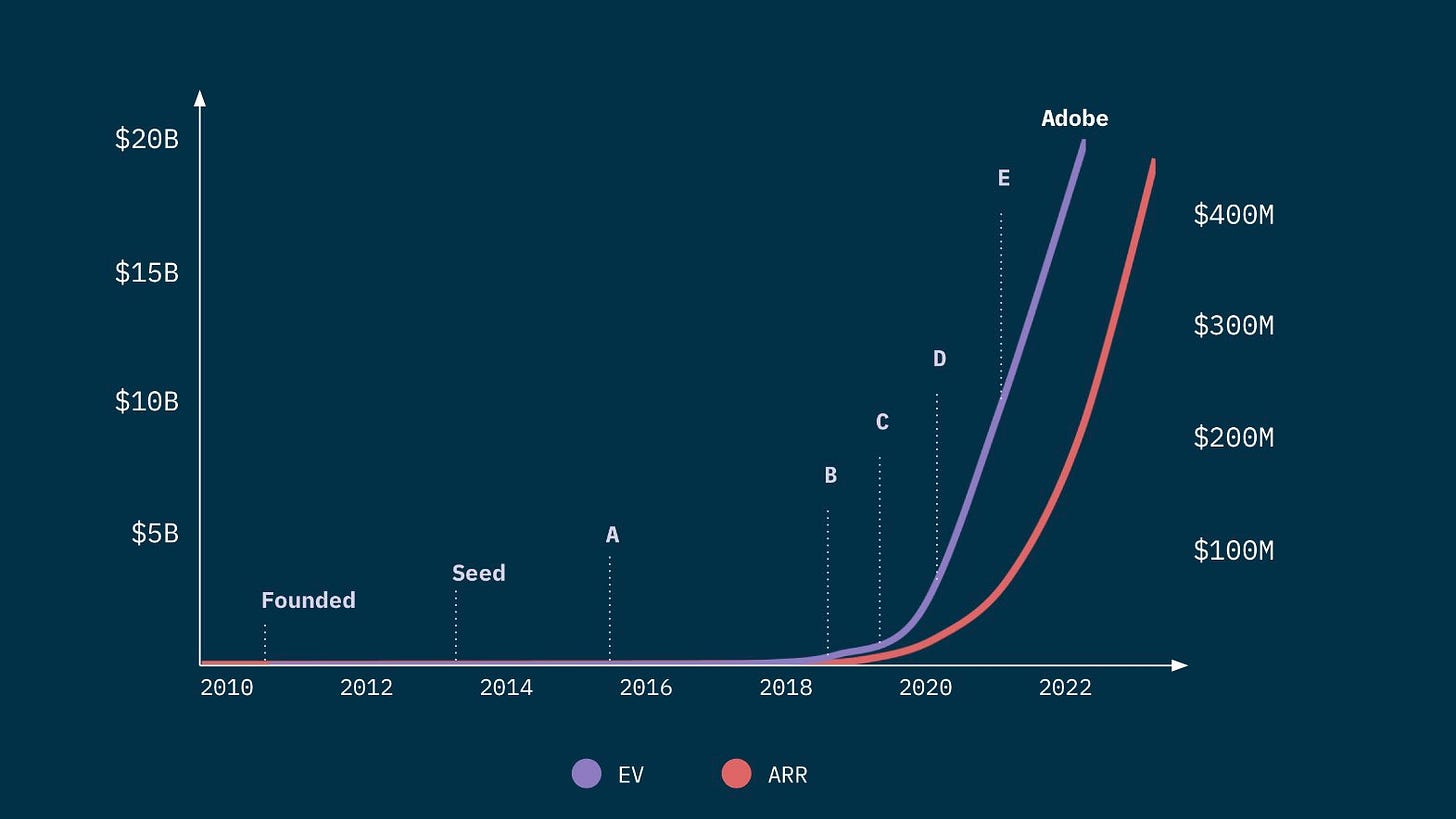

II. The actual deal price would have been ~$30B

Adobe’s acquisition of Figma was reported as a $20B consideration, half in cash and half in stock + 6M RSUs of Adobe stock in retention packages for Figma employees. However, the number of Adobe stock units was fixed based on the date of announcement of Sep 15, 2022, as opposed to based on the date of closing. This means that the actual consideration received by Figma shareholders would vary based on movements in Adobe’s price.

The per share closing stock consideration is fixed and will not be adjusted for changes in the market price of Adobe common stock prior to the consummation of the transaction. Therefore, the value of the consideration to Figma stockholders in the transaction will fluctuate between now and the completion of the mergers — SEC filing

At the time of announcement, Adobe stock was at $370/share. The total consideration for Figma was $10B in cash, $10B in Adobe stock and 6M in retention RSUs worth $2.2B for a total of $22.2B.

Today, Adobe’s stock price is at ~$600/share, up 60%. Had the acquisition gone through today, the total consideration for Figma would have been $10B in cash, $16B in Adobe stock and 6M RSUs of Adobe worth 3.6B for a total price of $29.6B.

With Adobe’s stock price soaring by 60%, the final cost for acquiring Figma would have been 33% higher than originally estimated.

In a world as above where major acquisitions across industries will face increased scrutiny and long approval periods (Adobe anticipated this Figma deal closing in 4 months, instead it tooks 15 months before being terminated), seemingly irrelevant details like this could end up affecting the final consideration a lot given the potential change in the acquirer’s stock price in the period to close.

III. The impact of the $1B termination fee

As part of this breakup, Adobe will pay Figma a $1B breakup fee in cash. This fee was set as part of the initial acquisition agreement and highlighted in some ways the perception of potential risk to the acquisition closing and the bargaining position Figma was in at the time.

With Figma having raised $333M in funding, the $1B breakup fee equates to nearly triple their total raised capital. They will receive this dilution-free capital in cash in the next three days, as stated in the SEC filing.

On December 17, 2023, the Company and Figma mutually agreed to terminate the Merger Agreement and entered into a mutual termination agreement effective as of such date (the “Termination Agreement”). The mutual termination of the Merger Agreement was approved by the Company’s and Figma’s respective Boards of Directors. In accordance with the terms of the Termination Agreement, the Company will make a cash payment to Figma in the previously agreed amount of one billion dollars ($1,000,000,000) (the “Termination Fee”) within three business days following the date thereof,

Putting the $1B in perspective: for Figma, a company with around 1400 employees, this amount alone could sustain 2-3 years of operating expenses, even without considering the company's revenue.

While most companies being acquired will not be in a position to negotiate breakup fees, I expect the ones in a strong position and where risks of scrutiny are high to push the acquirer on breakup fees moreso than in the past.

IV. What it means for Figma

Figma is currently at ~$600M in revenue and grew 40% y/y. At the time of acquisition it was at ~$400M with 150% in net dollar retention growing 100% y/y, with Adobe paying 50x ARR.

While Figma wouldn’t be worth $20B (or $29.6B) at today’s multiples, given its strong metrics, a ~15-16x NTM ARR multiple wouldn’t be crazy, assuming 25-30% growth NTM, you get to an Enterprise Value of ~$11-13B as of today.

Figma is already one of the most “IPO-ready” companies today given its strong numbers and metrics. With the $1B breakup fee bolstering their finances, combined with their cash flow profitability, Figma has the luxury to remain private, focus on growth, and time their IPO for when market conditions are favorable.

Given that they may not need cash when they go public, I also wouldn’t rule out them opting for a Direct Listing.

They have a great product and great community and brand, and so it is very possible that this abandoned acquisition allows them to achieve even greater things independently!

V. What it means for Adobe

Adobe’s acquisition of Figma was priced at 50x ARR in a very different market environment. In the interim 18 months, not only has the market environment changed, but also Generative AI has taken off which promises to significantly change how design works.

While Adobe will still face the competitive threat of Figma as an independent company and remains relatively weaker when it comes to product / UX design and doesn’t have an offering used as collaboratively and across a wide an audience within a company as Figma does (2/3rds of its users were non designers), Adobe has been investing in GenAI heavily, and has been one of the companies leading the charge in terms of integrating GenAI into its products.

Adobe can redirect its resources, leveraging its >$5B cash reserve, to accelerate R&D in collaborative web-based design interfaces and AI that can make their core products better. AI could also help accelerate the time to R&D of an AI-native Figma competitor if they decide to build one.

Thanks for reading! If you liked this post, give it a heart up above to help others find it or share it with your friends.

If you have any comments or thoughts, feel free to tweet at me.

If you’re not a subscriber, you can subscribe for free below. I write about things related to technology and business once a week on Mondays.