Hi friends,

This week’s newsletter is going to be a bit different. Below are some raw notes and thoughts based on the recent quarterly earnings results over the past week or two of some of the key consumer internet-related companies.

1. Advertising on a tear

Q2 2020 was a weak quarter for advertising as many companies pulled back demand with the uncertainty of COVID-19. That obviously made the Q2 ‘2021 Y/Y comparables a lot simpler.

But even with that in mind, the remarkable growth across pretty much all digital ad platforms was quite impressive as in the numbers below.

Even looking at the 2-year CAGRs of these platforms to get a better sense shows that many are growing in the mid to high double digits and still have a long runway.

To me, there are a couple of key observations:

A. The digital ad market is likely a lot bigger than most people think

I’ve written about this before, but it’s worth reiterating. Digital advertising isn’t just competing for dollars with other forms of media advertising (TV, etc), but can compete for other areas of budget as well (rent, shelf-space, trade spend, local ads, etc)

This was underscored during the Google earnings call by their CBO Philipp Schindler:

What is really important is we're not just addressing above-the-line marketing budgets, which is different metrics around, let's say, around $0.5 trillion, which is traditional advertising, TV advertising and so on. And there is also significant upside in below-the-line budgets overall, like promotional pricing, product within sponsorships and so on. And, sure, we've seen COVID accelerate the shift to e-commerce at an astounding rate, but keep also in mind, 80% of commerce still remains offline. So there's a lot of room for digital to play a bigger role and we think we can tap into other budgets that were traditionally used for, let's say, local advertising to derive sales

B. Ad-based models continue to be a great way to reach the globe

Advertising often gets a bad rep. But it remains a great way to make products and services available for free or low cost to many people while still allowing the companies building these products or services to capture value for themselves.

One way of seeing this is that Youtube now makes more money in aggregate on ads than Netflix does from subscriptions (while reaching 10X the number of users).

Given its subscription model, Netflix has a natural ceiling on the number of people it can reach. And while that model makes sense for its business and its content spend, it’s possible to build an equally valuable business taking a different approach: a free(mium) ad-based product as Youtube has done.

There’s been a lot of innovation in business models recently, many around how can you capture value from the premium users (monetizing your true fans, NFTs, the rise of subscriptions and usage-based models, etc), but I continue to believe that in the consumer world free(mium) ad-based models are here to stay for the long haul and remain the best way to be able to sustainably make vital digital products available to the whole world.

2. Lapping Tough Comps

While the ad platforms lapped a quarter of easy comps from a revenue perspective, eCommerce, media, and similar WFH / pandemic type stocks lapped a quarter of tough comps given they saw an explosion in usage and engagement in Q2 2020.

While many of the businesses continue to remain strong, that meant that given the difficult comps the Y/Y growth saw quite a deceleration compared to the previous quarters.

Some of the pandemic stocks are still to report (Zoom, Peloton, etc) but it was interesting to see the market’s reaction to the albeit expected deceleration.

A few common themes around tough comps:

A. Reduced engagement as COVID-19 eases

Pinterest’s stock was down over 15% (despite a triple-digit ad revenue increase) because of US daily active users being down 7% y/y. Others such as Teladoc have seen similar behavior.

Here’s what Pinterest’s CEO Ben Silbermann had to say:

In past earnings calls, we talked about how stay-at-home orders significantly increased usage of Pinterest. And for the past year, we've highlighted how people came to Pinterest for inspiration to reinvent their lives during such a difficult time. Now as the world opens up, we're seeing the similar effect in the opposite direction.

B. Slowing revenue growth given the increasingly tough comps

Amazon’s stock was down 5-7% post-earnings, despite strong revenue growth of 27% because of the lower than expected guidance as it comps the COVID quarters in Q3 and Q4.

C. Slowing user growth given the pull-forward effect

Netflix and Spotify stocks also took a beating. Netflix saw a sequential decline in subscribers in the US/Canada compared to Q1 ‘21 (losing 0.4M subs) and Spotify missed their MAU guidance and forecast because of weaker top-of-funnel.

They both talk attribute this in part to the pull-forward effect in 2020.

Netflix’s CFO Spencer Neumann pointed out:

We had the kind of big pull forward in 2020 of subscriber adds.

Similarly, Spotify’s CEO Daniel Ek said:

And, of course, MAU growth slowed during the significant COVID-related pull-forward we saw in 2020 and the impact of the uneven recovery in the first half of 2021

In the short term, the people who would likely have subscribed to these services did so in 2020. Now, in 2021, that means there are fewer obvious customers to go after for these platforms.

D. Looking Forward

Looking forward, to make sense of the performance of companies across tech verticals, people will pretty much have to look at 2-year CAGRs for ‘20 to ‘21, as Amazon’s CFO pointed out on their call:

Given all this volatility, it's useful to consider the two-year compounded annual growth rate, which remains strong in the 25% to 30% range. Recall this compares to our pre-pandemic growth rate of 21%.

3. Creators everywhere

A lot of companies played up the emphasis they are placing on creators, with a particular emphasis on growing the creator base on their platform and helping creators make a sustainable living on their platforms.

Pinterest played up their launch of Idea Pins (Pinterest’s publishing tool) and talked about creator monetization opportunities such as product tagging:

Creators are an important building block fulfilling our mission of giving everyone the inspiration to create a life they love - Ben Silbermann, Pinterest CEO

Spotify talked about their Paid Podcast Subscriptions and Spotify Open Access, which offer solutions for creators and publishers to earn revenue from their Spotify listeners. They also talk about their growth in creator numbers and the long runway ahead.

We've grown in the past few years from about 1 million creators to now more than 8 million creators, but the opportunity in front of us is really to get to more than 50 million creators - Daniel Ek, Spotify CEO

Twitter touched on the importance of retaining creators and providing them tools to better monetize, including their recent launches such as Ticketed Spaces and Super Follows

If the creator is creating great content and you see it in Super Follows or it's just a tweet and somebody puts money in their Tip Jar, or it's long-form content that we include in a different price point for a subscription without ads that's complemented with other features that come from us, then we would make sure that part of the value that can be attributed to the creator where those dollars go to them and we're more facilitating a transaction. If we do that, we're going to help creators build and nurture and grow their following base on the service. They'll continue to create great free content and they will also create great paid content as well, and if there is lots of good things happening on Twitter, there'll be great ways for us to monetize the service whether it would be ads, subscriptions or otherwise - Ned Segal, Twitter CFO

Youtube touched on their payouts to creators being the largest ever in their history and the early success of shoppable formats to allow creators to better monetize

I hope viewers can make purchases from their favorite creators with their early experiments with BrandConnect and shoppable product shelves and early adopters are seeing a lot of success here - Philipp Schindler, Alphabet CBO

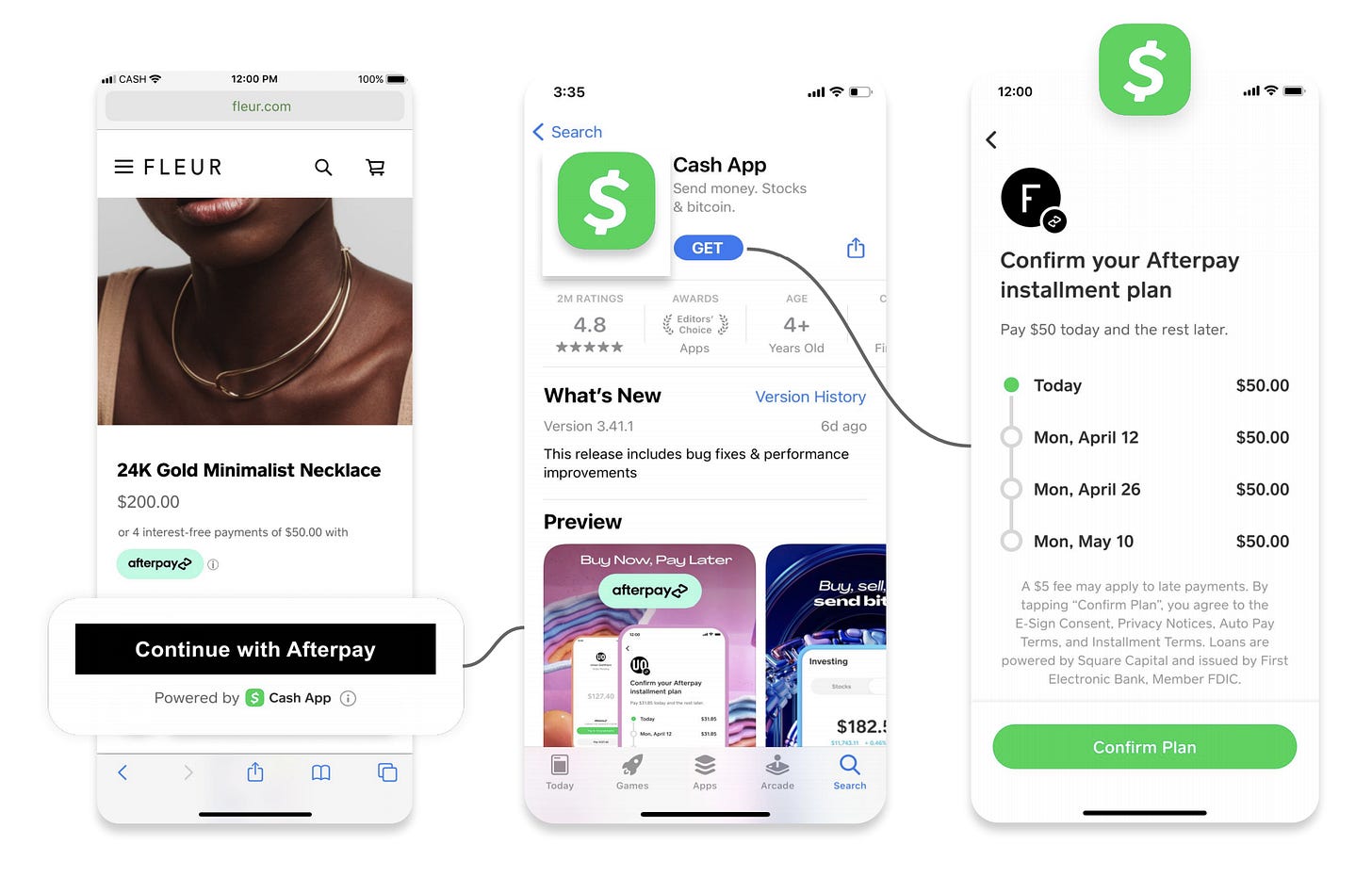

4. BNPL is here to stay

Another thing that came up in a lot of the commerce/fintech-related earnings was the growth of Buy Now Pay Later or installments as some choose to call it.

It is clear that every major player will have a bet or product in this space whether via a third party partnership, acquisition, or building in-house.

Square has gone the acquisition route, through an all-stock acquisition of Afterpay for ~$29B representing a ~30% premium. While expensive from traditional metrics perspectives, the opportunity for synergies here is quite large, which Square has made the point to play up.

With Afterpay, we have the opportunity to strengthen and closely connect our seller ecosystem which serves millions of merchants and Cash App which serves 70 million active consumers on an annual basis. Together, we can create an even more powerful commerce platform connecting the two.

Amrit Ahuja, Square CFO, speaking to CNBC

A few highlights on the transaction:

Afterpay has 16M consumers and ~100K active merchants. This compares with 70M consumers and millions of merchants for Square.

Afterpay has been growing GMVs and revenue close to triple digits y/y for the last few years

Square is paying 42x FY21 revenue for Afterpay

Square intends to integrate Afterpay into both the seller app (merchants) and the Cash App (consumers)

Paypal went the route of building its own BNPL offering, and it so far performing very well gaining traction with both merchants and consumers. They have processed over $3.5B in TPV (1.5B in Q2 alone), and have high repeat rates so far (70% are repeating within six months).

Approximately 650,000 merchants have customers who use our Buy Now, Pay Later capabilities, and 40,000 have positioned Buy Now, Pay Later upstream on their product pages. Over 7 million consumers have transacted more than 20 million times with our Buy Now, Pay Later product -

And we know those customers, so the approval rates are much higher. Returns are lower because we know the customer. And so a lot of the other Buy Now, Pay Later players don't necessarily know the consumer the way that we know the consumer in this. And so we're pretty pleased.

Dan Schulman, Paypal CEO

Shopify went the partnerships route (through Affirm) and talked about enabling their Shop Pay Installments to all merchants in the US by default, and are seeing some good early traction.

GMV transacting through Shop Pay installments more than tripled in Q2 over the prior quarter as more buyers are using our product to check out

- Amy Shapero, Shopify Chief Financial Officer

Visa talked about their BNPL strategy of working with providers and offering their own platform and how BNPL could help if it splits up one Visa transaction into 4-5 Visa transactions.

I don't know where installment is going to end up, but we are attacking that like we attack crypto and other things and assuming that it's going to be successful and that we want to lean in heavily and be in the middle of it and be a driver of what's going to potentially happen. As you alluded to, we have both a strategy of working with third-party providers, as well as offering our own Visa proprietary platform that would allow issuers to offer their own buy now, pay later capability. And we see it as potentially having a very, very good effect for us. I mean, we could see -- we could work with all bunch of options, virtual cards from Visa could be used for repayment.

A Visa card on file could be used for repayment. We could explore Visa Direct as a way for installments to be paid off. And in many of those cases, if that's the case, what ends up happening is a single purchase turns into a number of installments so that one transaction can end up being three to four or five payment transactions, which is certainly very, very good for us. We also think that this is a space where we can sell value-added services, data, and analytics, the broadband of providers, underwriting, for example, or risk products to help some of the third-party providers.

- Al Kelly, Visa Chairman and Chief Executive Officer

It is clear that BNPL is gaining traction with merchants and consumers and has strong repeat rates across the board. It’s helping drive up conversions for merchants, and consumers like the flexibility of paying in installments, especially when they can do with low or no interest rates.

Thanks for reading! If you liked this post, give it a heart up above to help others find it or share it with your friends.

If you have any comments or thoughts, feel free to tweet at me.

If you’re not a subscriber, you can subscribe below. I write about things related to technology and business once a week on Mondays.

really enjoyed this. keep up the great writing, Tanay!