A few more Q2 earnings musings

On dating apps, app store fees, gig economy supply and app tracking

Hi friends,

Based on the feedback I received about this format from a few weeks ago, this week I’m again going round up a few trends which stood out to me across earnings calls over the past few weeks.

If you missed the previous post, you can read it here.

I. Labour Shortages in the Gig Economy

Lyft, Doordash, and Uber are investing heavily in growing driver/dasher supply and have made a lot of progress in Q2, but prices continue to be at elevated levels as supply and demand continue to be imbalanced.

A. Investments into Supply Acquisition

These companies are all investing heavily to attract and retain drivers and workers to the platforms, typically through the form of incentives.

Lyft noted that:

Incentives classified as contra-revenue increased 92% quarter-over-quarter to over $375 million, well above the 26% sequential increase in revenue, still with Lyft achieving adjusted EBITDA profitability

Similarly, Uber CEO Dara Khosrowshahi noted a heavy investment in incentives in Q2, accompanied by pulling them back in late July.

So in terms of driver acquisition spend, the heaviest driver acquisition spend and incentive spend that we think we will see and we saw was in Q2. We really have to take action very quickly because the marketplace was not at a place that we considered healthy and we wanted to lean in to get wait times down, to get surge levels down

Doordash CFO Prabir Adarkar also noted Doordash’s investment in Dashers:

The short answer is the uptick in sales and marketing from a Q-on-Q perspective was driven primarily by our Dasher acquisition costs. Remember, when we spoke last at Q1, we were talking about being undersupplied. And so we made significant investments in acquiring Dashers

B. Supply Growth

Between the high spending on acquisition as well as elevated earnings opportunities, the companies were able to make progress on fixing some of their supply issues.

Doordash saw 3M people dash in Q2, including more first-time Dashers than in any previous quarter.

Uber noted that in July, new driver additions on Uber in the U.S. grew 30% month-over-month, even as they started to pull back on incentives

Lyft noted that Driver supply grew 60% year over year, and they welcomed 50% more new drivers compared to Q1.

C. Hourly Earnings

However, imbalances still remain and prices continue to remain at elevated levels. And for those who do decide to join the platforms, hourly earnings are also currently at elevated levels:

Per Lyft, driver average hourly earnings reached an all-time high in Q2. In some of the busiest markets, drivers are earning over $35/hr on average across their time online (during which they may have also been driving for another app)

Per Uber, drivers in the top 20 US cities are making over $40/hr on average, excluding Uber’s incentives.

II. Dating Apps 📈📈

With more countries reopening in Q2 and everyone predicting the roaring 20s is upon us, one set of companies that is interesting to look at is the dating apps.

A. Strong performance across the board

While people turned to Dating apps during the pandemic, the re-opening is sparking an even larger increase in users and propensity to pay.

Match CFO and COO noted Match Group’s accelerating revenue growth:

We had a terrific Q2 with 27% year-over-year total revenue growth, the strongest growth the company has achieved since 2018.

This was a result of strong performance all-around in Match’s portfolio:

Tinder accelerated direct (i.e., non-advertising) revenue 26%, up from 18% y/y and 13% y/y the previous 2 quarters

Hinge grew revenue almost 150% y/y in the quarter, driven by strong growth in subscriptions and a-la-carte offerings

Bumble CFO noted a similar performance from Bumble

On a global basis in Q2, registrations and monthly active users on Bumble App grew at the fastest year-over-year rate since the beginning of the pandemic.

Bumble President Tariq noted that

B. Re-openings influence monetization

Re-openings are playing a big role in the propensity to pay from users, based on Match Group’s results. Revenue growth was higher in regions that are more open as in the quote below.

Our direct revenue grew 25% in the Americas, 28% in Europe and 31% in APAC and Other. Our U.S. performance is exceptionally strong, and our performance in Europe is trailing slightly behind the U.S., consistent with the pace of the recovery there. APAC and Other growth also was solid in Q2. But a number of markets there, including important ones for us like Japan, are now facing increased COVID restrictions.

C. But engagement is high even as the delta variant spreads

Based on Bumble’s results, engagement has continued to be healthy even as the Delta variant has hit places, and was strong in India during the spread.

But in general, on Bumble, like I said, no real sign of an impact. Engagement is at pre-pandemic highs on both Bumble and Badoo.

For example, in Q2, we saw increasing engagement and activity even with the spread of the delta variant in India, and Bumble App monthly active users grew at over 60% year over year in that market.

D. Lastly, a reminder of just how big and profitable Tinder is.

III. Increasing Pressure on App Store Fees

Pressure on the app store fees levied by Apple and Alphabet continues to mount.

A new bill entitled “The Open App Markets Act” was introduced by a group of Senators last week, which would require the likes of Apple and Google to allow third-party app stores on their devices, among other things.

Aside from that, even in earnings calls, a few mentions were made of the possibility of changing app store fees.

Elon Musk, in classic Elon Musk fashion, took a jab at Apple, noting:

"I think we do want to emphasize that our goal is to support the advent of sustainable energy," Musk said in response to a question about whether Tesla would allow competitors to use its charger network. "It is not to create a walled garden and use that to bludgeon our competitors which is used by some companies."

He then faked a cough and said, "Apple."

He then followed it up with a more direct jab:

Match Group noted that it was increasing its expense outlook on advocacy related to App store fees, and is confident of change:

It also includes the previously mentioned additional legal costs and higher spend for government relations and advocacy to encourage the app stores to reduce their fees. We're increasingly confident that the lawsuits and investigations around the globe related to app store practices will result in changes to those policies in the not-too-distant future - Gary Swidler, COO and CFO of Match Group

Bumble took a more neutral stance but mentioned they were watching the developments closely:

So obviously, there's a ton of regulatory scrutiny around app store fees. We are watching all of it very closely, as you can imagine.

So we'll be waiting to see what happens from those conversations. Our current EBITDA guidance for the second half assumes minimal impact from Google Play. And we're having conversations with them about what this means for 2022. They've been great partners to us. - Anu Subramanian, CFO of Bumble

IV. IDFA and ATT Impact Felt Widely

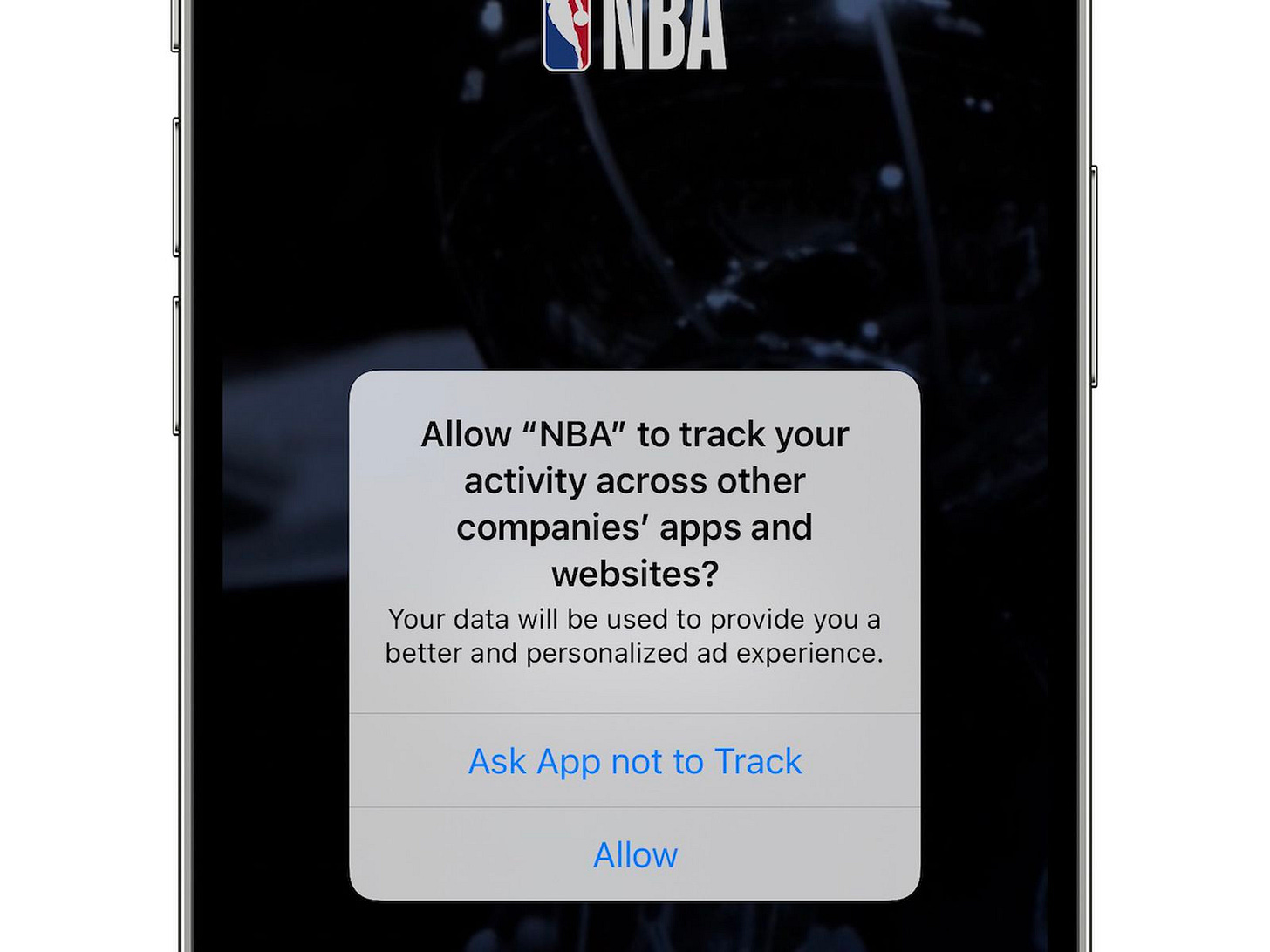

In more Apple related impact, as part of App Tracking Transparency (ATT), iOS 14.5 now asks every user whether they want an app to track their activity across other websites for advertising purposes (i.e., required developers to request a user’s explicit permission for accessing the IDFA token).

Opt-in rates have reportedly been pretty low (in the ~20% range), the result of which is lower ad revenue or worse ad performance from a marketing perspective for many advertisers.

A. IDFA changes are resulting in higher CACs for Advertisers

Companies reduced mobile spend in Q2, due to lower ROI due to IDFA changes, but expect some sense of normalcy by the end of the year, which will be interesting to keep a close eye on.

Zynga stock was down over 15% on cautious outlook and guidance due to the IDFA related changes. It resulted in a higher cost to acquire players which forced a pullback in spending.

The adoption of Apple's privacy changes resulted in a higher cost to acquire new players.

In response, we scaled back our UA spend to maintain targeted returns, resulting in fewer players installing our games during this period. We believe these trends are short term in nature.

Poshmark also noted a pullback in ad spend due to IDFA impact leading to lower ROI

During the second quarter, similar to others who use digital marketing, we began to see the impact of IDFA, which effectively increased the cost of mobile advertising due to less efficacy when running targeted marketing programs. We will continue to invest in a highly diversified mix of channels and expect the impact of IDFA to normalize throughout the year.

Smile Direct Club (SDC) missed expectations, partly blaming it on the iOS update

The miss in Q2 is primarily due to three main factors … Second, top of funnel weakness has been associated with the lasting effects of COVID on our target demographics in the U.S. as well as all-time high cost per lead metrics on social platforms … we believe is driven by some changes associated with Apple's new iOS update. To put this into perspective, our cost per lead metrics were up over 100% on a quarter-over-quarter basis.

B. Platforms in the aggregate are seeing a muted impact and working on solutions

Twitter noted that the impact has been relatively muted so far, and they are planning for the future.

The impact of ATT on the second quarter was also more muted than we expected, although it's too early to assess the long-term impact.

We worked really hard to implement the SkAdNetwork to give that data to third-party measurement partners to now show MAP ads to people have limit ad tracking on, to continue to work on ways that we can help attribution within a post-cookie world

Snap noted higher than average opt-in rates, and that they are working towards solutions, just like the rest of the industry.

I think the important thing about IDFA is to really understand that the solutions are not yet fully finalized. Everyone is still evolving Apple. The entire industry is still evolving. And we said this before and I just want to reiterate that we genuinely support Apple's approach. We've always believed that advertising should respect customers' privacy and its core at Snap and the products that this amazing team has built for the last almost 10 years now. And we've been working really hard to make this transition smooth for our advertising partners, as well as our businesses.

So, where we are in the cycle right now is that we've rolled out full support of SKAdnetwork 3.0, which we know will aid or we believe will aid and attribution for advertisers. And we've also implemented Apple's API. In addition, we launched advanced conversions in ad manager, so advertisers can measure their campaigns with our privacy conscious measurement stack. And then I think one of the things that we are -- what we're observing here is that our opt-in rates have been above what is sort of widely reported in both the press as well as with the analyst community.

Thanks for reading! If you liked this post, give it a heart up above to help others find it or share it with your friends.

If you have any comments or thoughts, feel free to tweet at me.

If you’re not a subscriber, you can subscribe below. I write about things related to technology and business once a week on Mondays.